Embed presentation

Download as PDF, PPTX

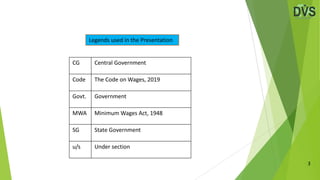

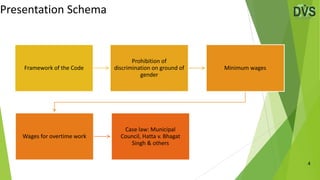

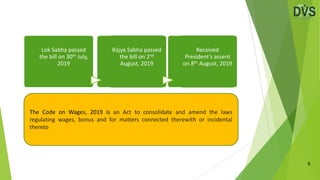

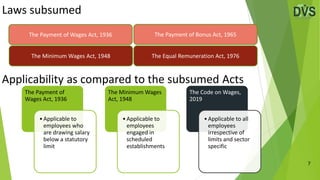

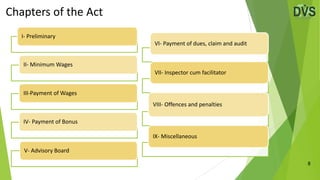

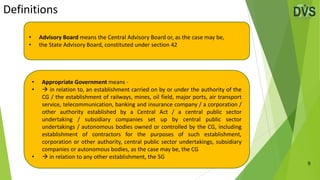

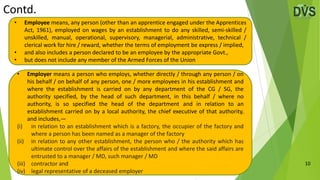

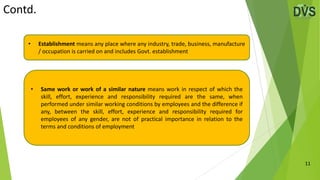

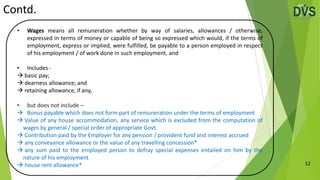

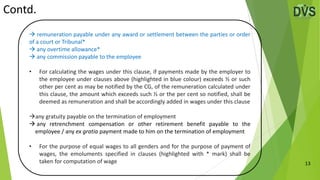

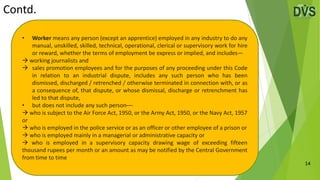

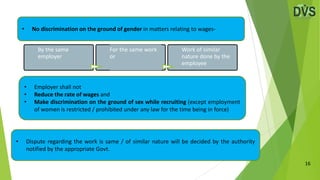

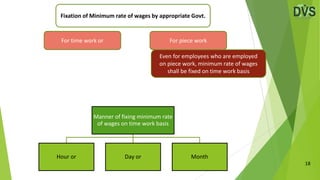

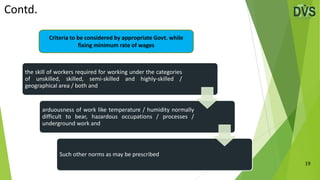

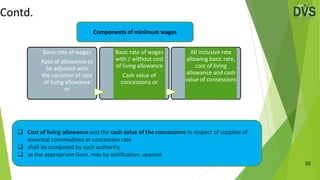

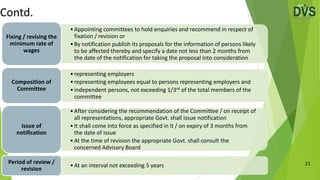

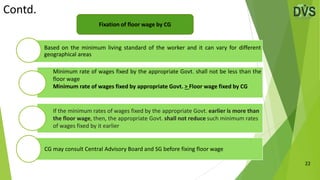

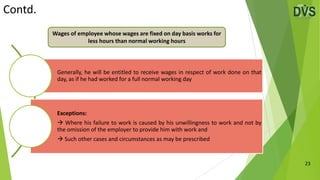

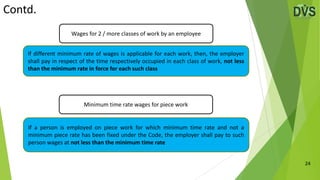

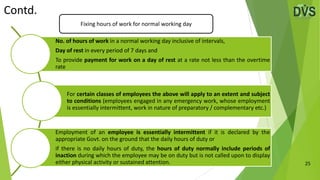

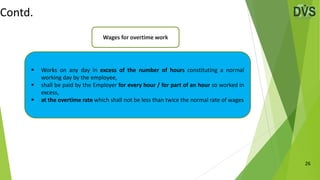

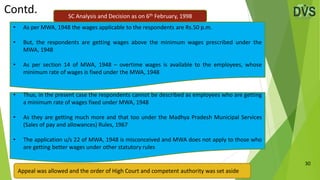

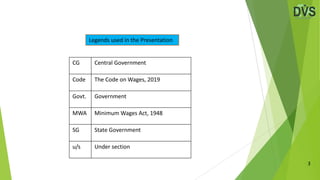

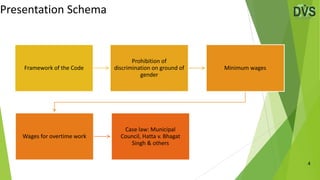

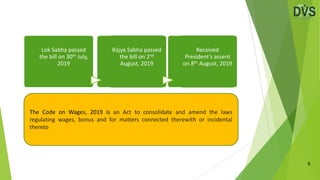

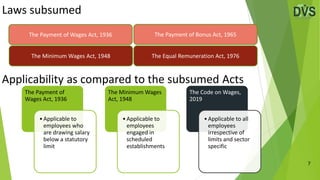

