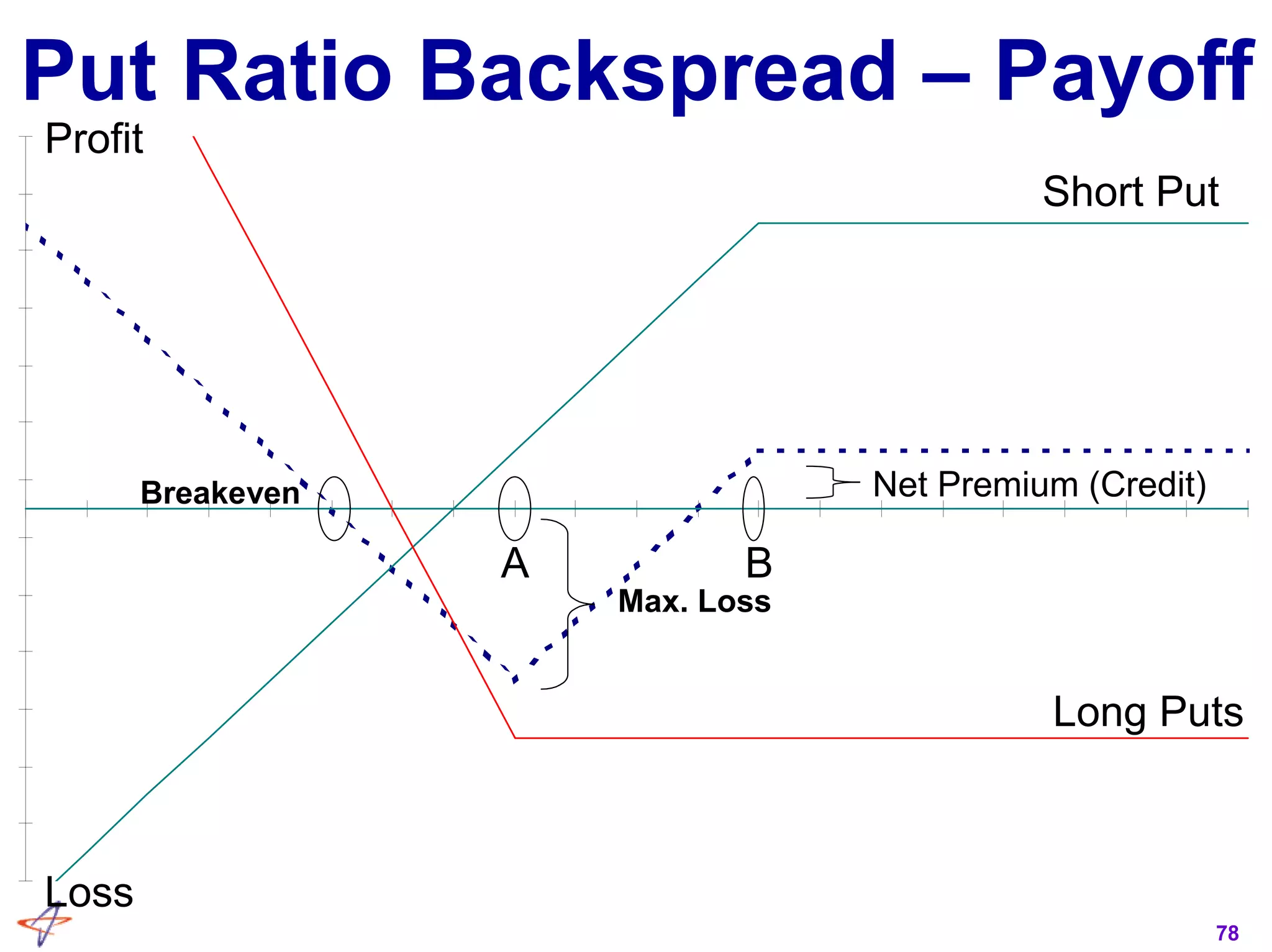

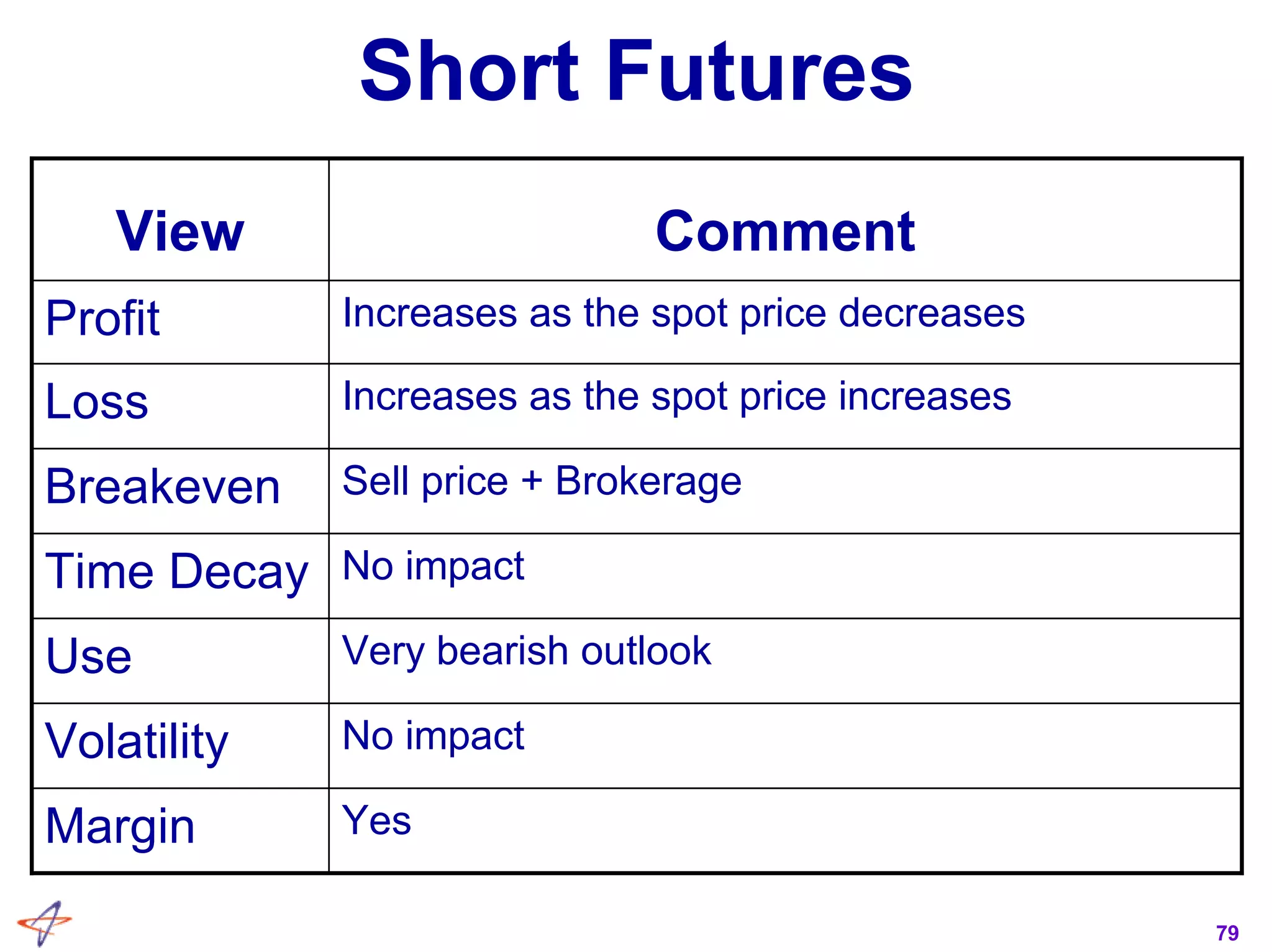

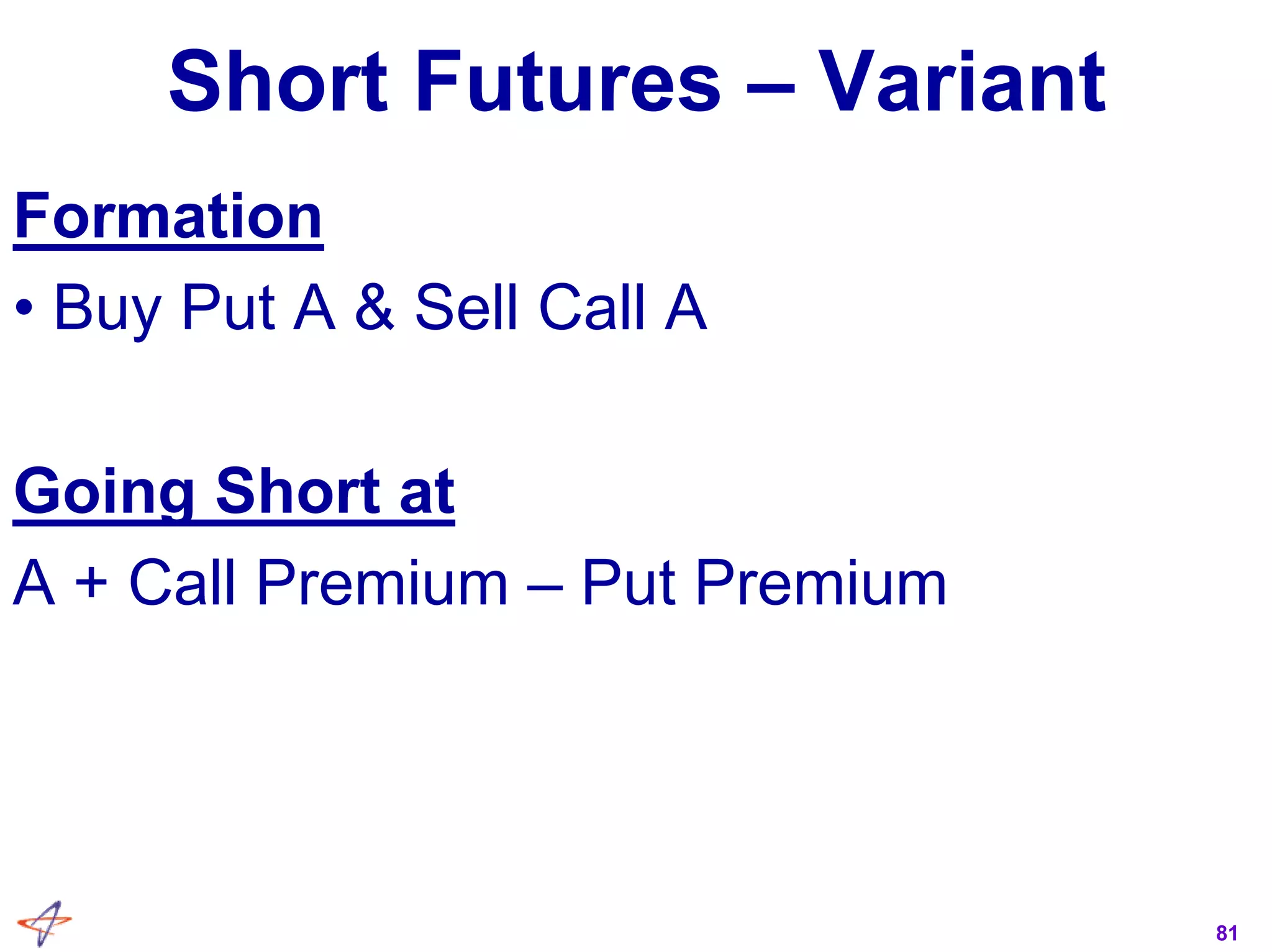

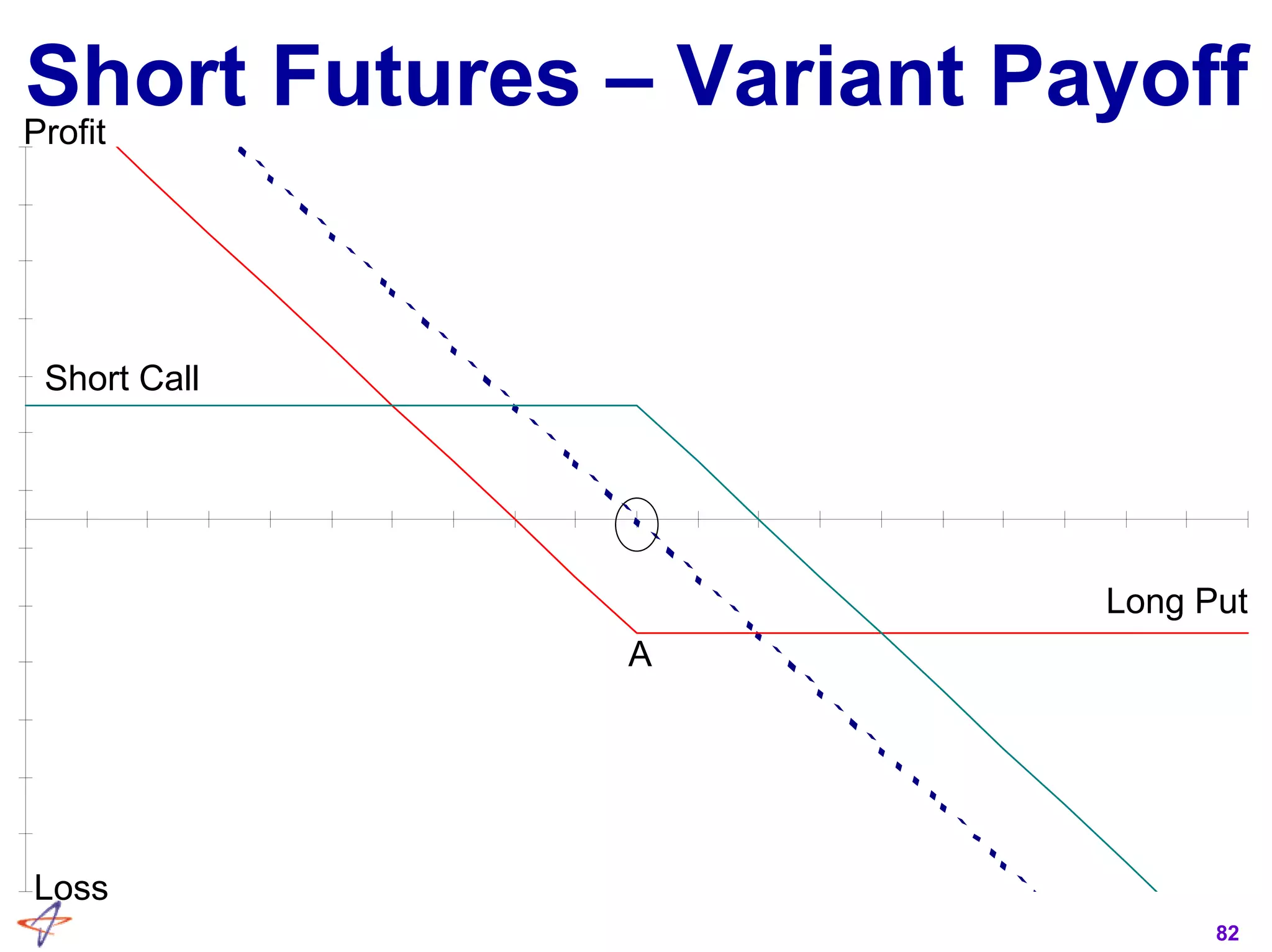

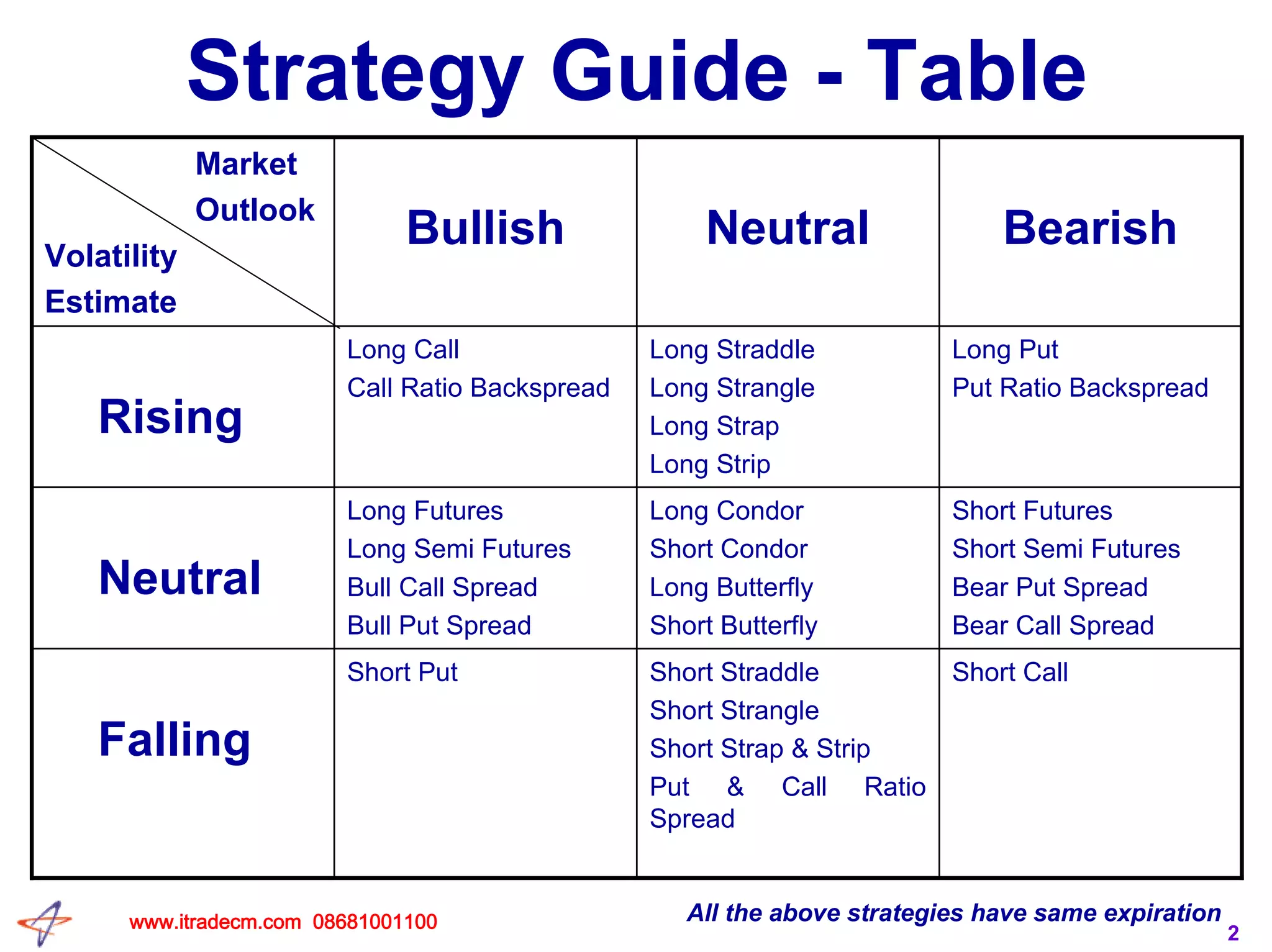

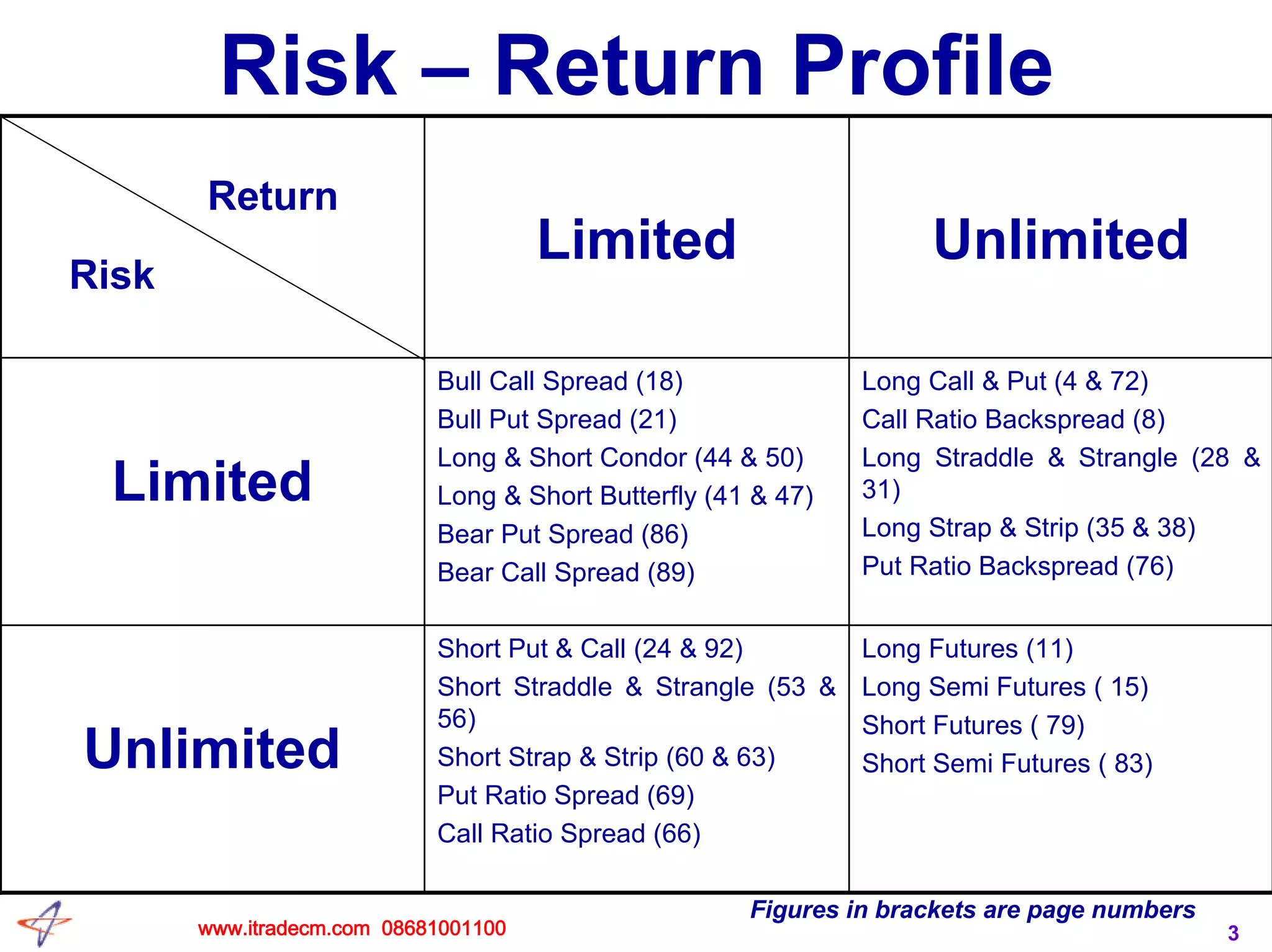

