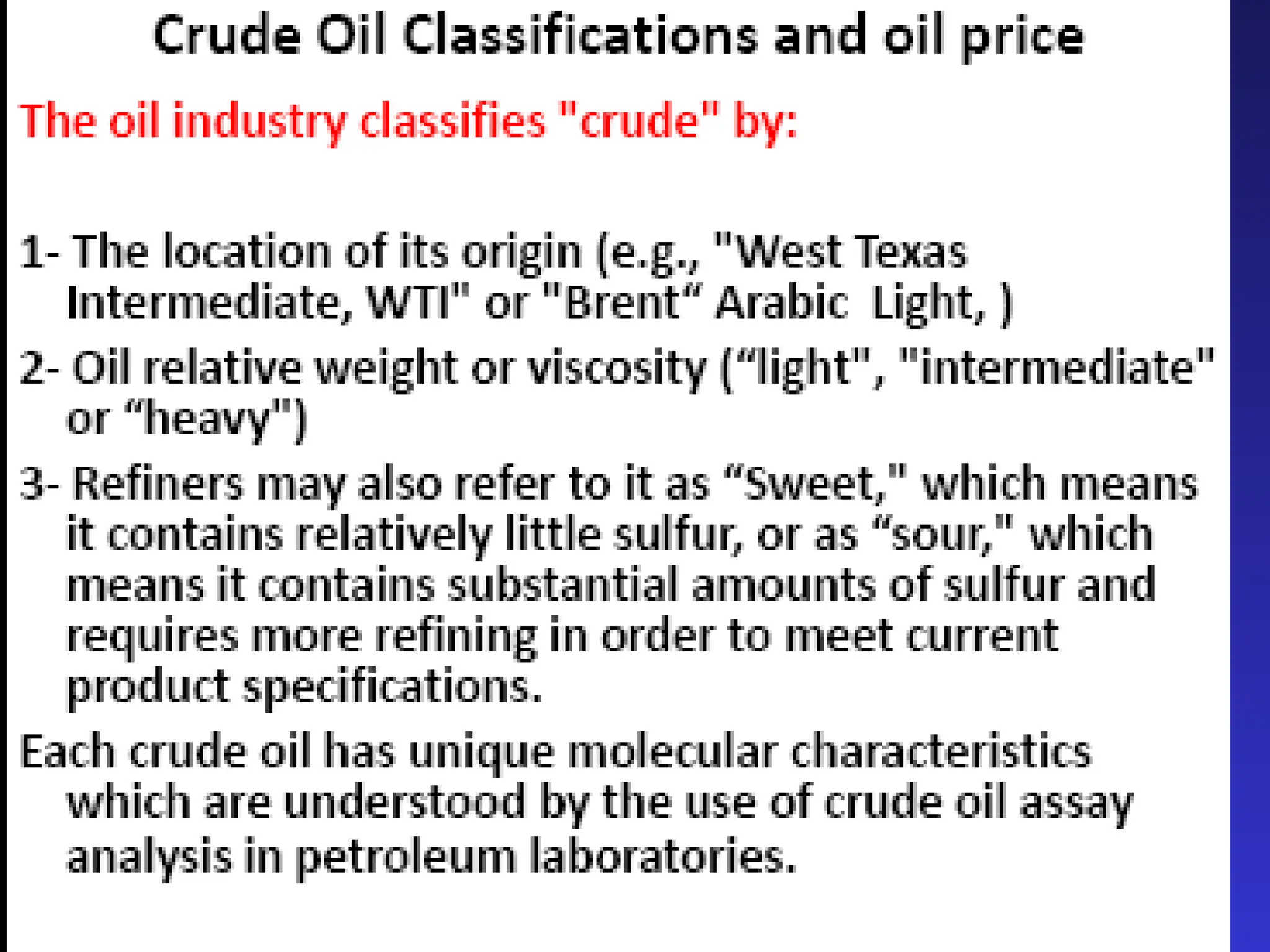

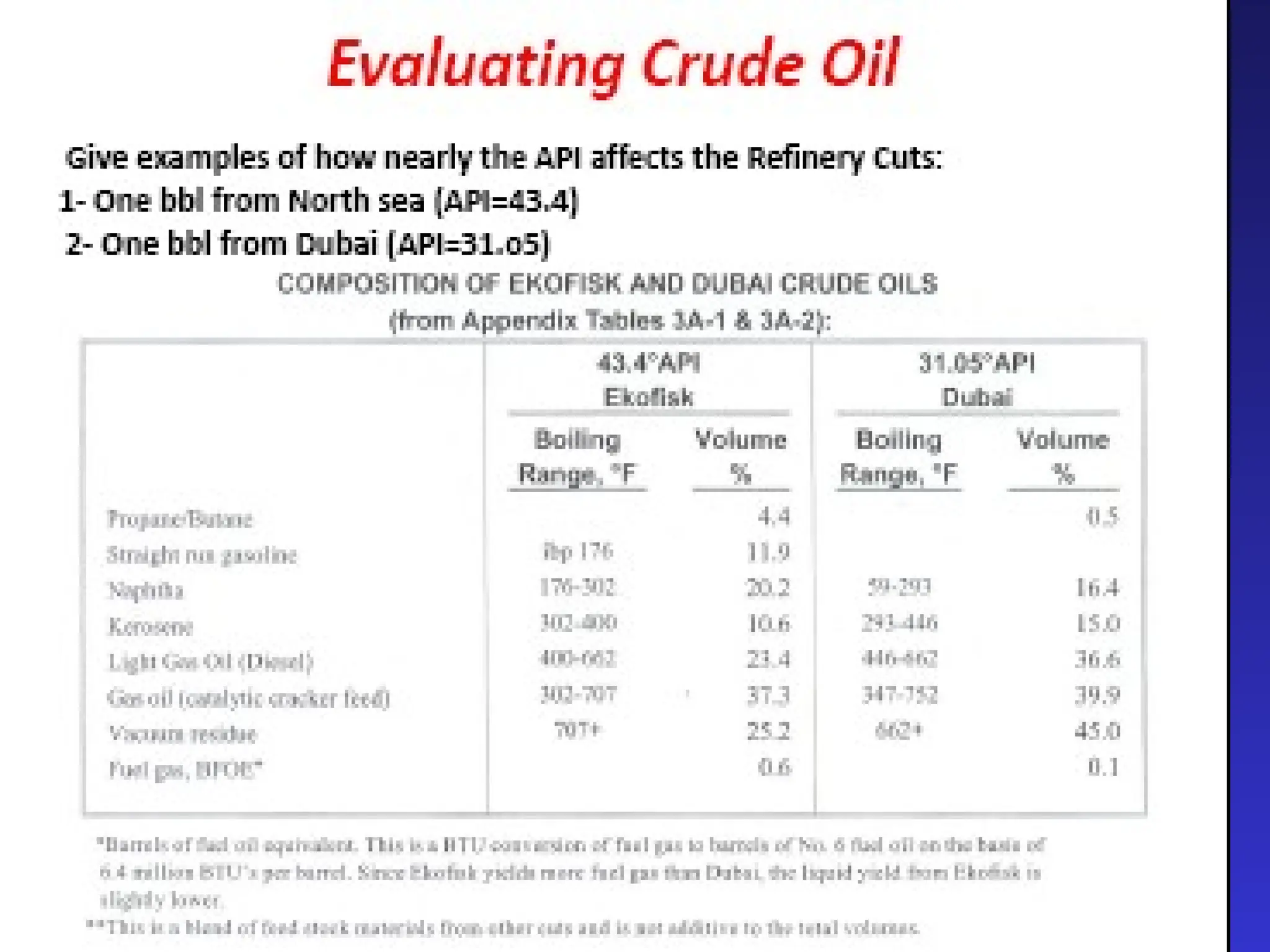

