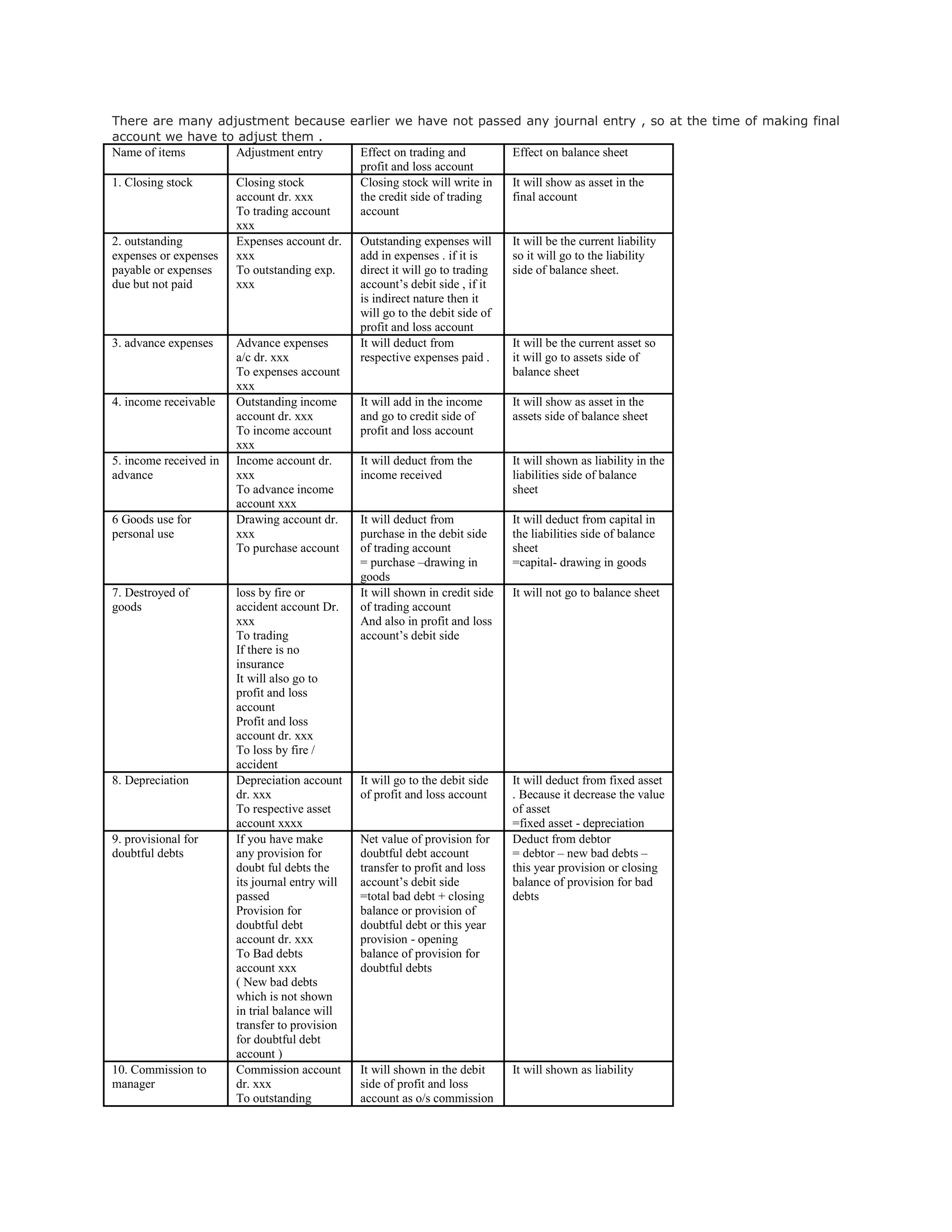

There are 10 common accounting adjustments that need to be made when preparing final accounts:

1. Closing stock is recorded by debiting the closing stock account and crediting the trading account. This adjusts the trading account and adds closing stock as an asset.

2. Outstanding expenses are recorded by debiting the expenses account and crediting the outstanding expenses account. This adjusts expenses and shows outstanding expenses as a liability.

3. Advance expenses are recorded by debiting the advance expenses account and crediting the expenses account. This deducts from expenses and shows advance expenses as an asset.

4. Income receivable is recorded by debiting the outstanding income account and crediting the income account. This