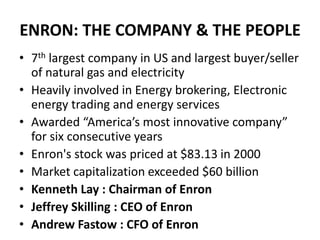

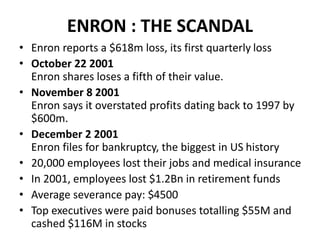

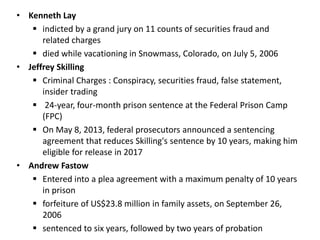

The document summarizes the rise and fall of Enron Corporation, once the 7th largest company in the US. It describes Enron as an energy trading company that was awarded as the most innovative company for six years. However, in 2001, Enron reported major losses and had to file for bankruptcy after overstating profits by $600 million. The scandal uncovered widespread accounting fraud and corruption at Enron and led to 20,000 employees losing their jobs and retirement funds. Top executives were paid large bonuses despite the company's troubles. The document examines how Enron's culture of greed, deception and lack of ethics contributed to the scandal. Key people involved were later charged and sentenced to prison for their role in the fraud.