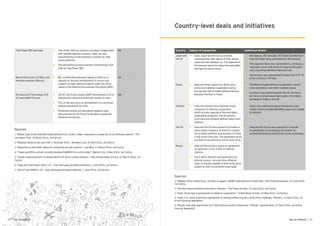

This document provides an overview of ammunition production in India. It discusses that ammunition production is dominated by government ordnance factories which are unable to meet the full requirements of the military, leaving an opening for private sector involvement. It analyzes the market for different types of ammunition and notes that artillery and tank ammunition each make up around 30% of the market. It also reviews the Ordnance Factory Board's targets and production shortfalls in meeting demands.