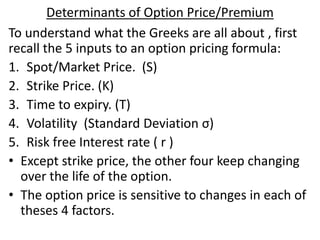

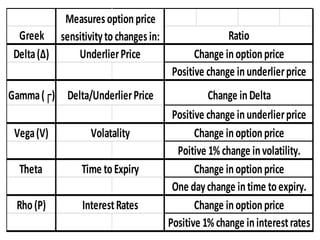

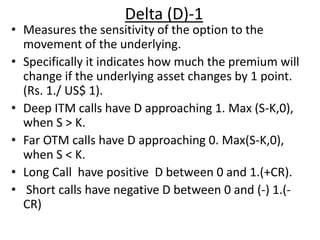

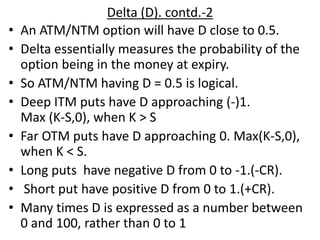

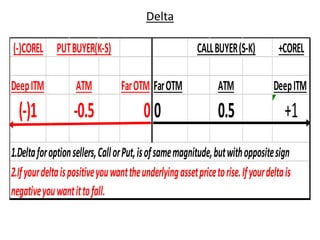

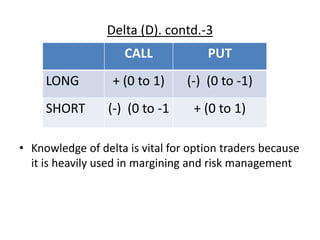

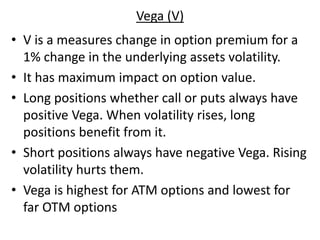

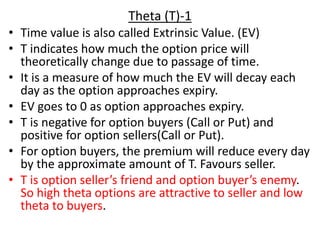

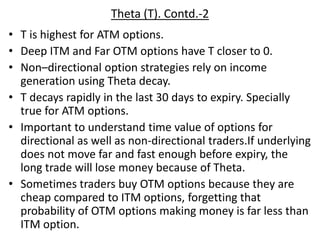

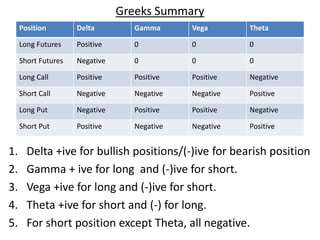

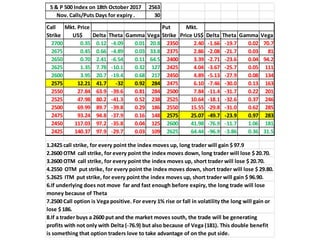

The document discusses the determinants of option price and the Greeks - Delta, Gamma, Vega, Theta, and Rho. It explains that these Greeks measure how sensitive an option's price is to changes in the underlying asset's price, volatility, time to expiration, and interest rates. Specifically, Delta measures change in option price for a $1 change in the underlying, Gamma measures rate of change of Delta, Vega measures change for a 1% volatility change, Theta measures daily time decay, and Rho measures change for a 1% interest rate change. Understanding how the Greeks change is important for risk management and making informed options trading decisions.