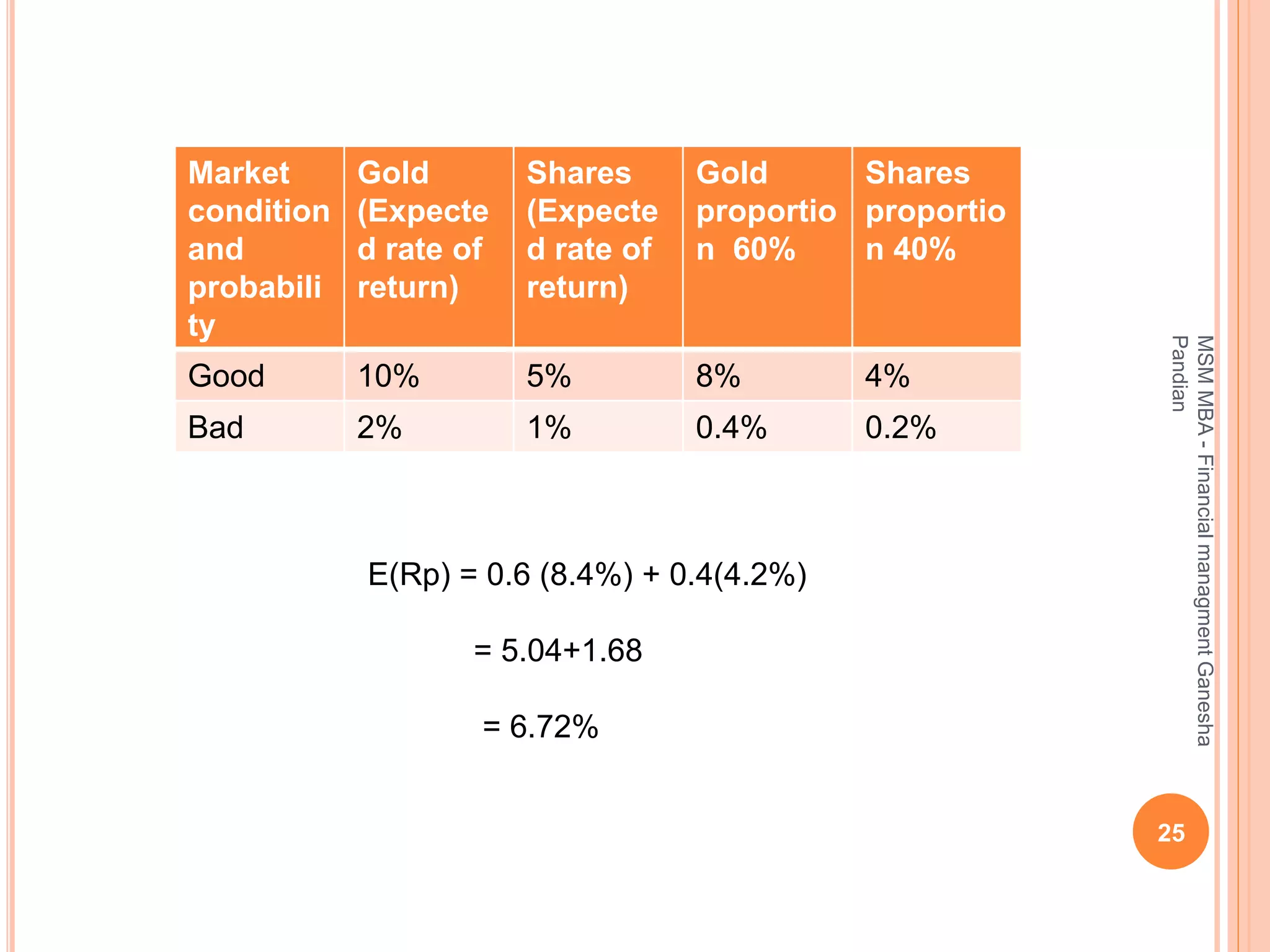

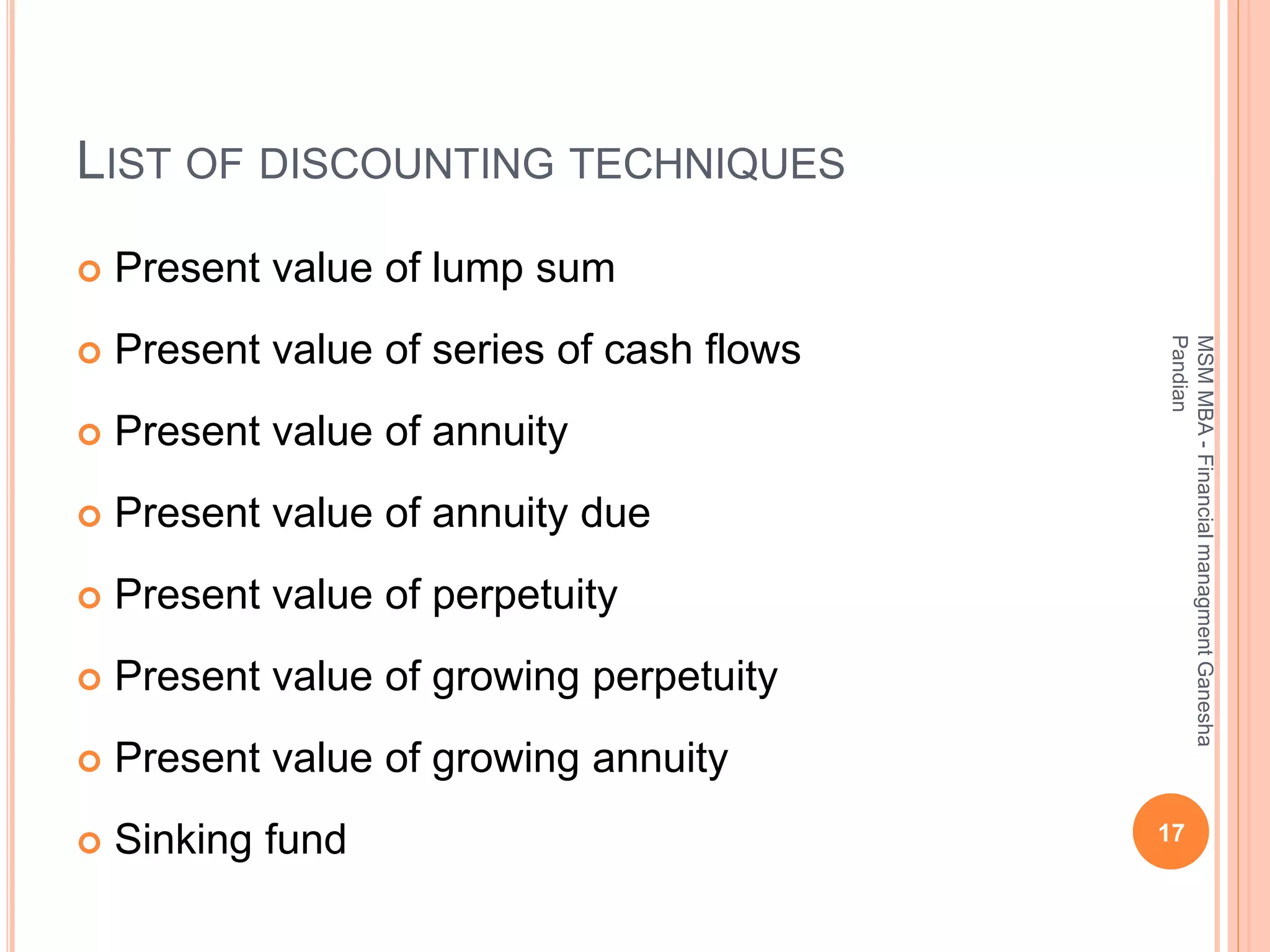

This document provides an overview of the key topics covered in the BA 5203 Financial Management unit on the foundations of finance. It introduces concepts such as financial management objectives and functions, the time value of money, risk and return analysis of single assets and portfolios. Methods for calculating present and future values are presented. The differences between equity shares and bonds are outlined. Overall it serves as an introductory guide to fundamental principles of corporate finance.

