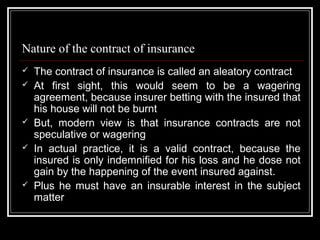

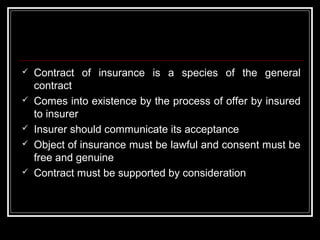

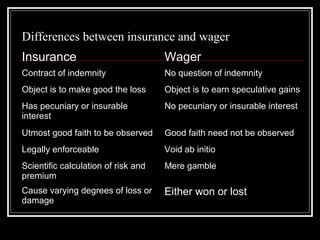

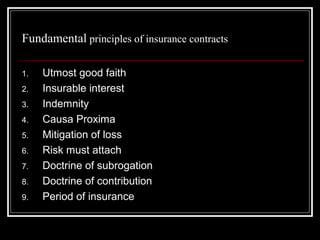

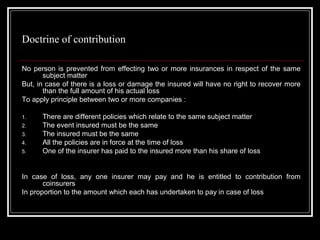

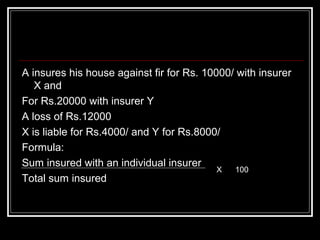

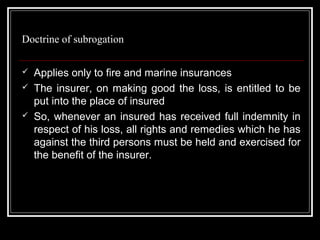

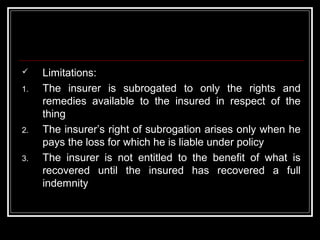

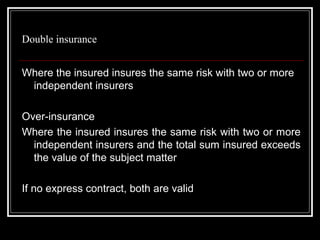

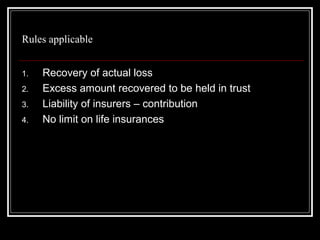

The document discusses key concepts related to insurance contracts in India including the Insurance Act of 1938, essential elements of insurance contracts, types of insurance, principles of insurance contracts, and concepts like insurable interest, indemnity, contribution, and subrogation. It also provides examples of different types of insurance like life, fire, and marine insurance and discusses the nature of insurance contracts.