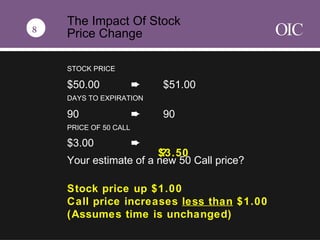

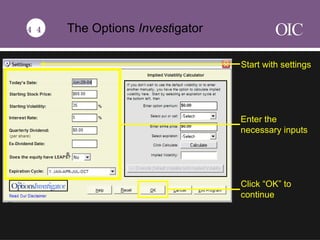

The document provides an overview of options spread strategies, including bull call spreads, bear call spreads, bull put spreads, and bear put spreads. It defines each strategy, provides an example, and outlines the potential profit/loss outcomes at expiration. The strategies are simulated using an online tool called The Options Investigator to demonstrate how the positions would perform at different stock prices. Spreads are explained to have similar pricing behavior and risk/reward profiles regardless of whether calls or puts are used.