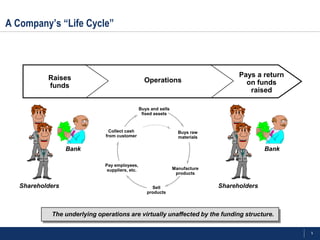

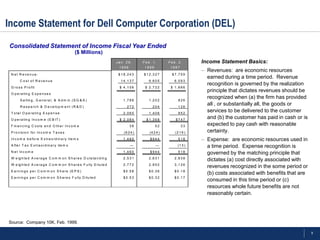

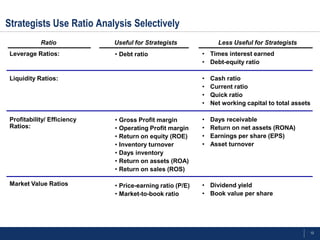

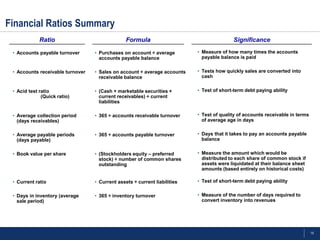

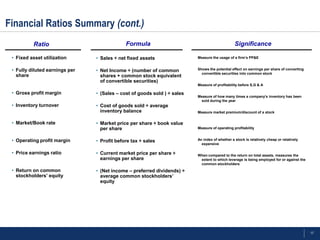

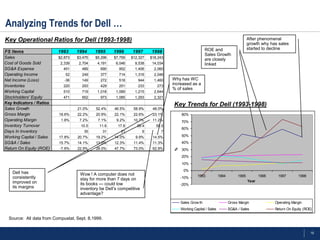

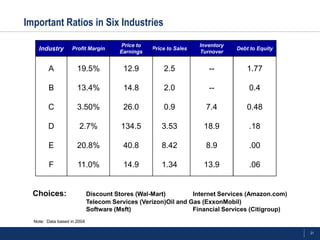

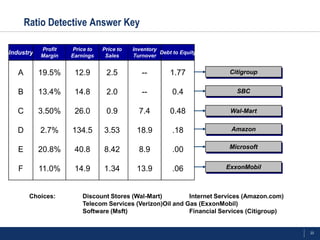

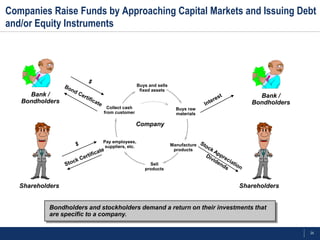

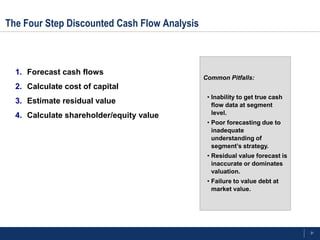

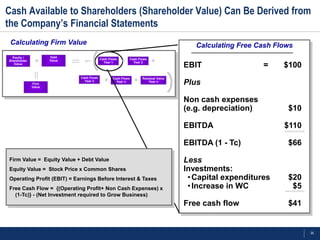

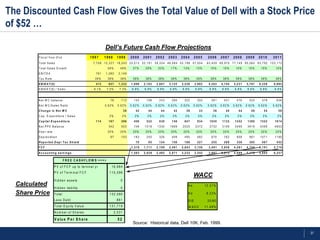

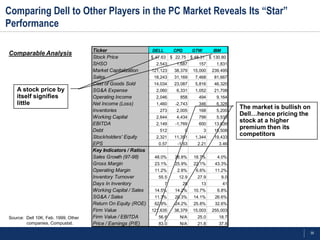

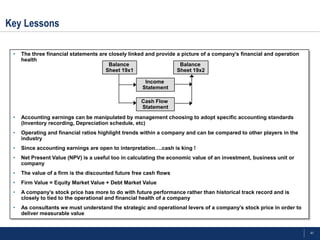

The document outlines the importance of financial analysis in strategy consulting, covering key concepts such as ratio analysis, valuation techniques, and industry benchmarks. It uses Dell as a case study to illustrate financial performance through income statements, operational ratios, and trends from 1993 to 1998, highlighting aspects like sales growth, gross margin, and return on equity. Additionally, it discusses investment decision-making tools like discounted cash flow analysis and net present value, emphasizing shareholder value derivation from cash flows and market price appreciation.