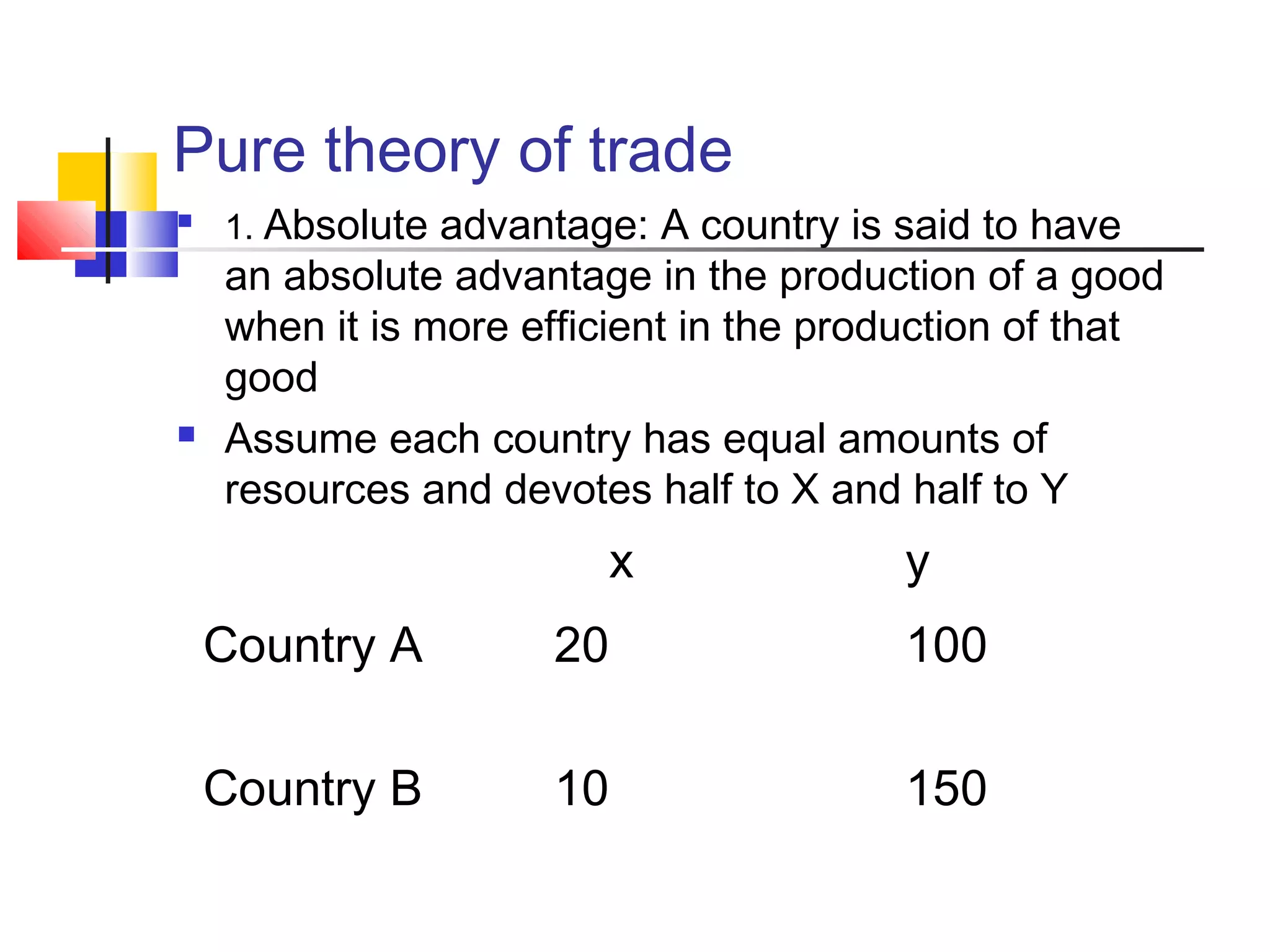

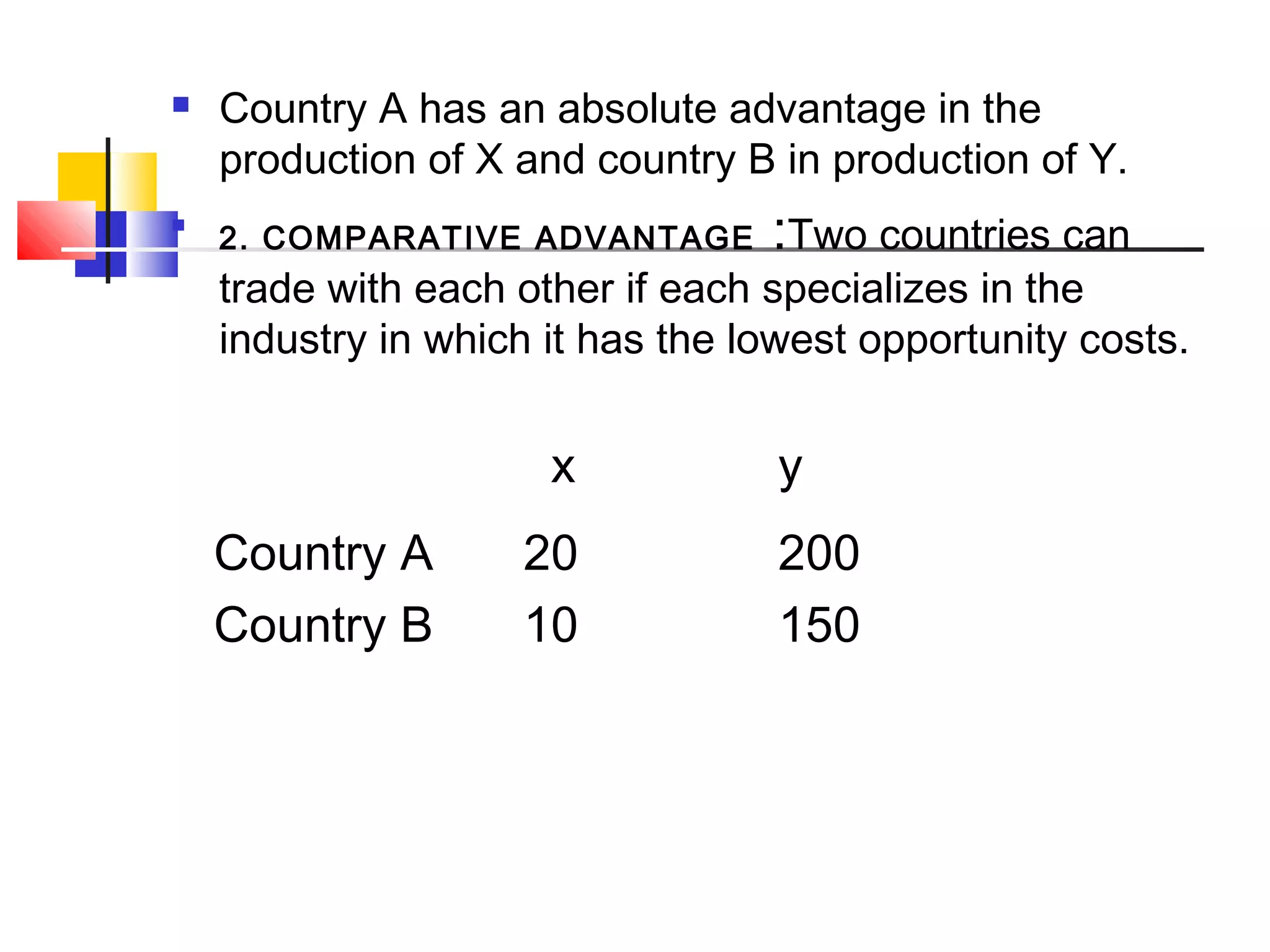

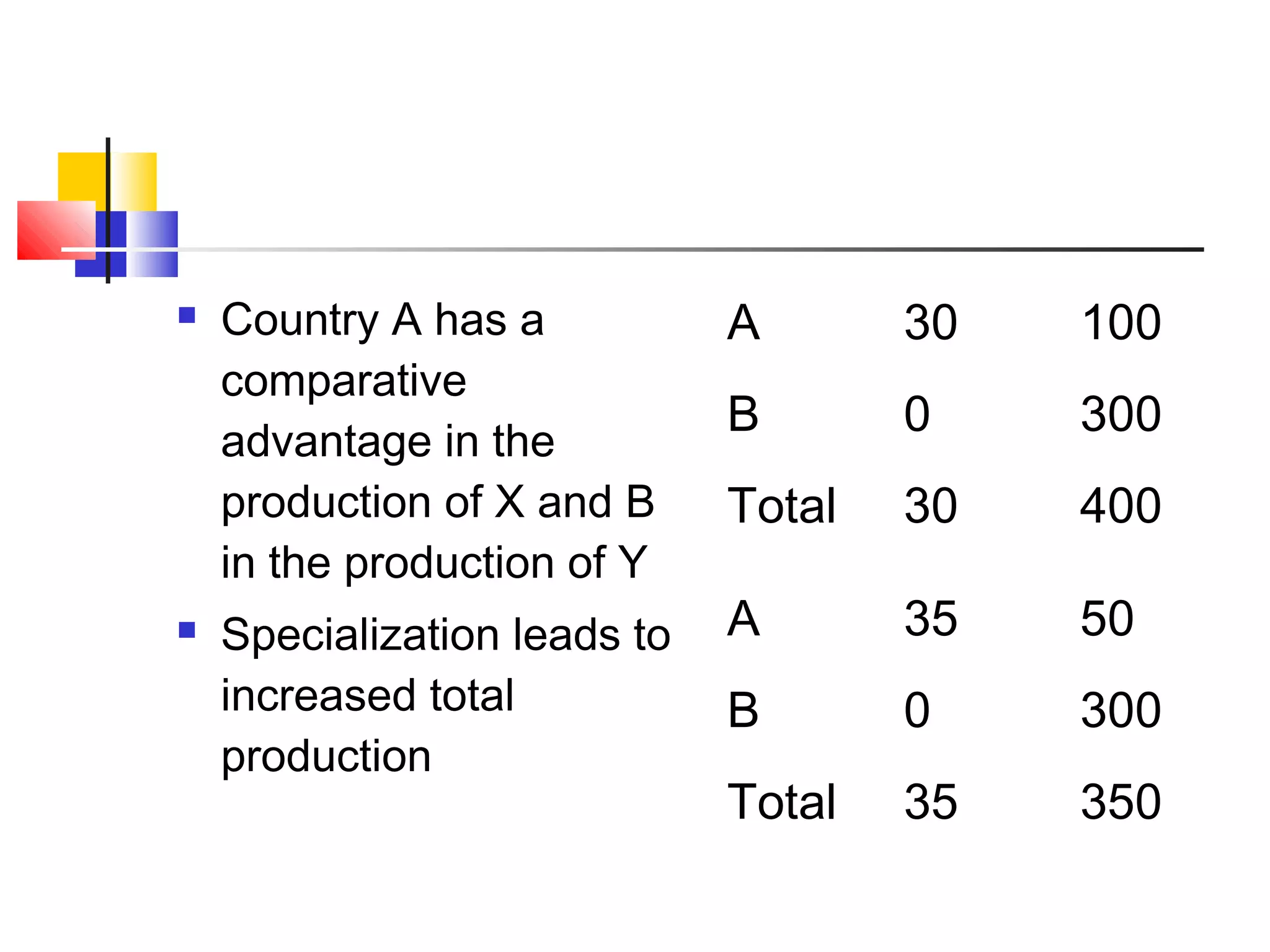

