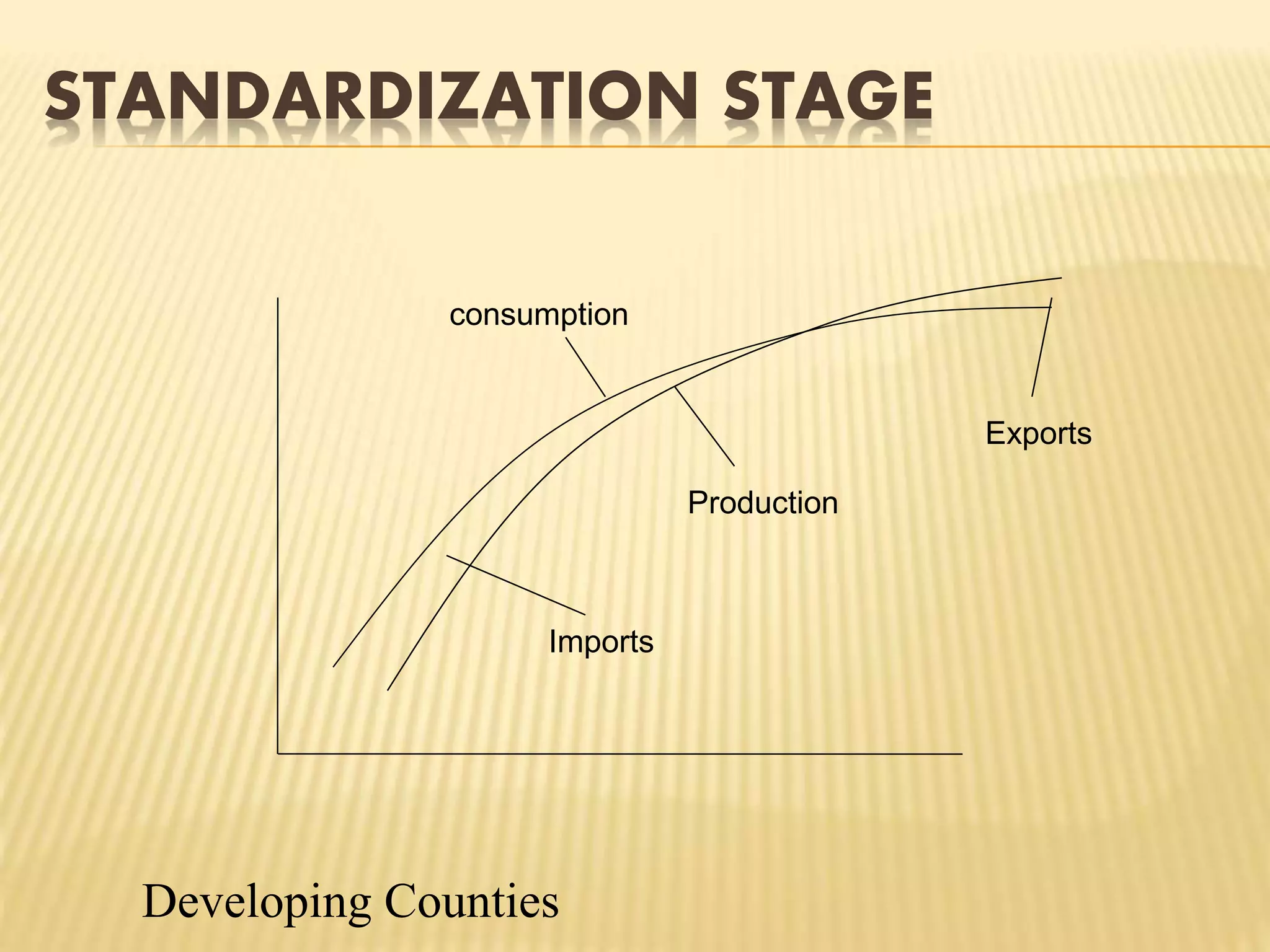

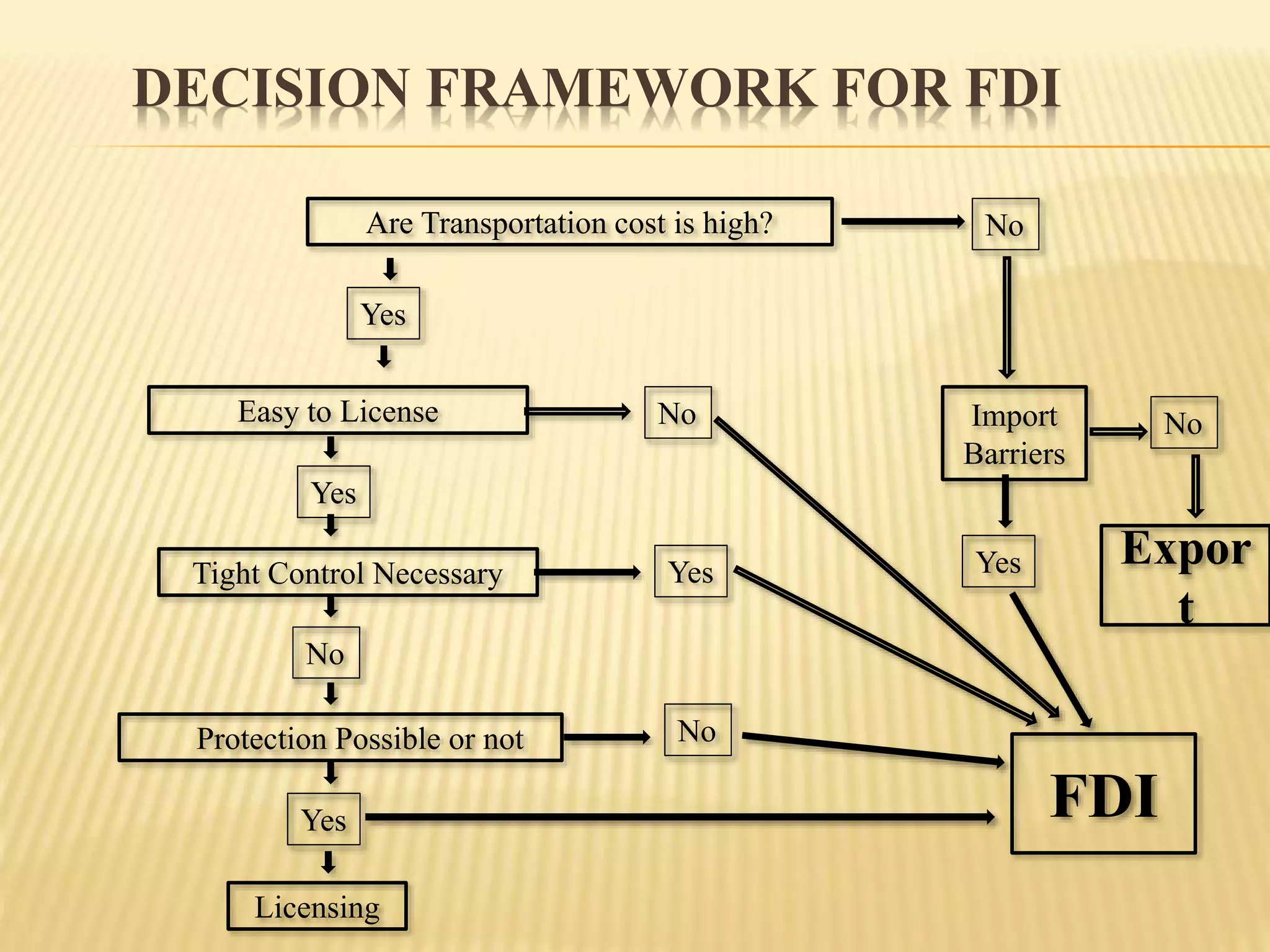

This document provides an overview of foreign direct investment (FDI) presented to Sir Ahmed Ghazali. It defines FDI and discusses types (inward and outward), forms (greenfield and mergers & acquisitions), sources, theories, stages, and factors in the decision framework for FDI. Theories covered include Mac Dougall-Kemp, industrial organization, and location specific theories. Benefits are outlined for both host and home countries, while drawbacks are noted for host countries. The document is a comprehensive introduction to FDI presented by a group of students.