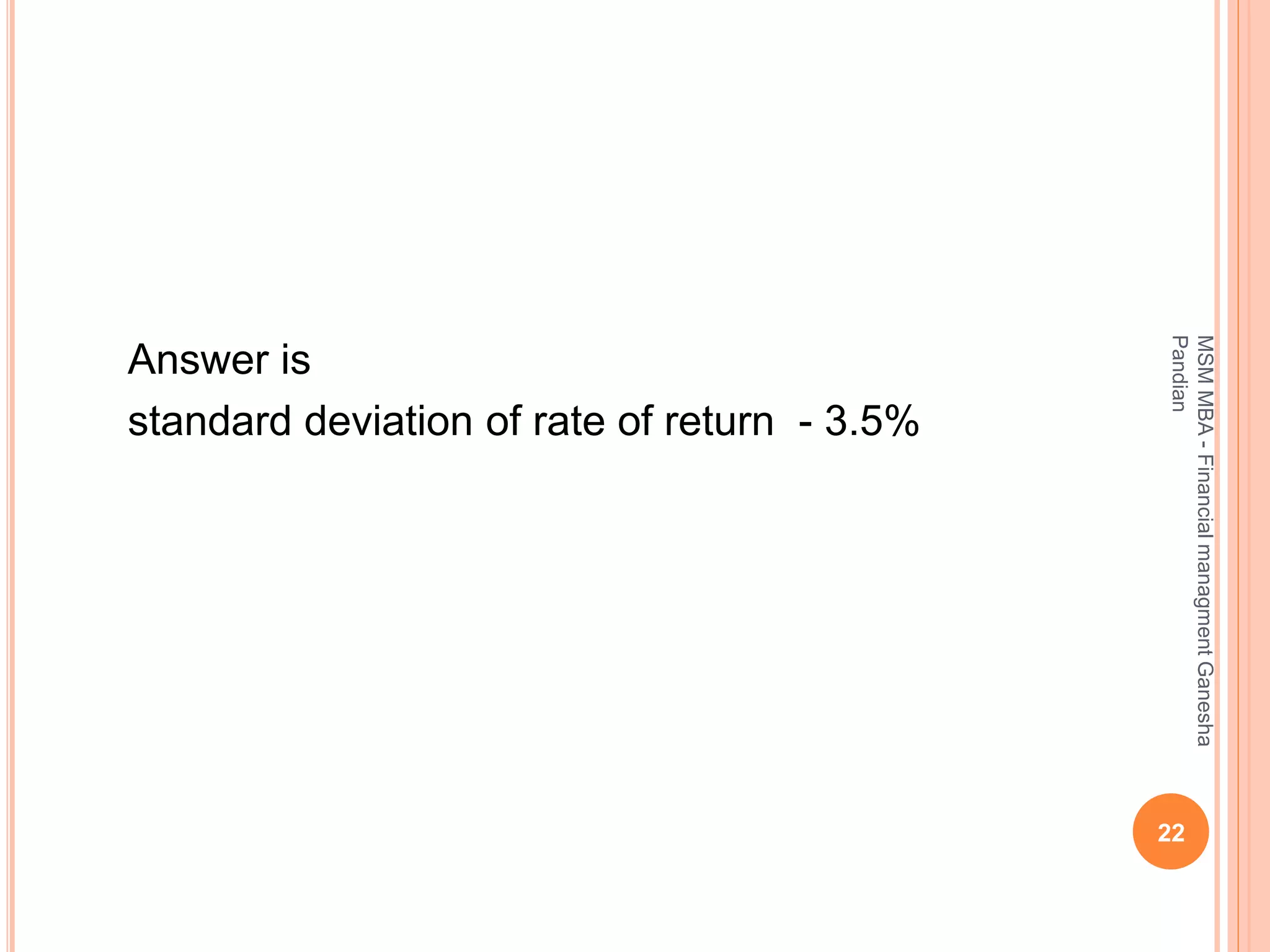

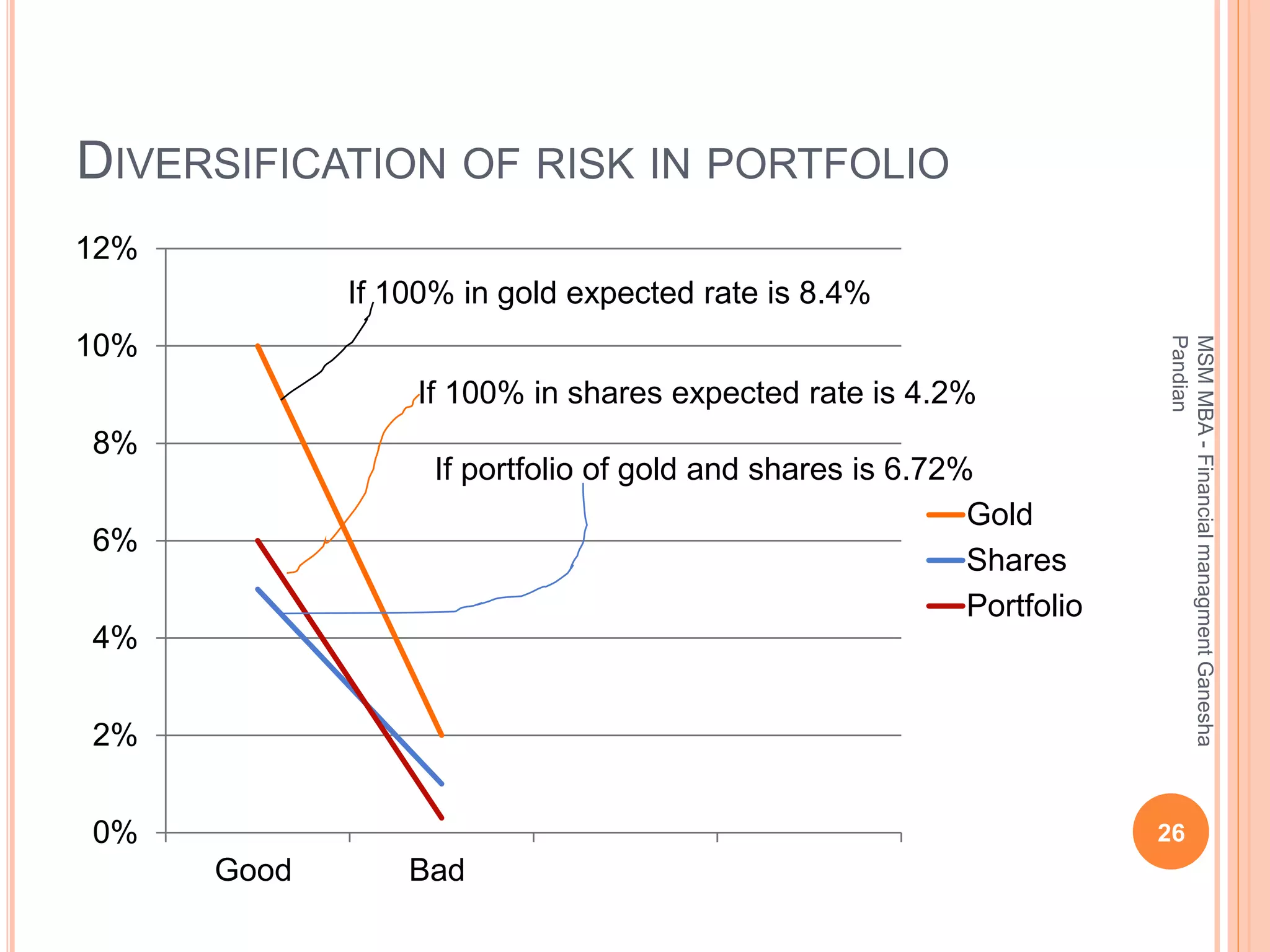

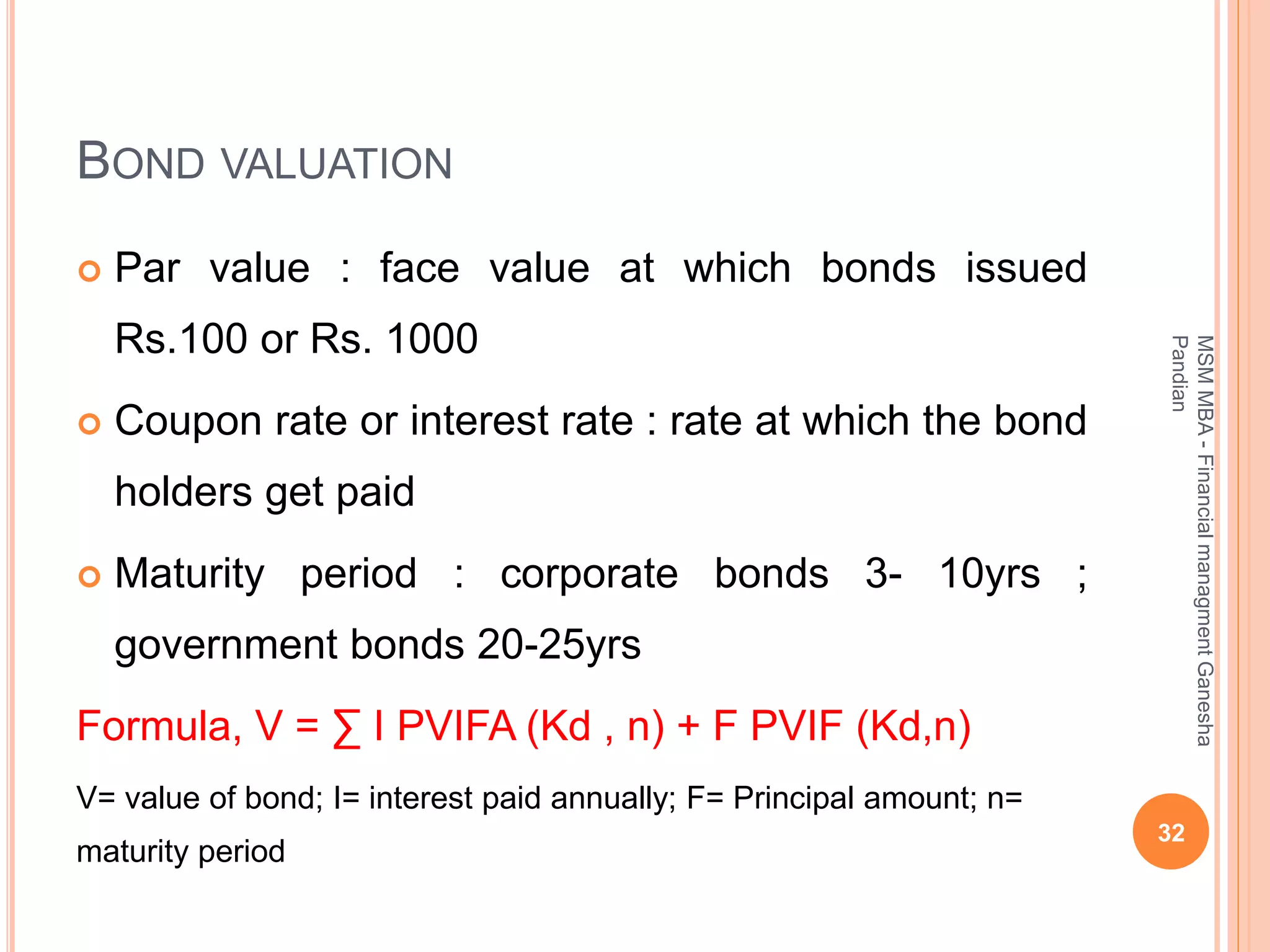

![Formula may be refined as,

Rate of return = Annual income + End price – begin price

begin price begin price

Now rate of return = [2.4/60]+[(69-60)/60] = 0.4+0.15

= 0.19 = 19 %

19

MSMMBA-FinancialmanagmentGanesha

Pandian](https://image.slidesharecdn.com/financialmanagementunit1-180108054830/75/Financial-management-unit-1-Foundations-of-finance-19-2048.jpg)