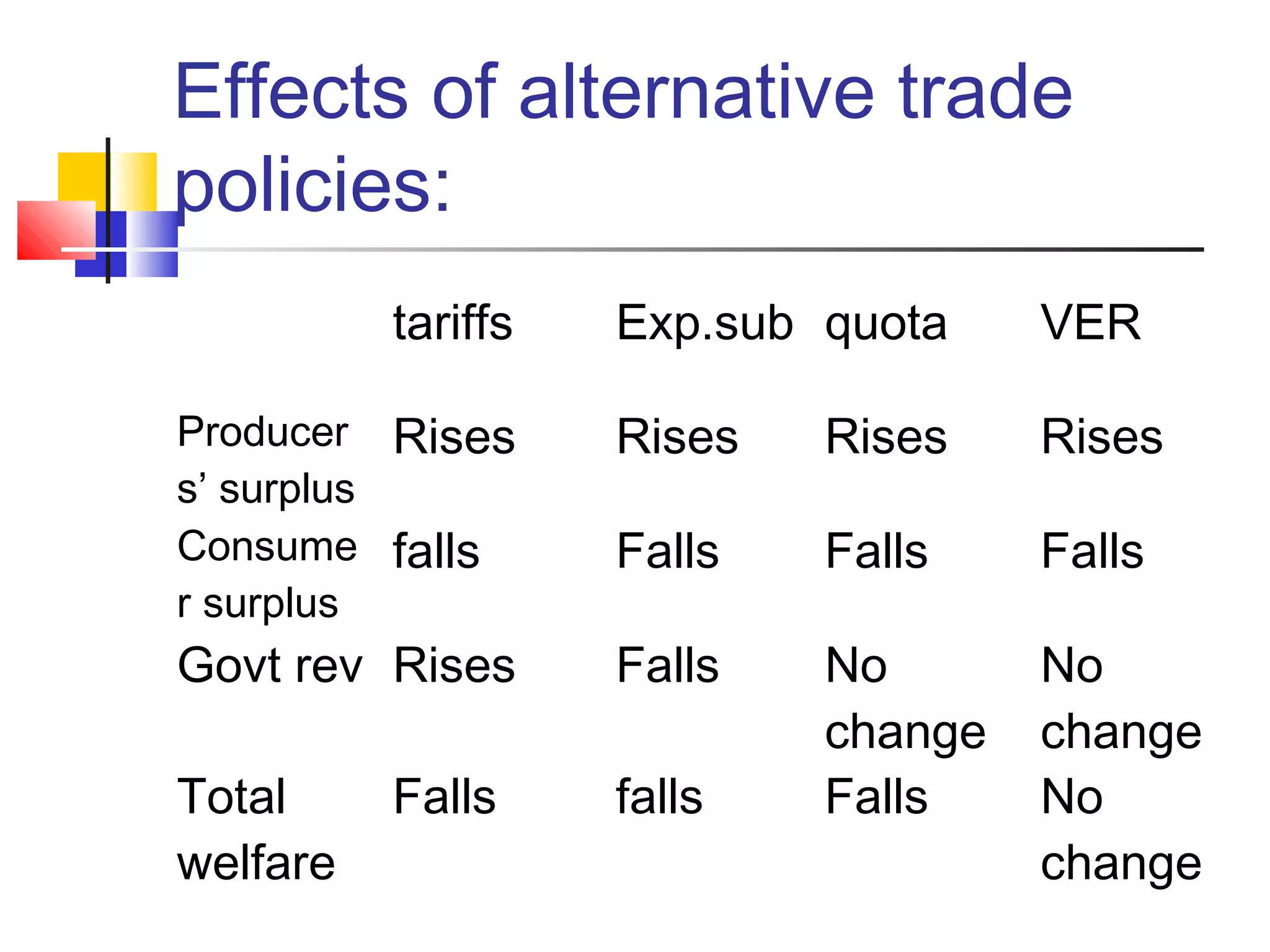

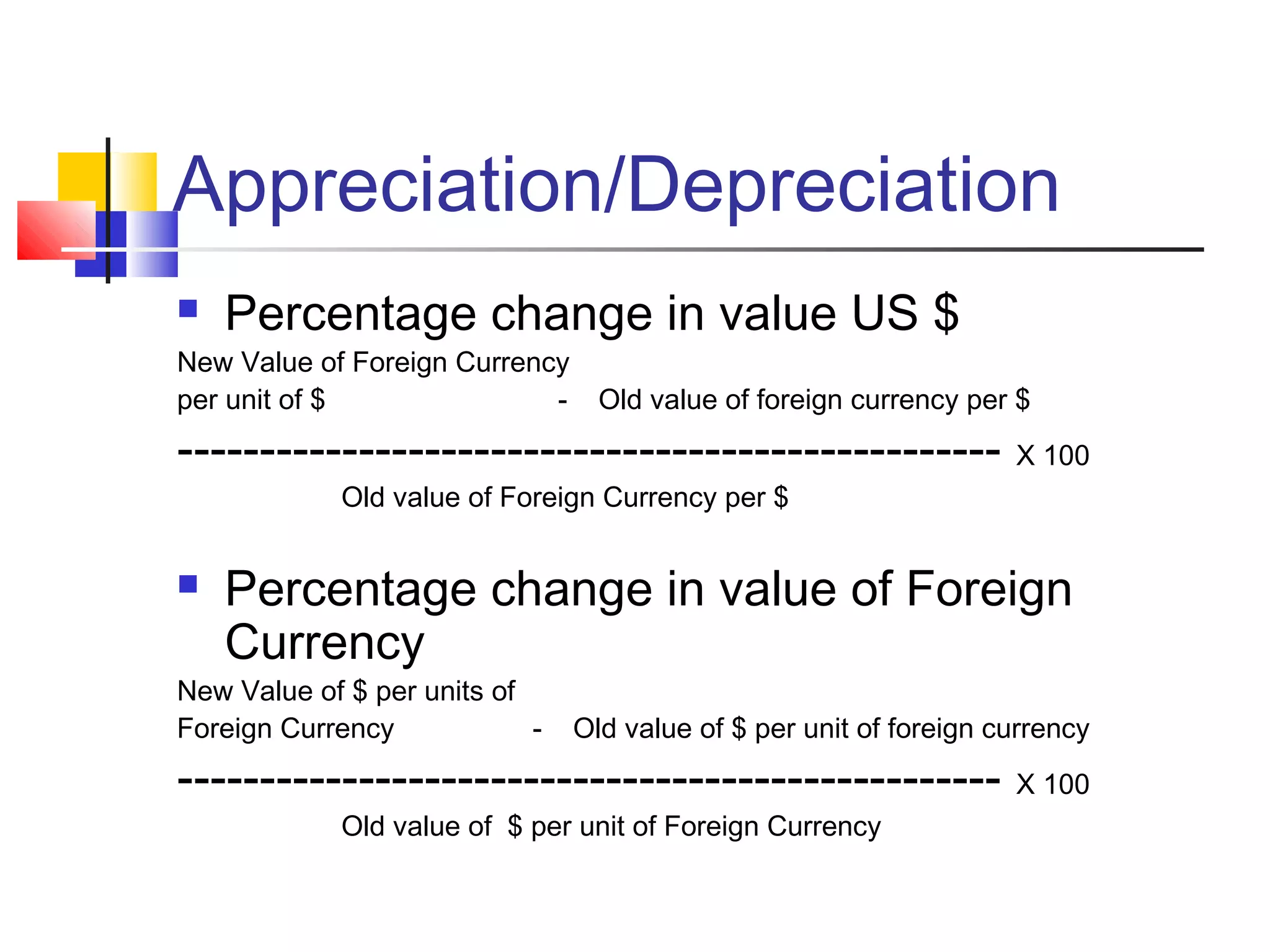

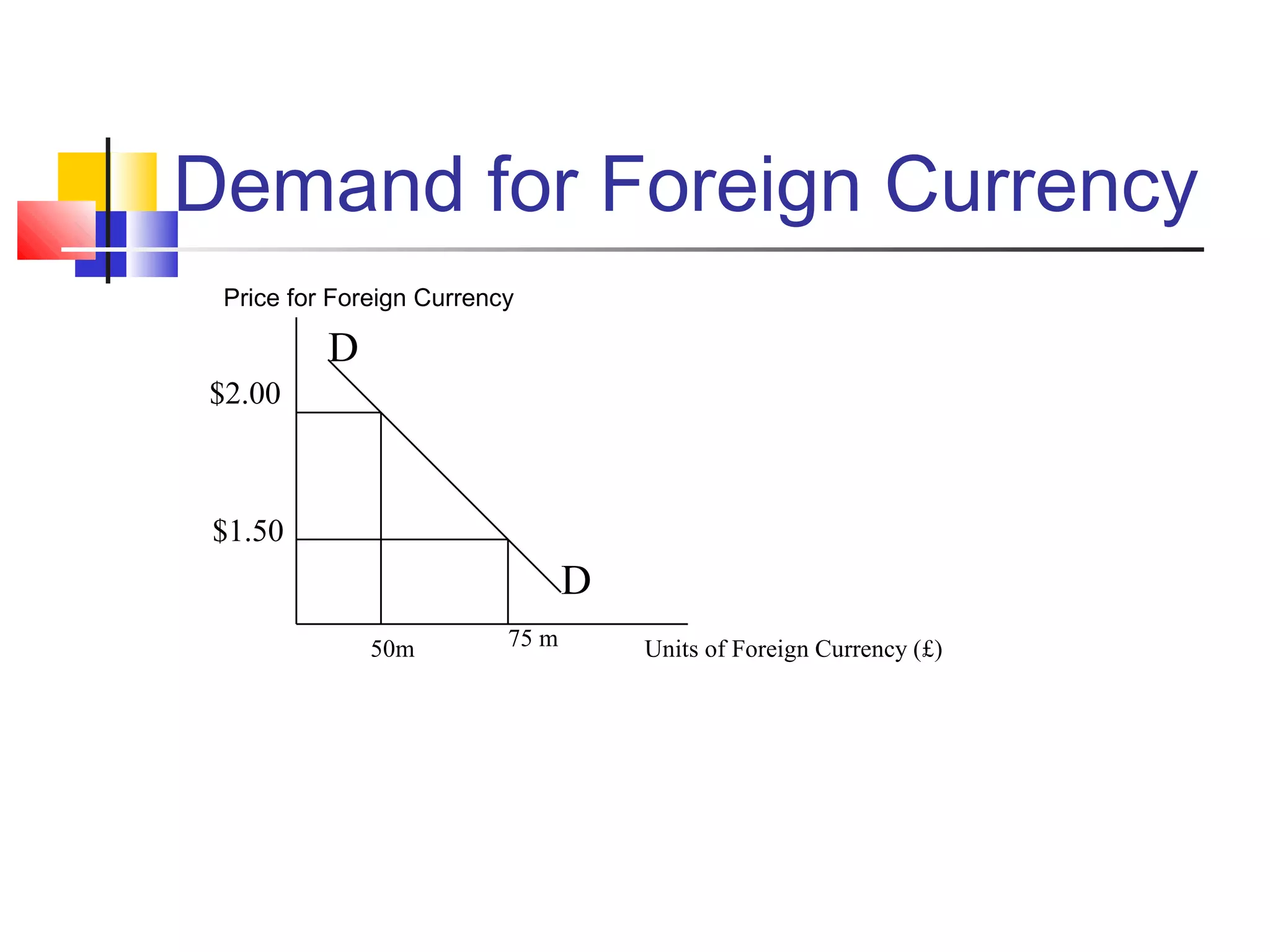

