The document discusses macroeconomics concepts related to exchange rates, including:

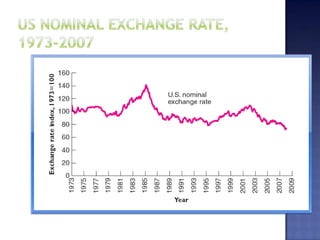

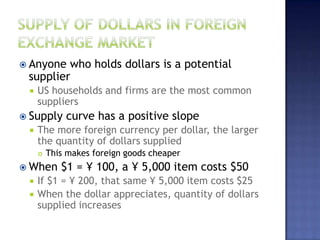

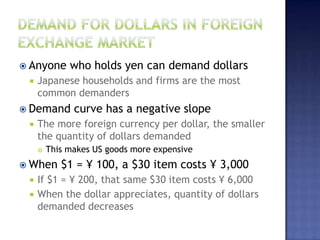

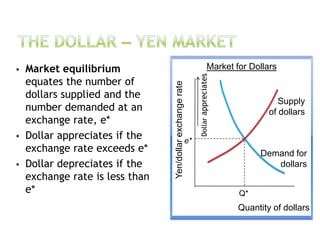

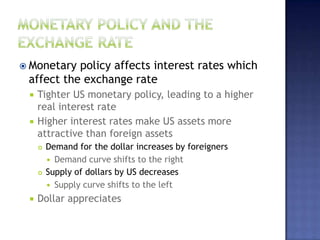

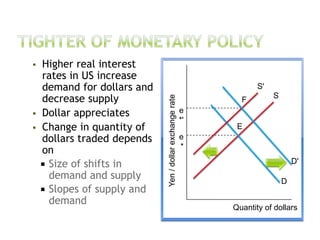

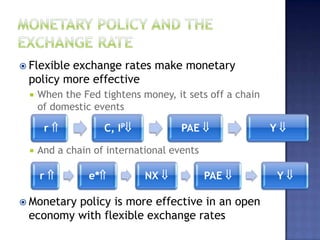

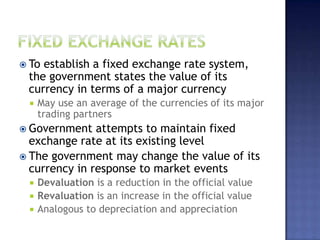

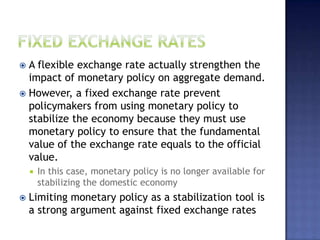

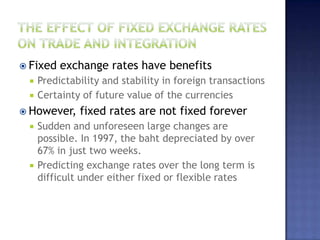

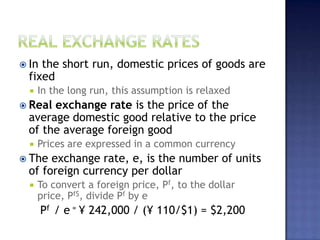

1. Flexible exchange rates are determined by supply and demand in the foreign exchange market, allowing monetary policy to effectively influence the domestic economy. Fixed exchange rates prevent this by requiring monetary policy to maintain a set exchange rate.

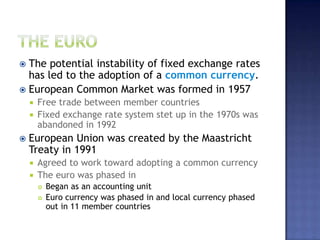

2. Countries have increasingly moved away from fixed exchange rates due to their potential instability towards more flexible rates or common currencies like the Euro to balance stability and policy effectiveness.

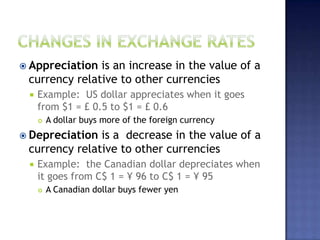

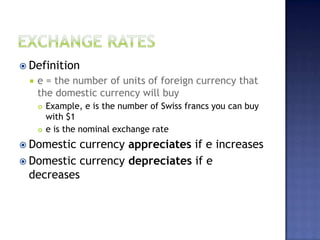

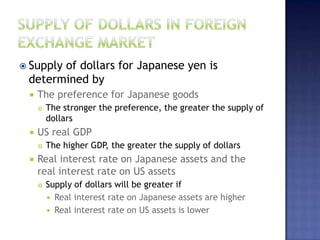

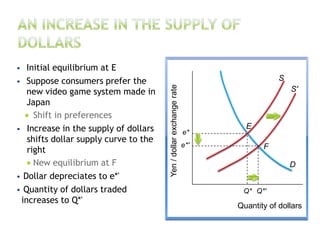

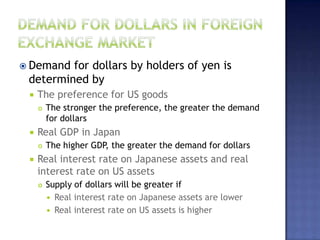

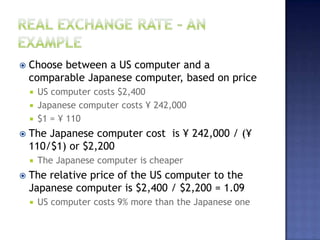

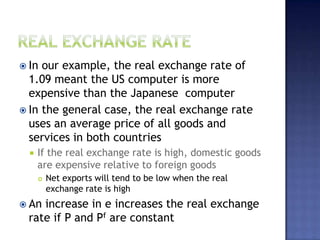

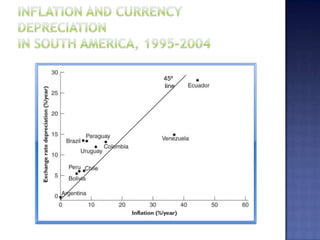

3. Exchange rates are influenced by factors like interest rates, trade preferences, and relative economic growth that shift the supply of and demand for currencies in the foreign exchange market.