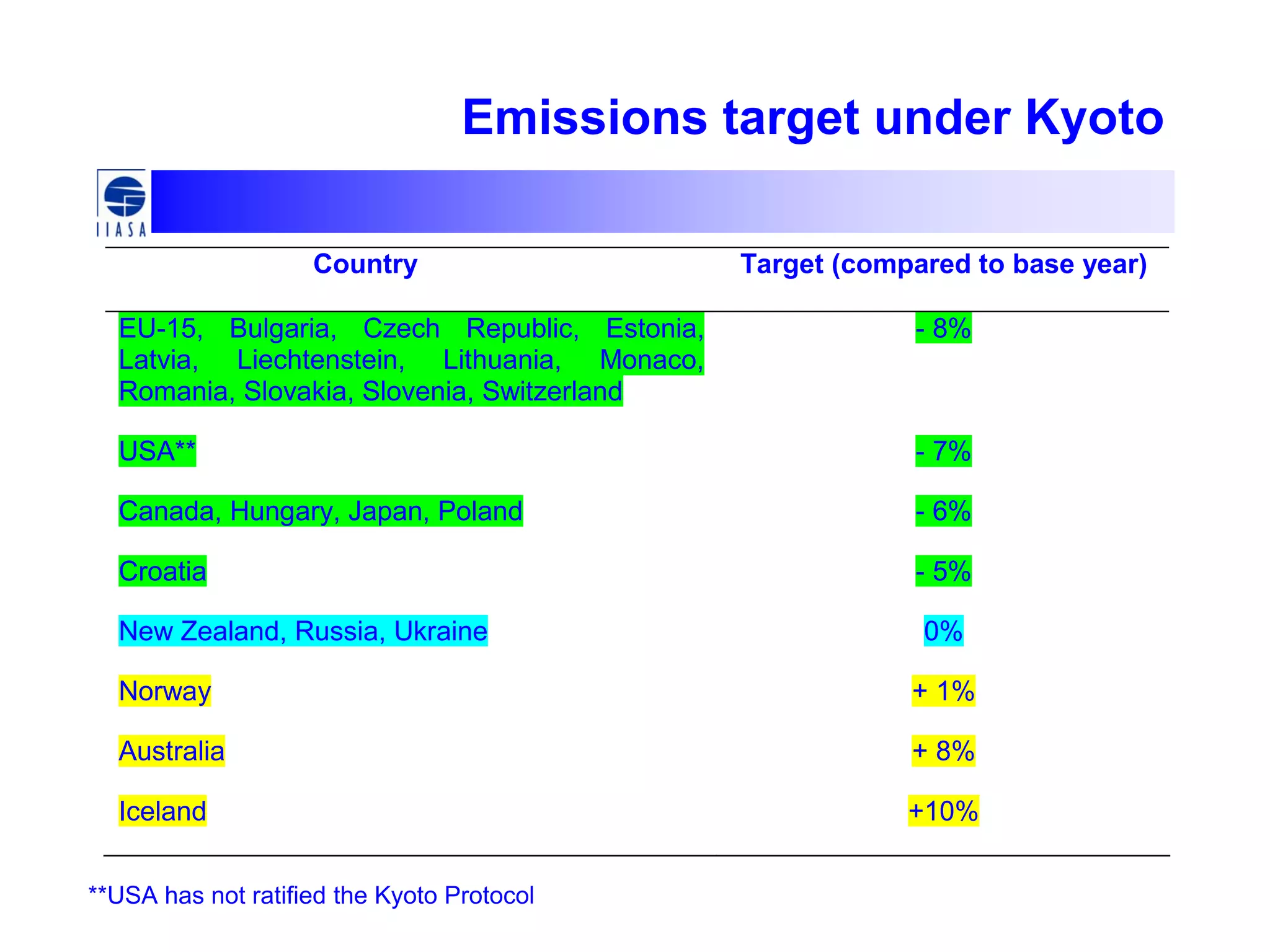

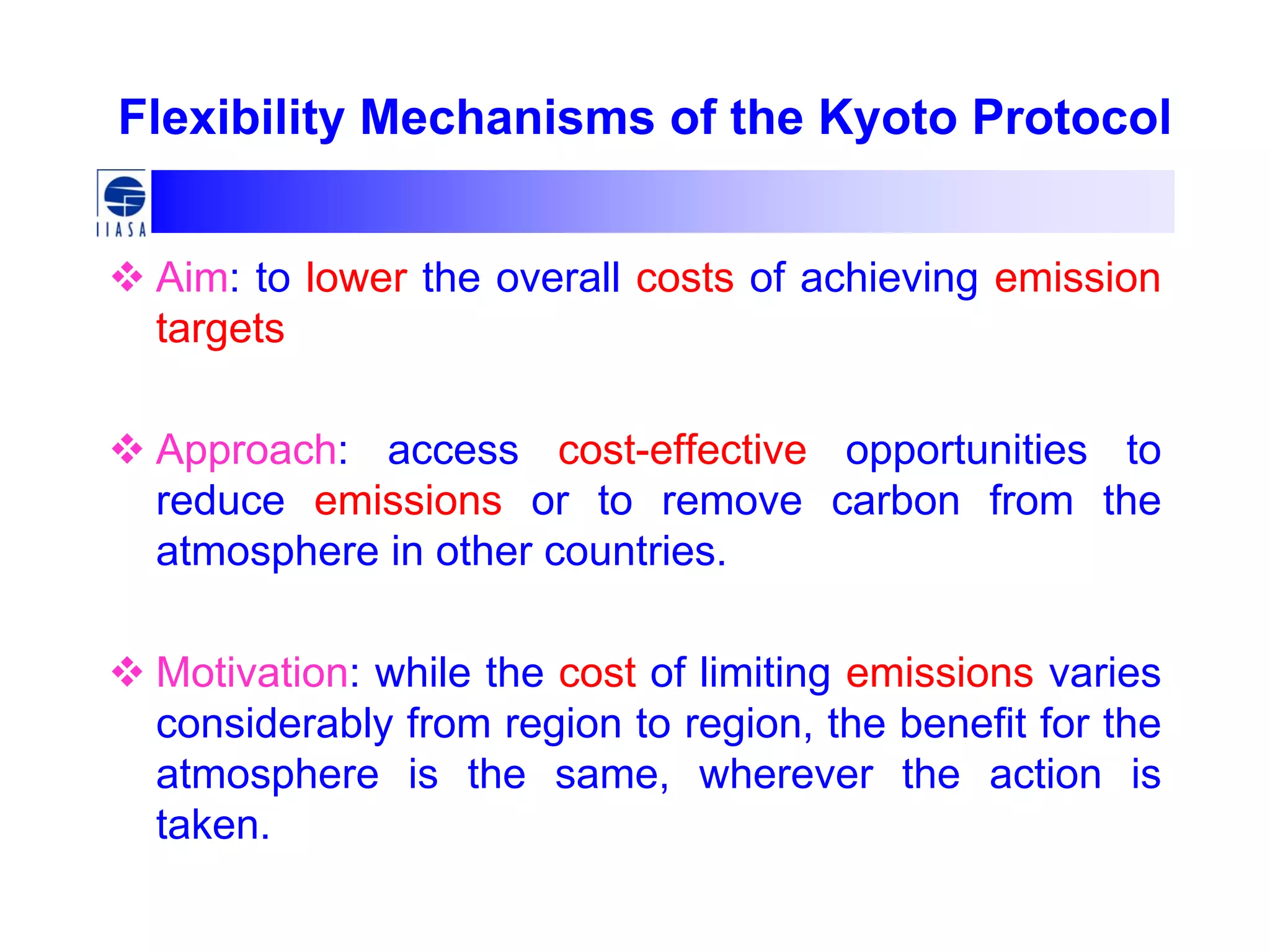

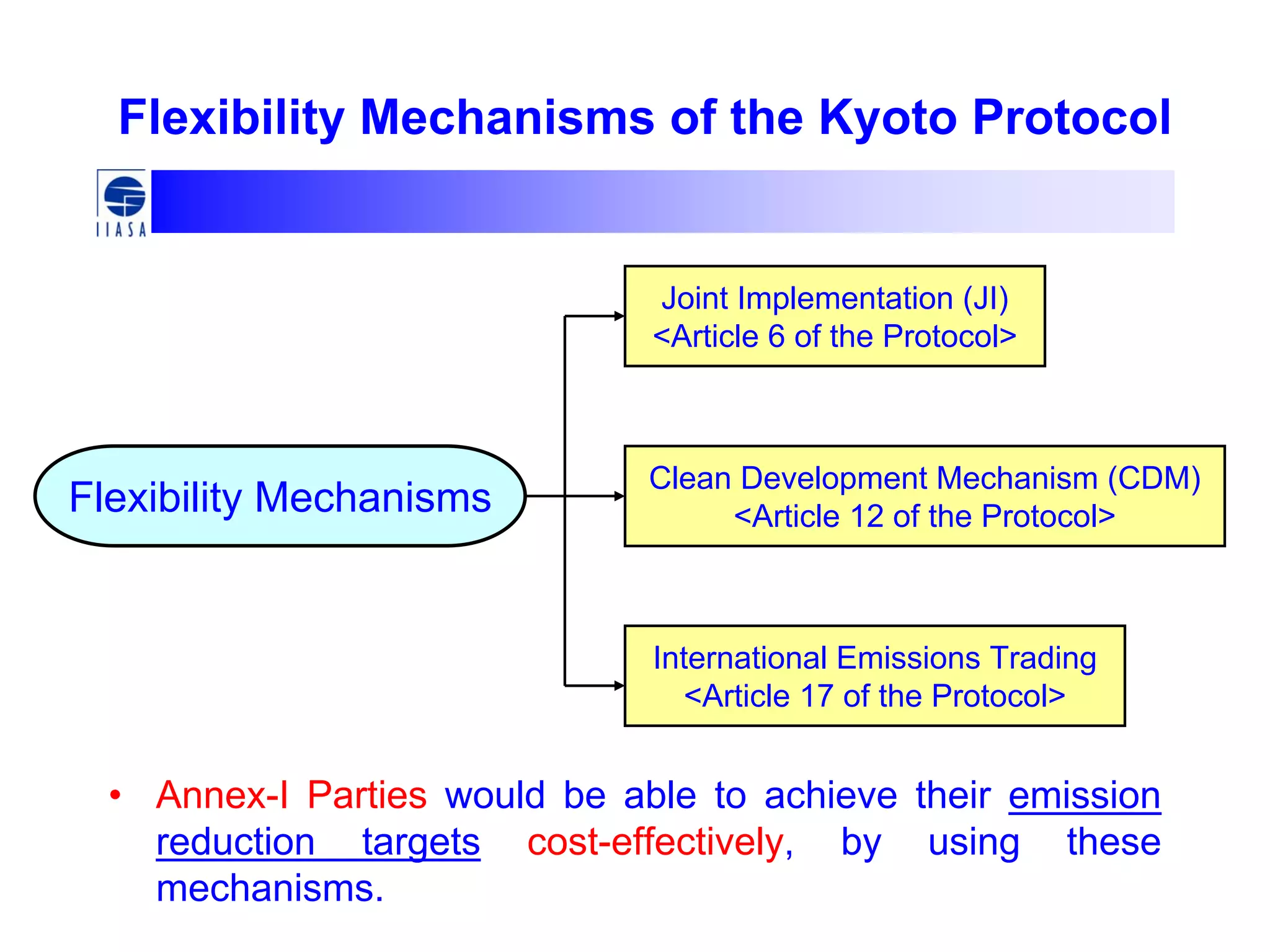

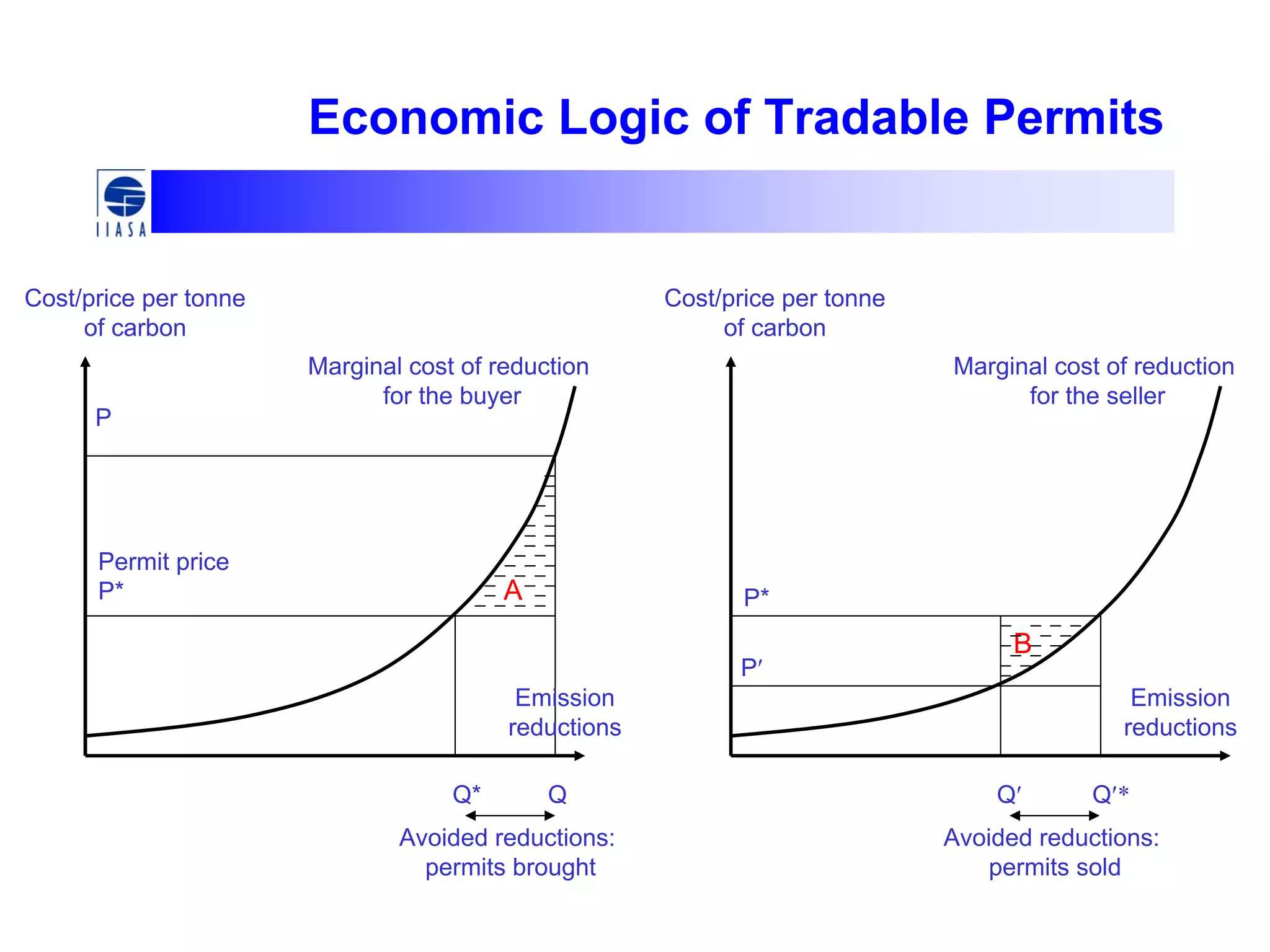