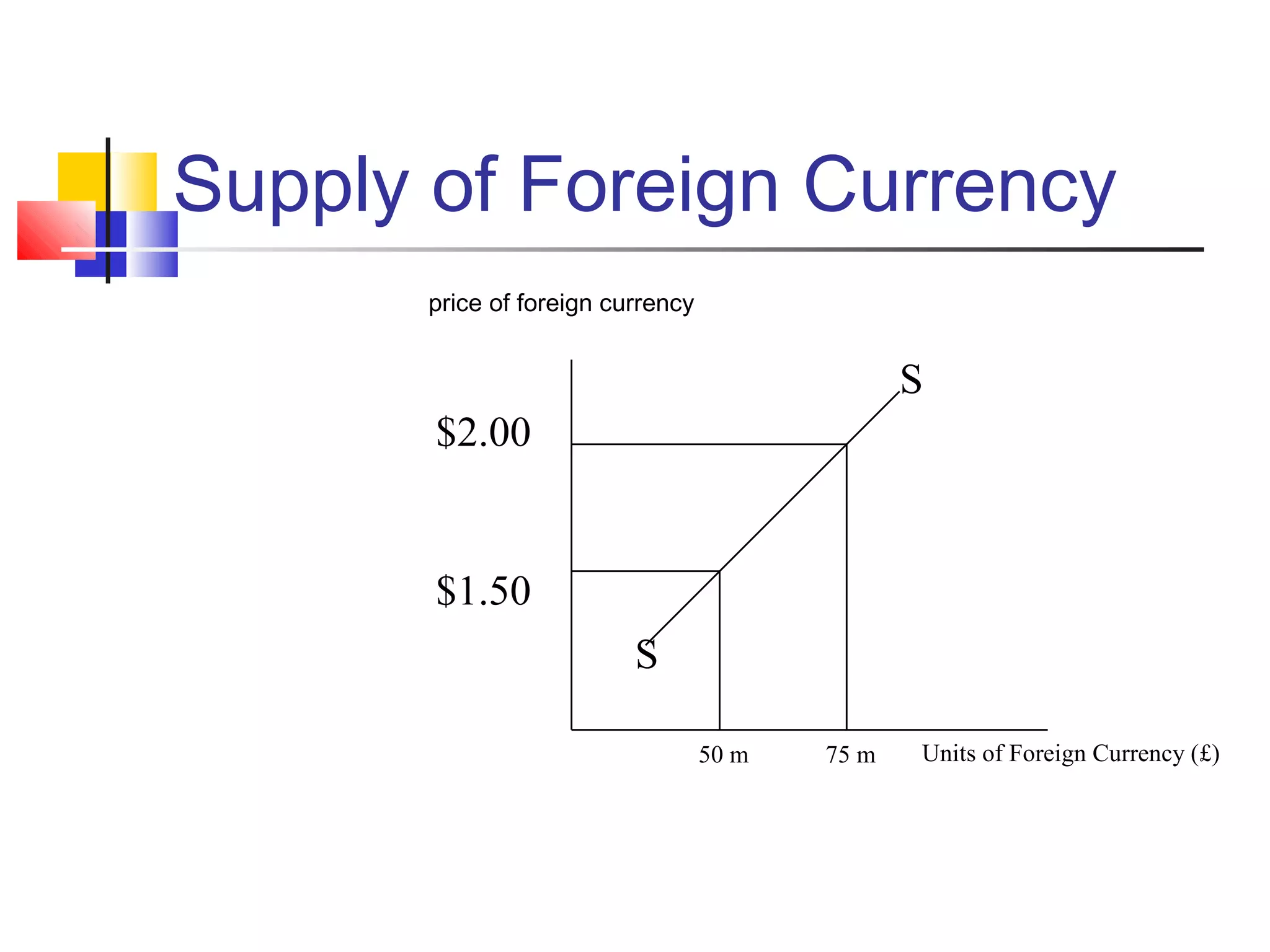

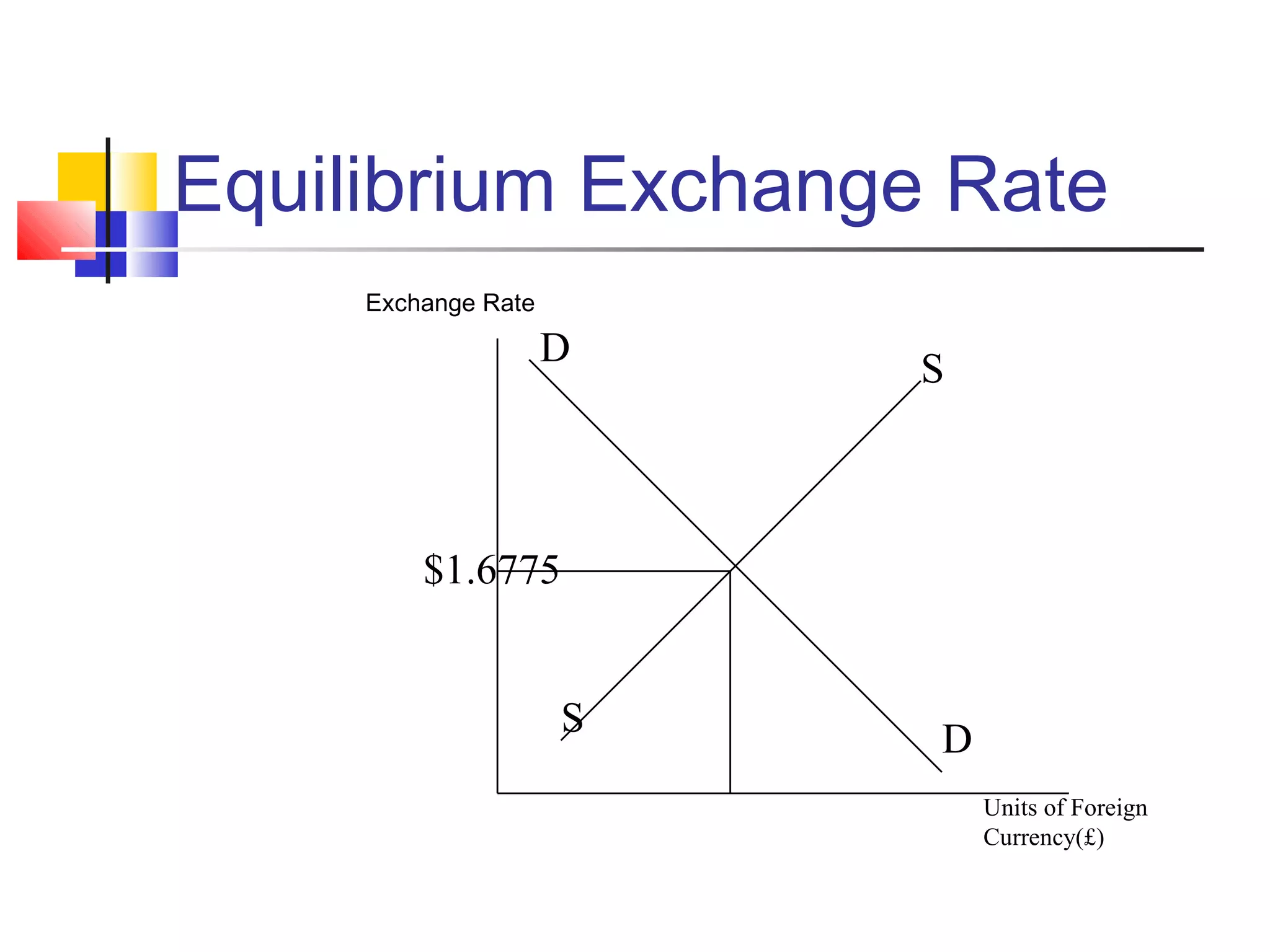

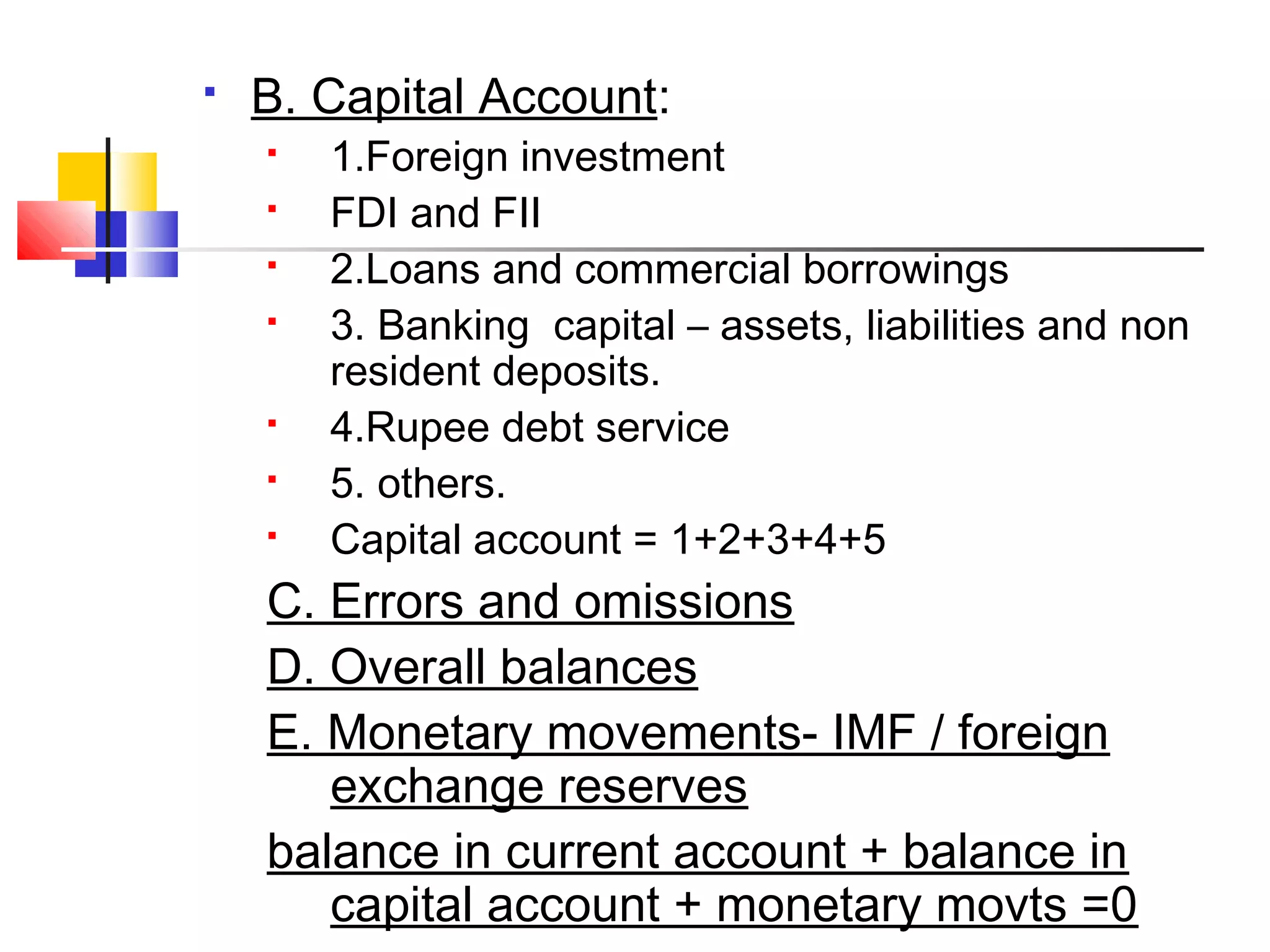