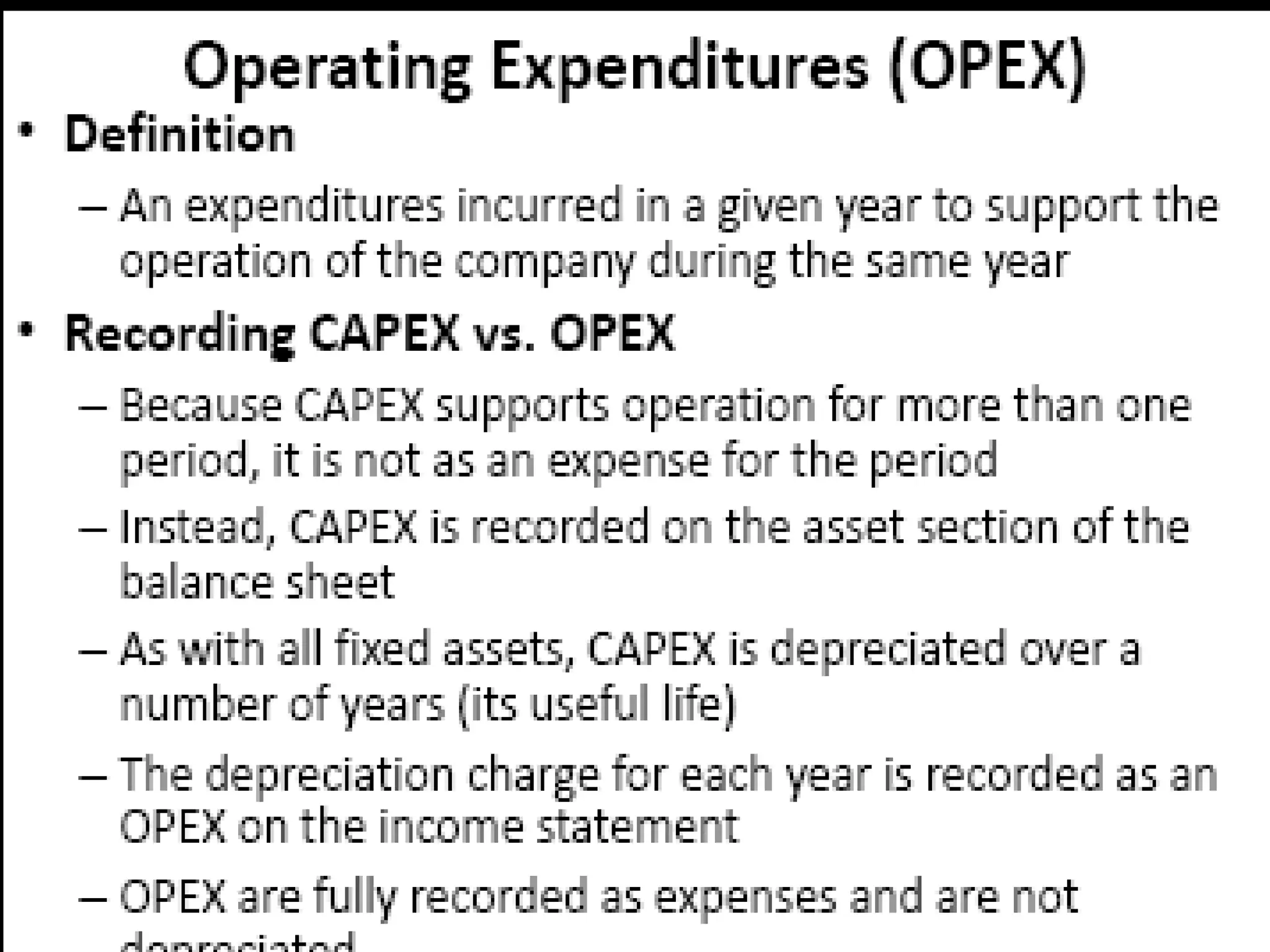

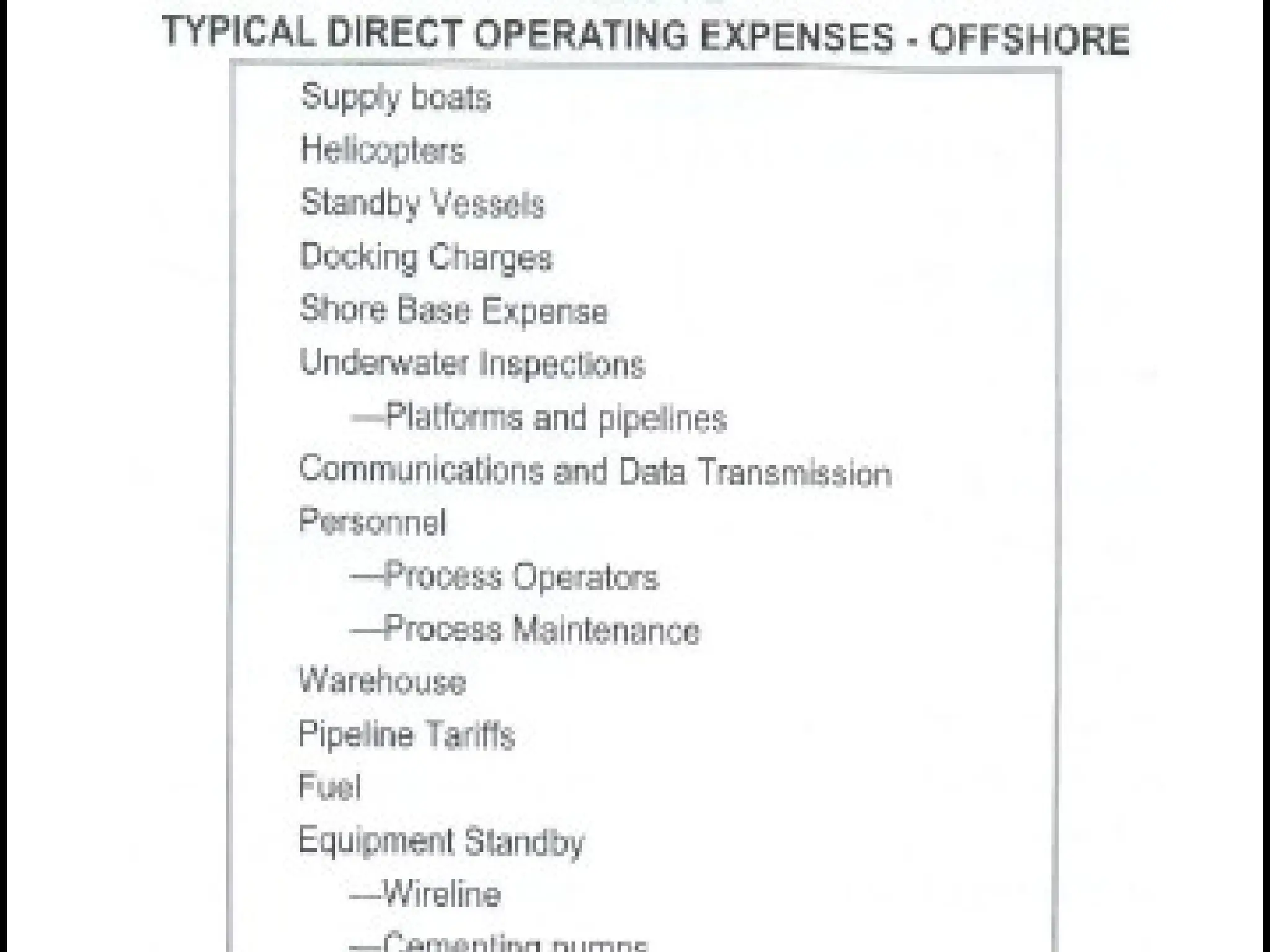

