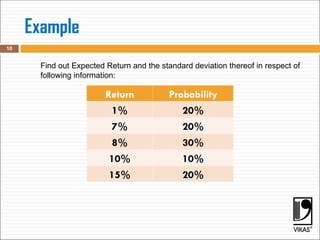

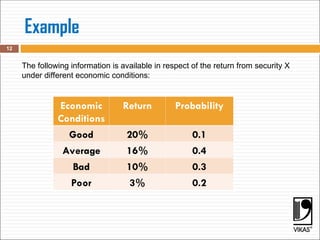

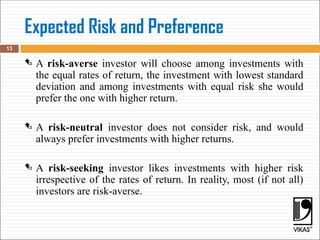

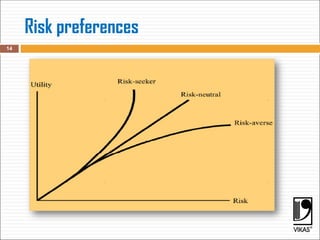

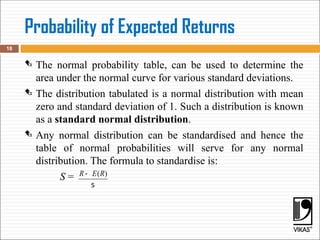

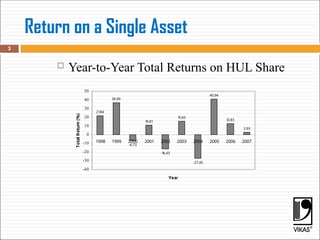

The document discusses key financial concepts including average and expected rates of return, risk measurement, and the calculation of variance and standard deviation. It explains the importance of normal distribution in evaluating investments and distinguishes between risk-averse, risk-neutral, and risk-seeking investor types. Additionally, it provides methodologies for calculating expected returns and probabilities related to asset returns.

![Average Rate of Return

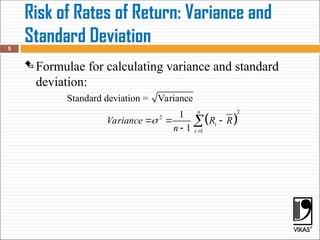

The average rate of return is the sum of the various

one-period rates of return divided by the number of

period.

Formula for the average rate of return is as follows:

4

1 2

=1

1 1

= [ ]

n

n t

t

R R R R R

n n

](https://image.slidesharecdn.com/3-241227153530-3f372722/85/3-1-Security-risk-Valuation-ppt-present-by-akash-4-320.jpg)

![6

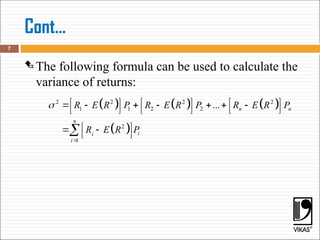

The expected rate of return [E (R)] is the sum of the product of each outcome

(return) and its associated probability:

Expected Return : Incorporating Probabilities in

Estimates

Rates of Returns Under Various Economic Conditions

Returns and Probabilities](https://image.slidesharecdn.com/3-241227153530-3f372722/85/3-1-Security-risk-Valuation-ppt-present-by-akash-6-320.jpg)

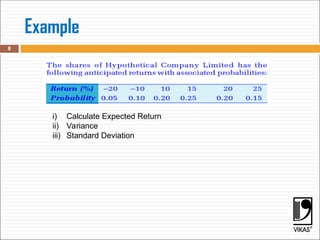

![Return [R] Probability (P) R*P R-E (R-E)^2

9](https://image.slidesharecdn.com/3-241227153530-3f372722/85/3-1-Security-risk-Valuation-ppt-present-by-akash-9-320.jpg)