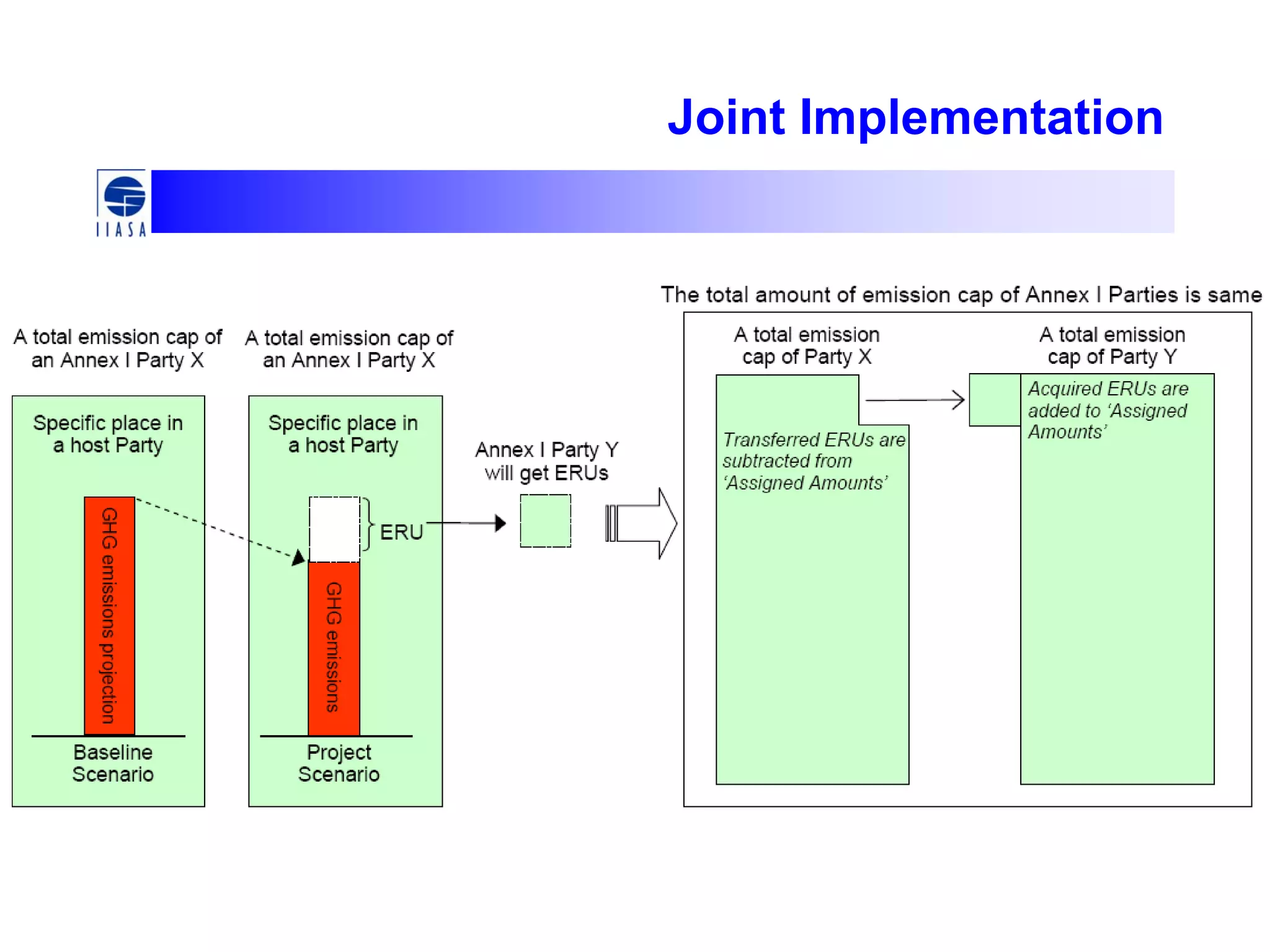

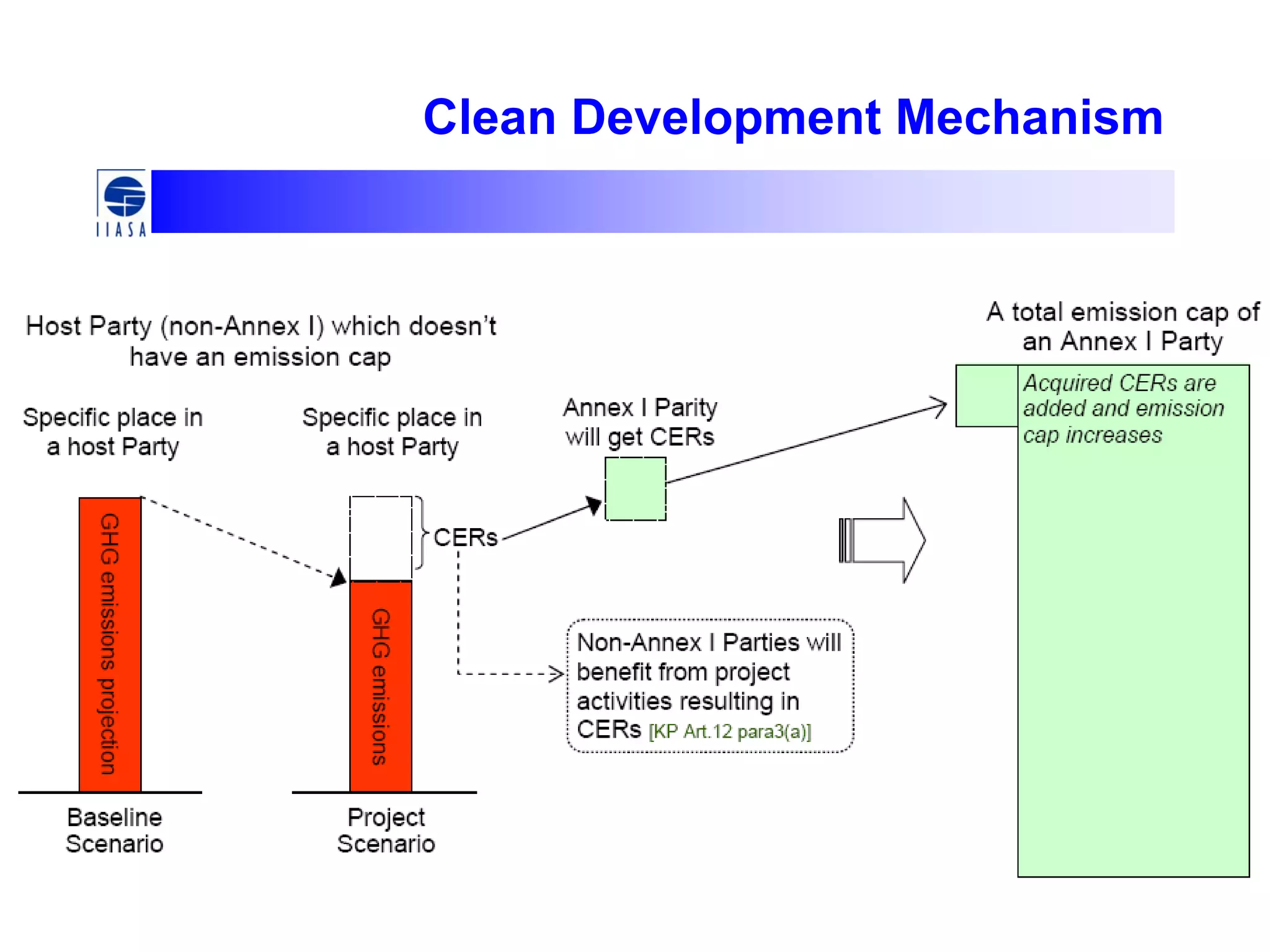

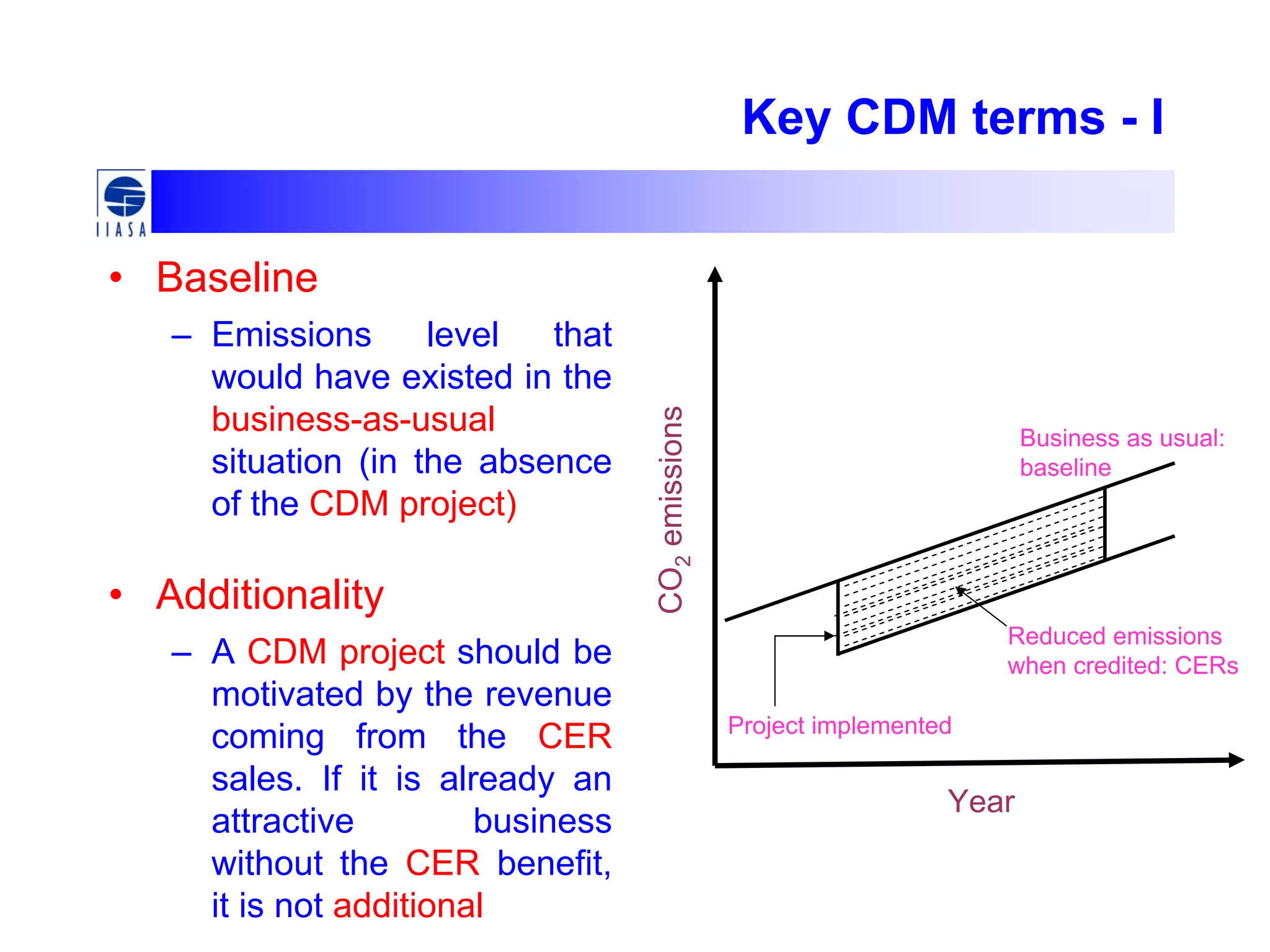

