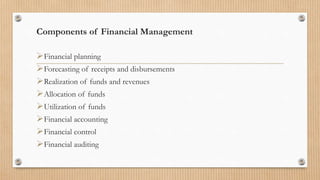

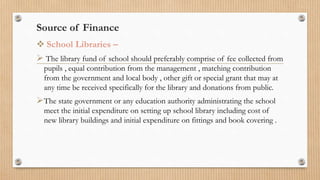

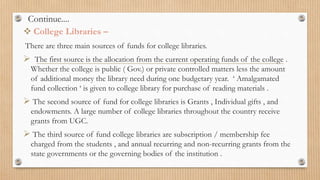

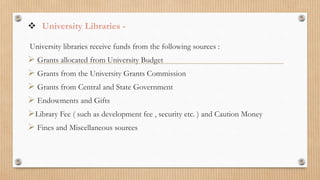

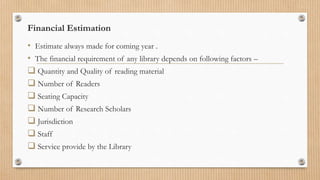

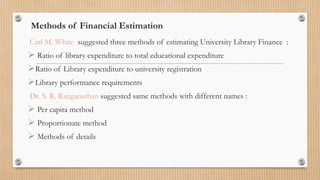

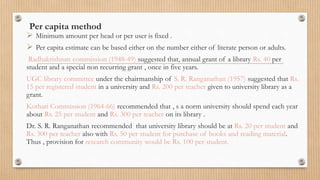

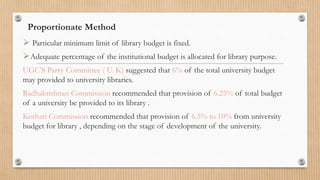

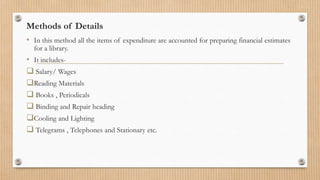

The document discusses the financial management of academic libraries, covering its definition, components, sources of finance, principles, methods of financial estimation, benefits, and drawbacks. Financial management involves planning and controlling financial activities to optimize fund acquisition and utilization in libraries. It highlights the challenges libraries face due to rising costs and advocates for consortia as a solution for financial sustainability.