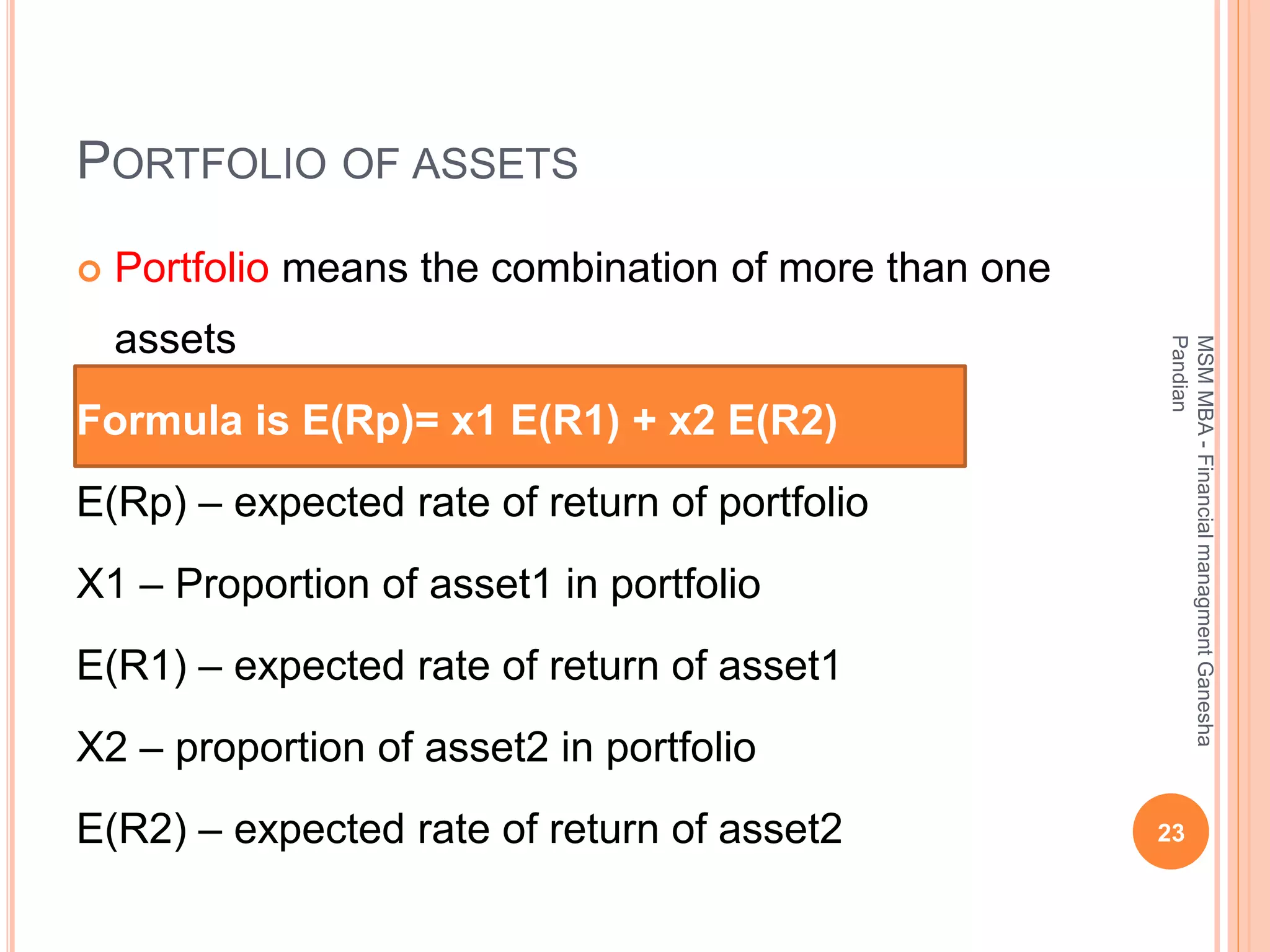

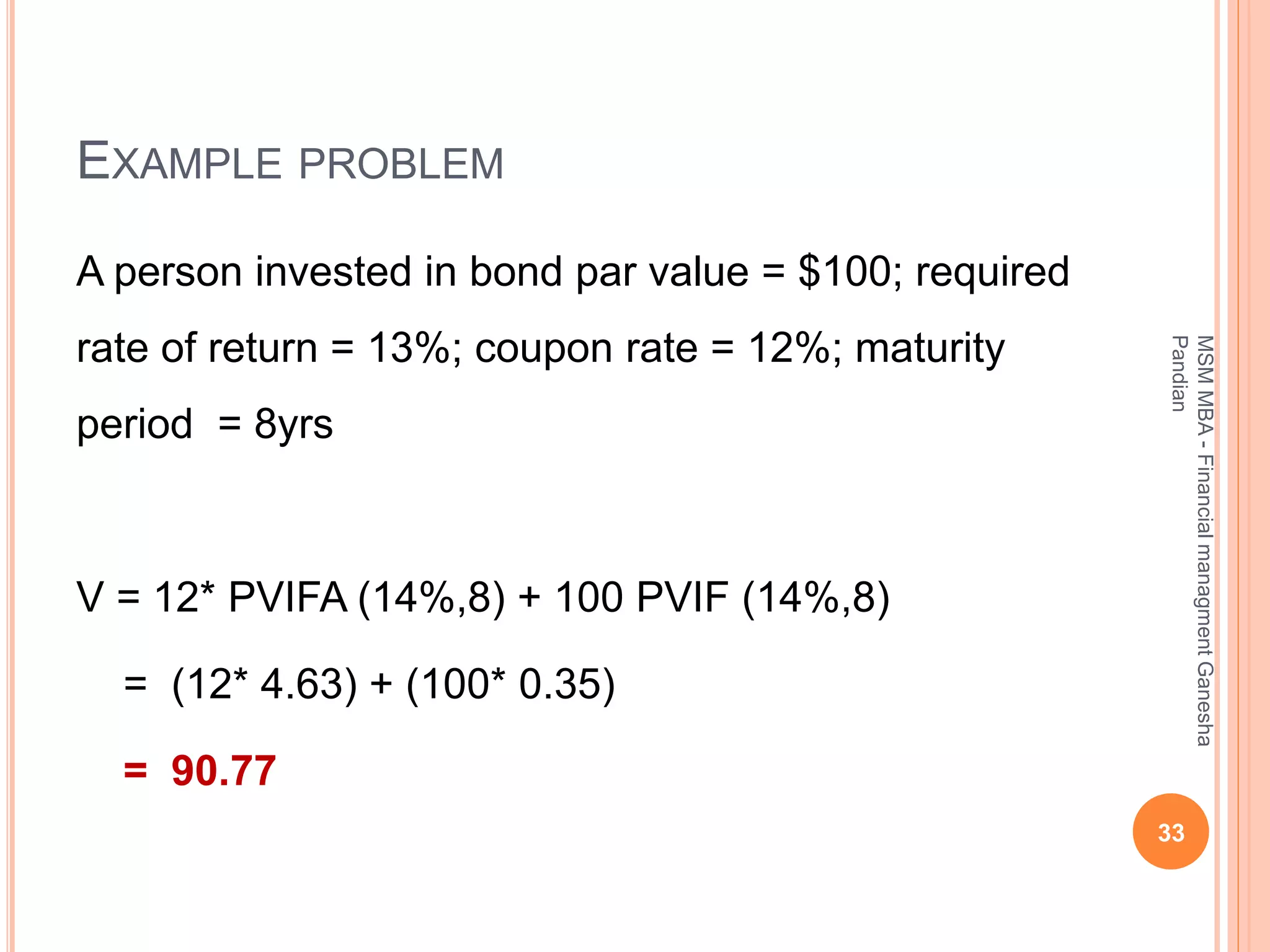

![ Expected rate of return E(R) = 11.5%

Calculation of standard deviation of return:

= root of [ ∑ Pi (Ri – E(R))^2 ]

21

MSMMBA-FinancialmanagmentGanesha

Pandian

Econo

mic

conditi

on

Proba

bility

Pi

Rate

of

return

Ri

Pi Ri Ri –

E(R)

Ri –

E(R)^2

Pi(Ri –

E(R)^2

)

Boom 0.3 16 4.8 4.5 20.25 6.075

Normal 0.5 11 5.5 -0.5 0.25 0.125

Reces

sion

0.2 6 1.2 -5.5 30.25 6.050

Contd…](https://image.slidesharecdn.com/financialmanagementunit1-180108054830/75/Financial-management-unit-1-Foundations-of-finance-21-2048.jpg)