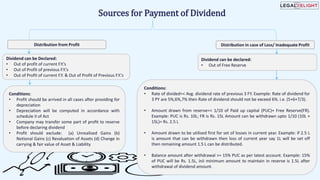

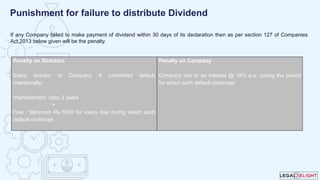

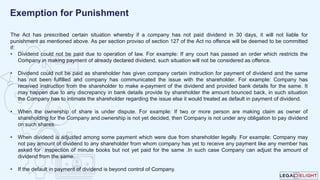

The document outlines the process for declaring and paying dividends, defining dividends as distributions to shareholders from a company's profits. It details the types of dividends (final and interim), conditions for payment, and the legal framework under the Companies Act, 2013. Additionally, it covers penalties for failure to declare dividends, as well as circumstances under which a company may be exempt from penalties.