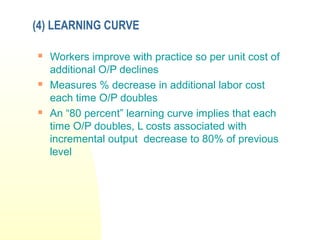

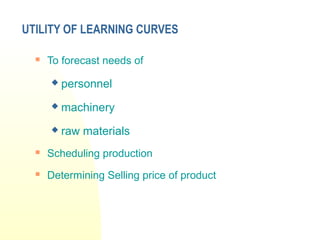

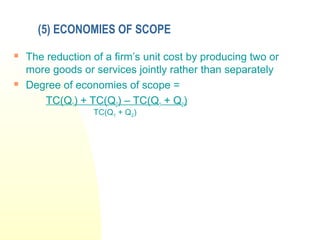

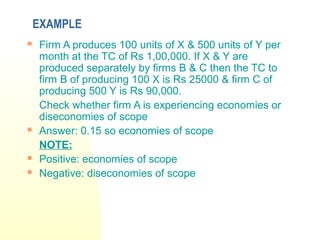

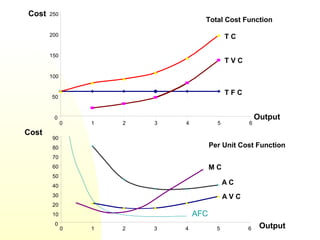

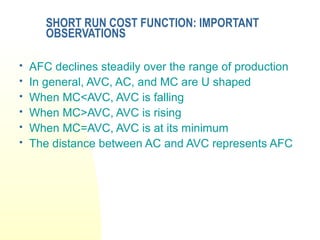

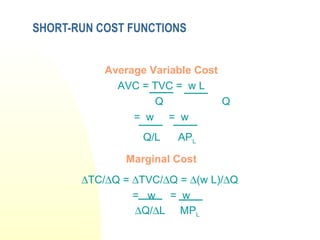

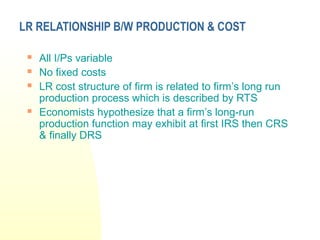

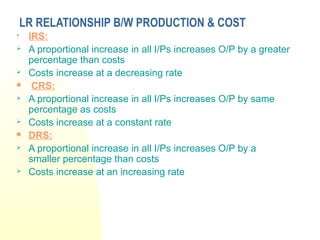

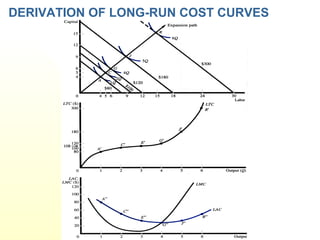

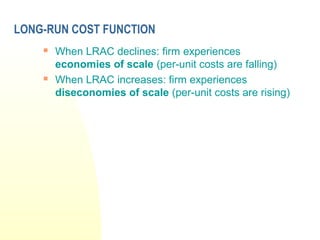

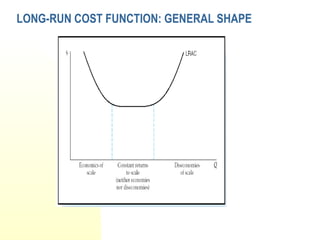

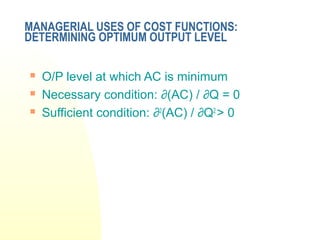

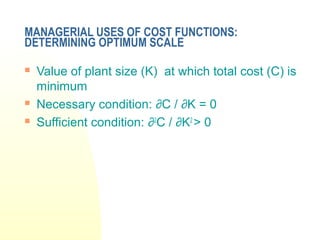

This document discusses various concepts related to cost theory and analysis. It defines different types of costs such as actual, opportunity, explicit, implicit, fixed, variable, accounting, economic, marginal, incremental, sunk, private, social, original, and replacement costs. It also discusses cost functions, the relationship between production and costs in the short-run and long-run, cost curves like total, average, and marginal costs. Finally, it covers special topics like profit contribution analysis, break-even analysis, operating leverage, learning curves, and economies of scope.

![(1) PROFIT CONTRIBUTION ANALYSIS

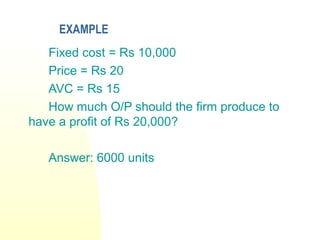

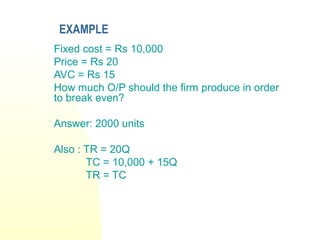

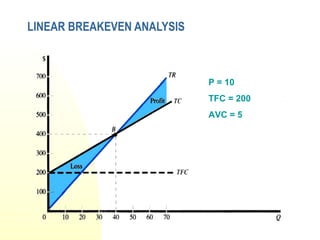

Total Revenue = TR = (P)(Q)

Total Cost = TC = TFC + (AVC)(Q)

Profit = TR -TC

Profit = Π = PQ - [TFC + (AVC)(Q)]

Q = TFC + Π

P - (AVC)

Profit contribution = P - AVC](https://image.slidesharecdn.com/f0dd9cost-130507023150-phpapp02/85/F0dd9-cost-34-320.jpg)

![(3) OPERATING LEVERAGE

Operating Leverage = TFC/TVC

Degree of Operating Leverage (or profit elasticity) = DOL

Π = PQ - TFC + (AVC)(Q)

= Q(P - AVC) - TFC

∆Π = ∆Q(P - AVC)

DOL = %∆Π = ∆Π/ Π = ∆Π * Q = E Π

%∆Q ∆Q/Q ∆Q Π

DOL = ∆Q(P - AVC)Q = Q(P - AVC)

∆Q[Q(P - AVC) - TFC] Q(P - AVC) - TFC](https://image.slidesharecdn.com/f0dd9cost-130507023150-phpapp02/85/F0dd9-cost-42-320.jpg)