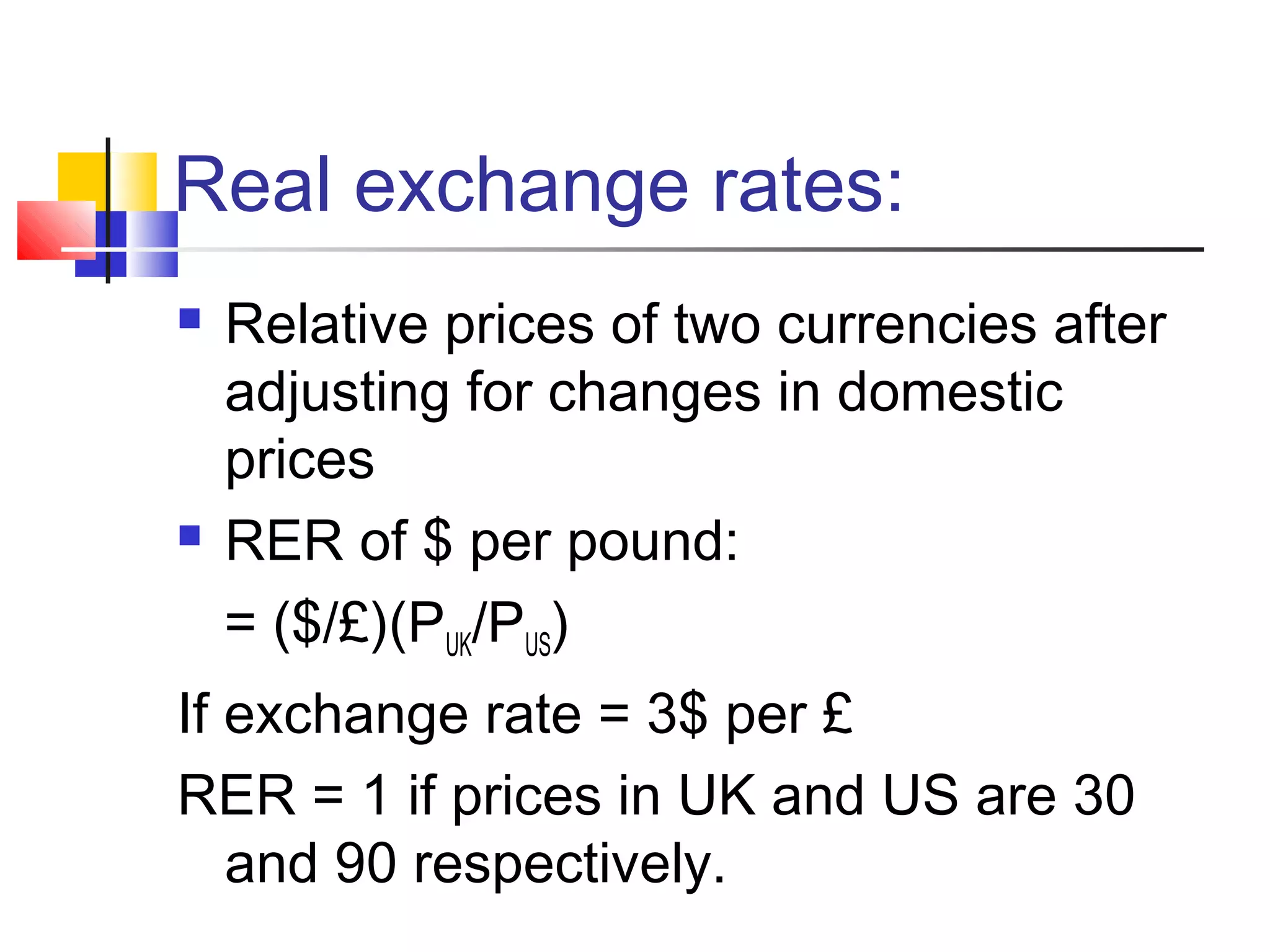

The document discusses international trade theory and exchange rates. It begins by explaining absolute and comparative advantage, noting that countries benefit from specializing in what they have a comparative advantage in producing. It then discusses instruments of trade policy like tariffs and quotas, and their effects. The document also examines exchange rates, defining them and exploring factors that influence exchange rate movements, like relative inflation and interest rates. It contrasts fixed versus floating exchange rate regimes and their advantages and disadvantages.