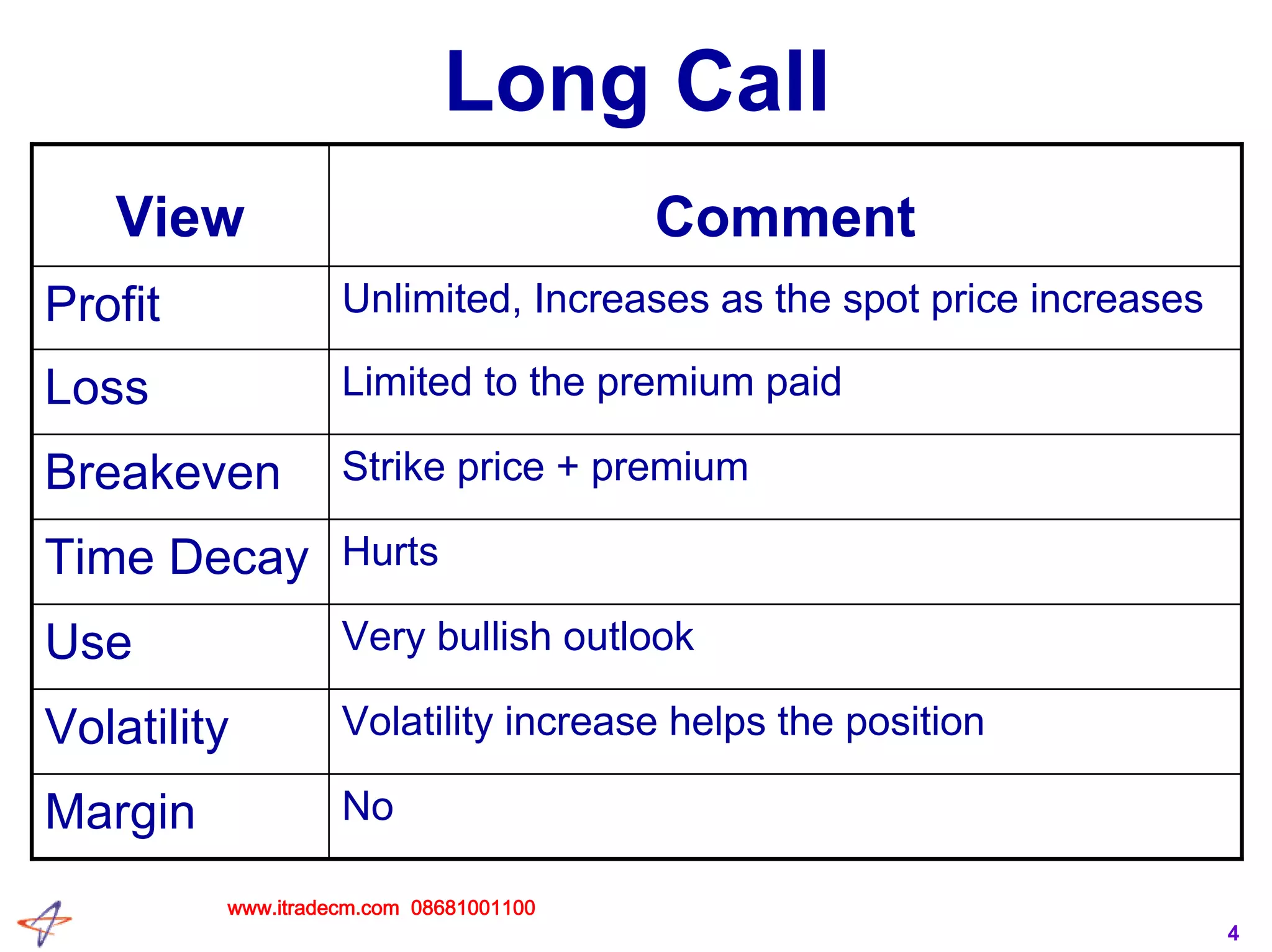

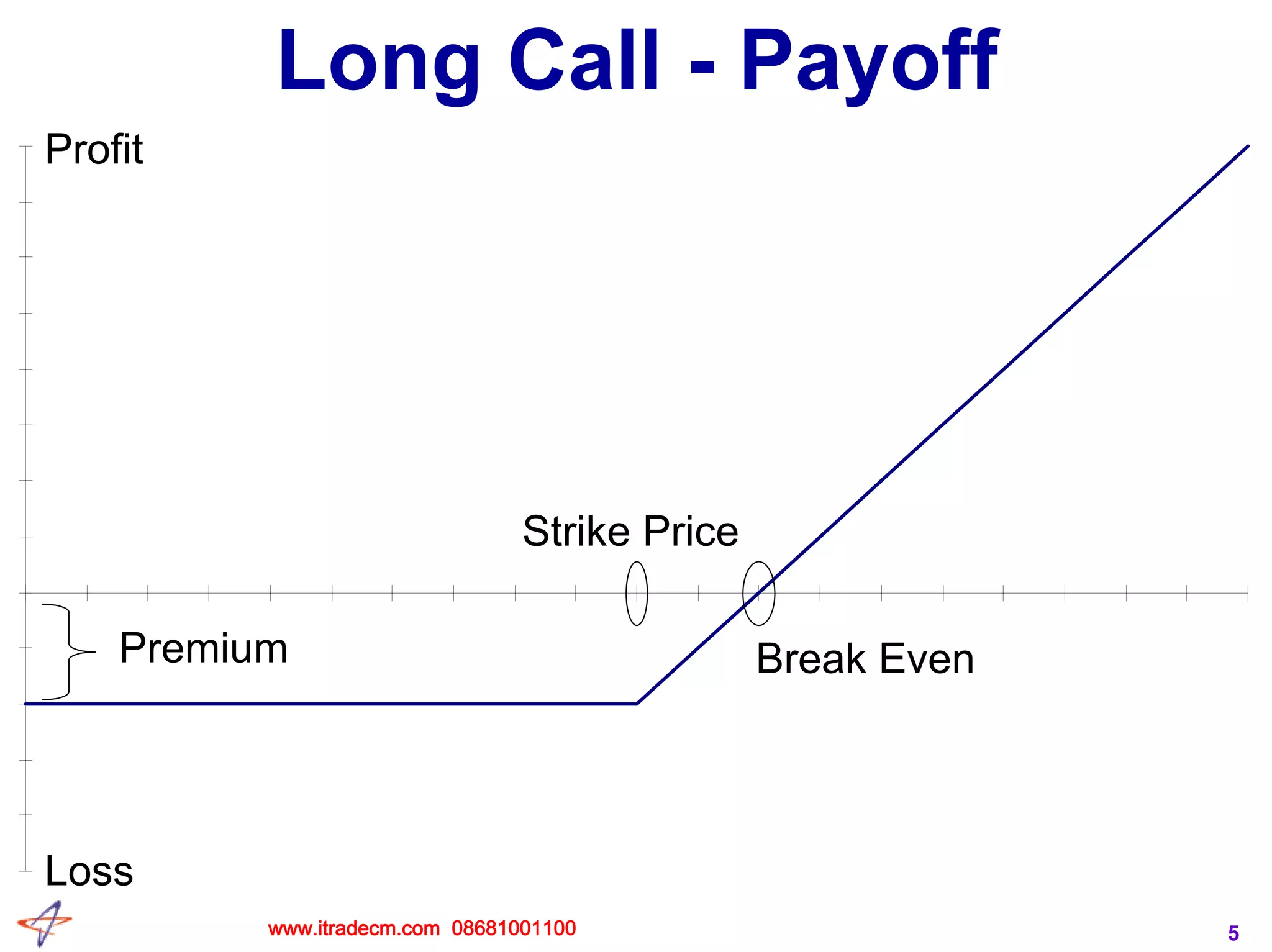

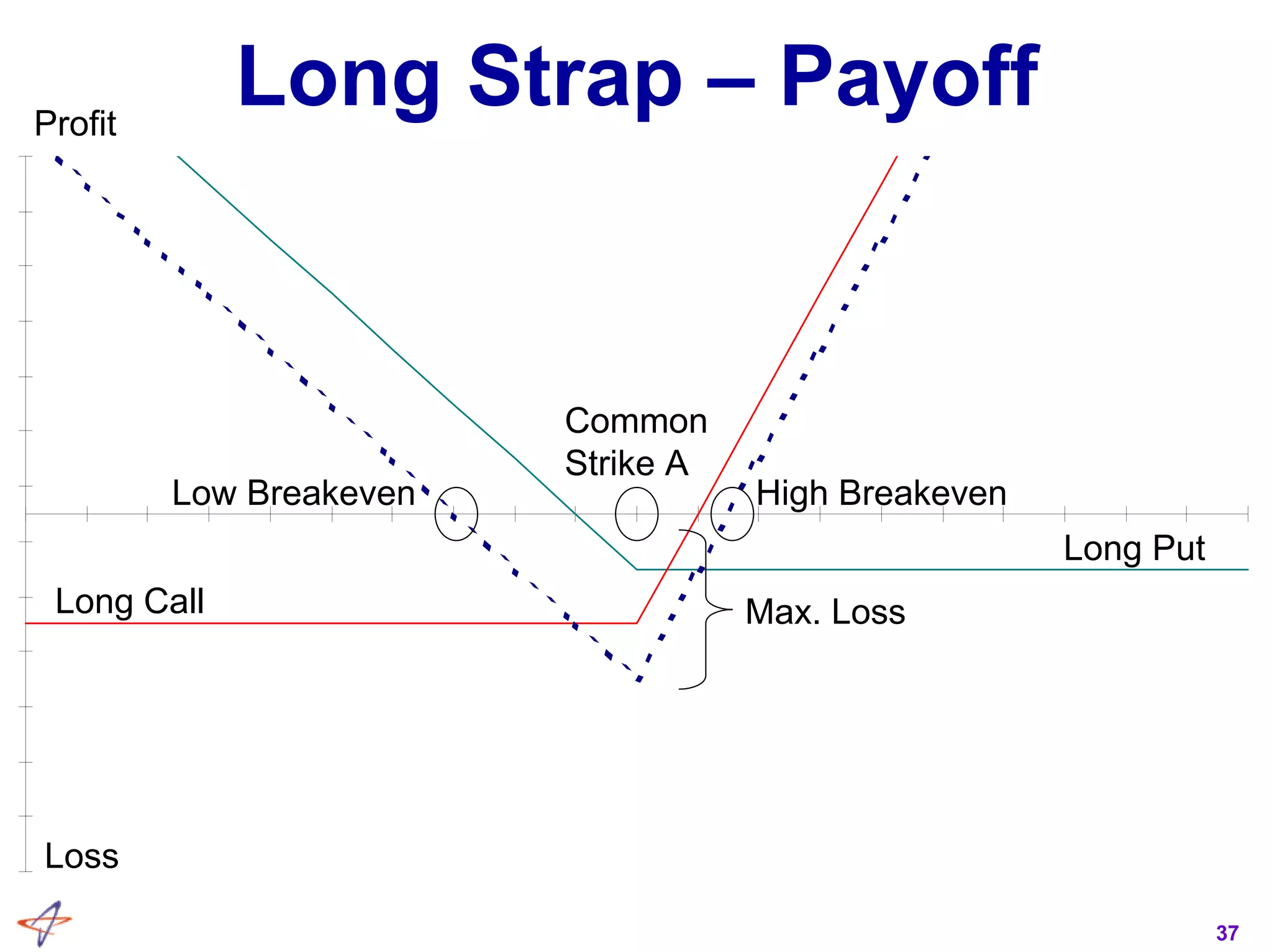

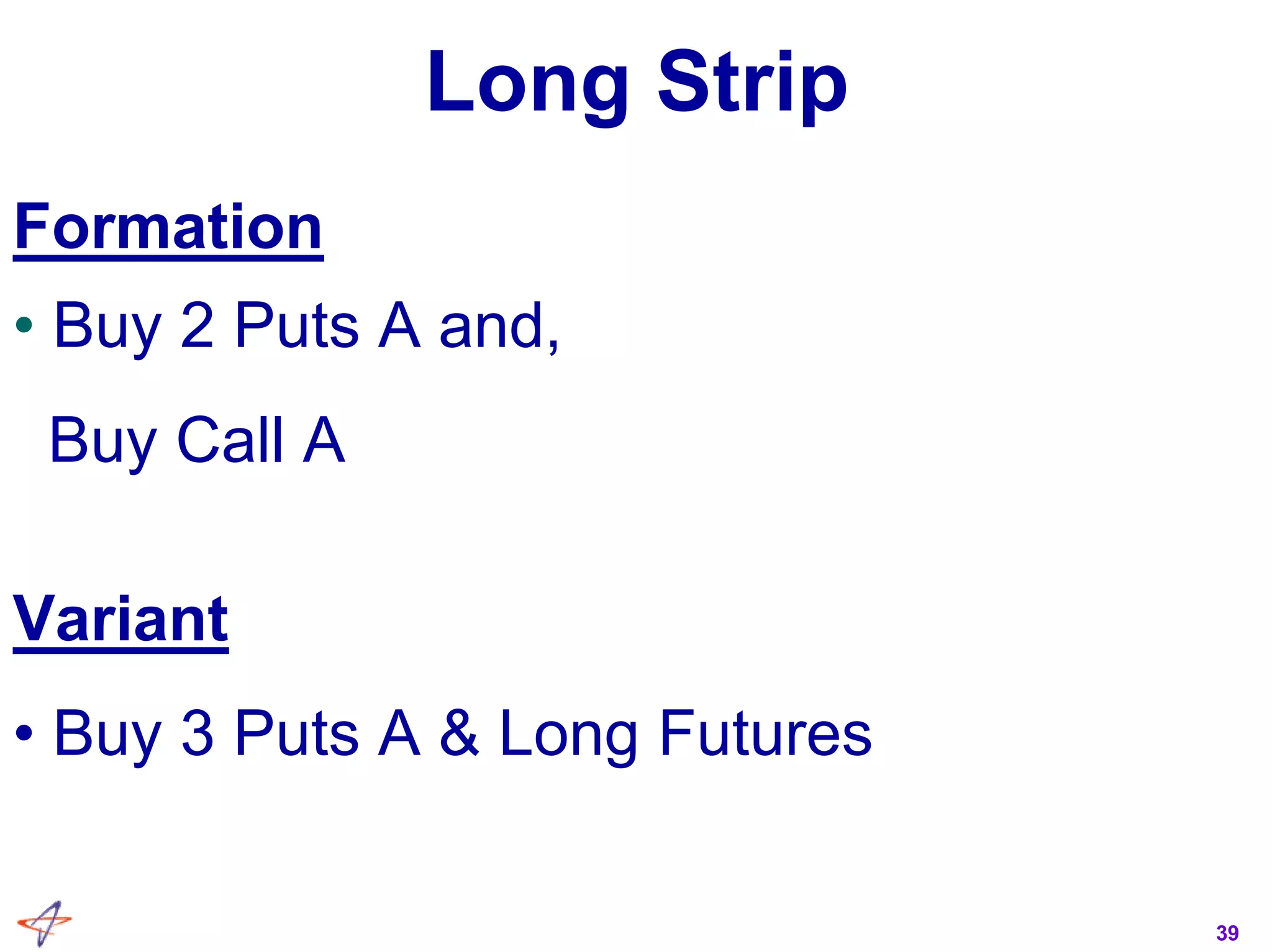

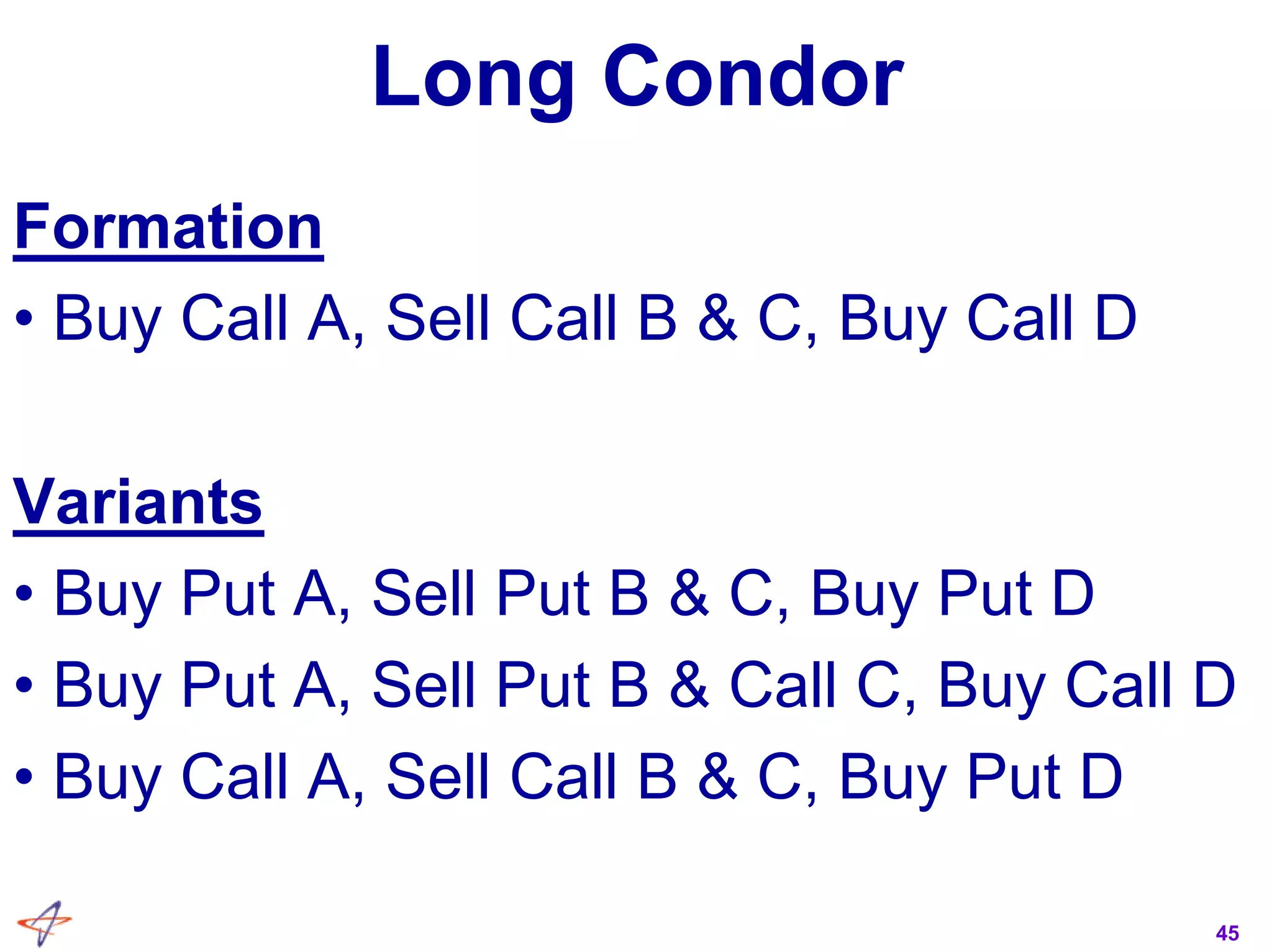

This document provides summaries and payoff diagrams for various derivatives trading strategies including long calls, protective puts, call ratio back spreads, long futures, bull call spreads, short puts, long straddles, long strangles, long straps, long strips, long and short butterflies, long and short condors, and short butterflies. Each strategy is described in 1-3 sentences and includes information on market outlook, breakeven points, risk, and profit potential. Payoff diagrams visually depict strategy outcomes at different price levels.

