The document discusses several valuation models:

1. Discounted cash flow (DCF) model, which discounts future cash flows.

2. Tobin's Q model, which compares a firm's market value to replacement cost of assets.

3. Market multiples model, which uses multiples like price-to-earnings to value firms.

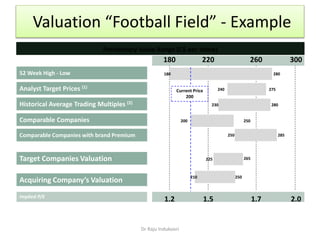

4. Valuation football field (FBF) provides an overview of valuations from different sources.