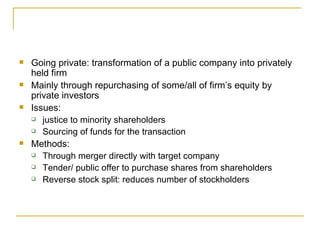

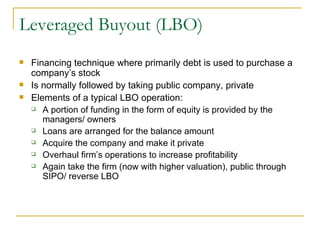

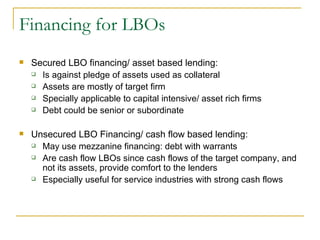

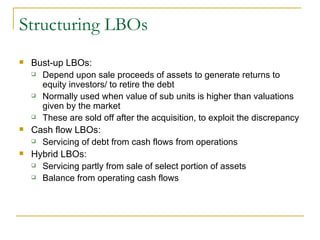

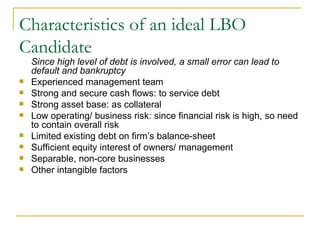

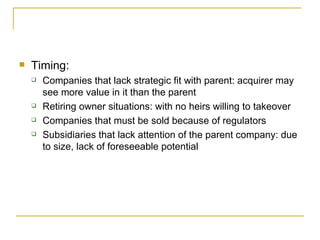

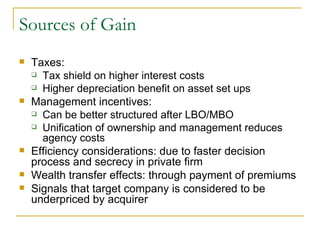

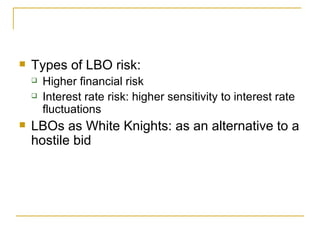

There are several methods for taking a public company private, including through a leveraged buyout (LBO). An LBO involves using primarily debt to purchase a company, with some equity provided by managers/owners. The company then undergoes operational overhauls to increase profits before potentially going public again. LBO candidates work best if they have strong and secure cash flows to service debt, experienced management, and limited existing debt. Going private can provide benefits like tax shields, management incentives, and signaling that a company is undervalued publicly. However, it also brings higher financial risk from debt.