![41

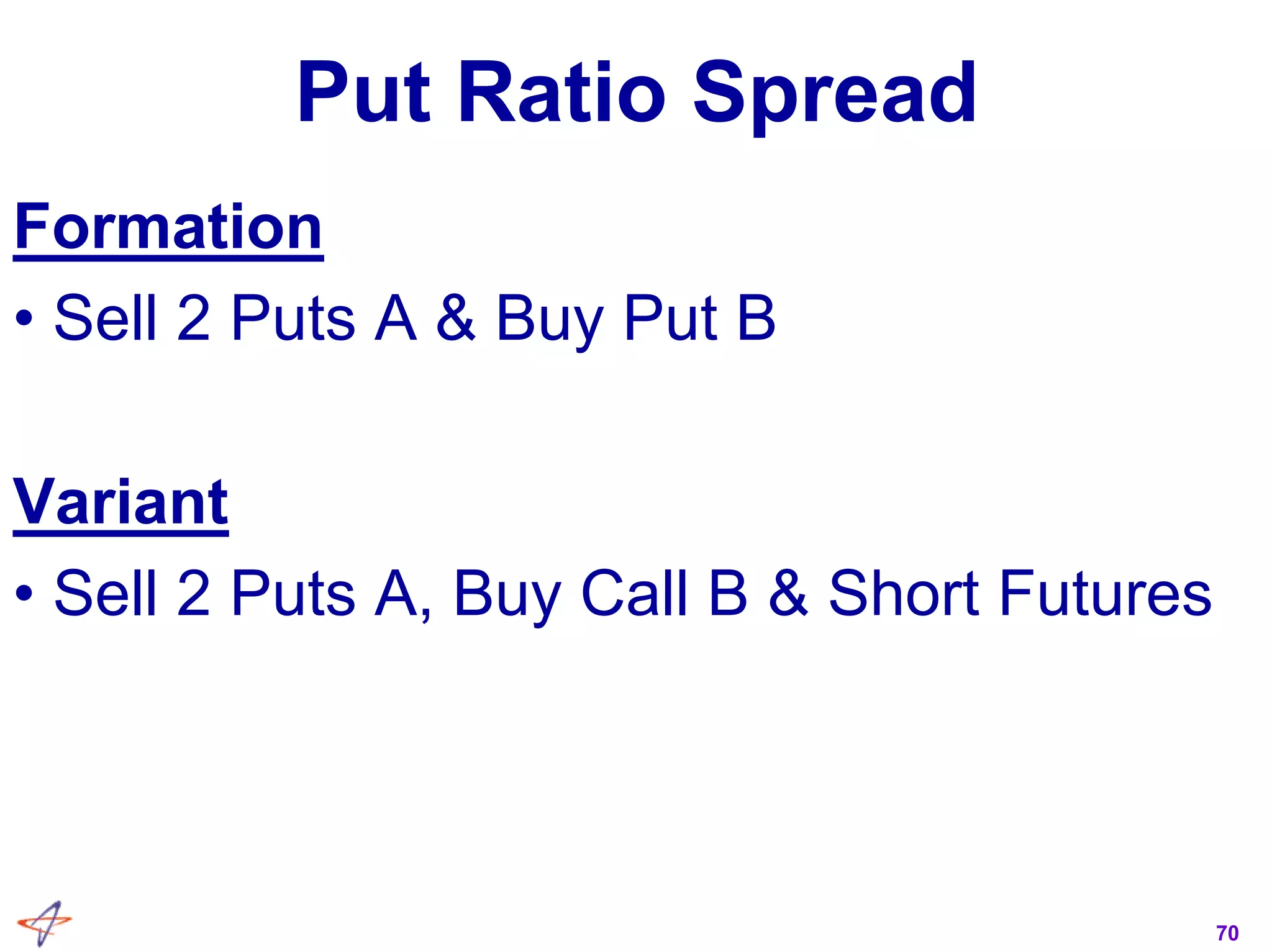

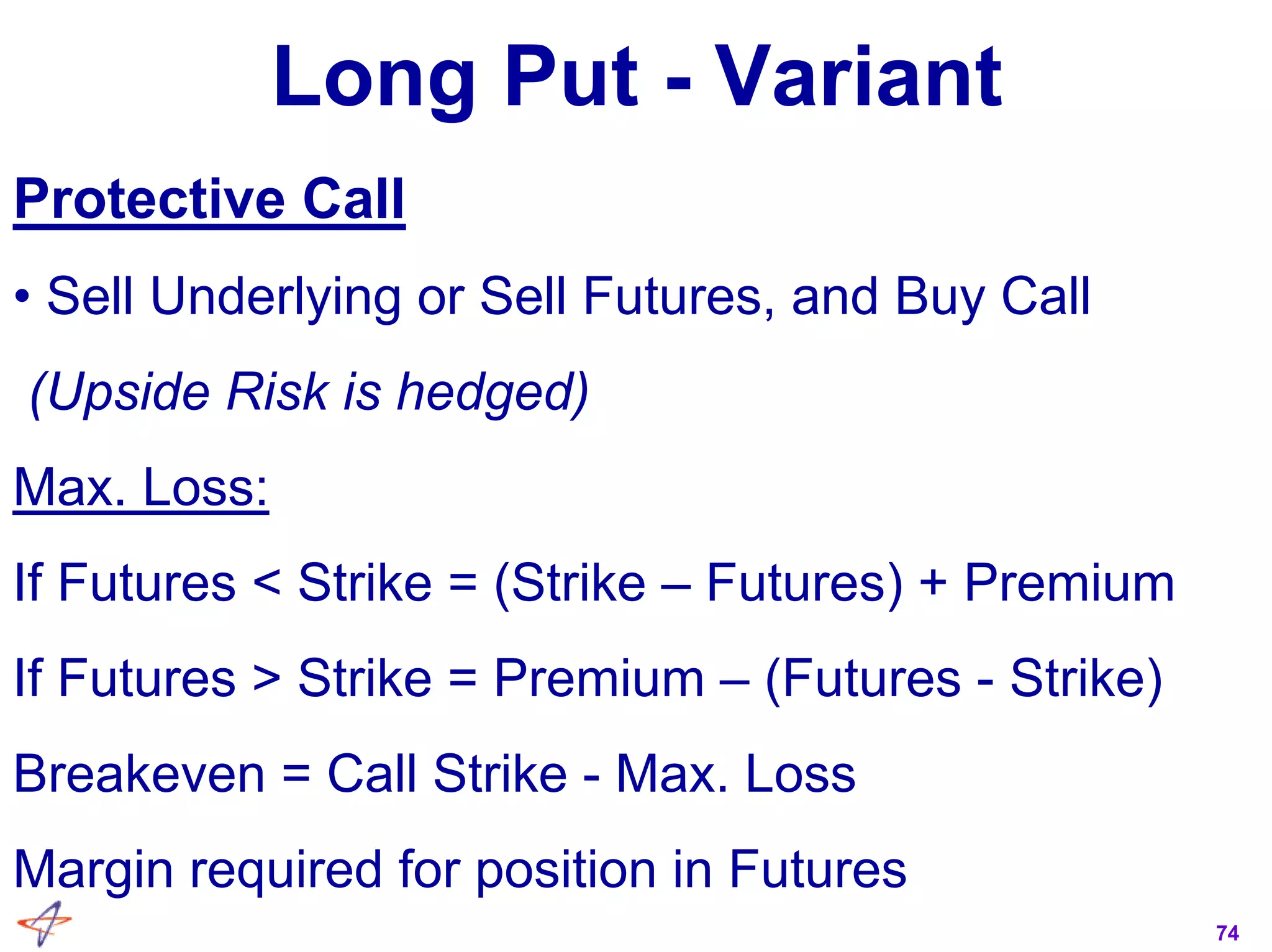

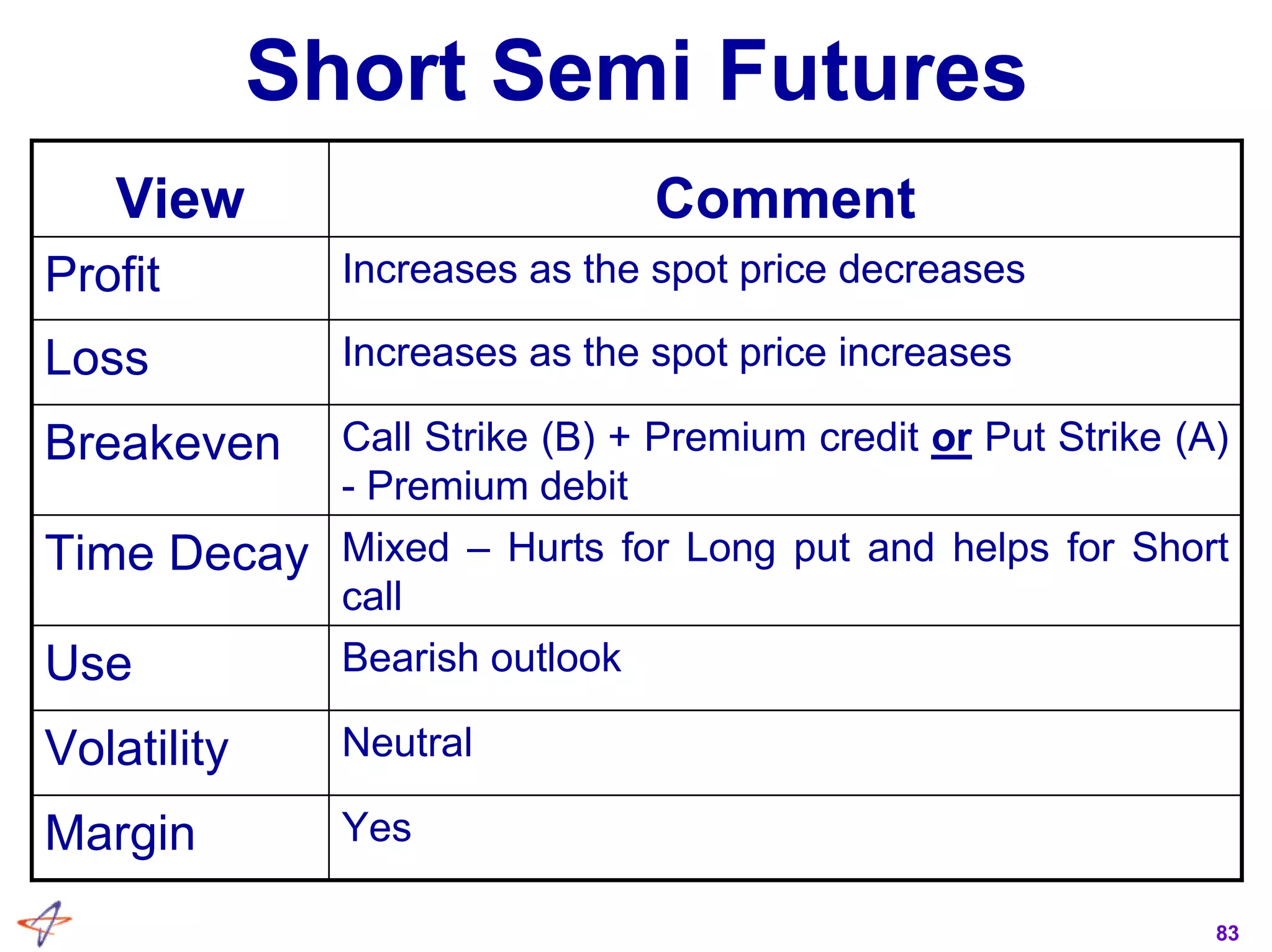

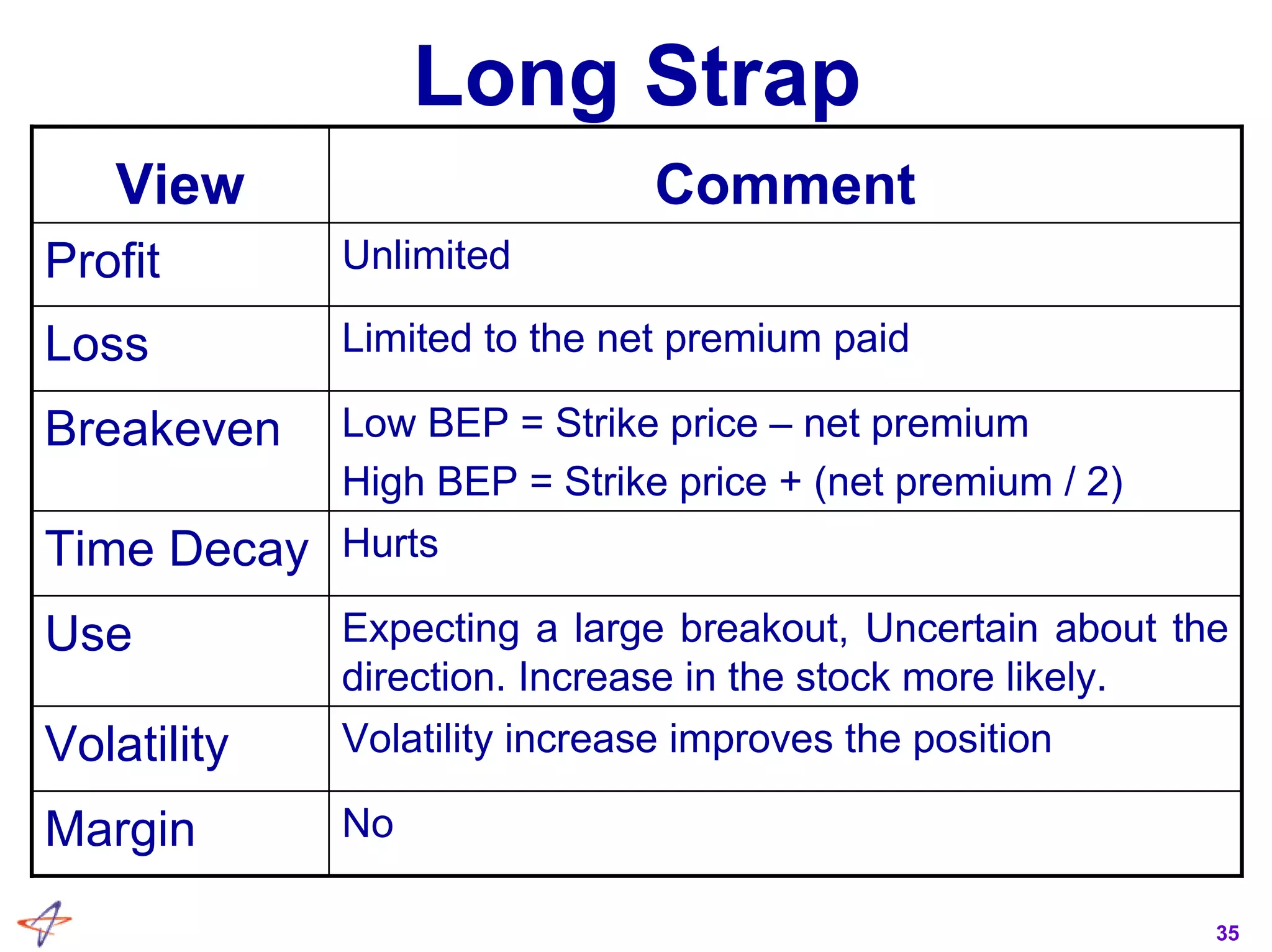

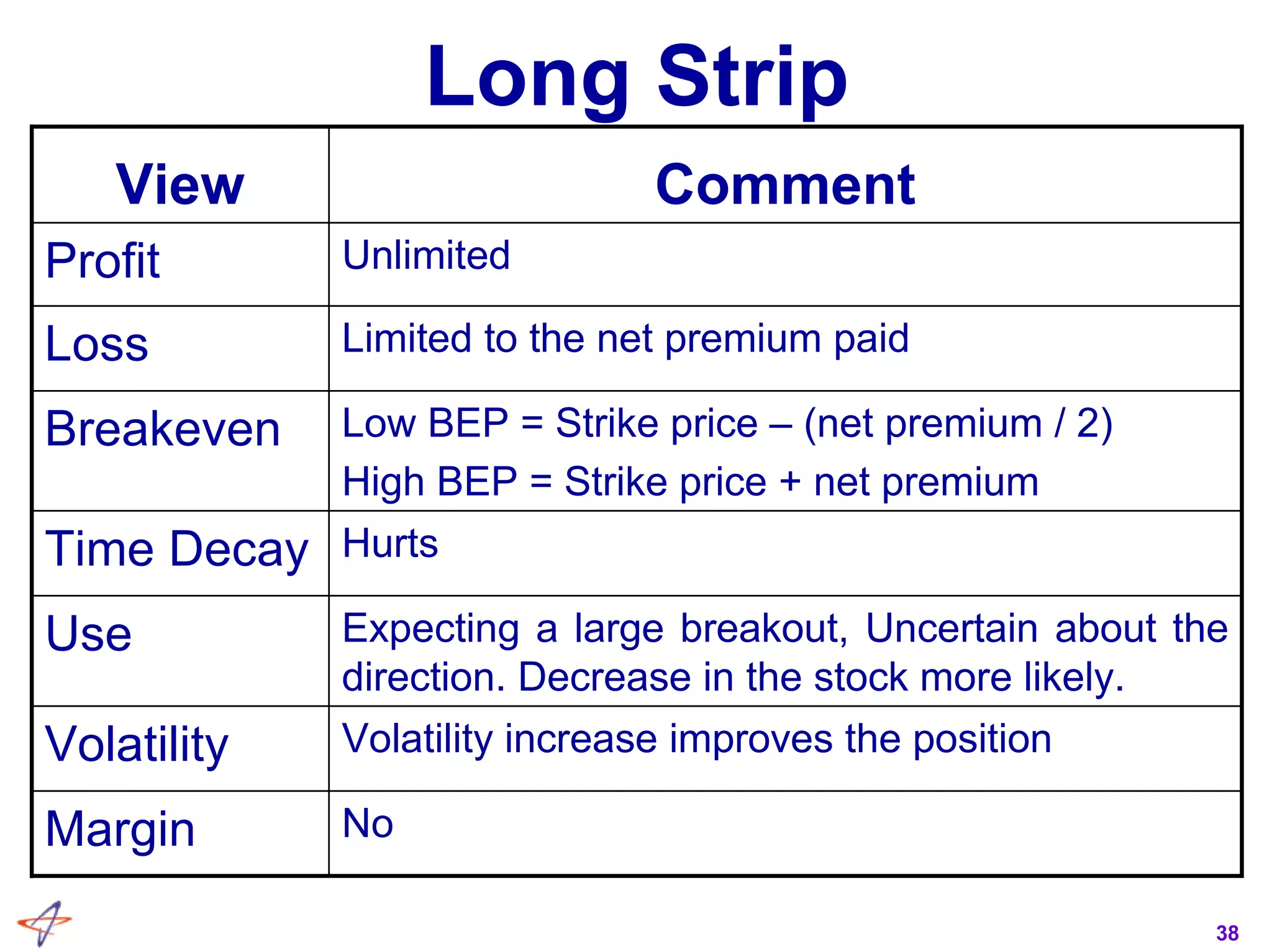

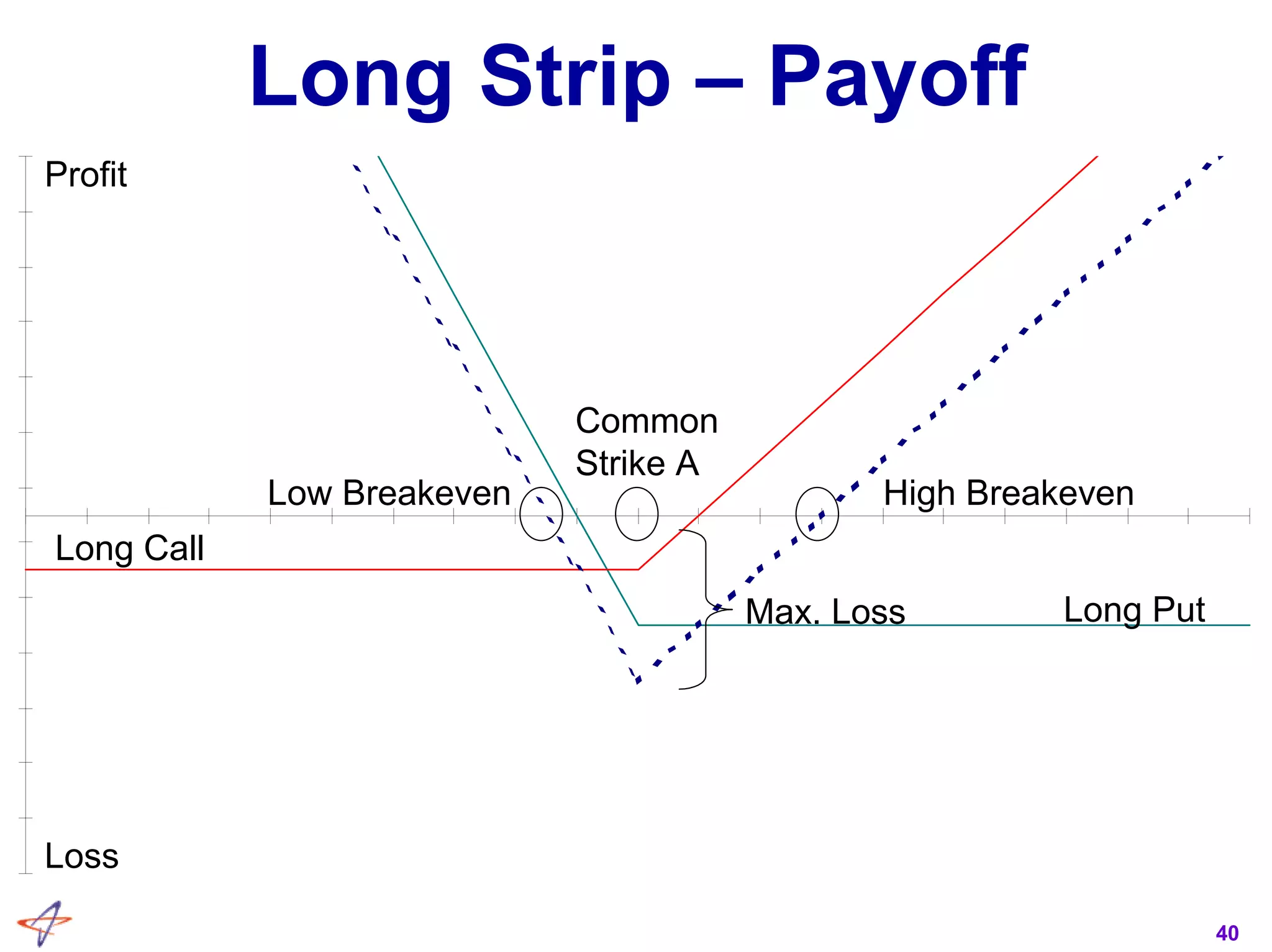

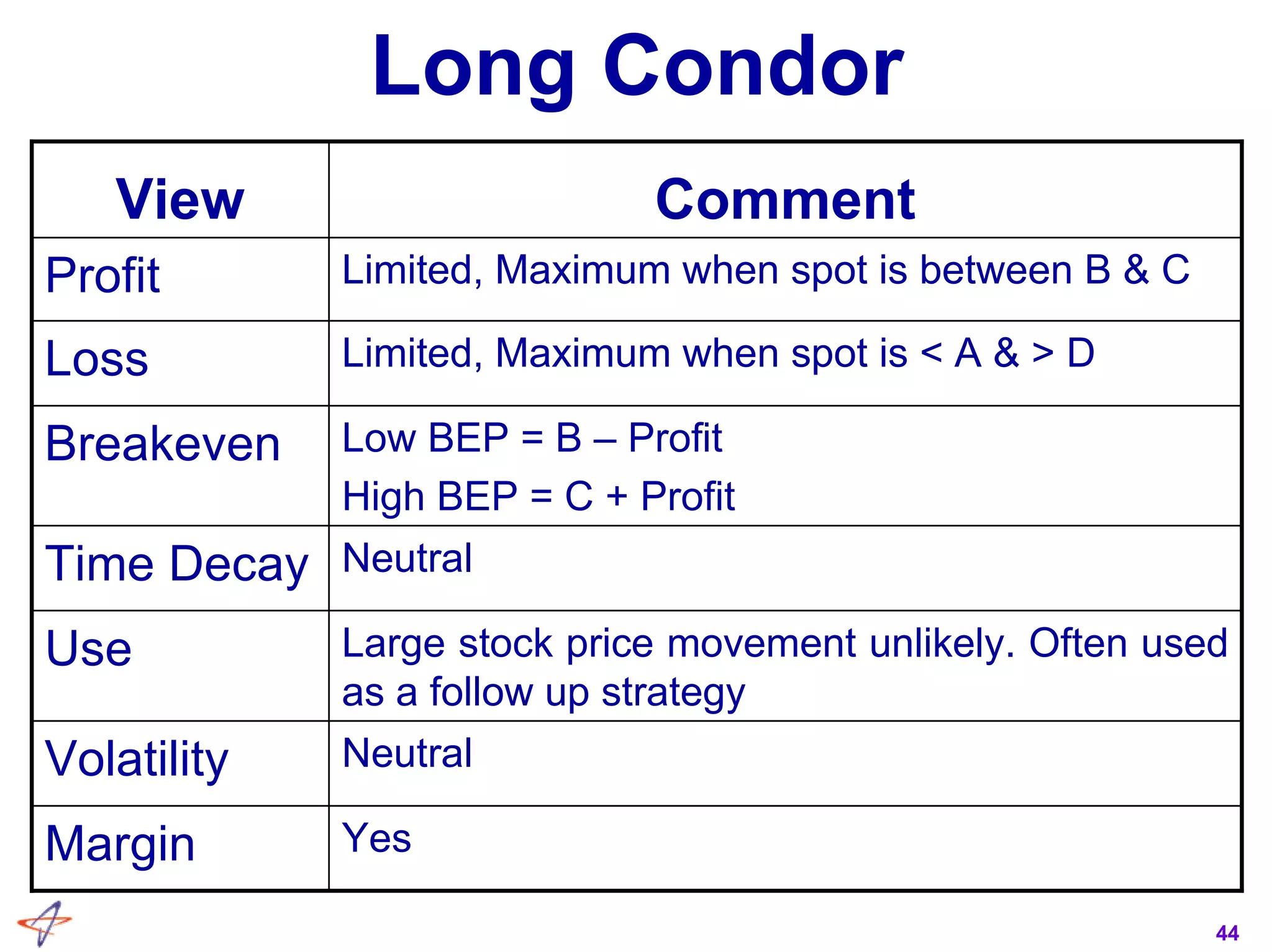

Long Butterfly

Large stock price movement unlikely. Often used

as a follow up strategy

Use

Low BEP = Middle Strike – Profit

High BEP = Middle Strike + Profit

Breakeven

YesMargin

NeutralVolatility

NeutralTime Decay

Limited to the net premium paidLoss

Limited to [(B – A) or (C – B)] – Net premiumProfit

CommentView](https://image.slidesharecdn.com/derivativesstrategyguideitrade-140927003506-phpapp02/75/ITRADE-Derivatives-strategy-guide-41-2048.jpg)

