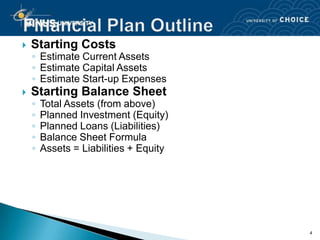

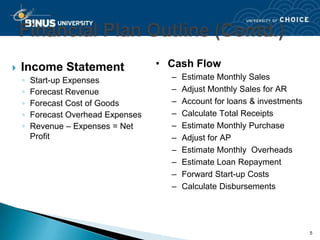

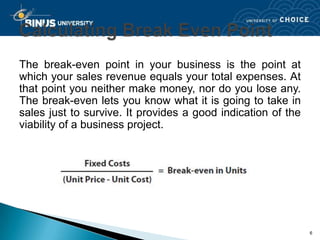

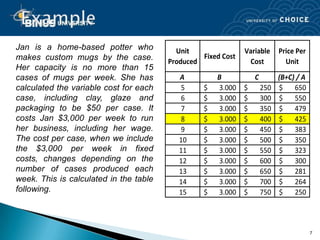

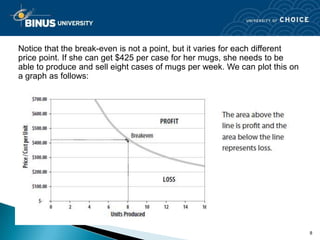

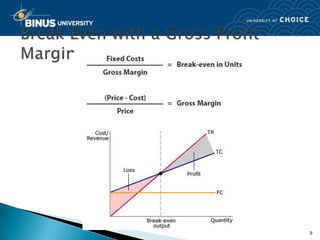

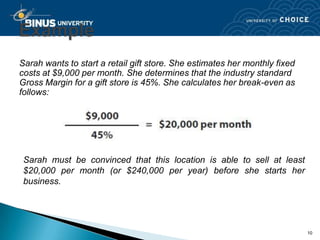

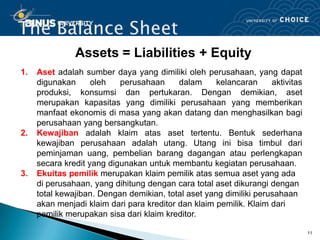

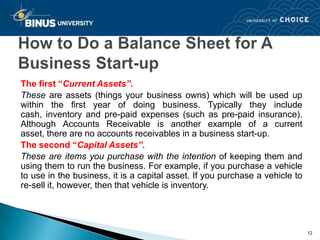

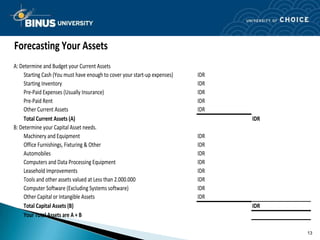

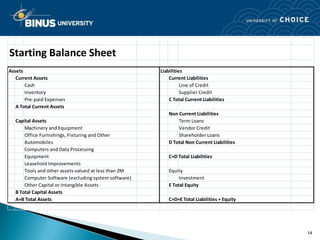

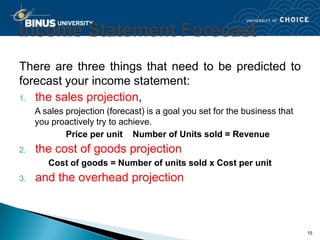

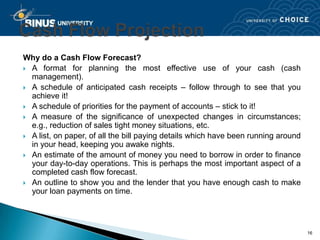

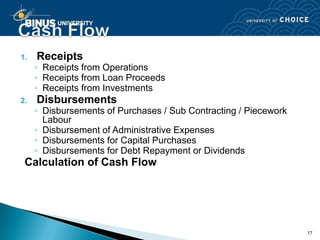

The document provides information on creating a financial plan for a business. It discusses the key components of a financial plan, including a starting balance sheet, pro-forma income statement, and cash flow forecast. It emphasizes the importance of the cash flow forecast for obtaining bank loans. Templates are provided to estimate starting costs and assets, create a starting balance sheet, forecast income and expenses, and project cash flow. Tips are given to be patient, get help, be consistent, and use the simple templates. Break-even analysis and an example are also included to illustrate how to calculate the sales volume needed to cover fixed costs.