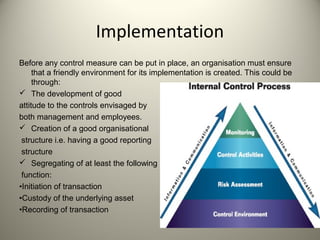

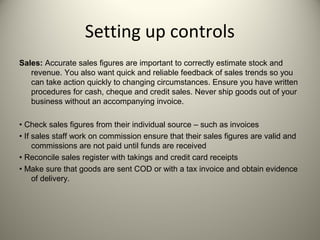

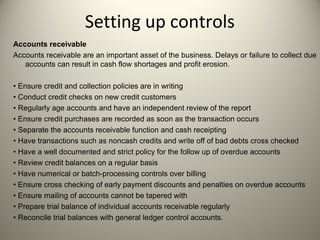

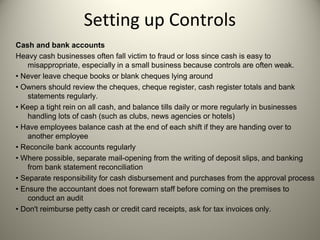

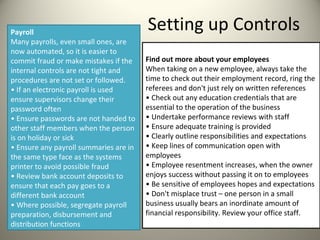

Financial control involves managing an organization's financial resources, ensuring they are effectively acquired, allocated, and evaluated. It helps safeguard assets, detect fraud, and promote good management practices while implementing preventive, detective, and corrective measures. Proper financial controls can be established across various business functions, including sales, accounts receivable, cash management, and payroll, with the goal of enhancing efficiency and reducing risks.