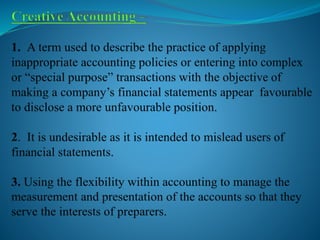

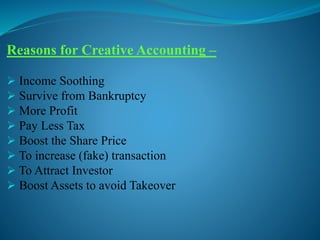

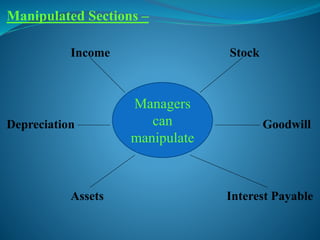

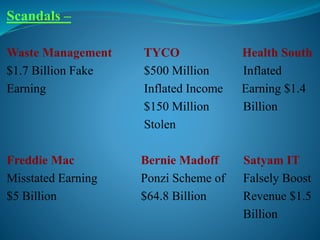

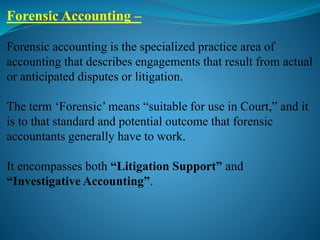

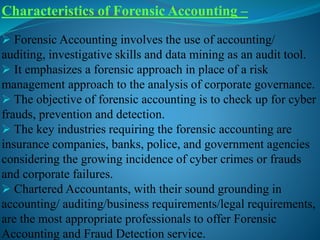

The document discusses creative accounting practices, their motivations, and methods, including income smoothing and off-balance sheet financing, which can distort financial information. It highlights the role of forensic accounting in investigating financial crimes, including the characteristics and skills required for forensic accountants. The document also outlines the advantages and disadvantages of forensic accounting in resolving disputes and detecting fraud.