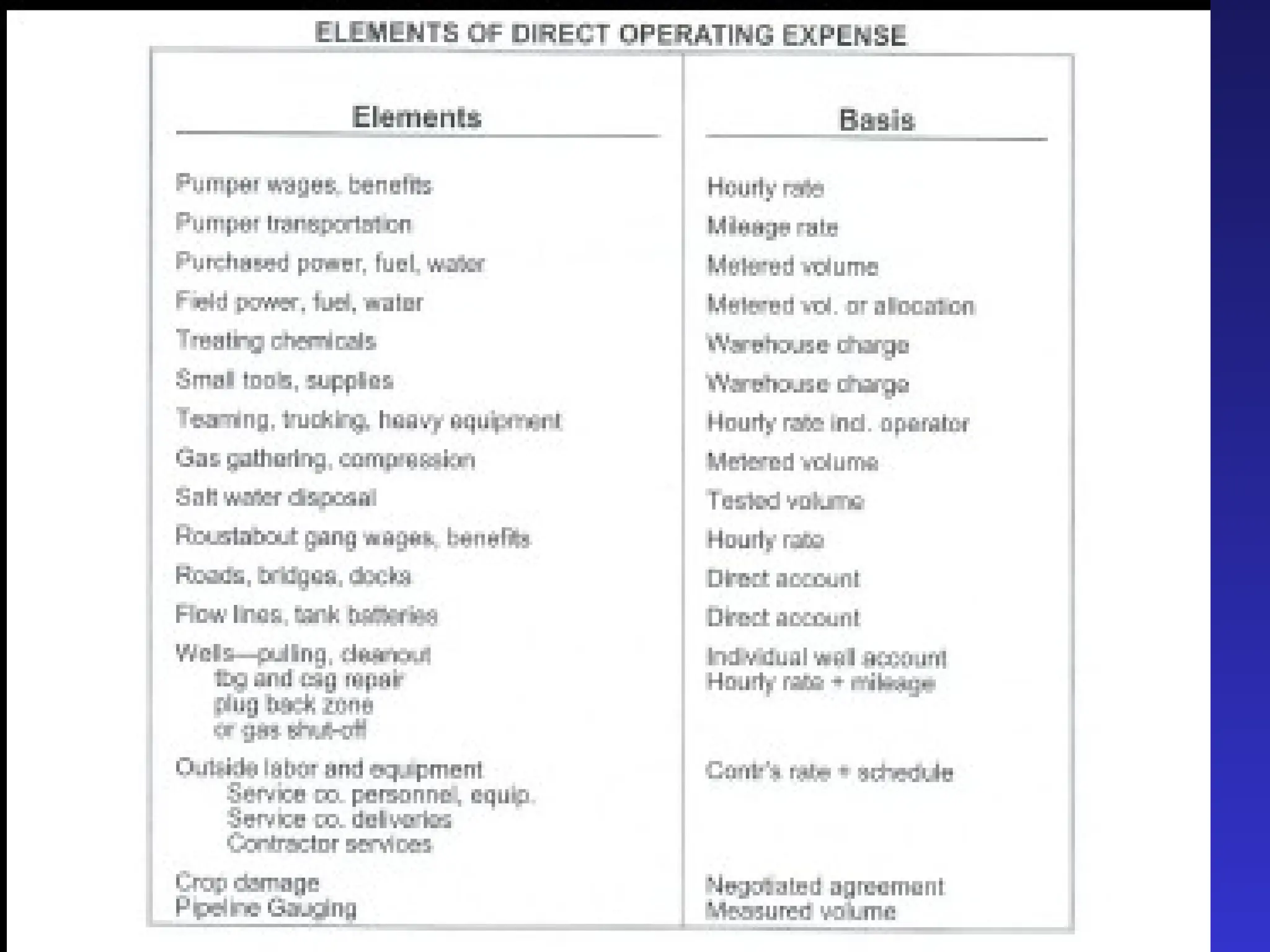

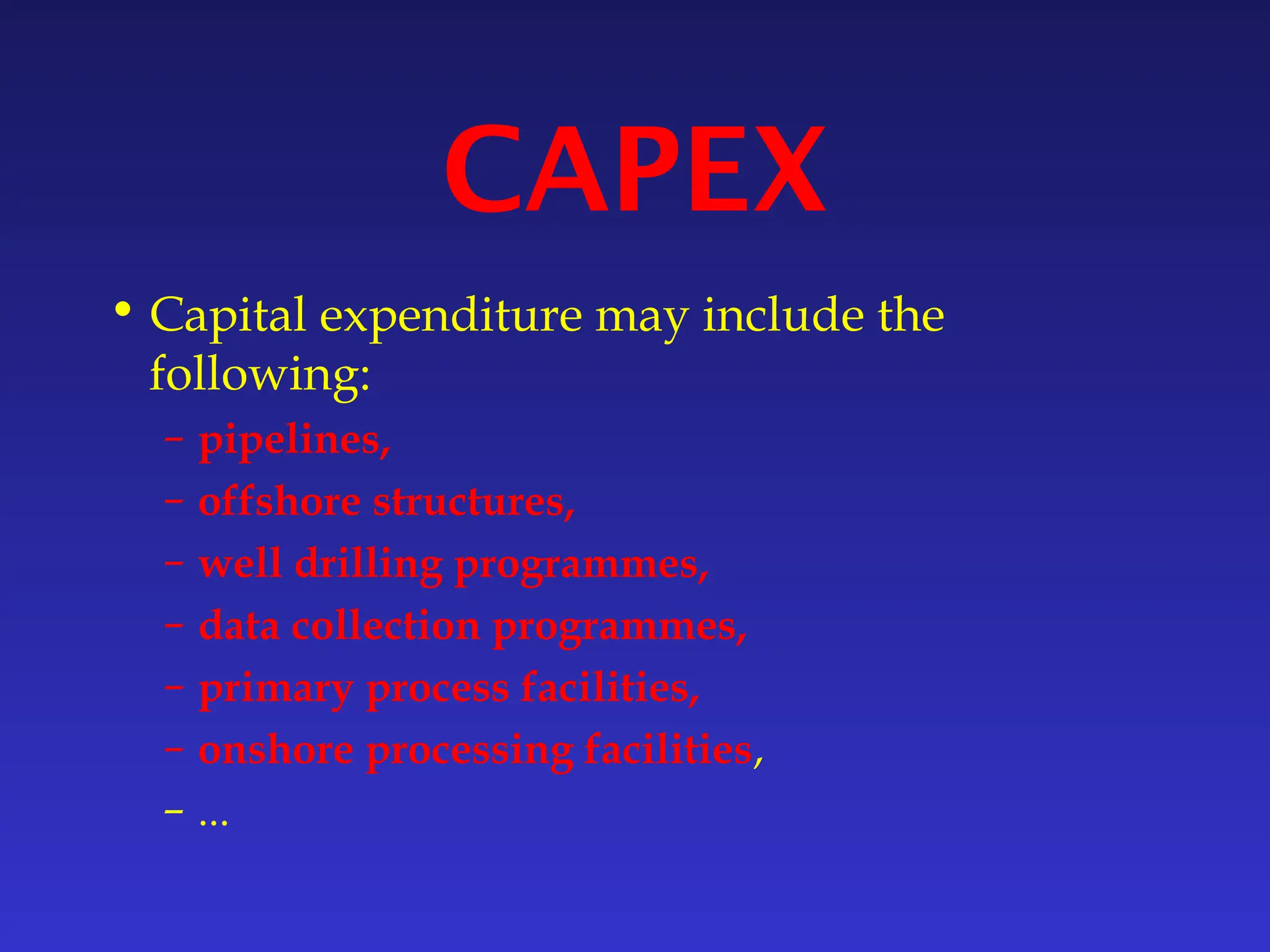

