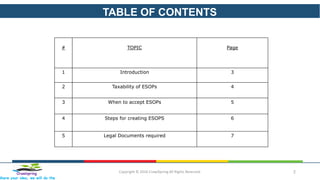

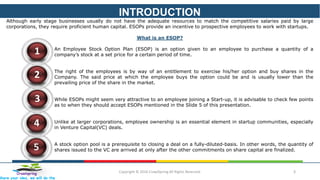

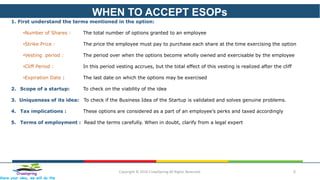

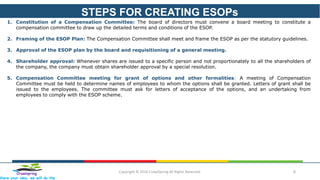

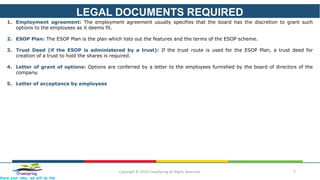

The document provides an overview of Employee Stock Option Plans (ESOPs) specifically for startups, outlining their structure, tax implications, and the necessary legal frameworks. It emphasizes the importance of understanding the terms, viability of the startup, and unique business ideas before accepting ESOPs, as well as the steps and documents required to establish an ESOP. Additionally, it suggests consulting with legal experts when creating ESOP agreements to ensure compliance and clarity.