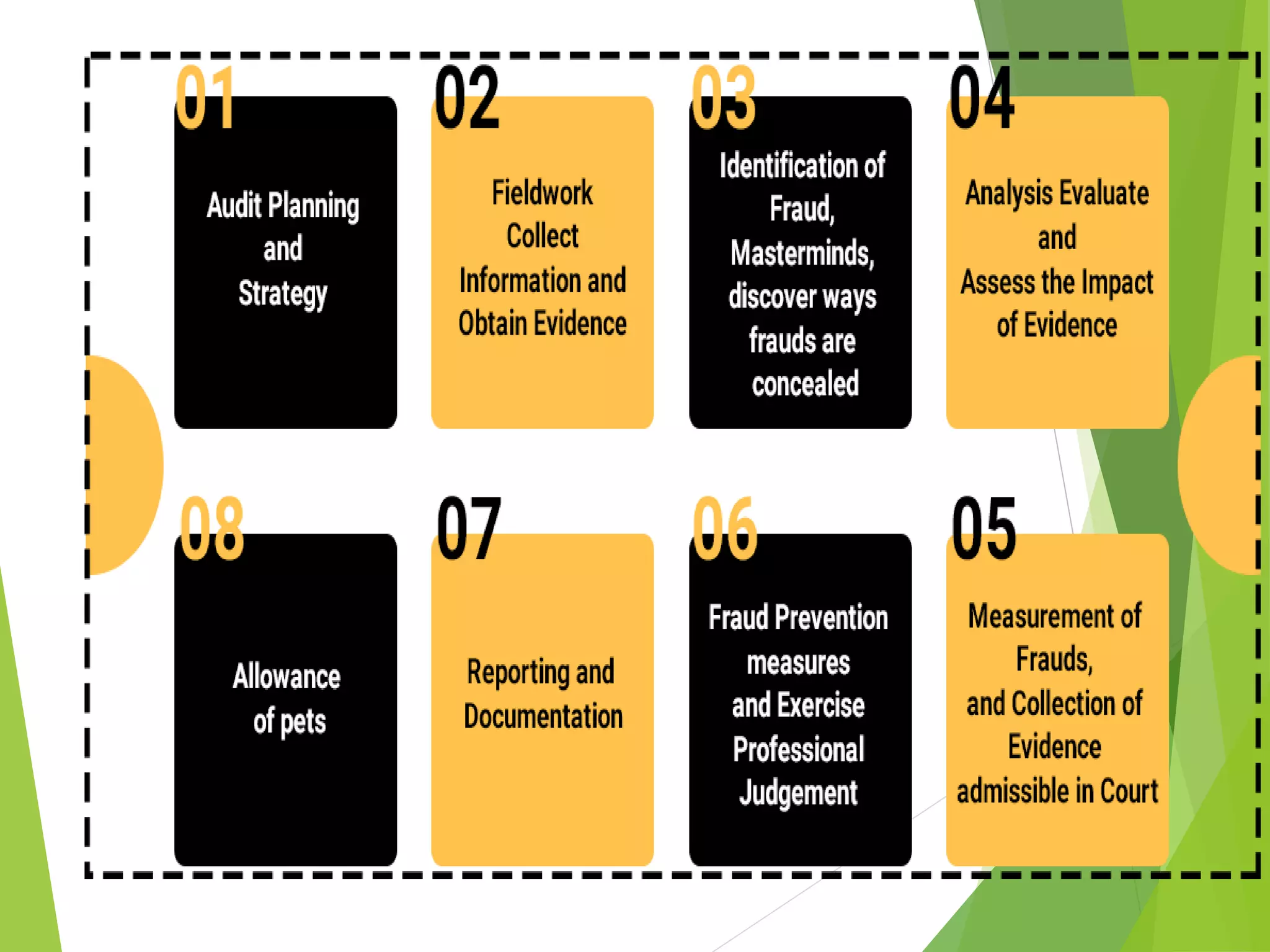

A forensic audit examines a firm's financial records to derive evidence for use in legal proceedings. It requires accounting and auditing procedures as well as expertise in legal frameworks. The process involves planning an investigation, collecting evidence, and producing a written report. Auditors must be prepared to explain their findings and evidence in court. Forensic audits are necessitated by suspicions of corruption, fraud, asset misappropriation, or financial statement fraud.