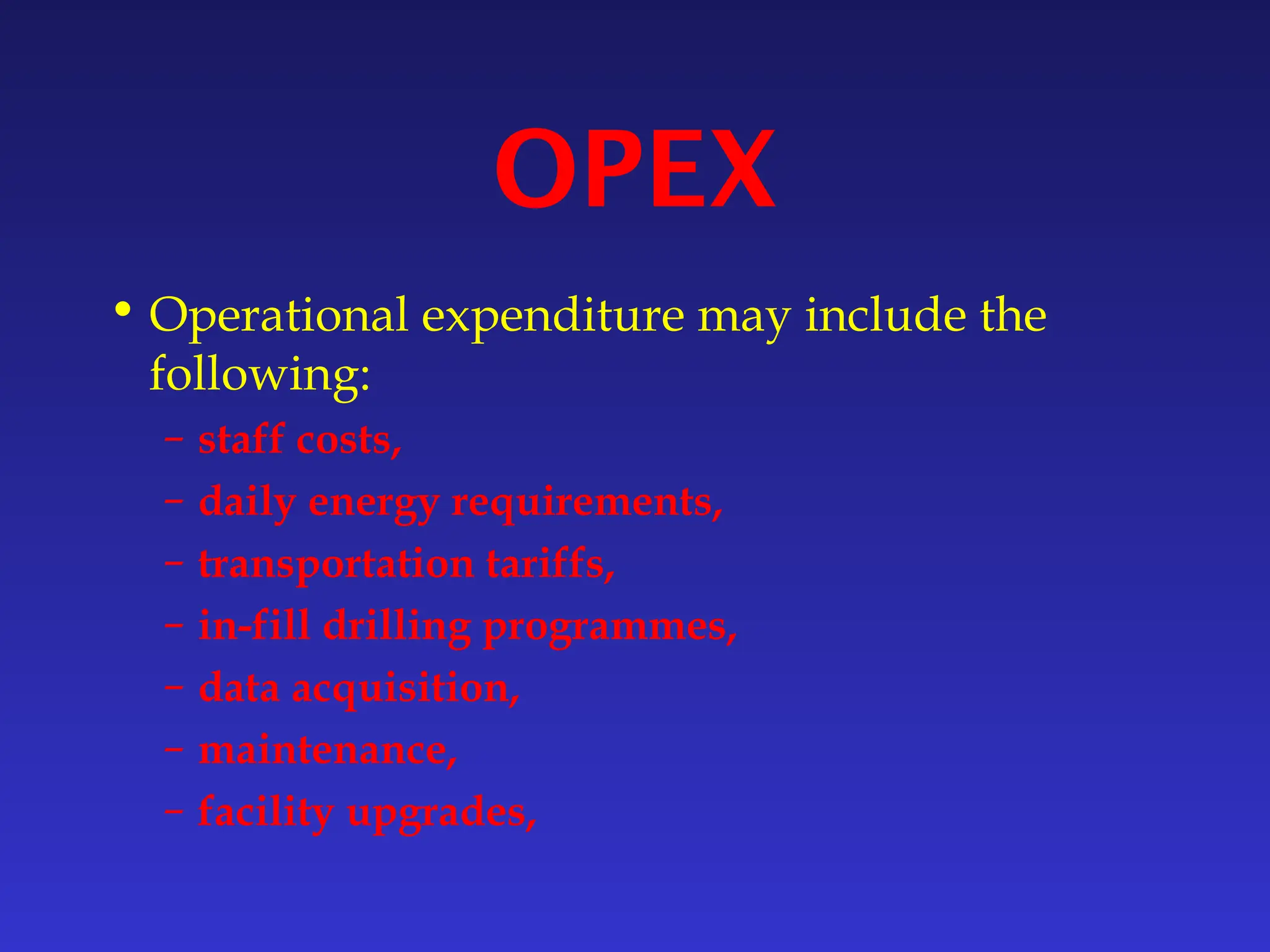

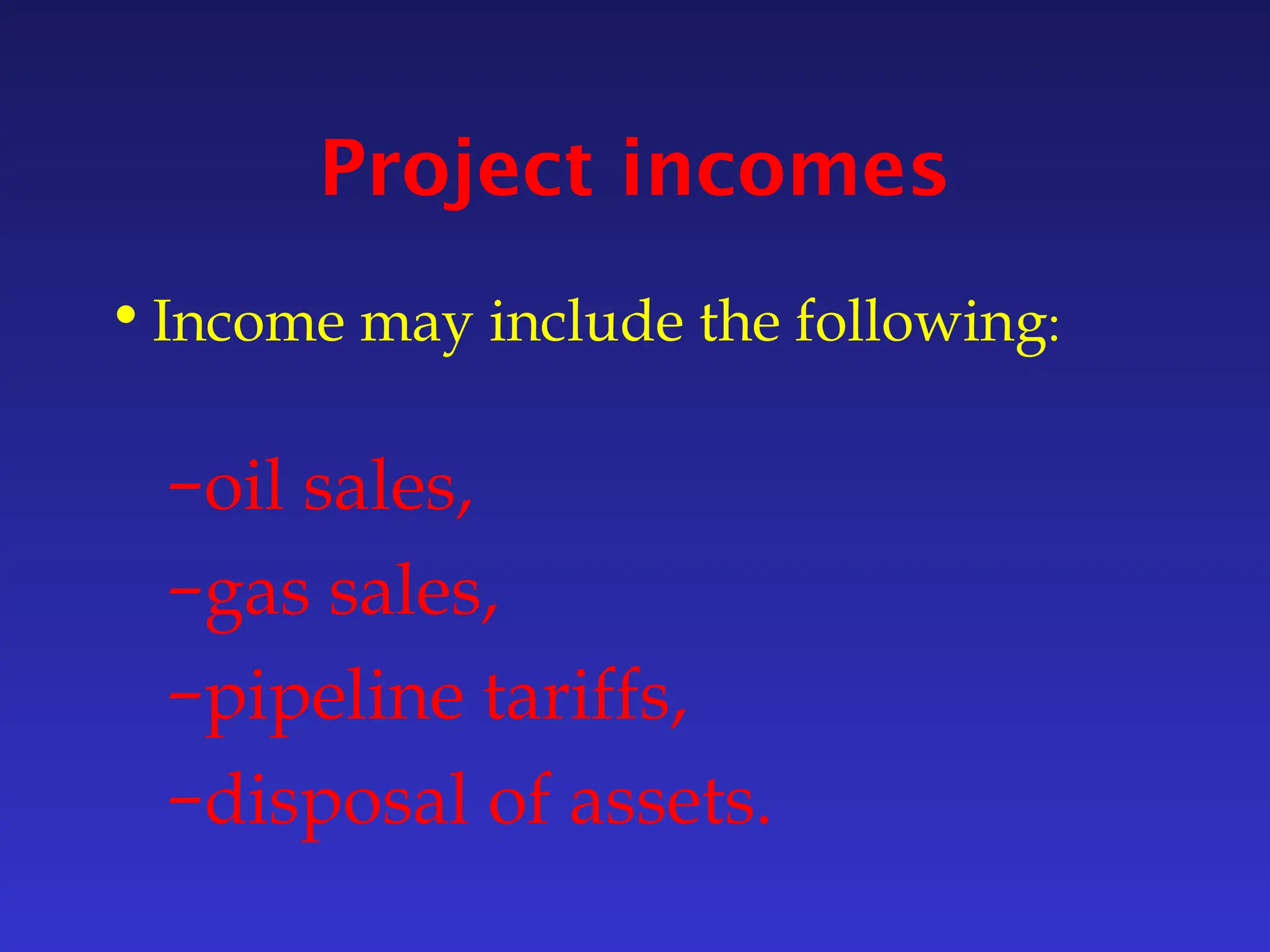