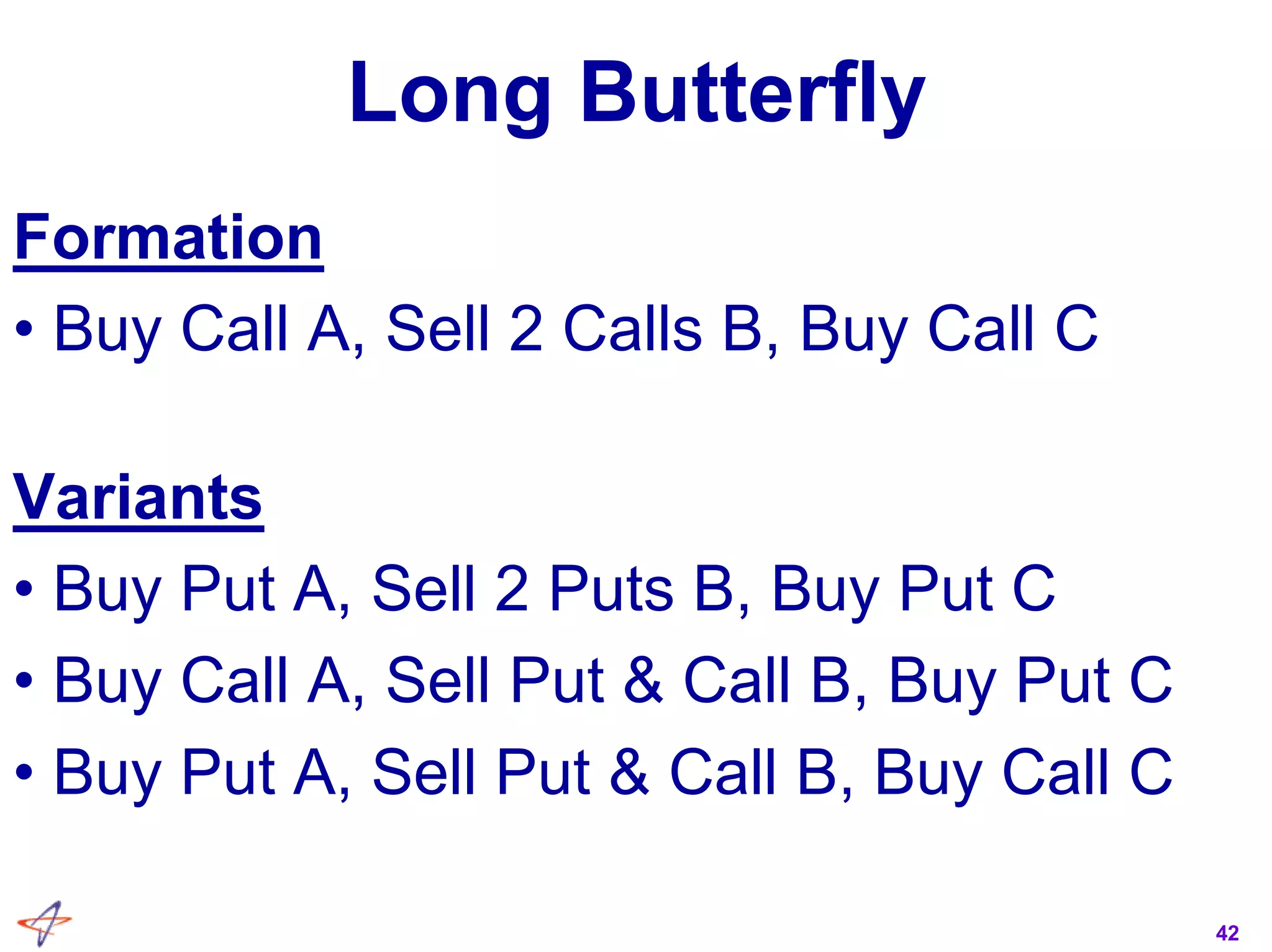

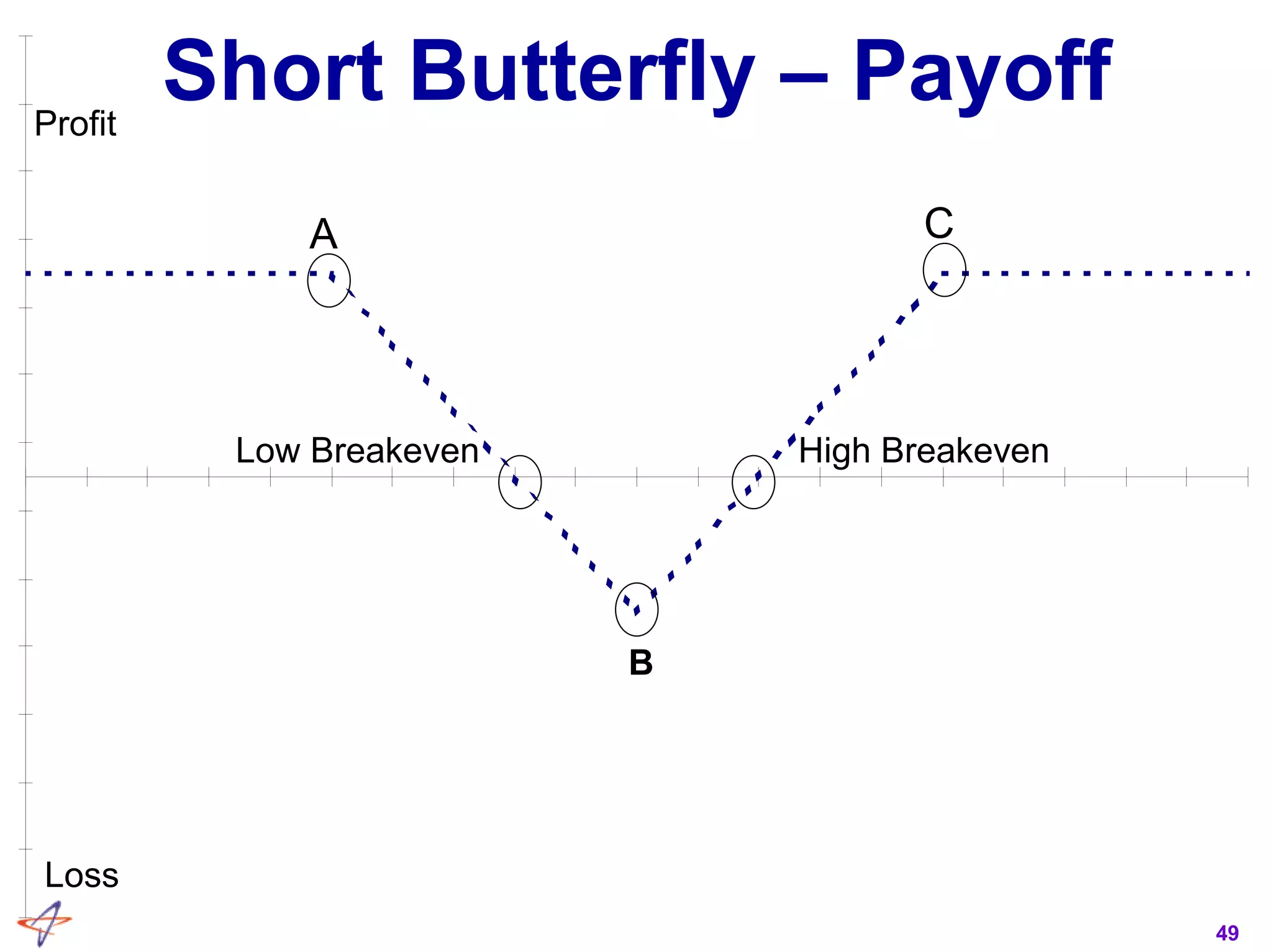

![47

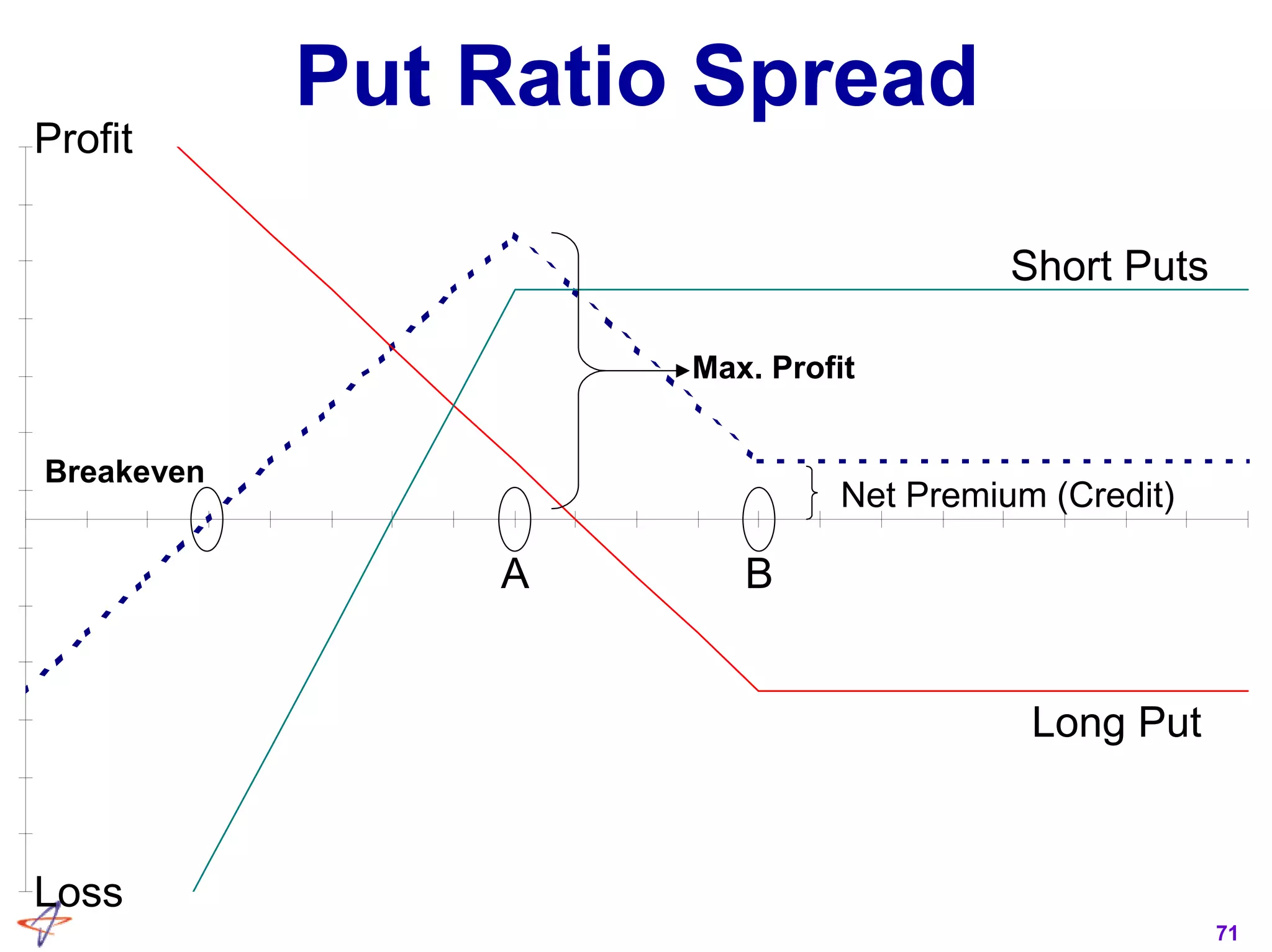

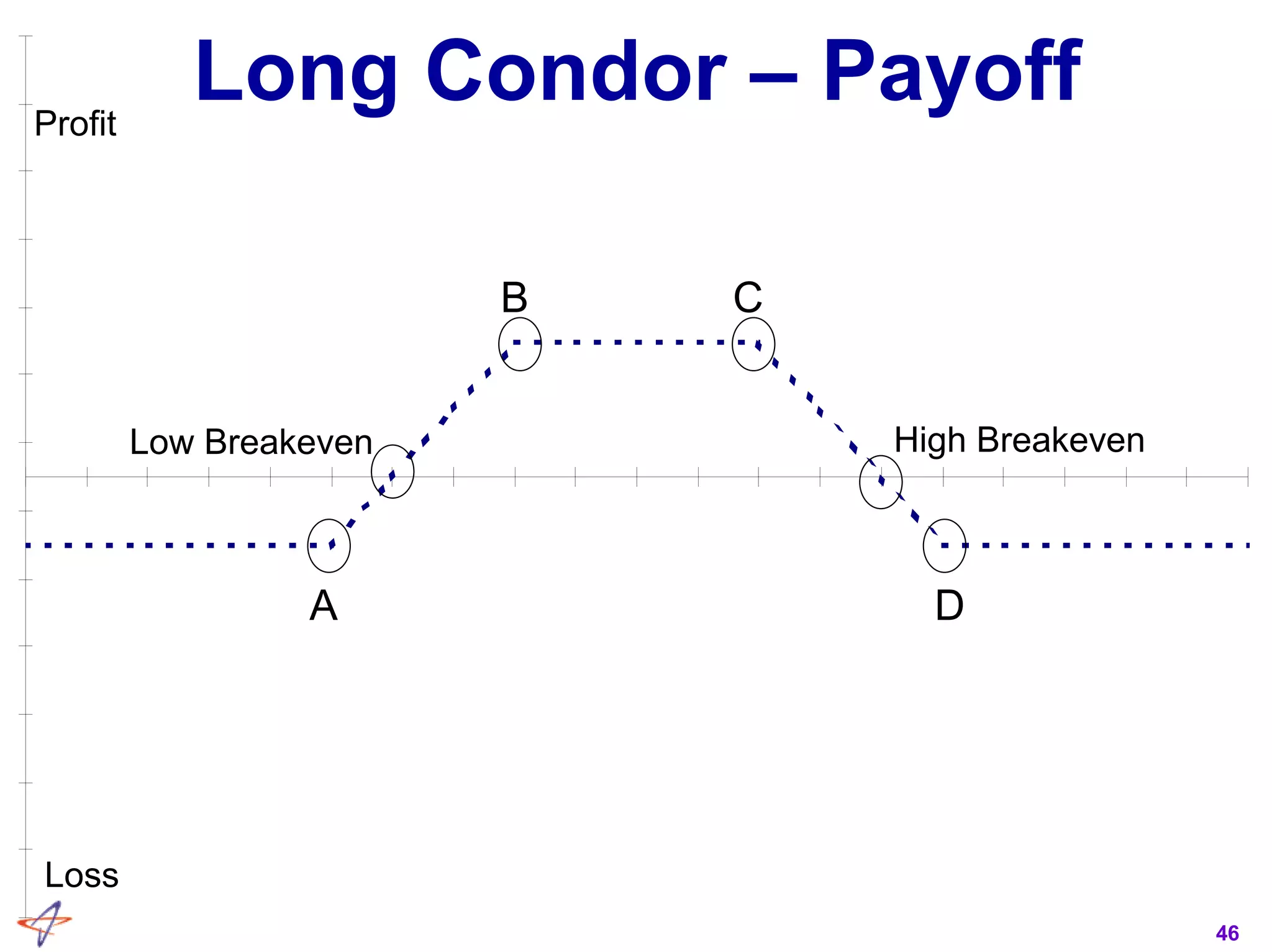

Short Butterfly

Large stock price movement expected. Often

used as a follow up strategy

Use

Low BEP = Middle Strike – Loss

High BEP = Middle Strike + Loss

Breakeven

YesMargin

NeutralVolatility

NeutralTime Decay

Limited to [(B – A) or (C – B)] – Net premiumLoss

Limited to the net premium receivedProfit

CommentView](https://image.slidesharecdn.com/derivativesstrategyguideitrade-140927003506-phpapp02/75/ITRADE-Derivatives-strategy-guide-47-2048.jpg)

