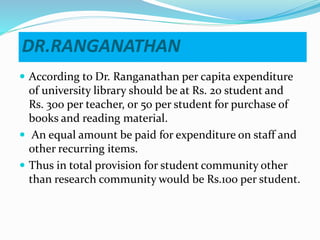

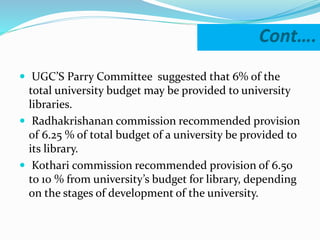

The document discusses the importance of financial management in libraries, emphasizing that effective financial resources are crucial for providing quality library services. It outlines the sources of finance for university libraries in India, including grants from various government bodies and funding methods recommended by commissions. The conclusion stresses that adequate financial support directly impacts the quality of library resources and services.