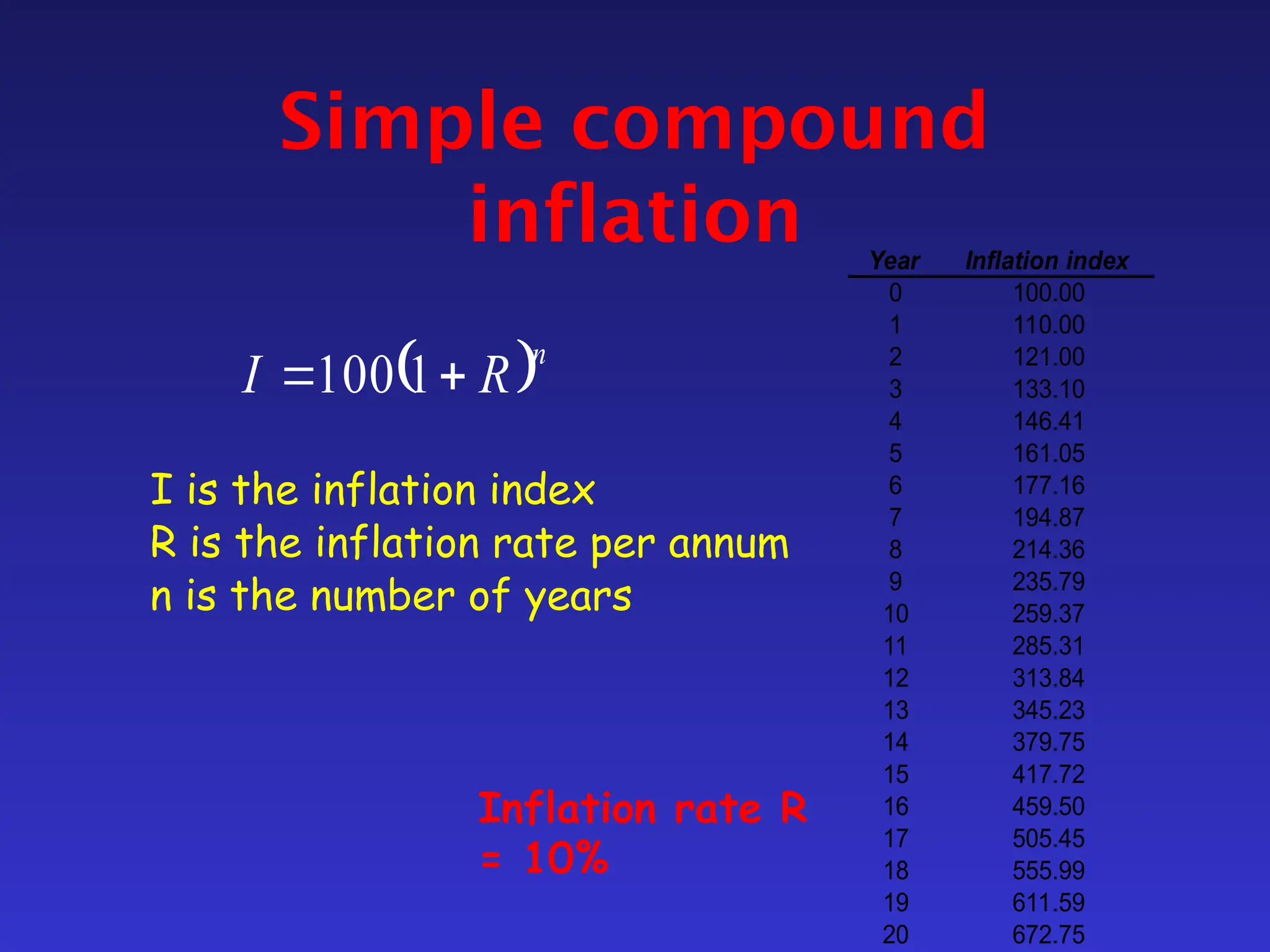

