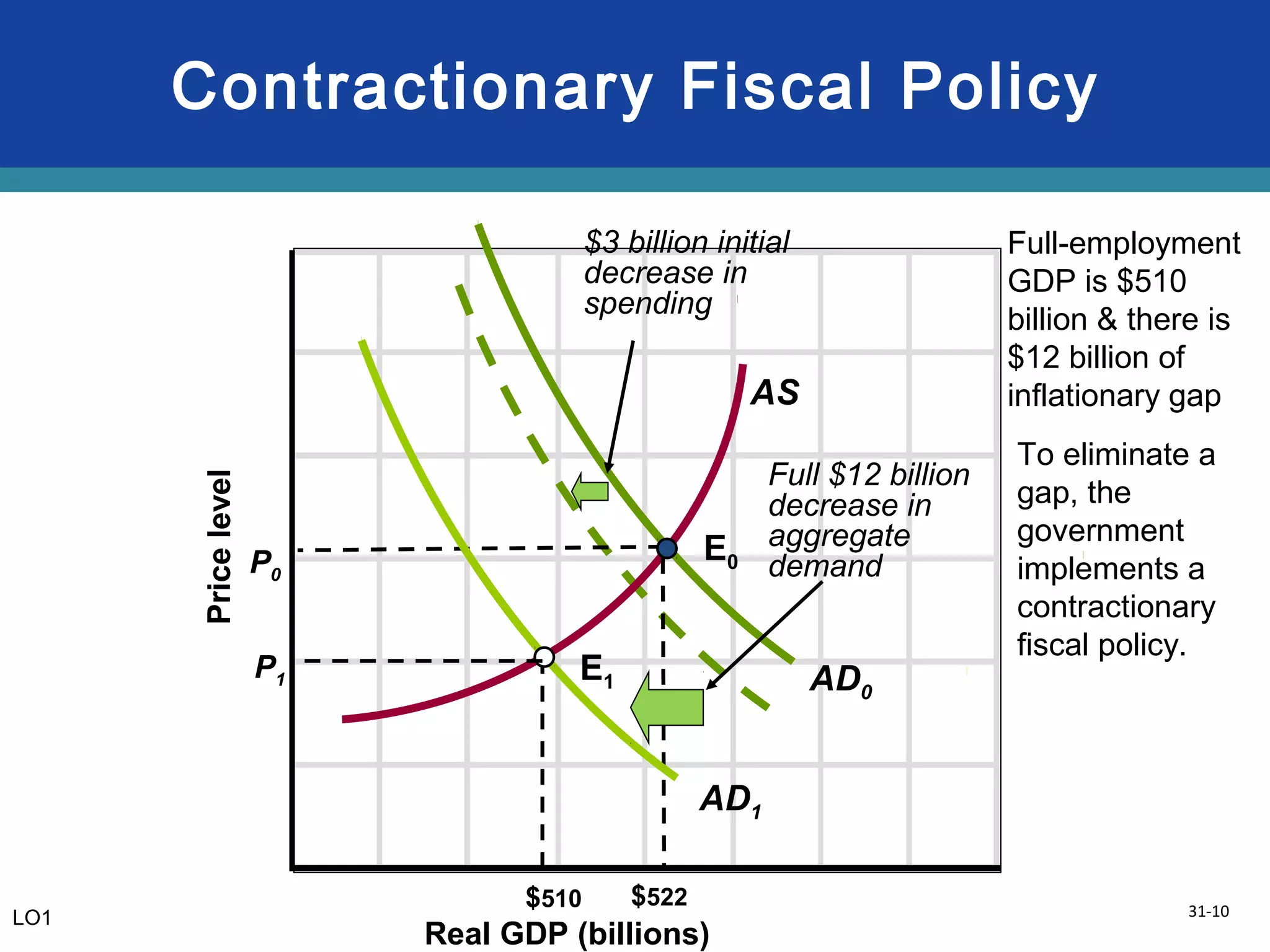

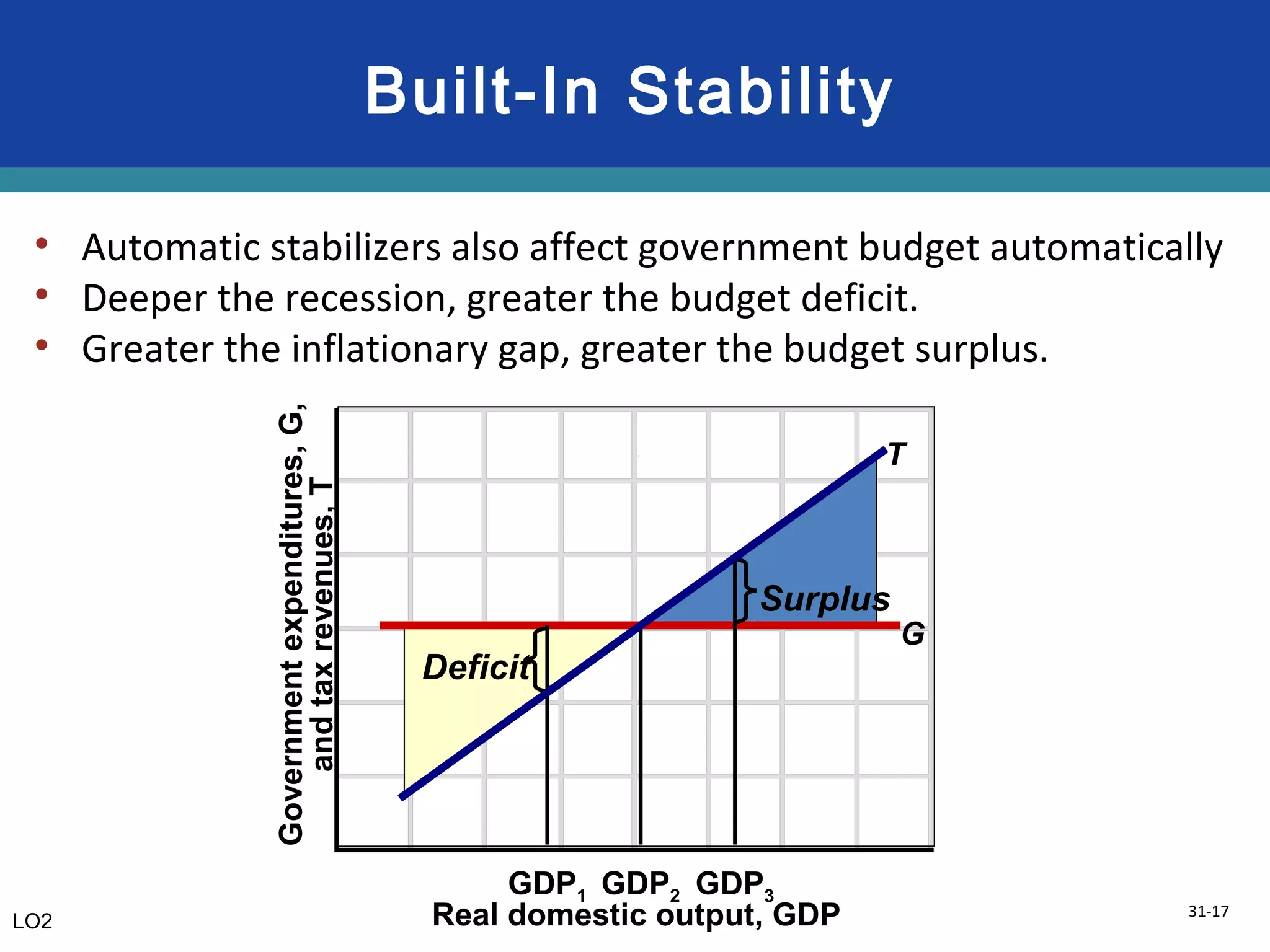

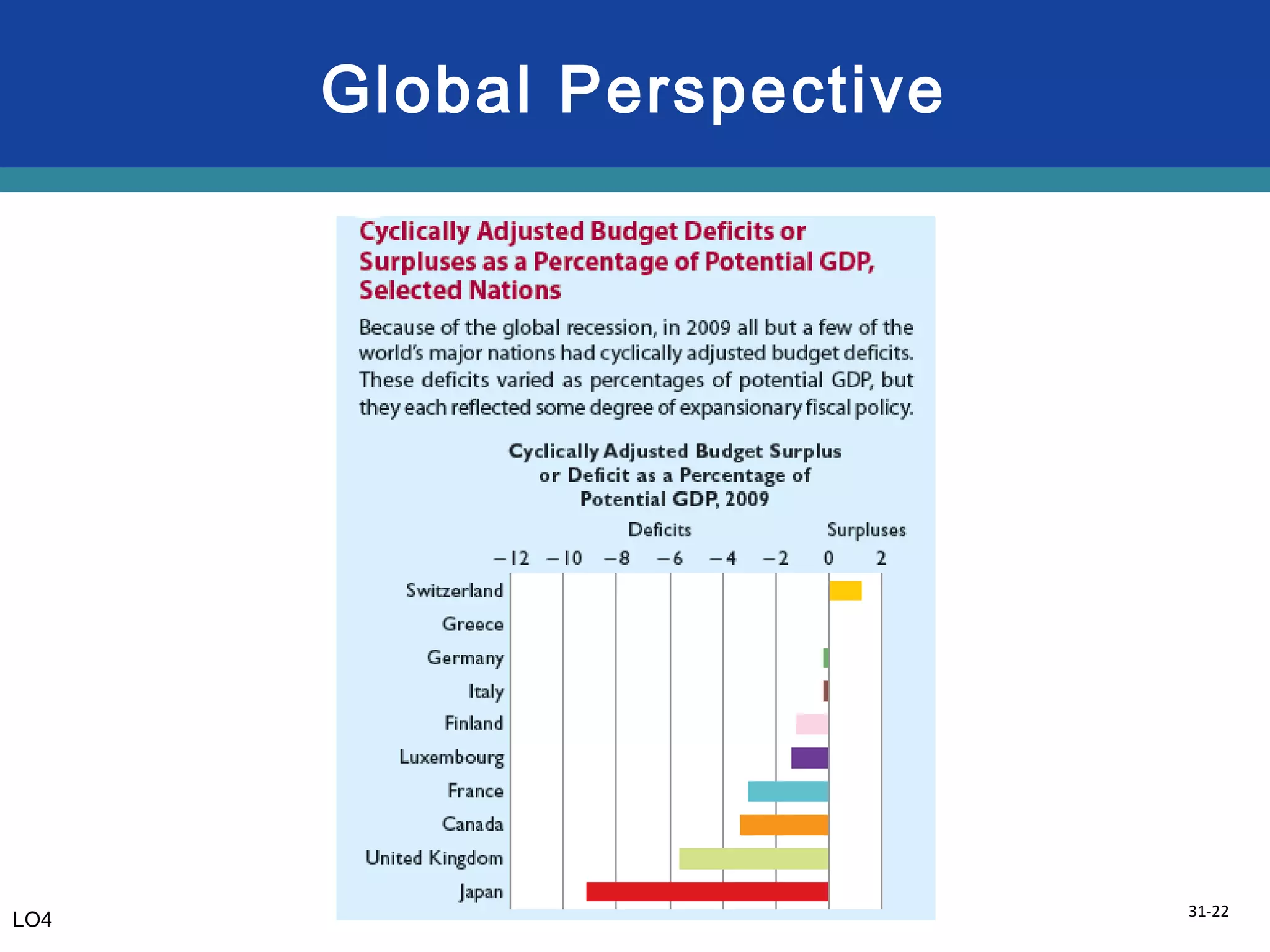

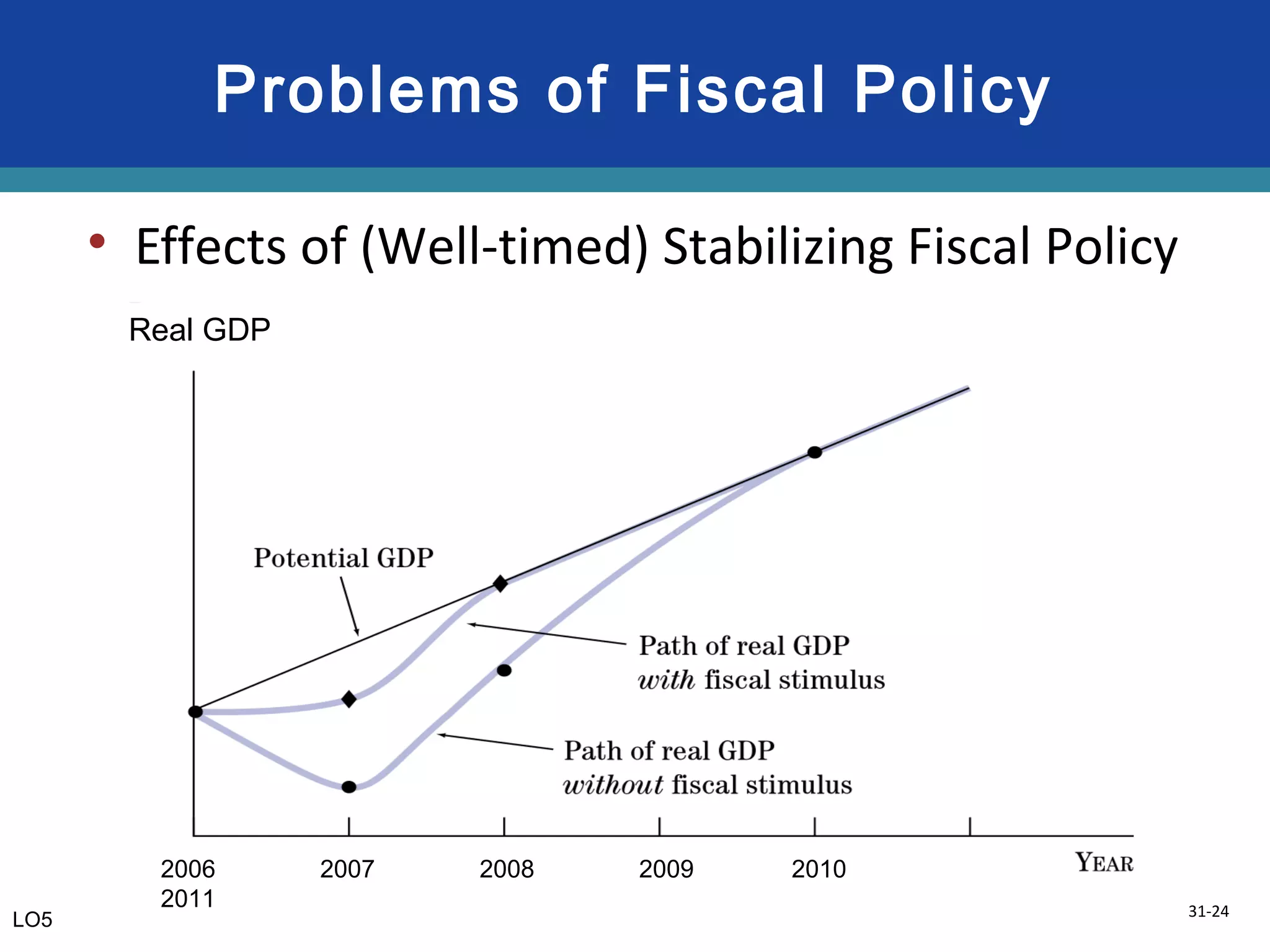

