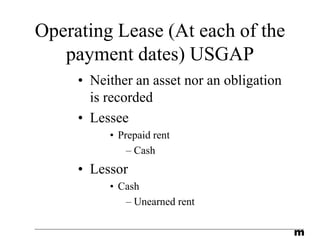

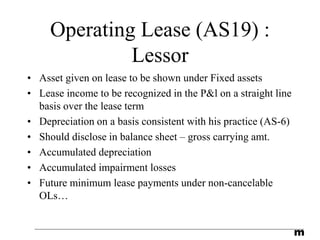

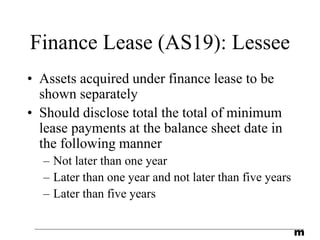

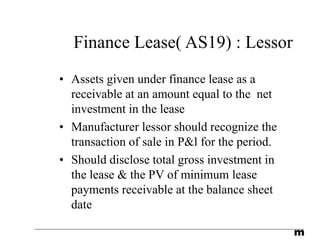

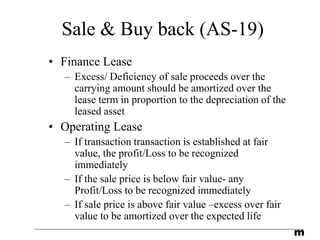

This document provides an overview of lease accounting standards under US GAAP, IAS, and AS 19. It defines key lease classifications such as operating and finance leases. For operating leases, it outlines the accounting treatment for lessees and lessors. For finance leases, it discusses how lessees should recognize assets and liabilities, and how lessors account for the transactions. It also covers sale and leaseback transactions and treatment of residual values under various standards.