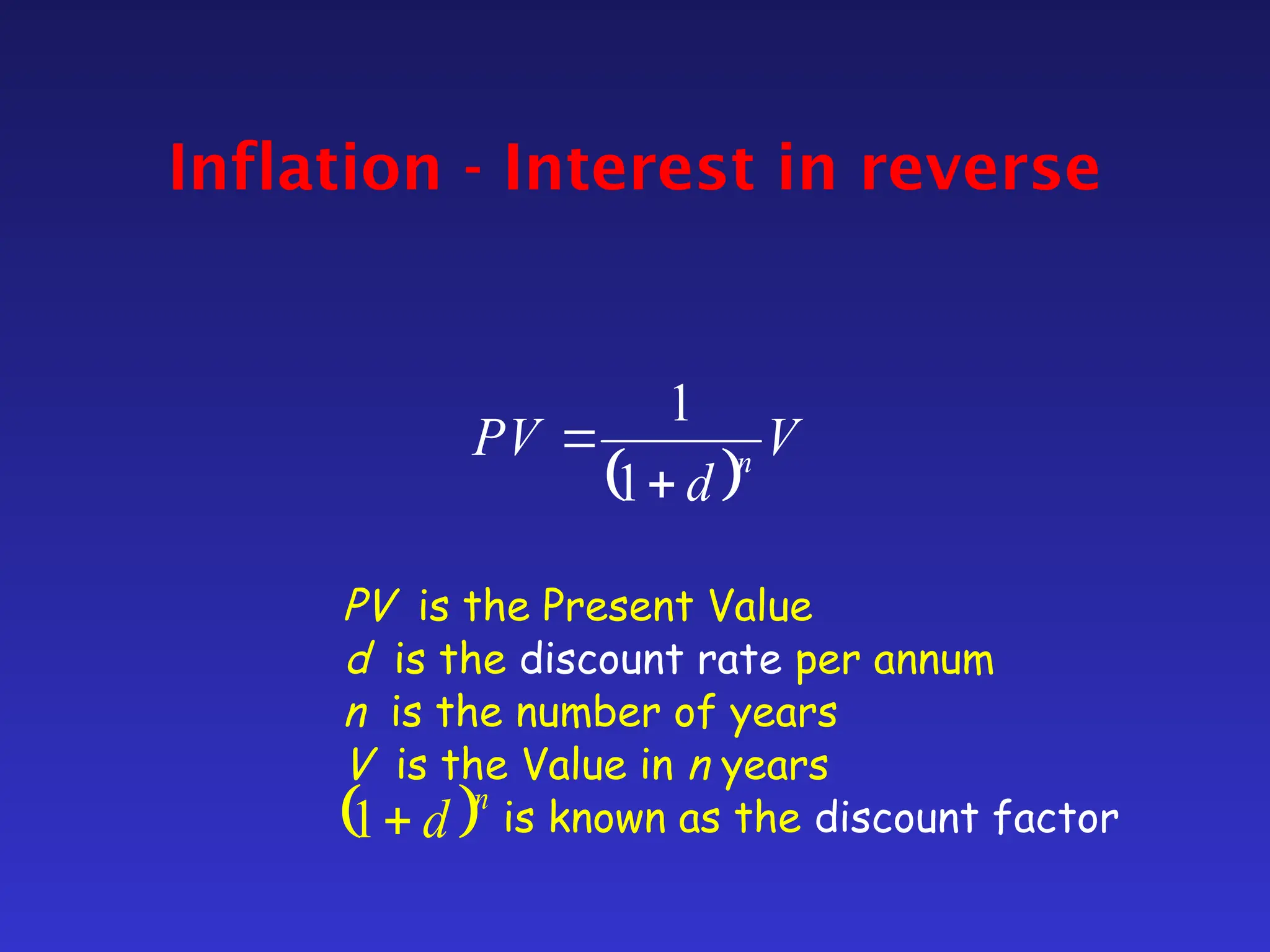

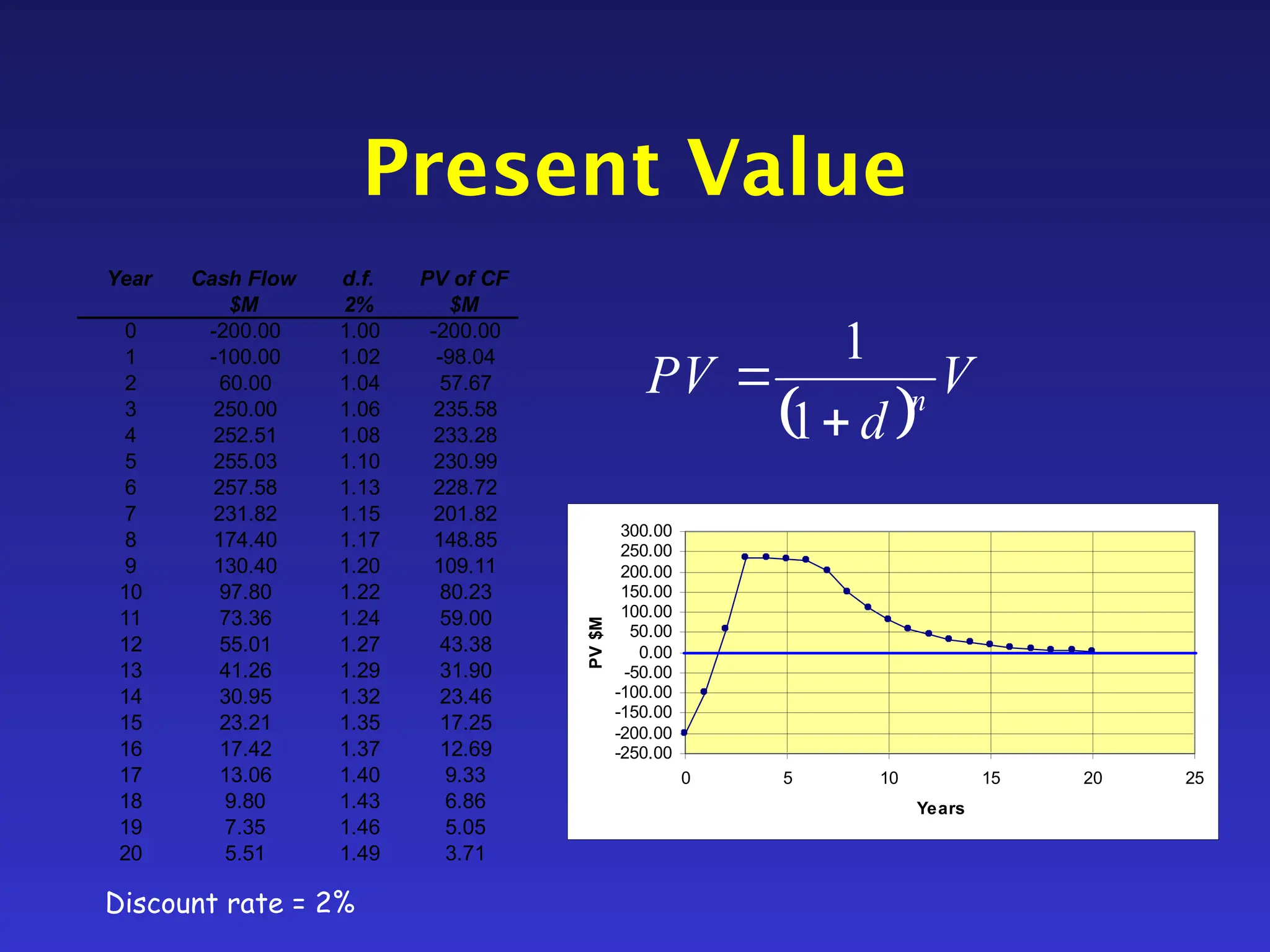

