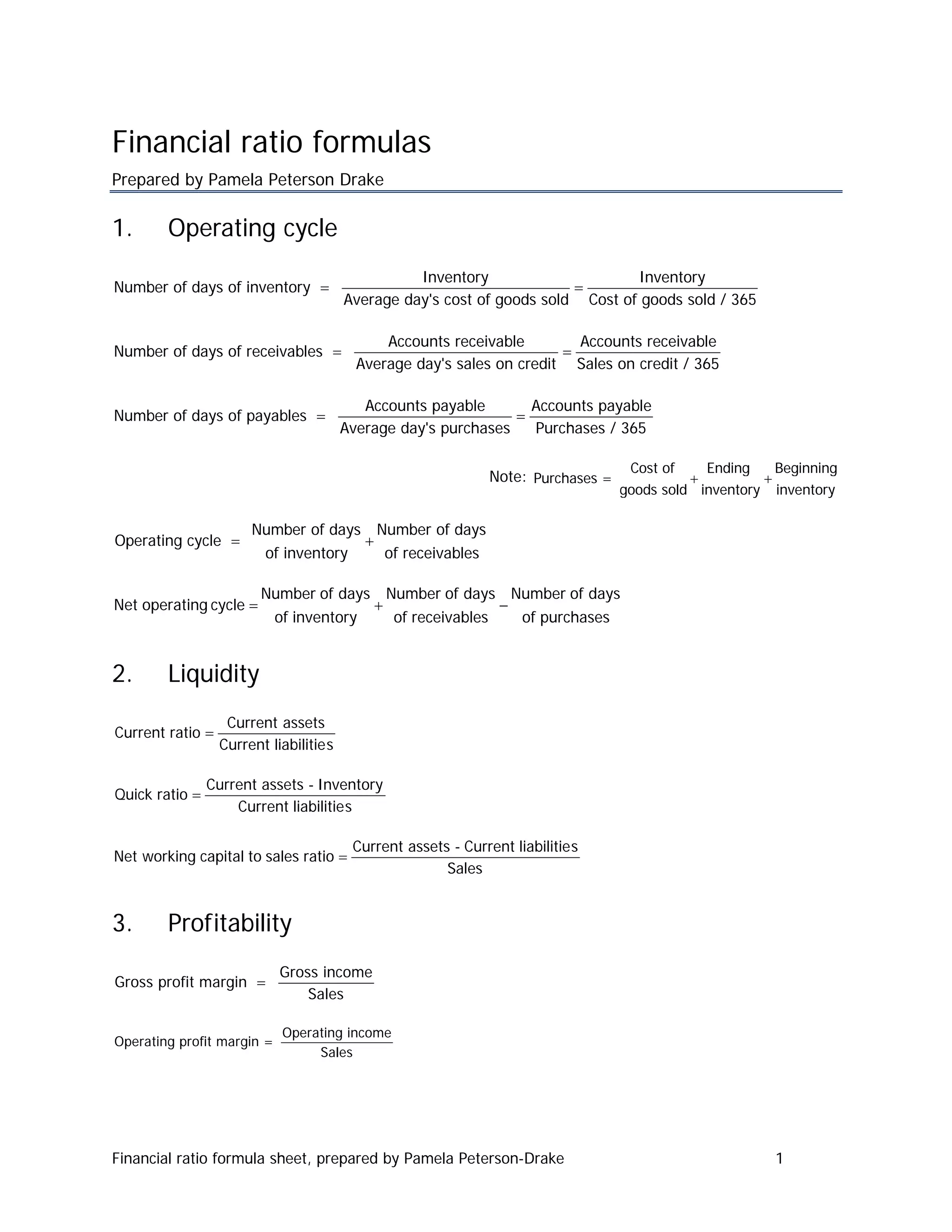

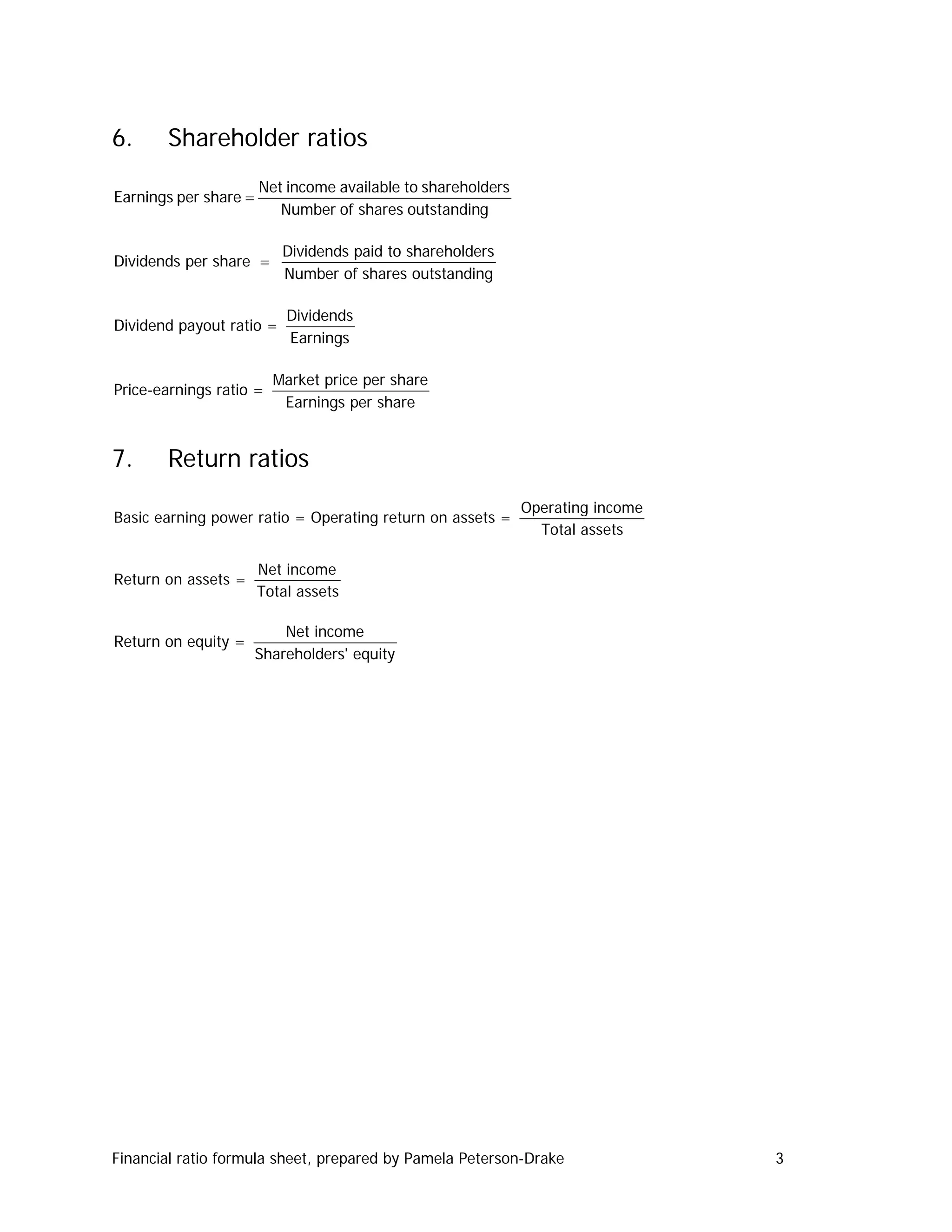

This document provides definitions and formulas for various financial ratios used to analyze a company's profitability, liquidity, asset utilization, debt levels, and returns. The ratios are grouped into categories including operating cycle, liquidity, profitability, activity, financial leverage, shareholder ratios, and return ratios. Key formulas include calculations for current ratio, inventory turnover, return on equity, and price-earnings ratio. The ratios and their formulas allow for analysis of a company's performance and financial health.