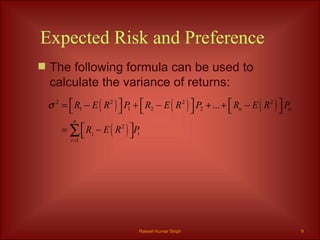

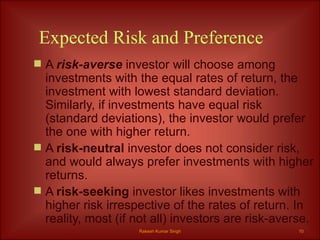

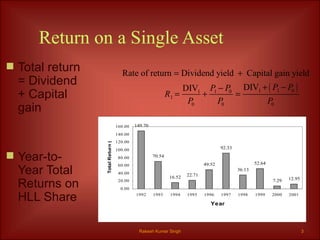

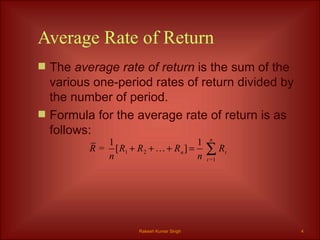

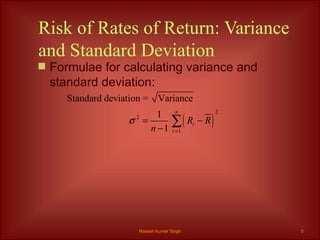

The chapter discusses key concepts in capital market theory including average and expected rates of return, measuring risk for individual assets, calculating variance and standard deviation, and the relationship between risk and return. It explains that expected return incorporates probabilities, variance measures expected risk, and risk-averse investors prefer lower risk for equal returns or higher returns for equal risk. Normal distribution is an important concept that assumes returns are normally distributed.

![Expected Return : Incorporating Probabilities in Estimates The expected rate of return [ E ( R )] is the sum of the product of each outcome (return) and its associated probability: Rakesh Kumar Singh](https://image.slidesharecdn.com/ch04-111224051946-phpapp01/85/Financial-Management-chapter-4-8-320.jpg)