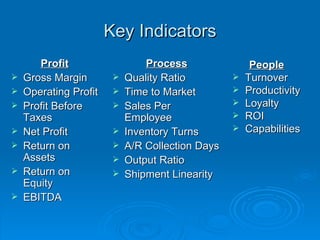

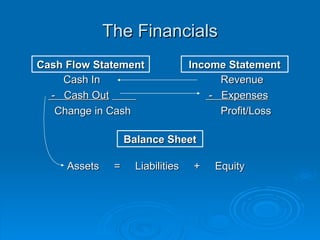

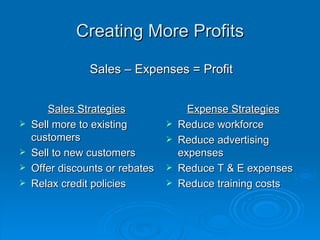

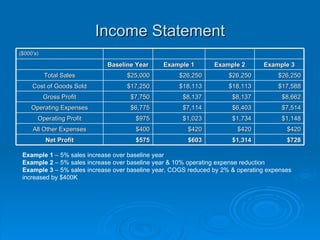

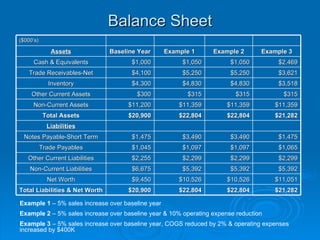

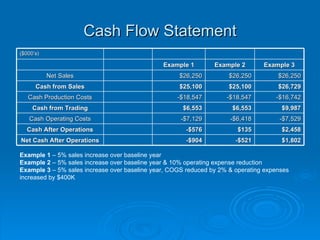

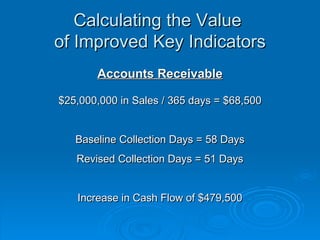

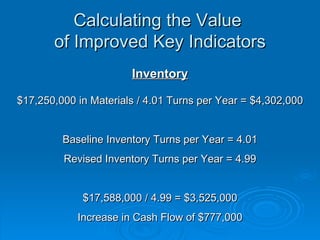

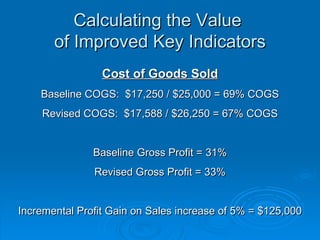

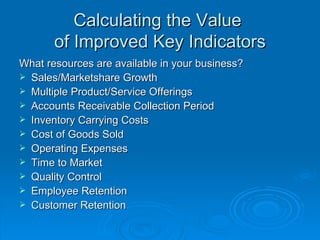

This document discusses ways to increase the enterprise value of a business. It identifies key performance indicators like profit, return on assets, and productivity that can be optimized. Strategies are presented to improve indicators like increasing sales, reducing expenses, improving collection periods and inventory turns. Examples show how even small improvements to indicators can significantly increase cash flow and profits. The document advocates identifying untapped indicators, forecasting the impact of changes, and tracking investments to maximize returns.