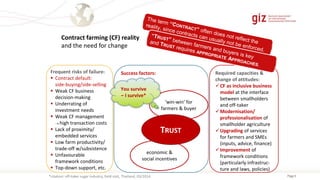

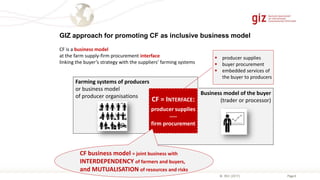

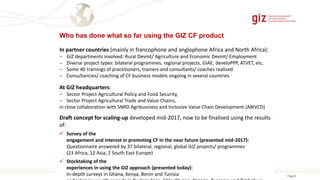

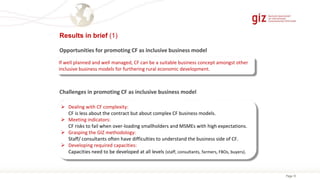

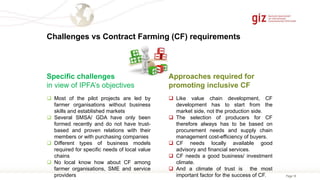

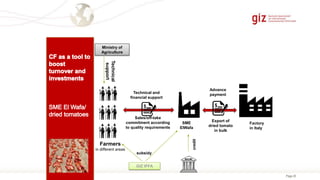

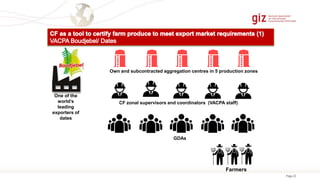

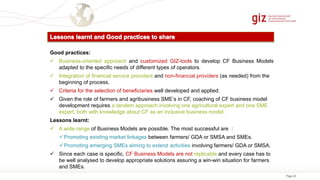

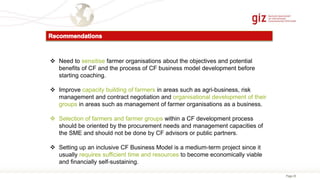

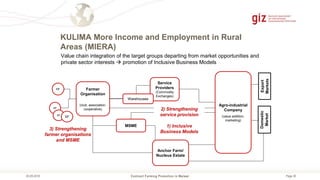

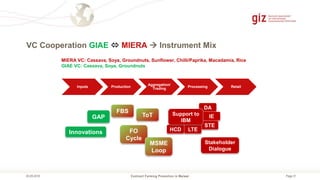

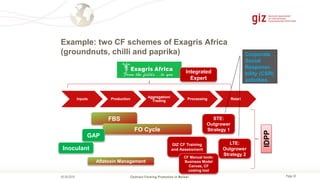

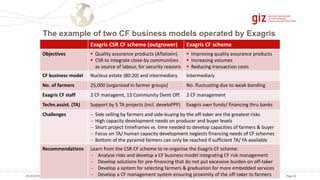

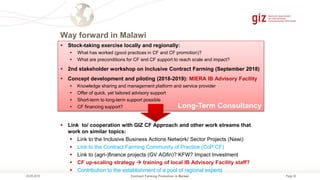

The document summarizes experiences with promoting contract farming as an inclusive business model in Malawi and Tunisia. In Malawi, GIZ has supported contract farming through its KULIMA project by working with the agribusiness Exagris, which operates two successful contract farming schemes for soybeans and groundnuts. Lessons learned include the importance of selecting farmers based on procurement needs. In Tunisia, the IPFA project has piloted 12 contract farming projects led by farmer organizations with support from GIZ in assessing value chains, developing business models, and obtaining funding. Key to success is developing sustainable, mutually beneficial business relationships between farmers and buyers.