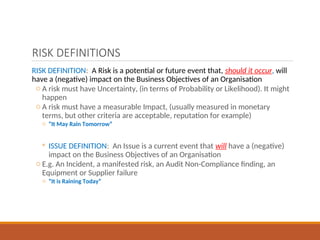

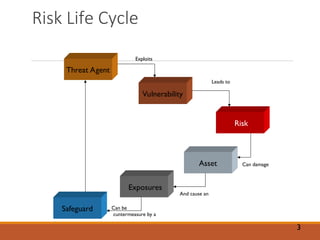

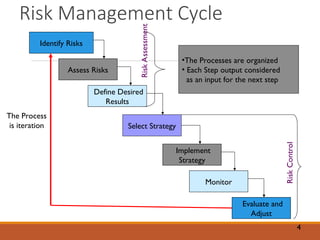

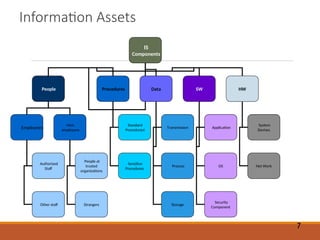

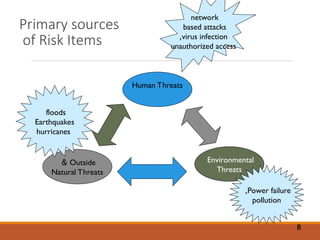

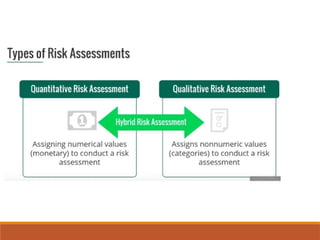

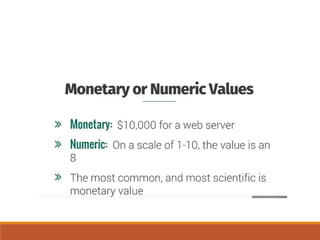

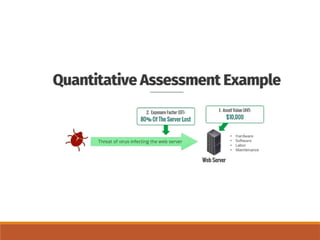

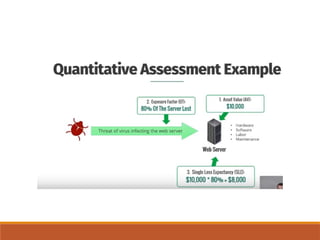

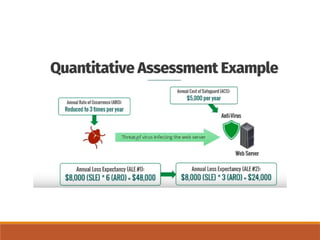

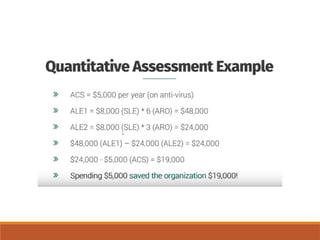

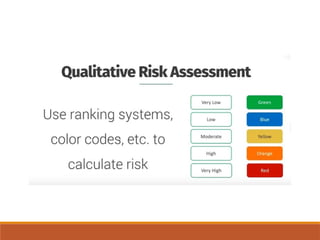

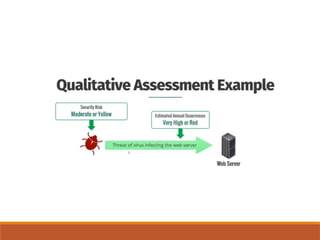

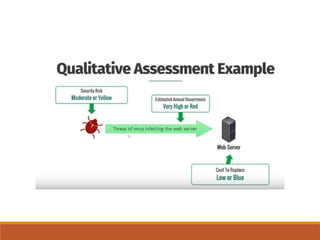

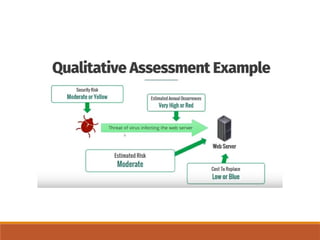

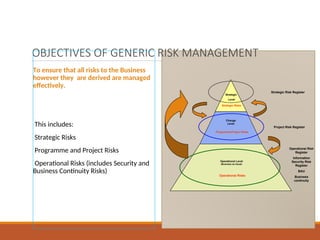

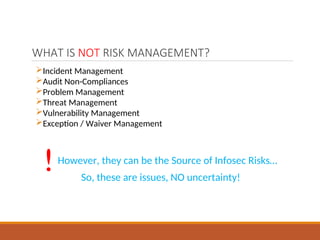

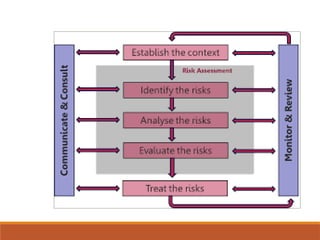

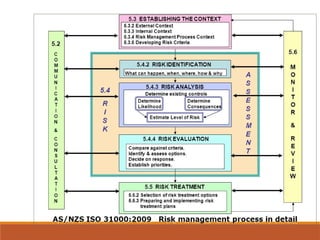

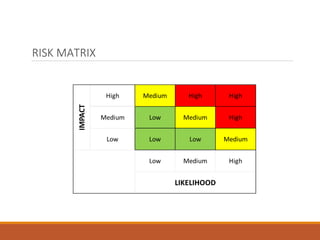

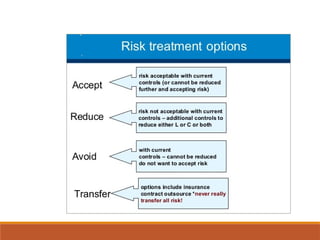

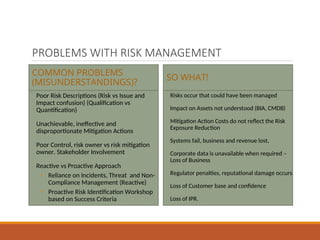

The document outlines definitions and distinctions between risk and issue, emphasizing the need for effective risk management in organizations. It discusses the risk management cycle, including risk identification, assessment, and mitigation strategies, while identifying various sources and methods of risk assessment. Additionally, it highlights the importance of proactive approaches to managing risks, the role of information security, and the necessity of maintaining proper risk documentation and reporting.