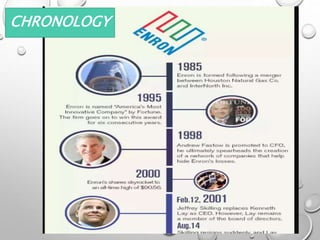

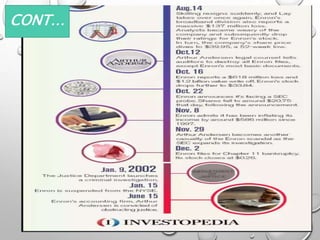

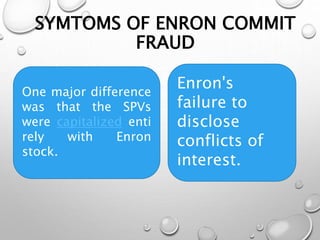

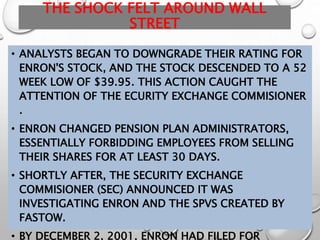

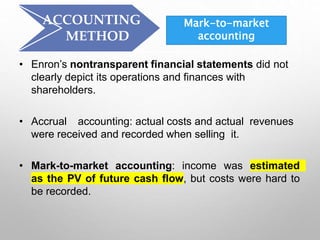

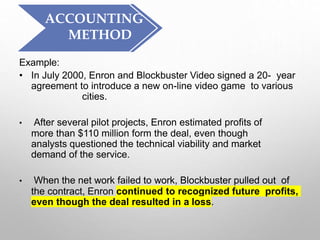

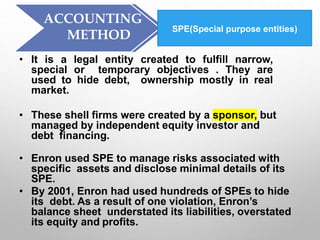

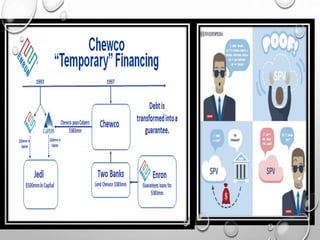

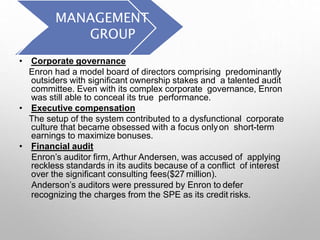

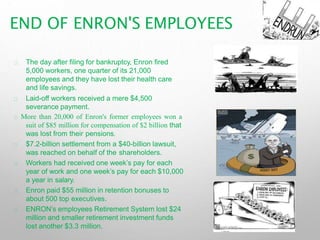

Enron Corporation was an American energy company based in Houston, Texas. It grew rapidly in the 1980s and 1990s through mergers and acquisitions to become one of the largest natural gas and electricity suppliers. However, in 2001 it was revealed that Enron had been using accounting loopholes and complex financial reporting to hide billions in debts and inflate profits. This led to Enron's bankruptcy in late 2001, causing employees to lose their jobs and retirement funds. The scandal uncovered widespread corruption and fraud at Enron and its auditor, Arthur Andersen, and led to new regulations and oversight through the Sarbanes-Oxley Act of 2002.