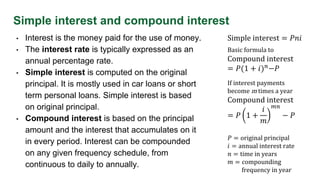

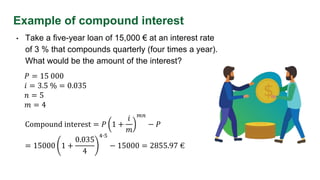

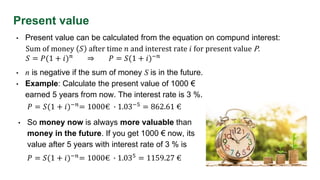

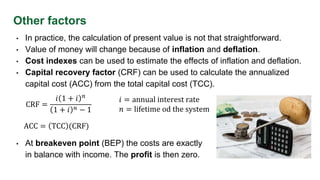

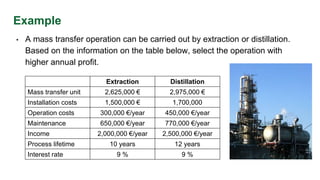

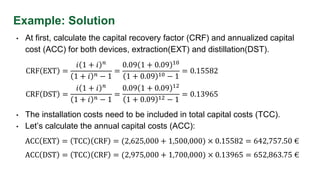

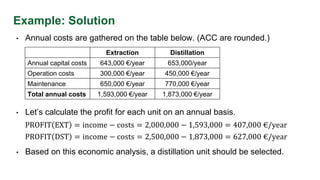

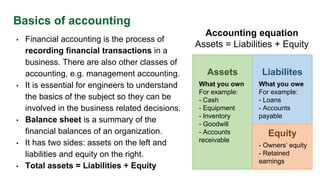

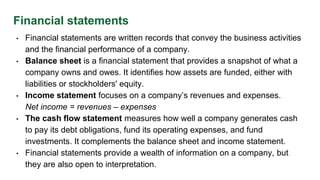

This document discusses engineering economics, focusing on evaluating engineering alternatives through economic techniques and financial principles like present value, interest rates, and costs. It provides examples of simple and compound interest calculations, capital recovery factors, and returns from extraction versus distillation operations to analyze profits. Additionally, it covers basics of accounting and the importance of financial statements in business decision-making.

![This project has received funding from the European Union’s Horizon 2020

research and innovation programme under grant agreement No 869993.

References

Engineerin Economics [Online]. Wikipedia. Available at:

https://en.wikipedia.org/wiki/Engineering_economics (Accessed: 18 March 2021).

Investopedia Dictionary [Online]. Available at: https://www.investopedia.com/financial-term-

dictionary-4769738 (Accessed: 17 March 2021).

Theodore, L. & Ricci, F. 2010. Mass Transfer Operations for the Practicing Engineer. John Wiley &

Sons, Inc, pp. 489-511.

Videos:

• Introduction to financial statements: https://youtu.be/4sGEtZcLdx8 (12:29)

• Net present value: https://youtu.be/N-lN5xORIwc (5:25)

• Straight line method of depreciation: https://youtu.be/iruD9KTNnNc (6:51)](https://image.slidesharecdn.com/3-210323093138/85/Engineering-economics-and-finance-13-320.jpg)