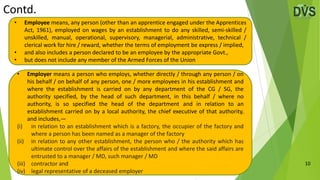

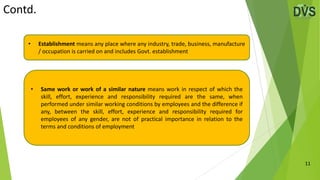

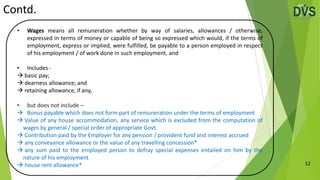

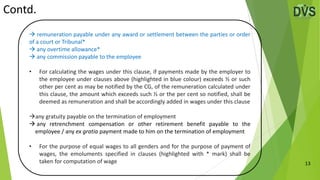

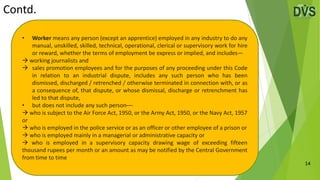

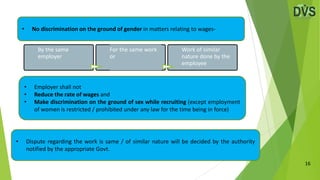

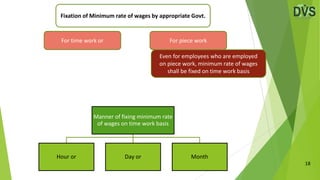

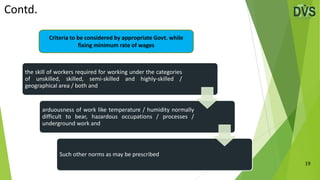

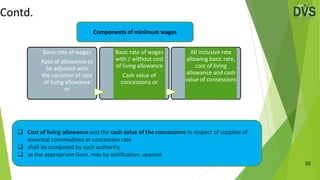

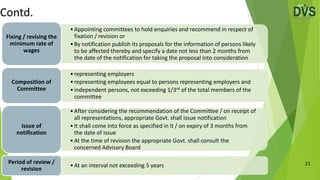

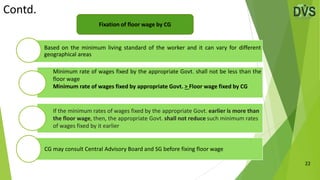

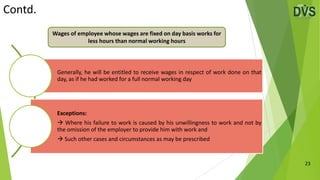

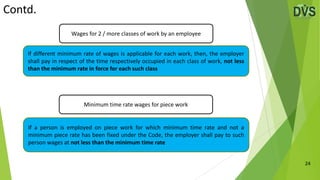

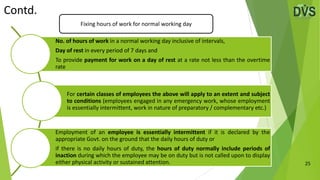

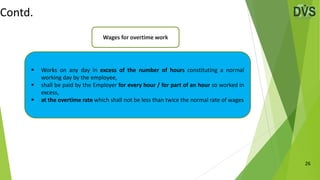

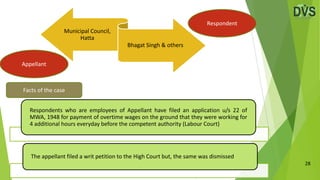

The Code on Wages, 2019 aims to consolidate and amend existing laws related to wages and bonus across sectors, encompassing all employees without statutory limits. It introduces key provisions including prohibition of gender discrimination in wages, establishment of minimum wages, and stipulations for overtime pay. The Code replaces several previous acts, ensuring a uniform framework for wage regulation and enhancing protections for workers.