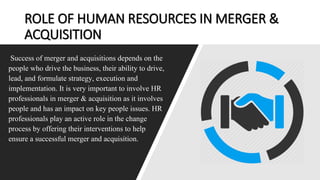

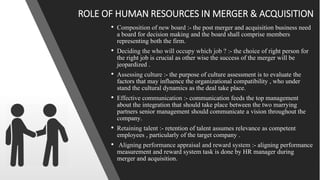

The document discusses mergers and acquisitions and the role of human resources in the process. It defines mergers and acquisitions as combinations of companies that unite them under one new company. Some key reasons for mergers and acquisitions include synergies, diversification, growth, and eliminating competition. The document outlines HR's important role in ensuring a successful integration, such as composing the new board, deciding job placements, assessing company culture, effective communication, and retaining talent. It also discusses potential benefits like accessing new markets, skills, and assets, but notes mergers can increase costs and damage brands if not implemented properly.