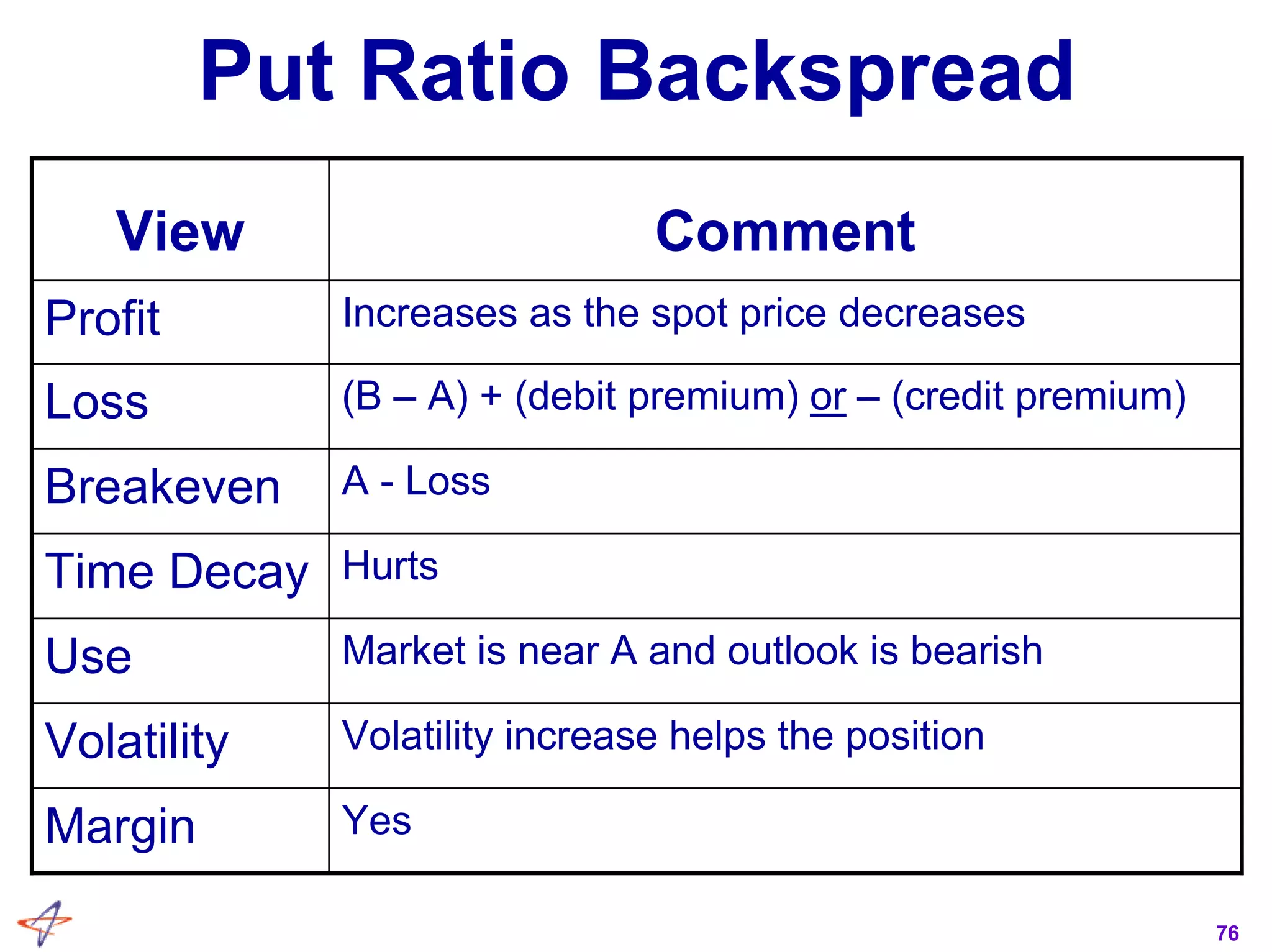

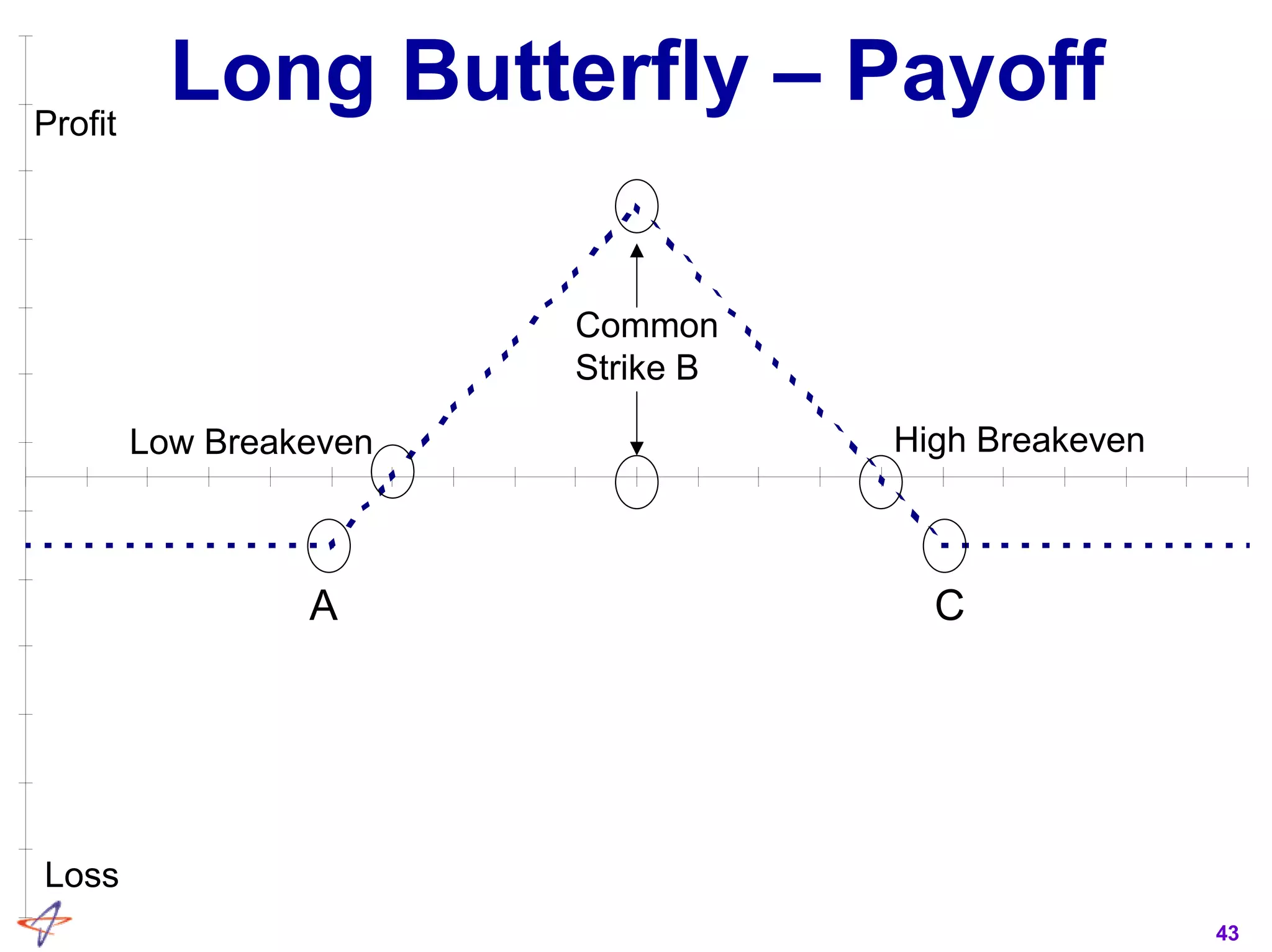

![69

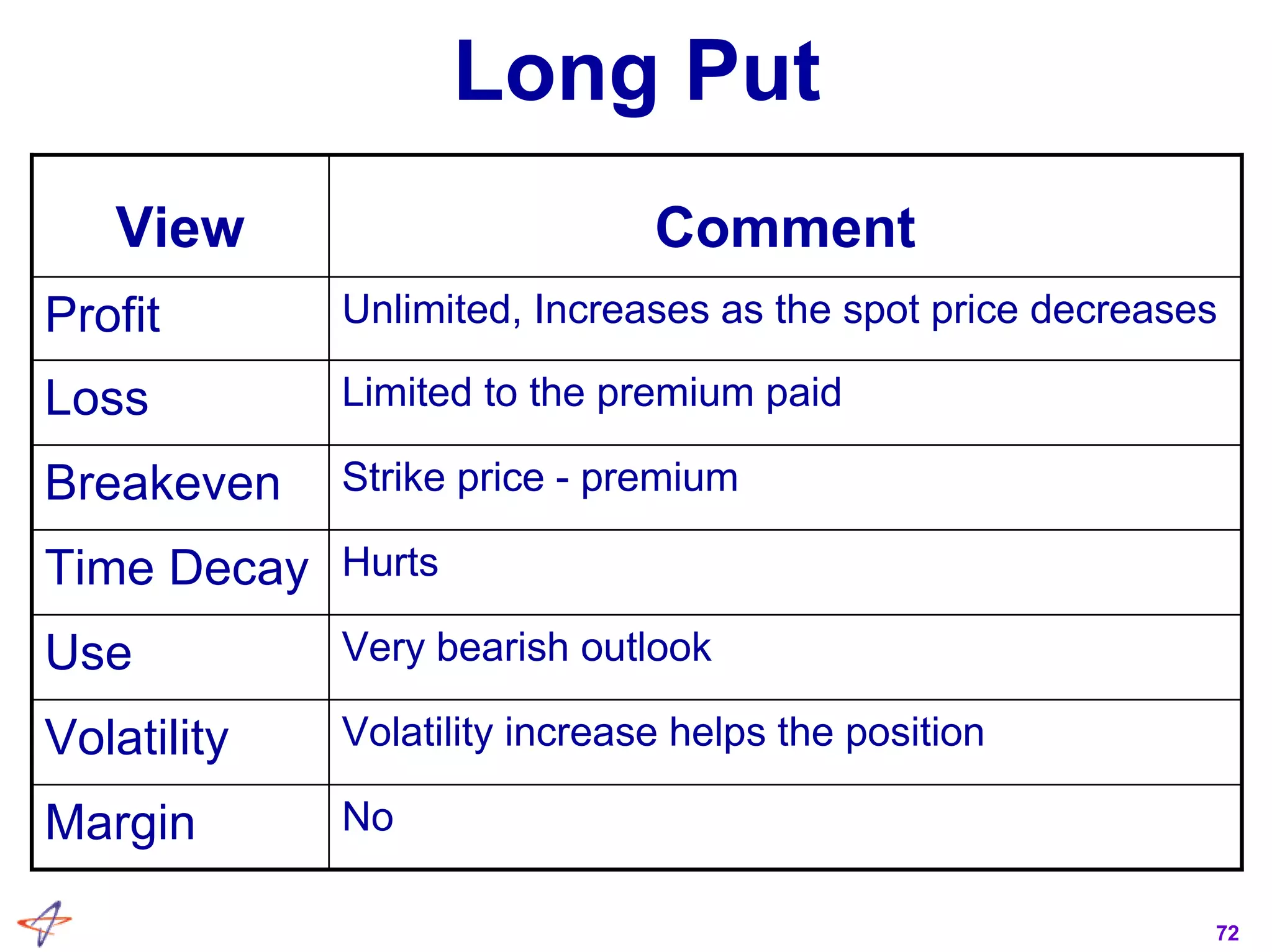

Put Ratio Spread

YesMargin

Volatility decrease helps the positionVolatility

Expecting a tight sideways movement. Biased

towards an increase in stock price.

Use

HelpsTime Decay

If credit premium = [A – (B – A)] – premium

If debit premium = [A + (B – A)] – premium

Breakeven

Increases as the spot price decreasesLoss

(B – A) - (debit premium) or + (credit premium)Profit

CommentView](https://image.slidesharecdn.com/derivativesstrategyguideitrade-140927003506-phpapp02/75/ITRADE-Derivatives-strategy-guide-69-2048.jpg)