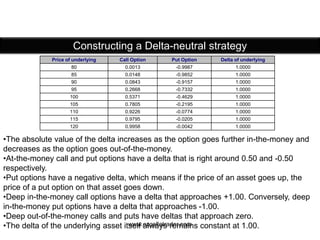

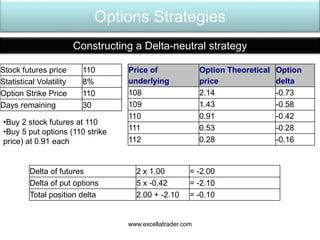

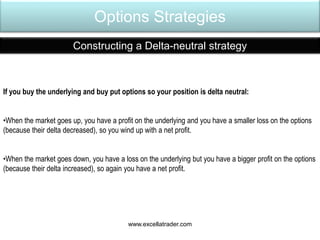

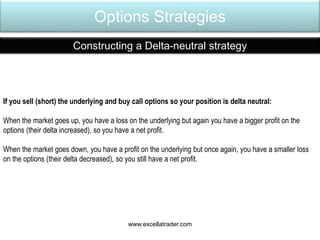

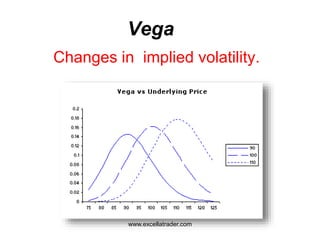

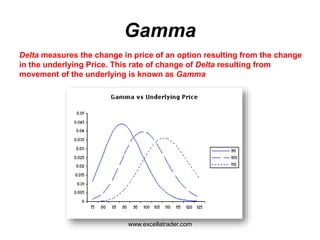

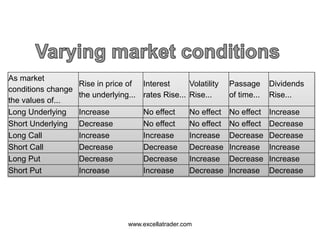

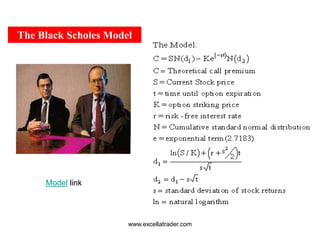

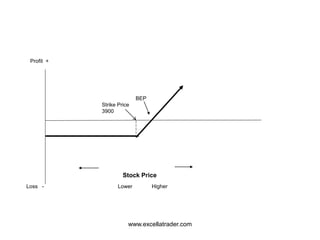

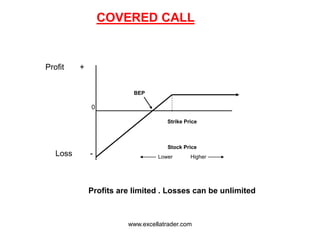

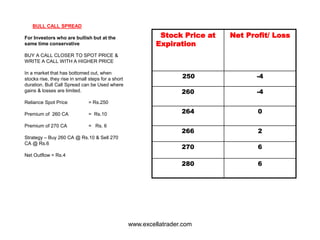

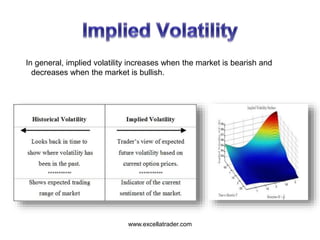

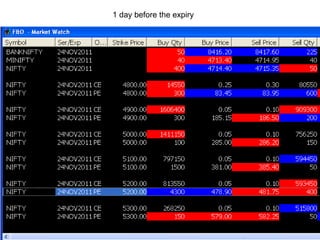

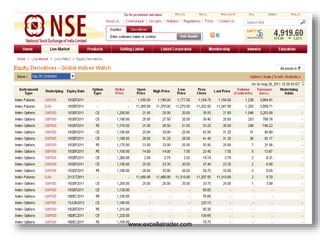

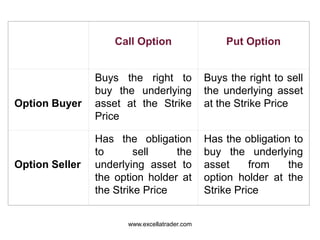

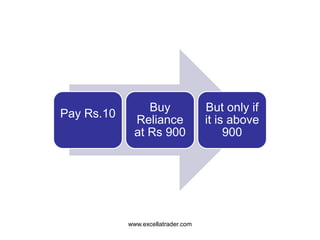

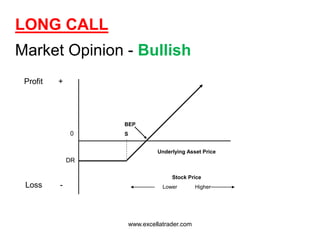

The document provides an overview of futures and options trading, focusing on derivatives, pricing, and trading strategies. It explains key concepts such as call and put options, hedging, and the Black-Scholes model, as well as detailing the various factors that influence option pricing. Case studies and examples illustrate practical applications of these financial instruments and strategies in the market.

![www.excellatrader.com

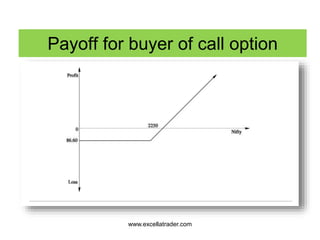

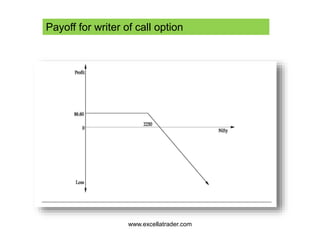

In the case of Call - Max[0, (St — K)]

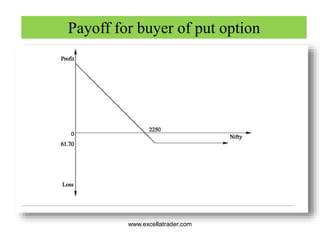

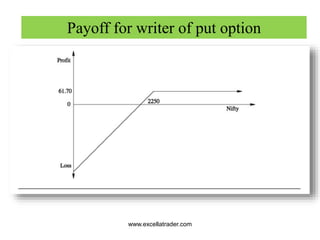

In the case of Put - Max[0,K — St]

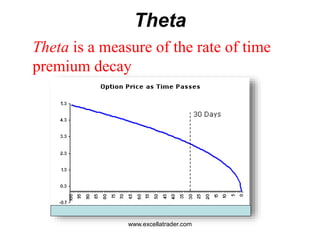

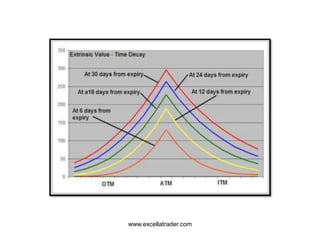

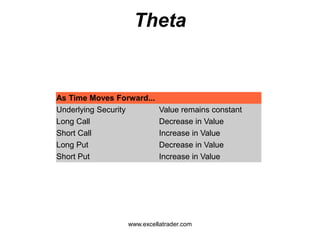

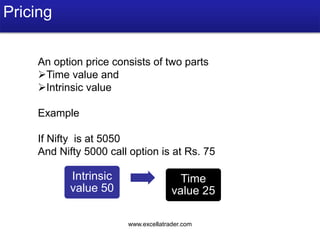

Time value of an option: The time value of an option

is the difference between its premium and its intrinsic

value.](https://image.slidesharecdn.com/excellatraderderivativeclass-150421004011-conversion-gate01/85/Excella-trader-derivative-class-18-320.jpg)