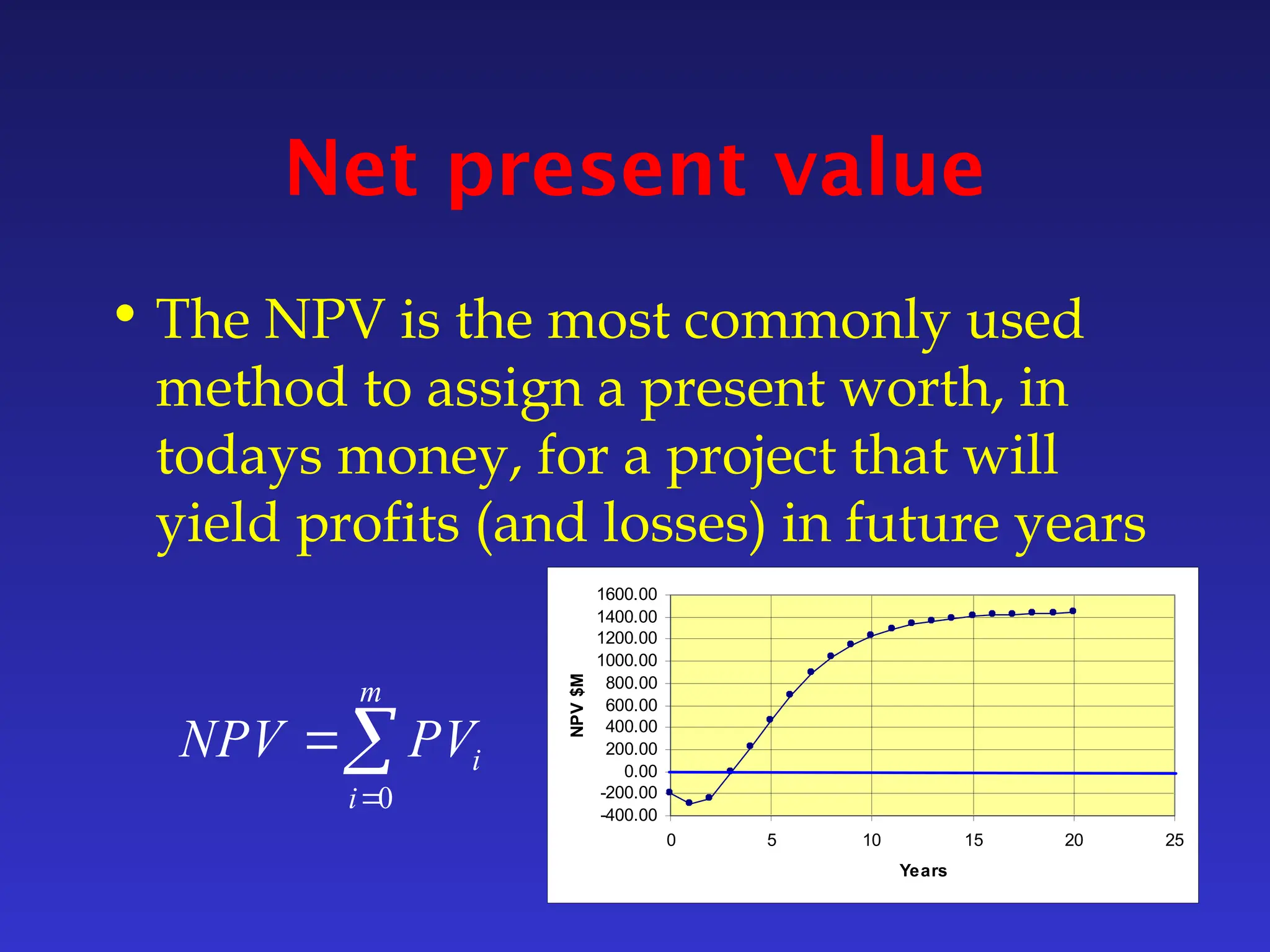

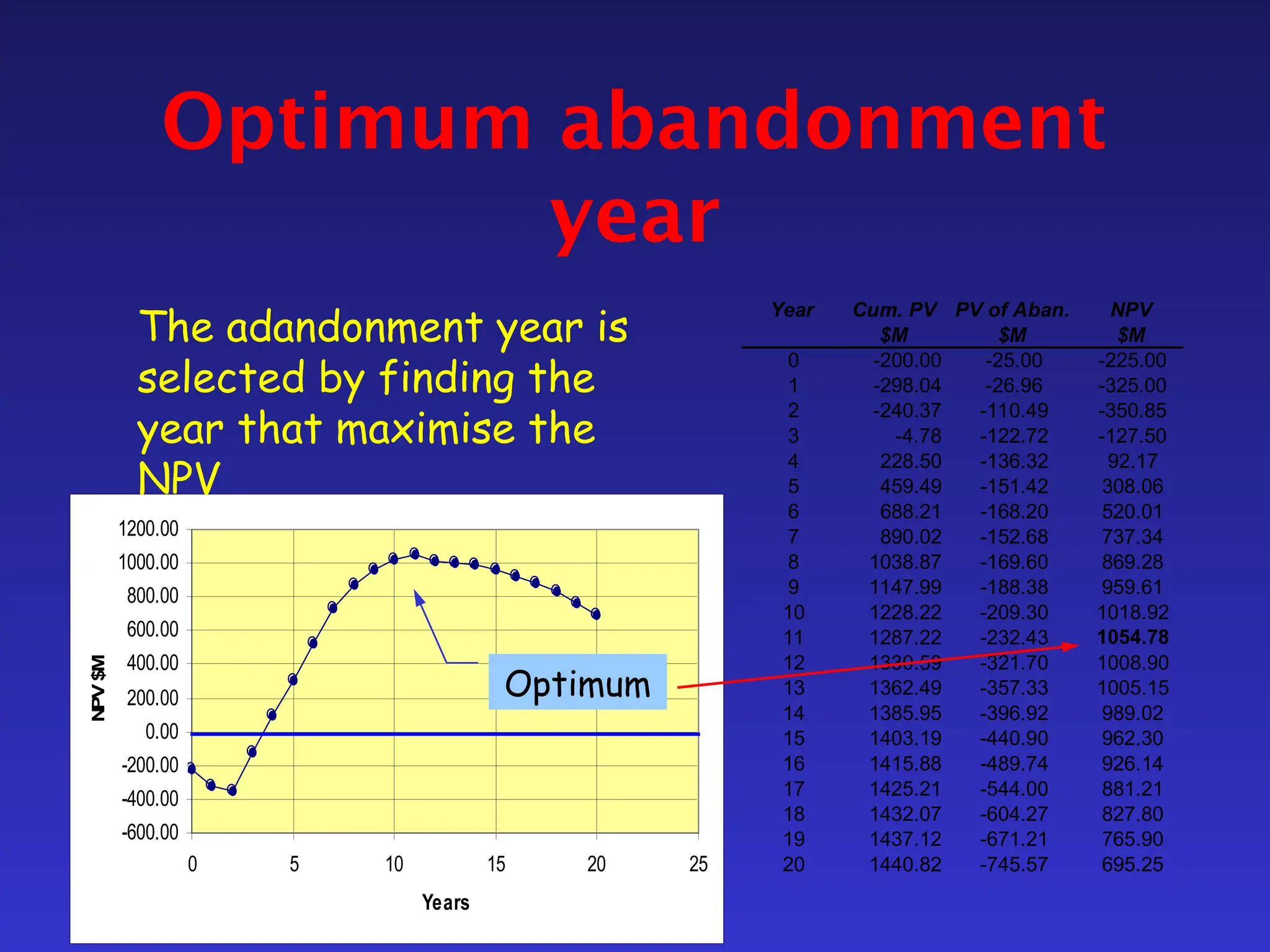

