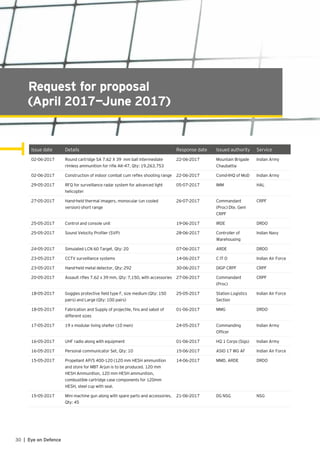

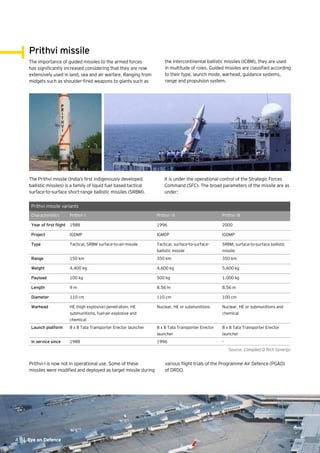

The document provides an overview of the evolution of guided missile programs in India, summarizes the key elements of the Strategic Partnership Policy, and highlights recent updates in the defense and civil aviation sectors. It begins with outlining India's Integrated Guided Missile Development Program and the development of key missiles like Prithvi, Trishul, Akash, and Nag. It then summarizes the Strategic Partnership Policy and notes eligibility criteria and selection process. Recent updates on the SCOMET list and industrial licensing are also highlighted. Finally, it provides an overview of the growing civil aviation sector in India.

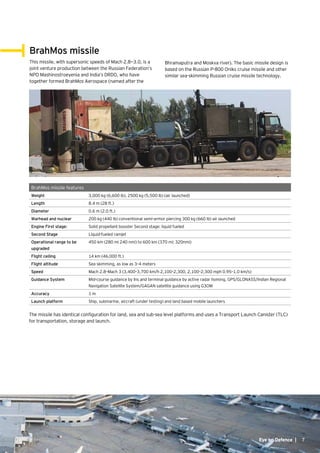

![Agni missile

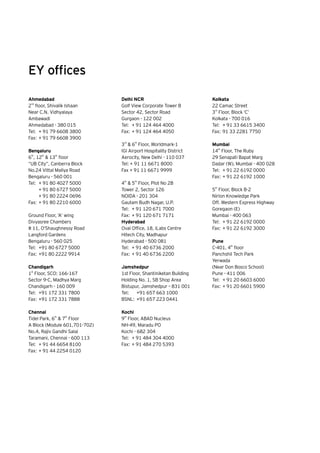

Agni missile is a family of medium to intercontinental

range surface-to-surface ballistic missiles developed by

the Advanced Systems Laboratory (ASL) under DRDO. The

missile uses solid fuel and has an instant reaction time.

Agni missile variants

Variant Length Weight Range Status Launch Platform

Agni I

Stage –I

15 m 12 tonne Medium Range

Ballistic Missile

(MRBM) 700 km —

1,250 km

Tested in January 2002

(operational)

8 x 8 Tata TELAR (transporter erector

launcher) Rail Mobile Launcher

Agni II 20 m 18 tonne MRBM 2,000 km

—3,000 km

Test conducted again on 7

April 2013 (operational)

8 x 8 Tata TELAR

Agni III 17 m 22 tonne IRBM 3,500 km —

5,000 km

First tested on 12 April

2007 (operational)

8 x 8 Tata TELAR

Agni IV 20 m 17 tonne IRBM 3,000 km —

4,000 km

First tested on 15

November 2011

(operational)

8 x 8 Tata TELAR

Agni V 17.5 m 50 tonne ICBM 5,000 km —

8,000 km

First tested on 19 April

2012 (under testing)

8 × 8 Tatra TEL and rail mobile launcher

(canisterized missile package)

Agni VI 20 m 50 tonne ICBM 8,000 km —

10,000 km

Under development 8 × 8 Tatra TEL and rail mobile launcher

(canisterized missile package) Arihant Class

Submarine (Submarine Launched Ballistic

Missile [SLBM] version — K6)

Source: Compiled Q-Tech Synergy

6 | Eye on Defence](https://image.slidesharecdn.com/eyeondefencejuly2017h-170705062840/85/Eye-on-Defence-July-2017-6-320.jpg)