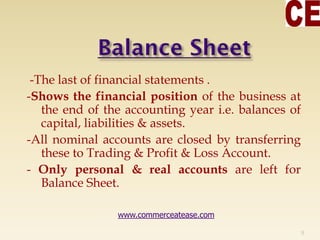

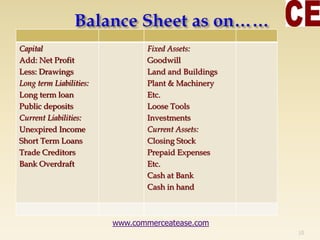

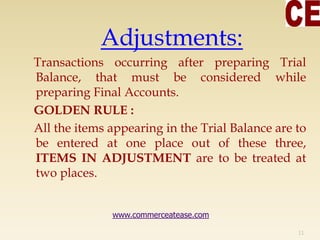

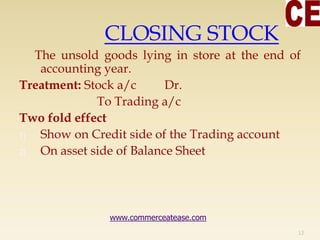

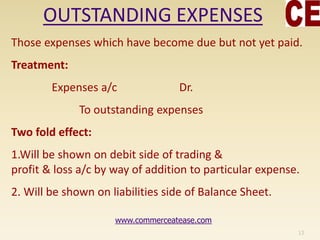

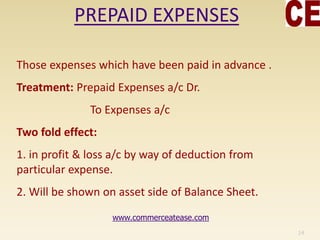

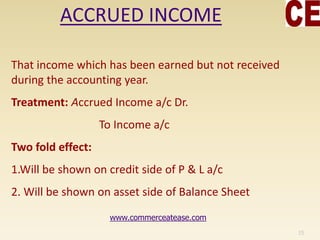

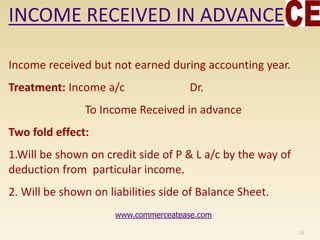

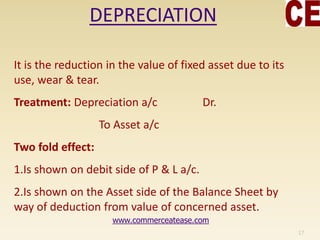

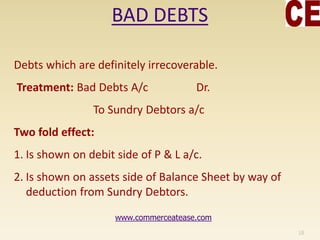

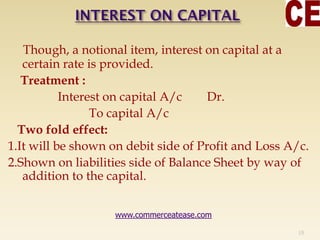

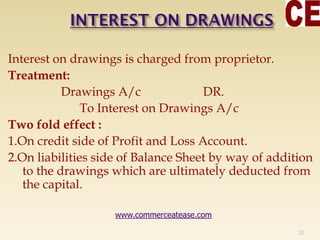

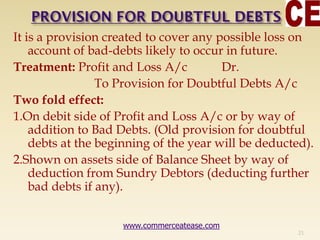

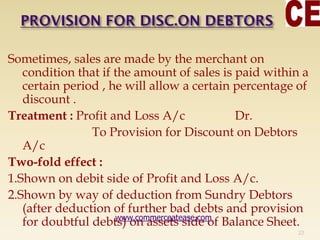

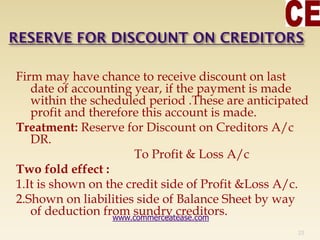

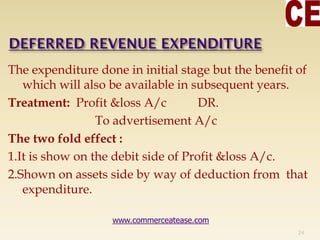

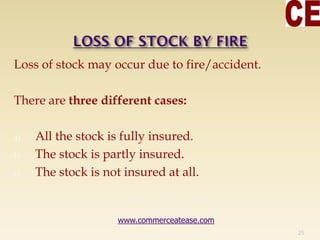

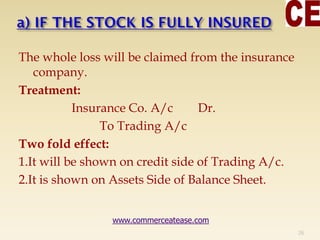

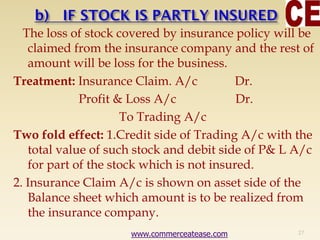

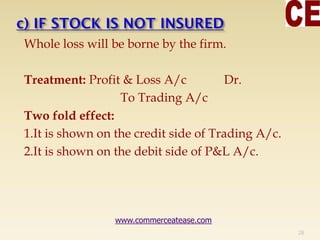

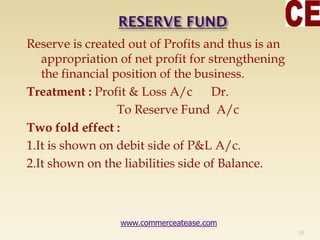

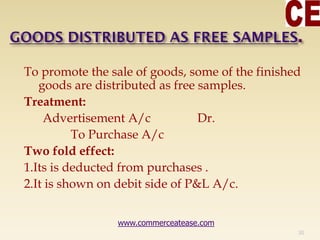

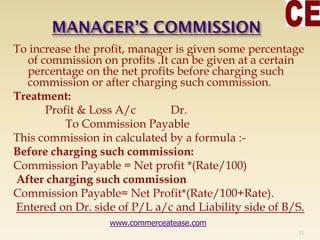

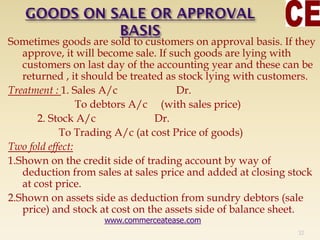

The document outlines the process of final accounts preparation in accounting, detailing the sequence of trading accounts, profit and loss accounts, and balance sheets. It explains the adjustments needed based on trial balance discrepancies and various types of expenses, income, and financial positions. Additionally, the document provides treatments for specific accounting scenarios such as outstanding expenses, bad debts, and stock losses.