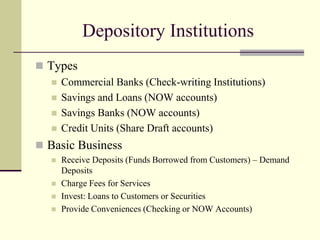

Depository institutions are financial entities, including commercial banks, savings and loans, and credit unions, that gather funds from public deposits to lend to borrowers, generating income through loan interest and service fees. Commercial banks, the primary financial institutions, provide various services like checking accounts, loans, and currency exchanges, while facing risks such as credit, regulatory, funding, and liquidity risks. The Basel agreements outline capital requirements for banks, categorizing assets based on risk levels to ensure financial stability.