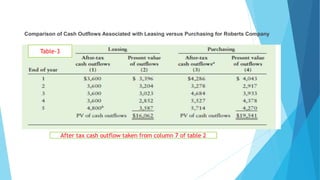

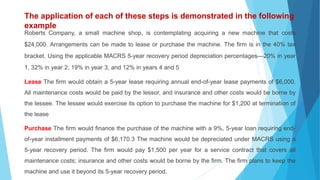

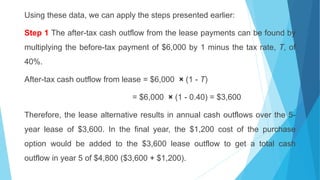

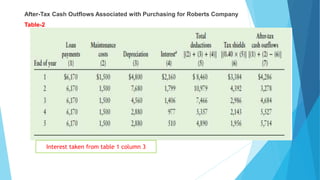

The document discusses lease financing, explaining the difference between operating and financial leases, and providing an analysis framework for the lease-versus-purchase decision. It outlines the necessary steps to evaluate cash flows and present values associated with both alternatives, using a practical example of a machine acquisition by Roberts Company. The conclusion indicates that leasing is the preferred option due to lower present value cash outflows compared to purchasing.

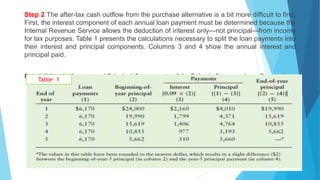

![Step 3 The present values of the cash outflows associated with the lease

(from Step 1) and purchase (from Step 2) alternatives are calculated in

Table 3 If we ignore any flotation costs, the firm’s after-tax cost of debt

would be 5.4% [9% debt cost (1 0.40 tax rate)]. To reflect both the flotation

costs associated with selling new debt and the possible need to sell the debt

at a discount, we use an after-tax debt cost of 6% as the applicable

discount rate. The sum of the present values of the cash outflows for the

leasing alternative is given in column 2 of Table 3, and the sum of those for

the purchasing alternative is given in column 4.](https://image.slidesharecdn.com/leasefinancing-200902143350/85/Lease-financing-18-320.jpg)