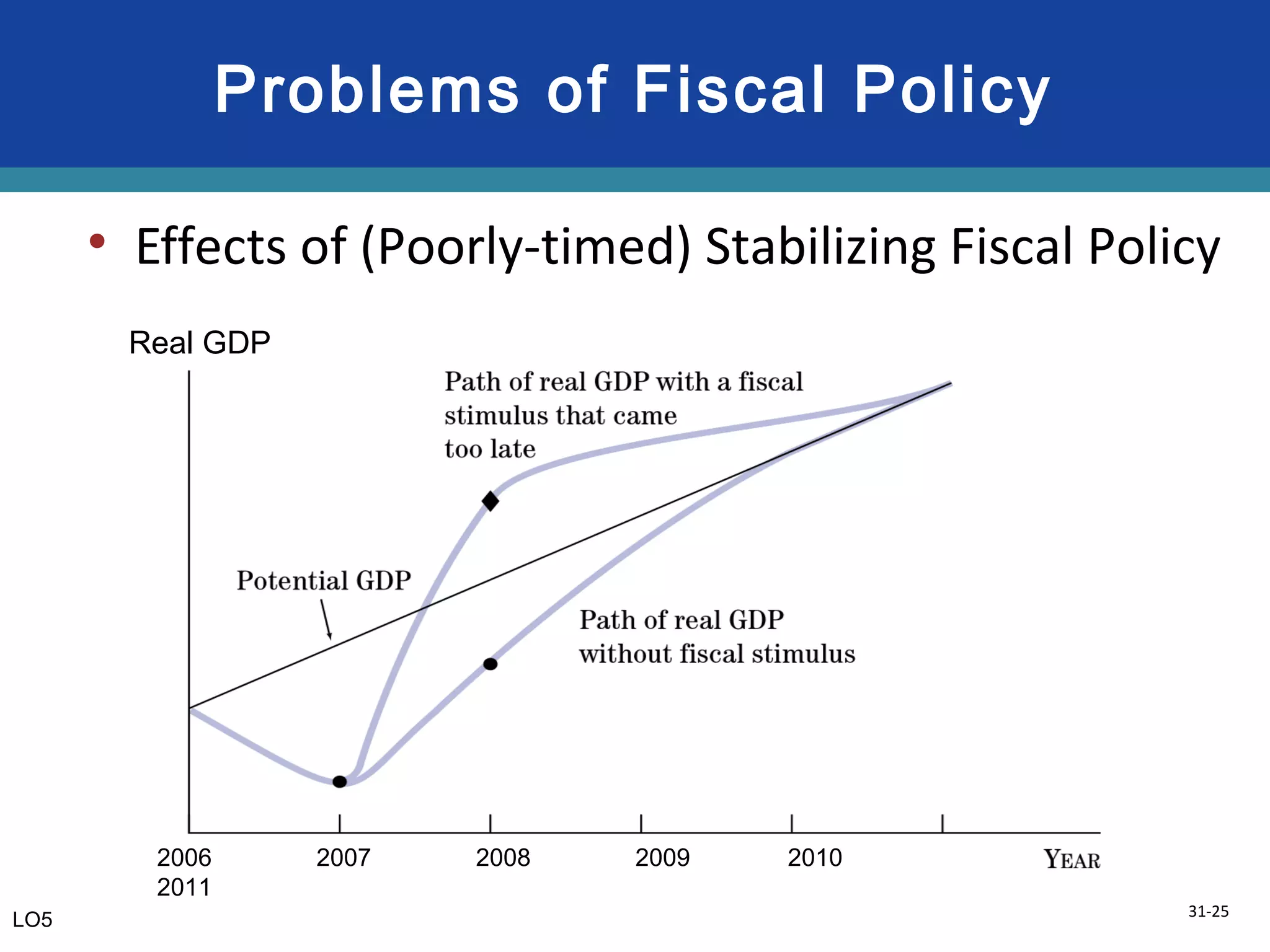

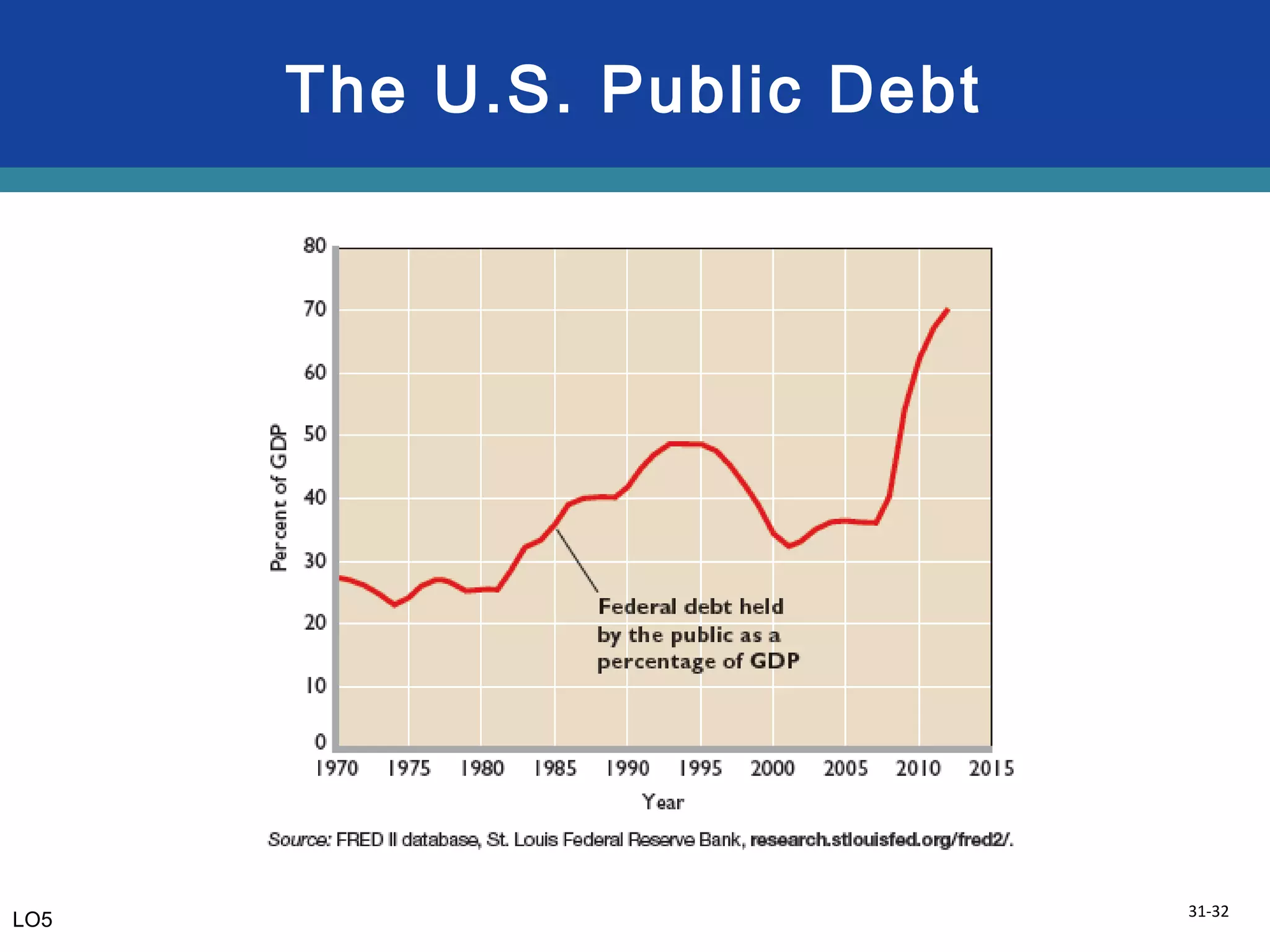

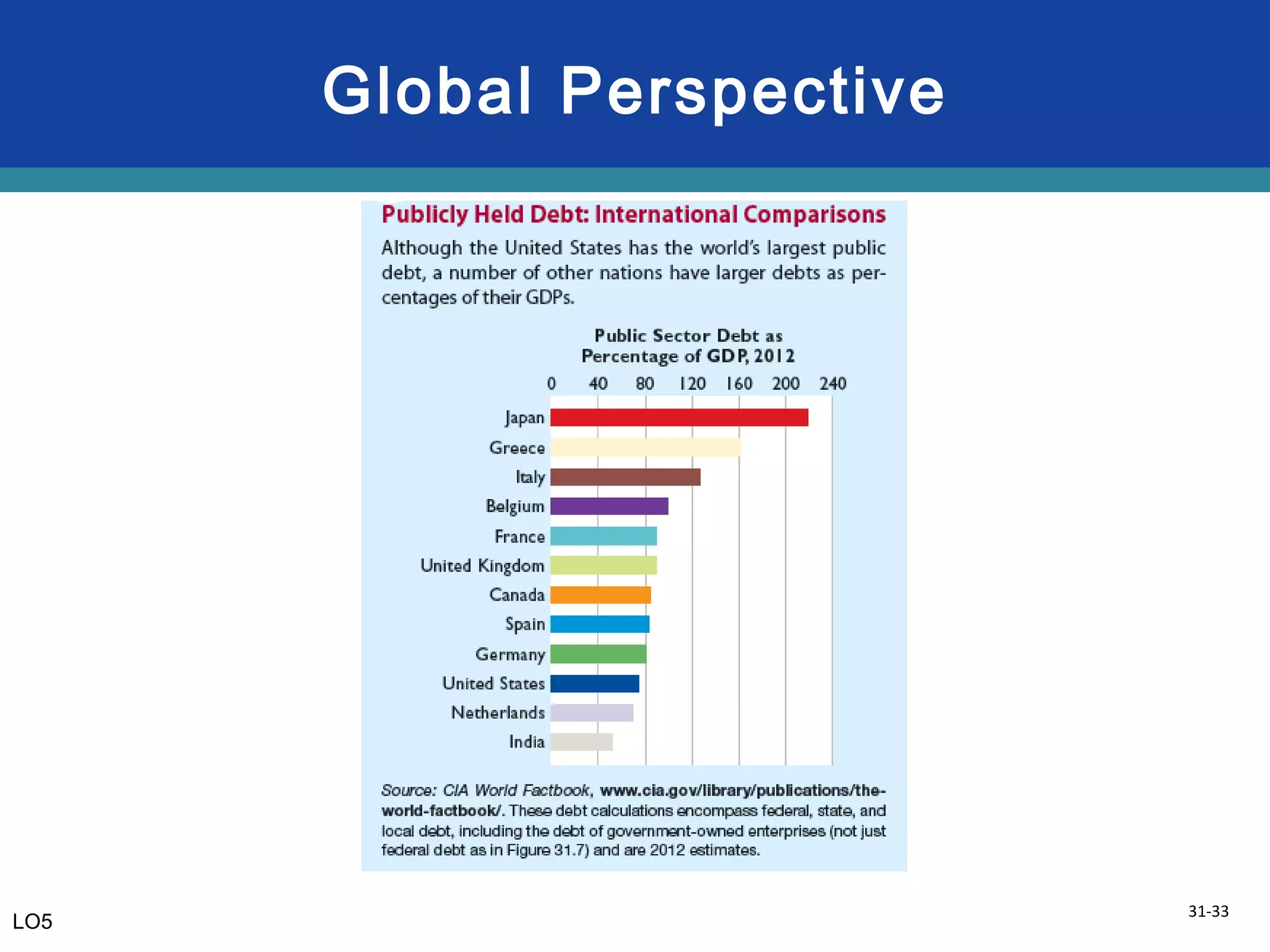

The document discusses fiscal policy, deficits, and debt. It defines fiscal policy as using the federal budget to achieve macroeconomic goals of growth and employment. There are two types of fiscal policy - discretionary, which are deliberate changes to spending and taxes, and non-discretionary, which are automatic changes. Expansionary fiscal policy involves increasing spending or decreasing taxes to boost aggregate demand during recessions, while contractionary policy involves the opposite to reduce inflationary gaps. Large deficits and debt are a long-term concern but bankruptcy is unlikely due to the ability to refinance or collect taxes. Social security and medicare funds face shortfalls that may require reforms like raising the retirement age.