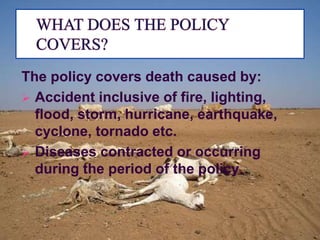

Cattle and livestock insurance policies provide coverage for animals such as cows, buffaloes, bullocks, sheep and goats owned by individuals that are used commercially or personally. The policies cover the risks of permanent disability or death of the animals due to accidents or diseases during the policy period. They cover deaths caused by accidents, diseases, surgeries, riots and strikes. The policies also cover permanent total disability of cattle. However, they do not cover willful injury, neglect, overloading, unskilled treatment, use of animals for unauthorized purposes, pre-existing accidents or diseases, intentional slaughter, theft or sale of insured animals, or losses due to war, nuclear events, or diseases within 15 days of the policy start