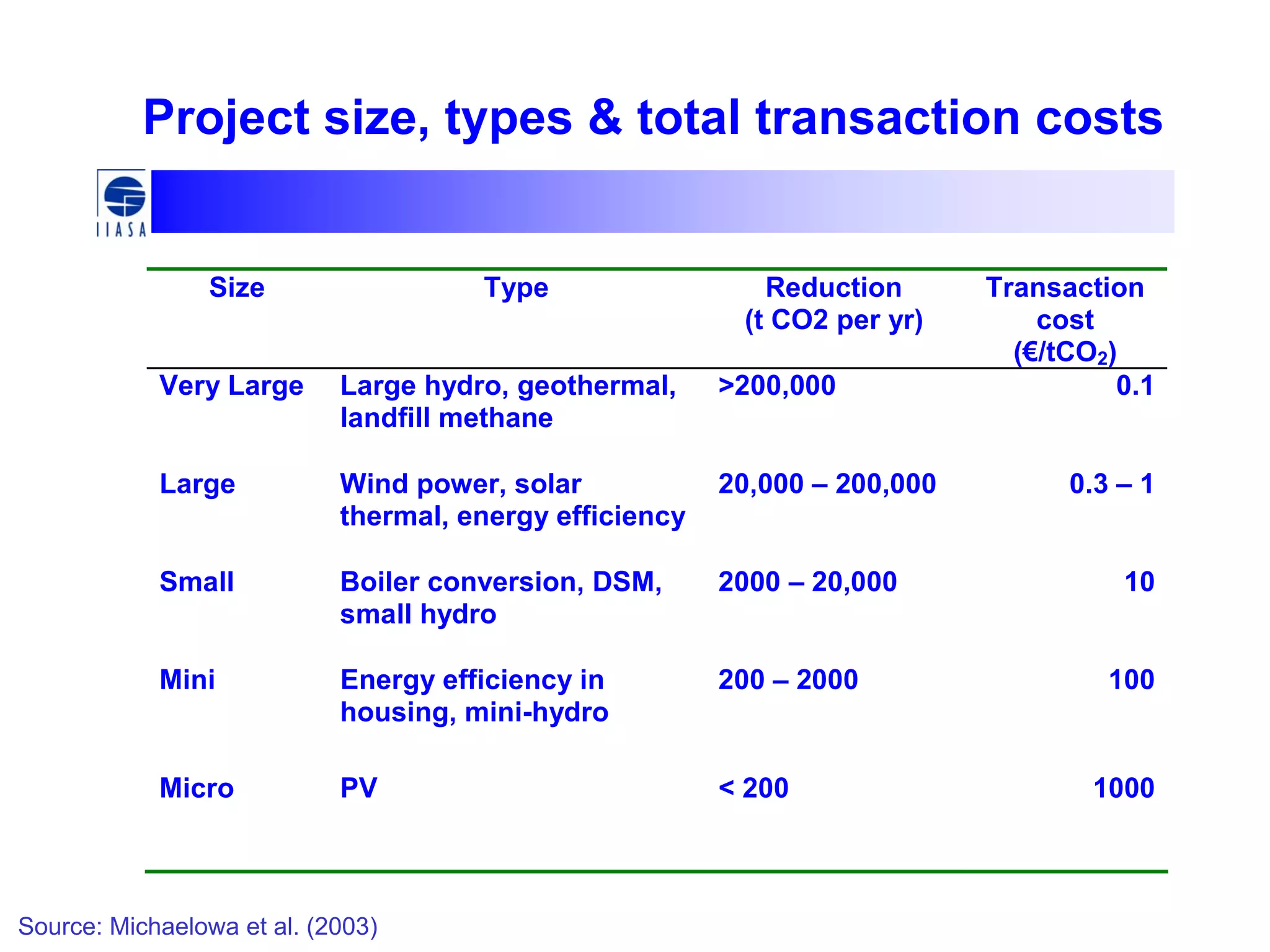

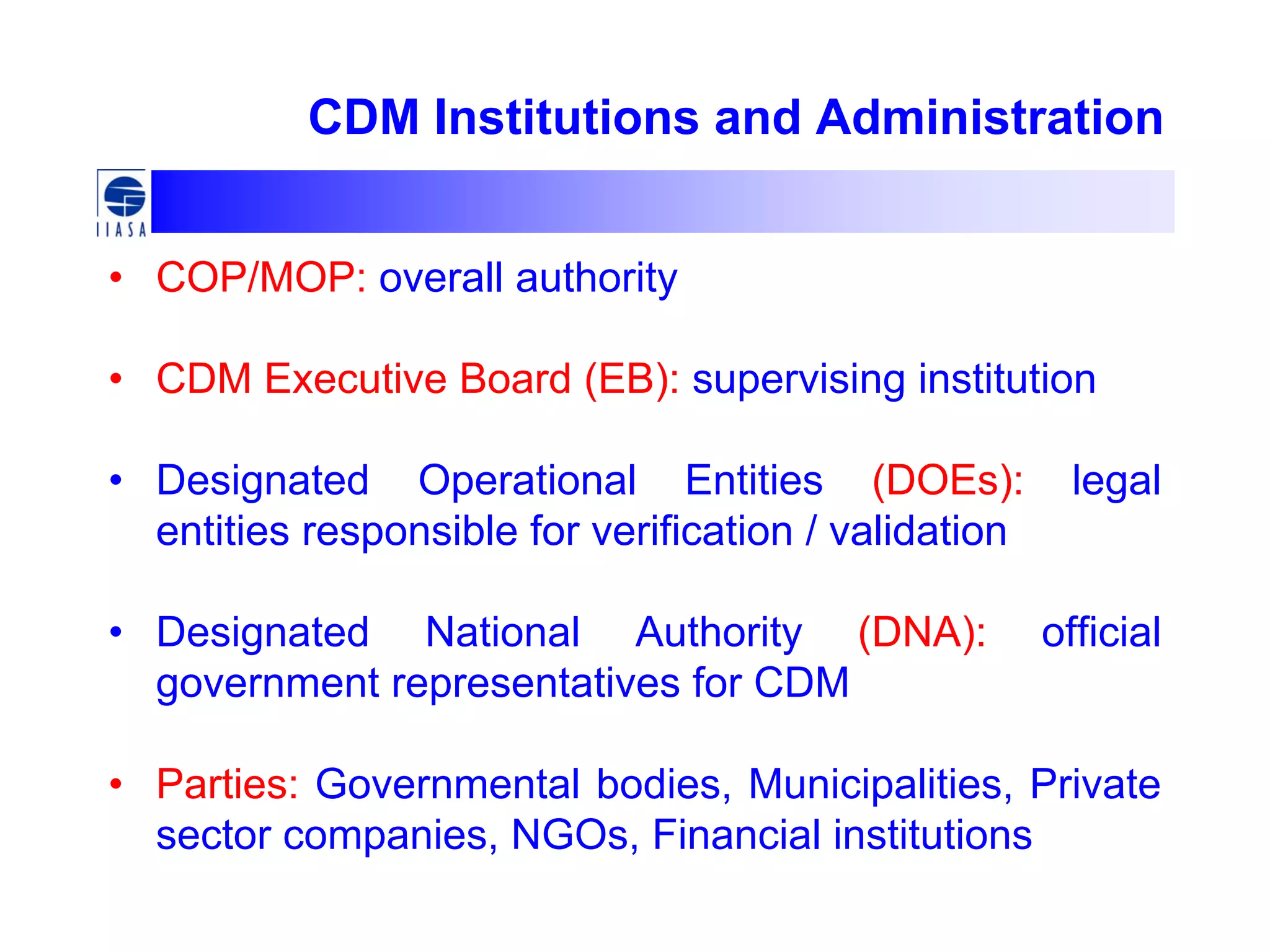

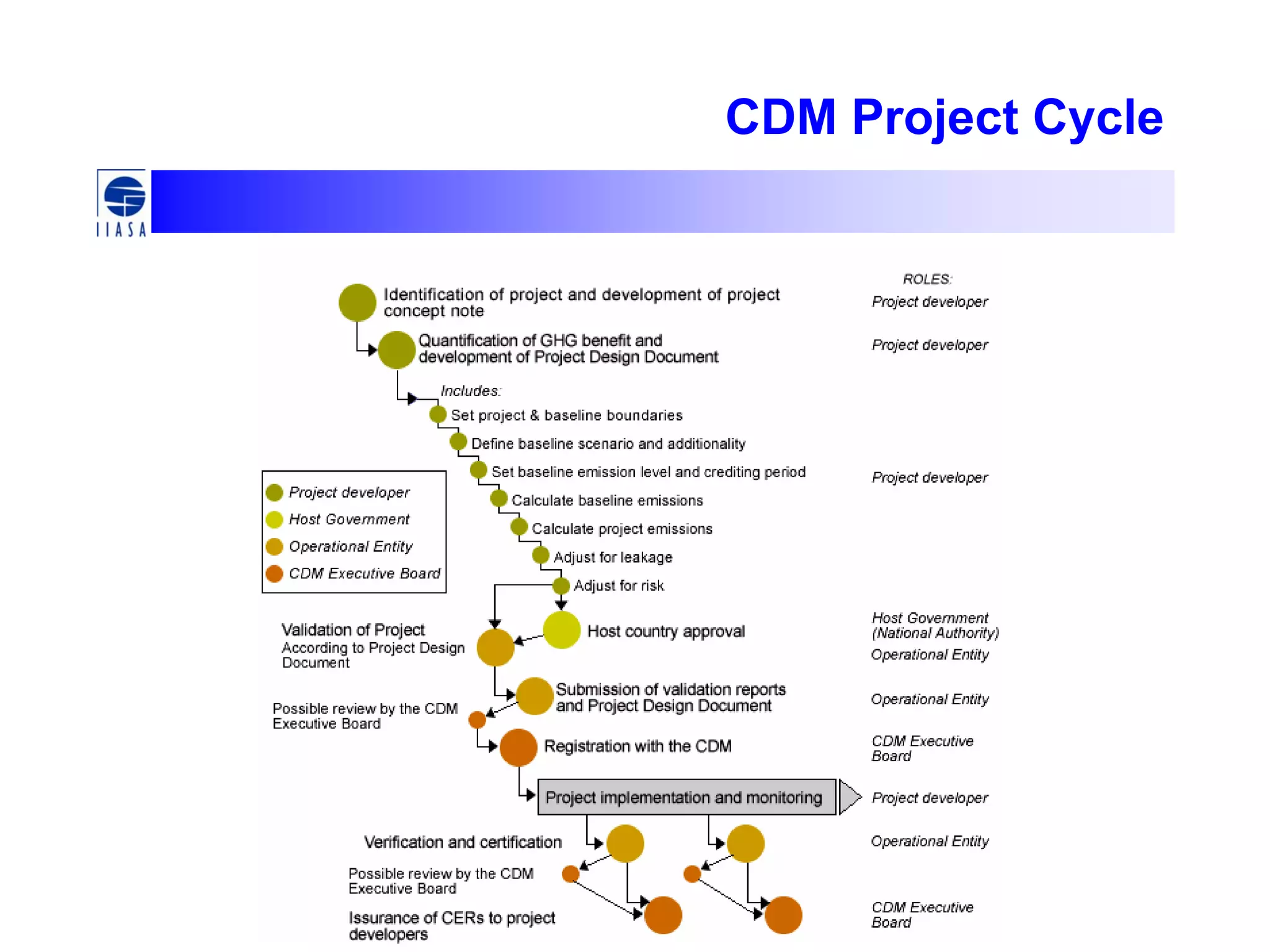

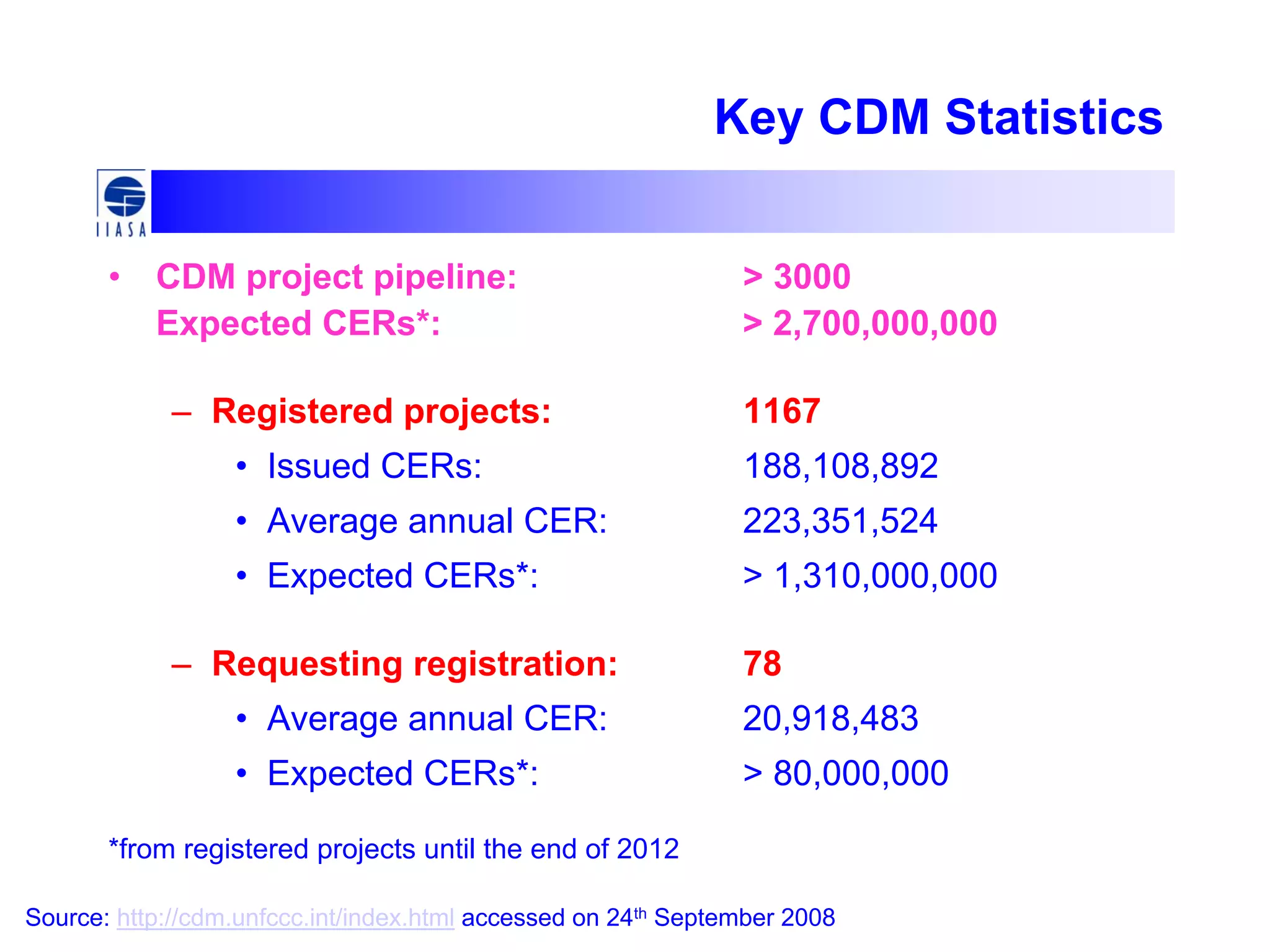

