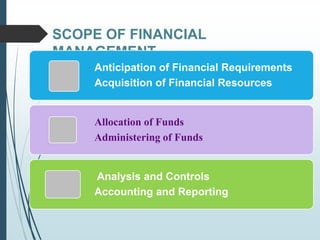

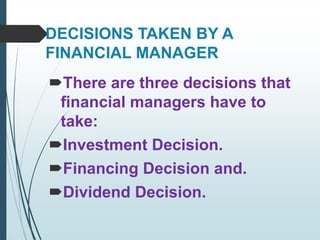

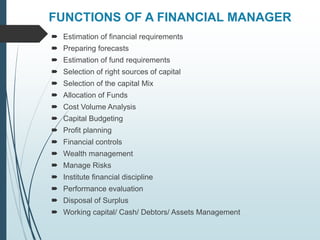

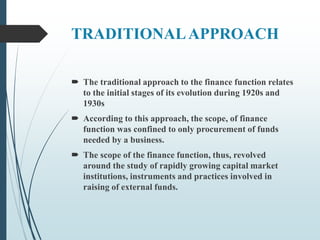

Financial management is crucial for the sustainability and profitability of organizations, involving planning, organizing, directing, and controlling financial resources. It encompasses various activities such as budgeting, risk management, and financial forecasting to ensure effective utilization of funds. The evolution from traditional to modern approaches highlights the shift from merely procuring funds to optimizing their use for achieving broader financial objectives.