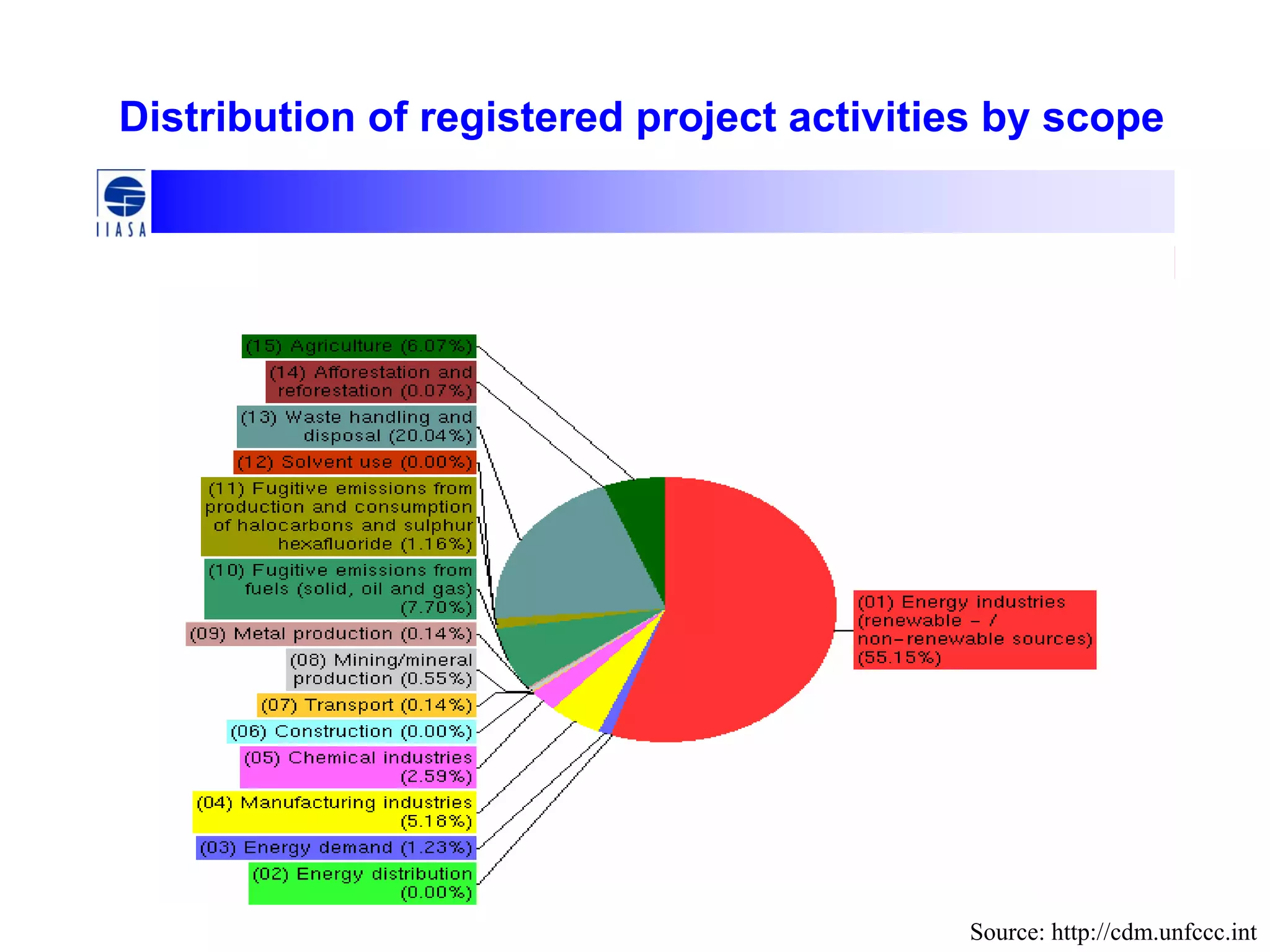

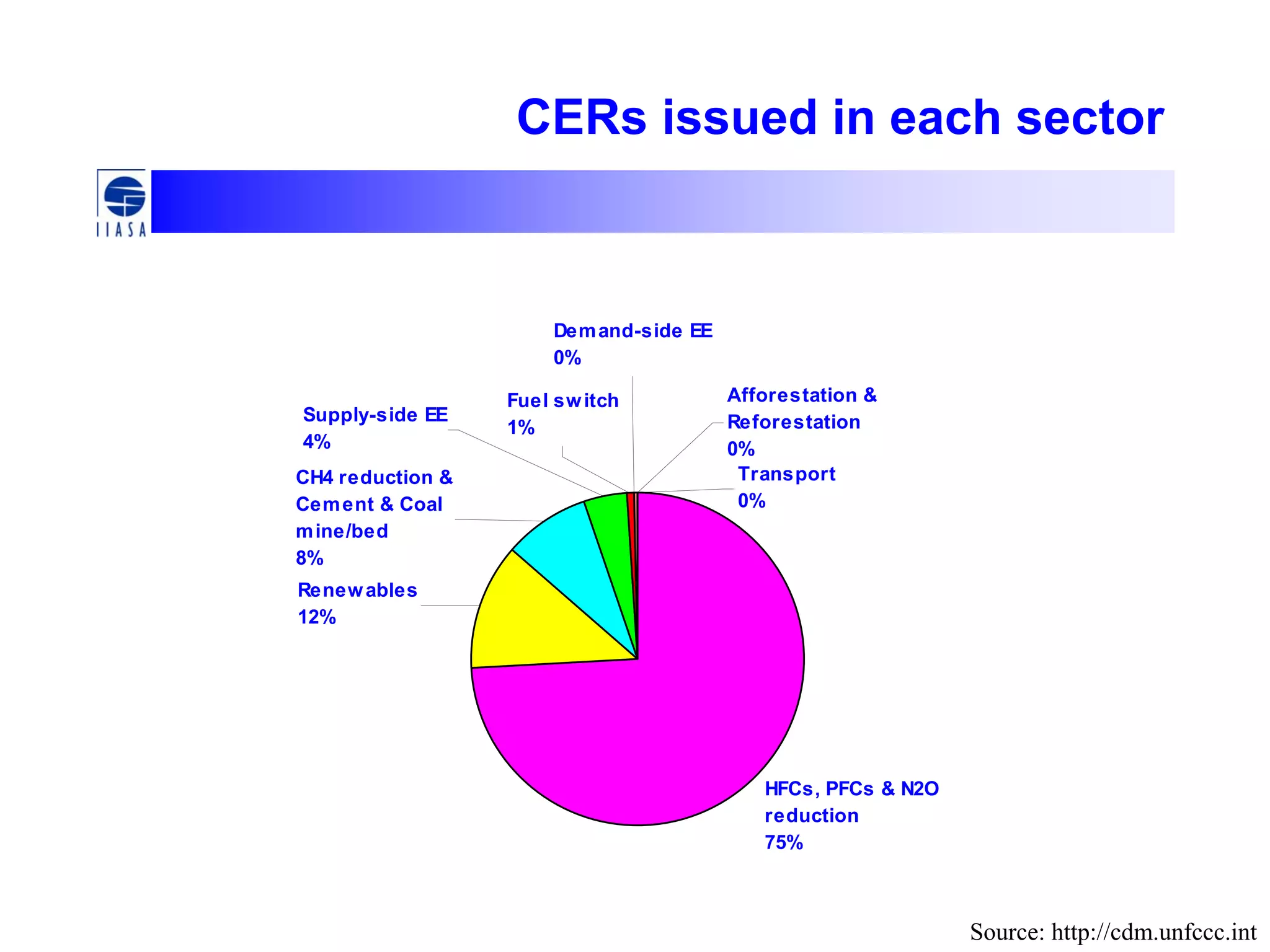

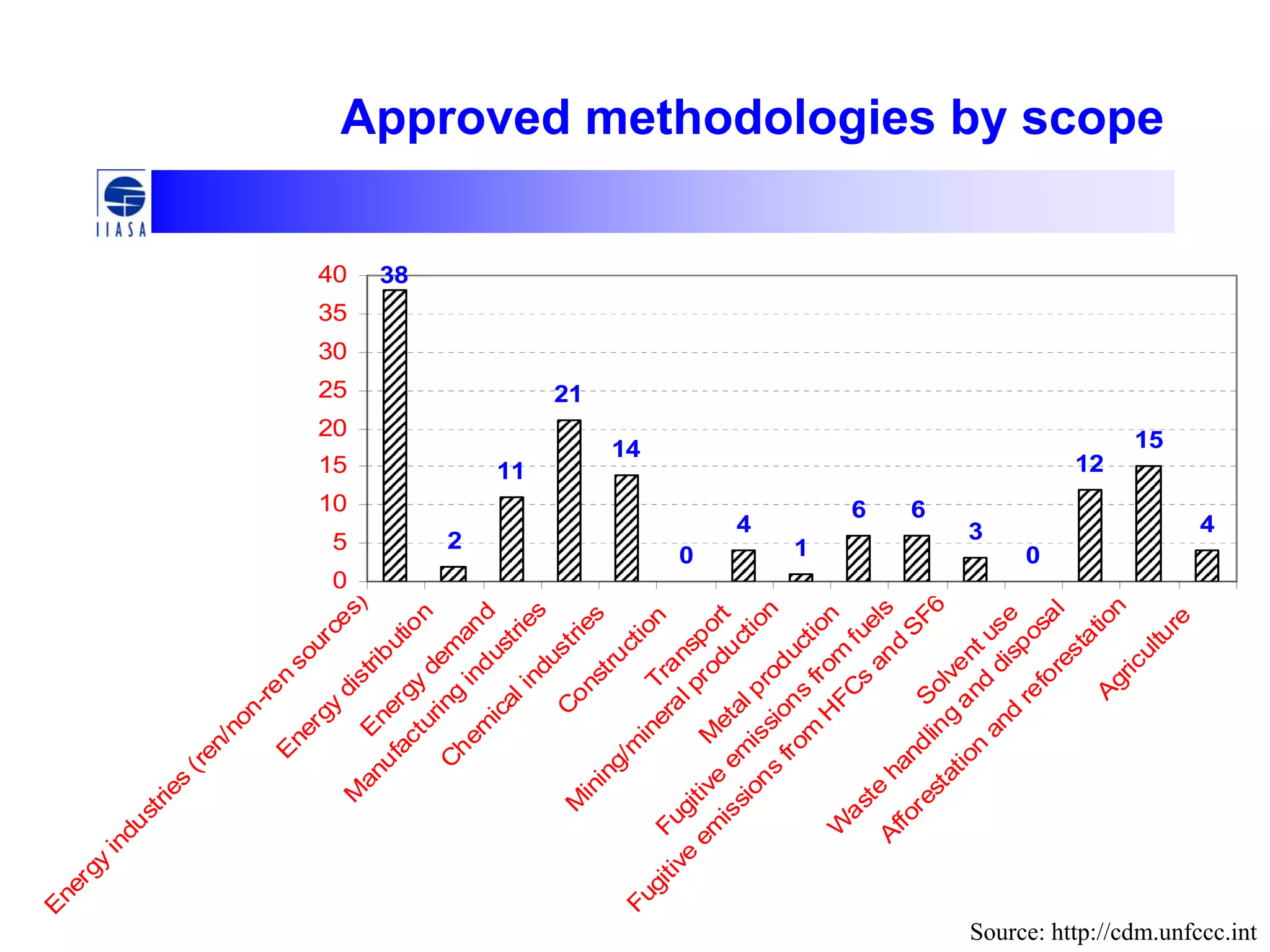

The document summarizes the Kyoto Protocol's flexibility mechanisms, including the Clean Development Mechanism (CDM). It outlines emissions targets for countries, describes how the CDM works to generate carbon credits from emissions reduction projects in developing countries, and reviews CDM project statistics. Over 3000 CDM projects have been proposed, with over 2.7 billion credits expected. Registered projects have generated over 188 million credits so far. The CDM aims to lower compliance costs and drive sustainable development, but has also faced criticisms around additionality and effects on national strategies.