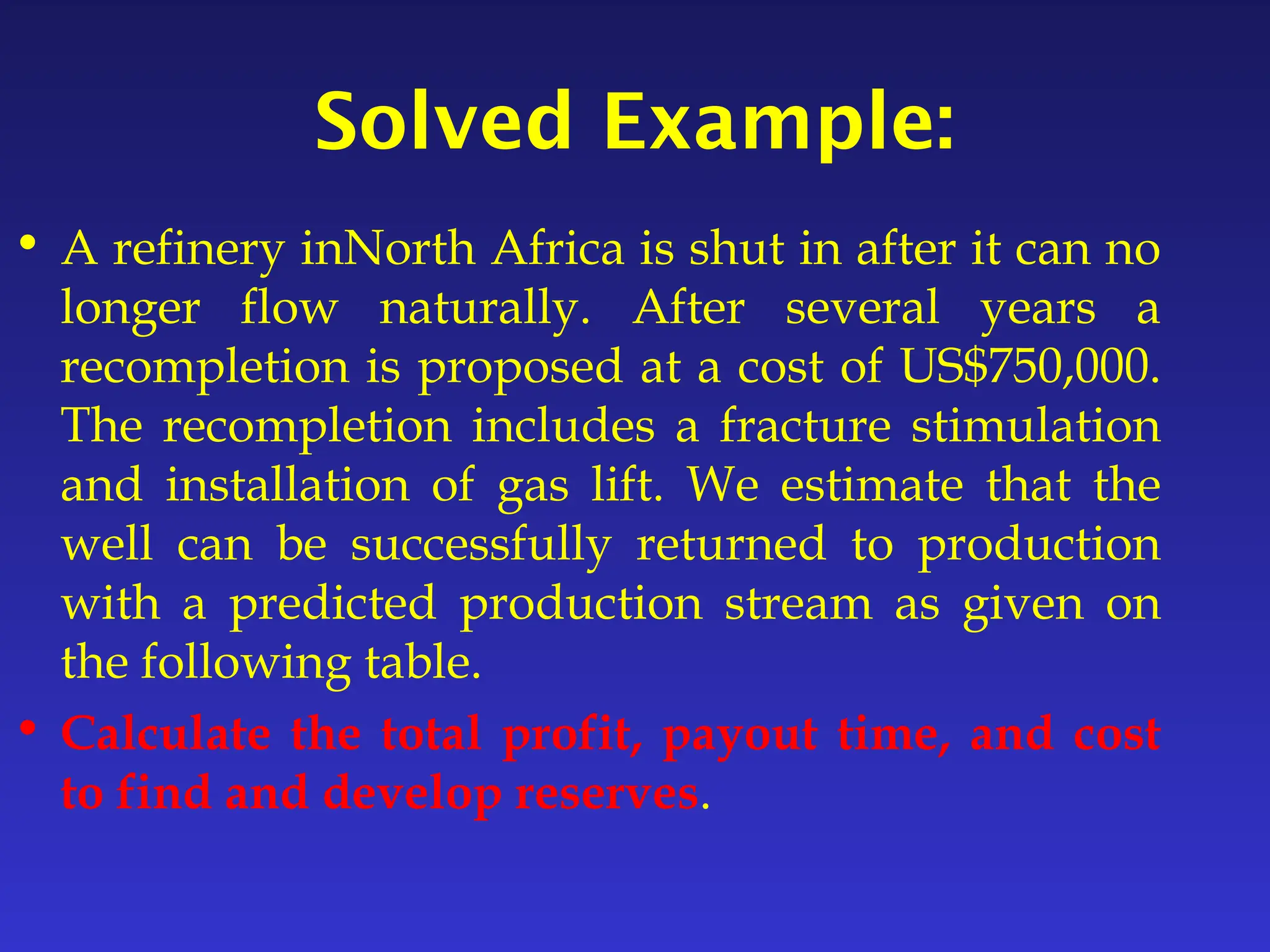

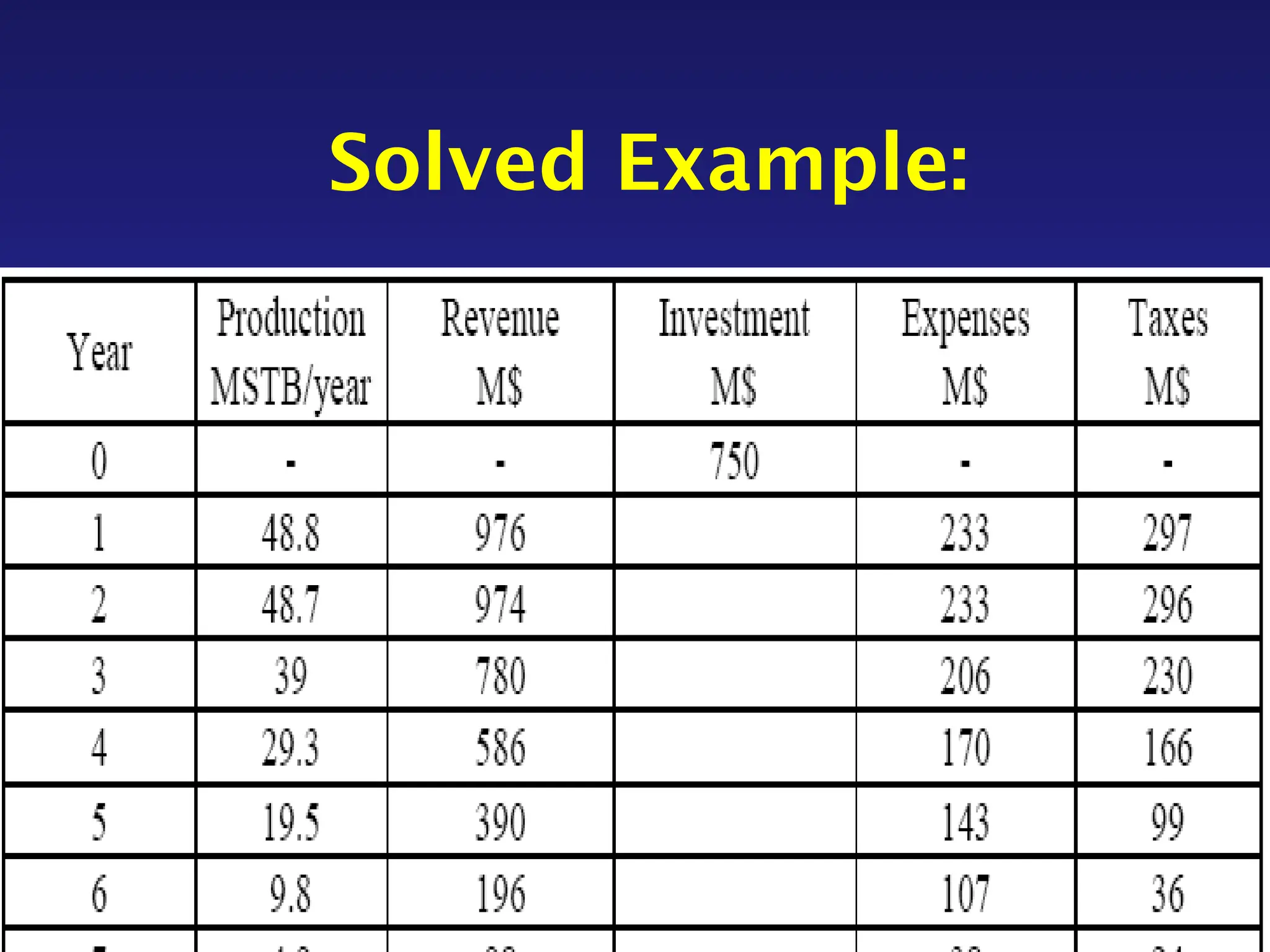

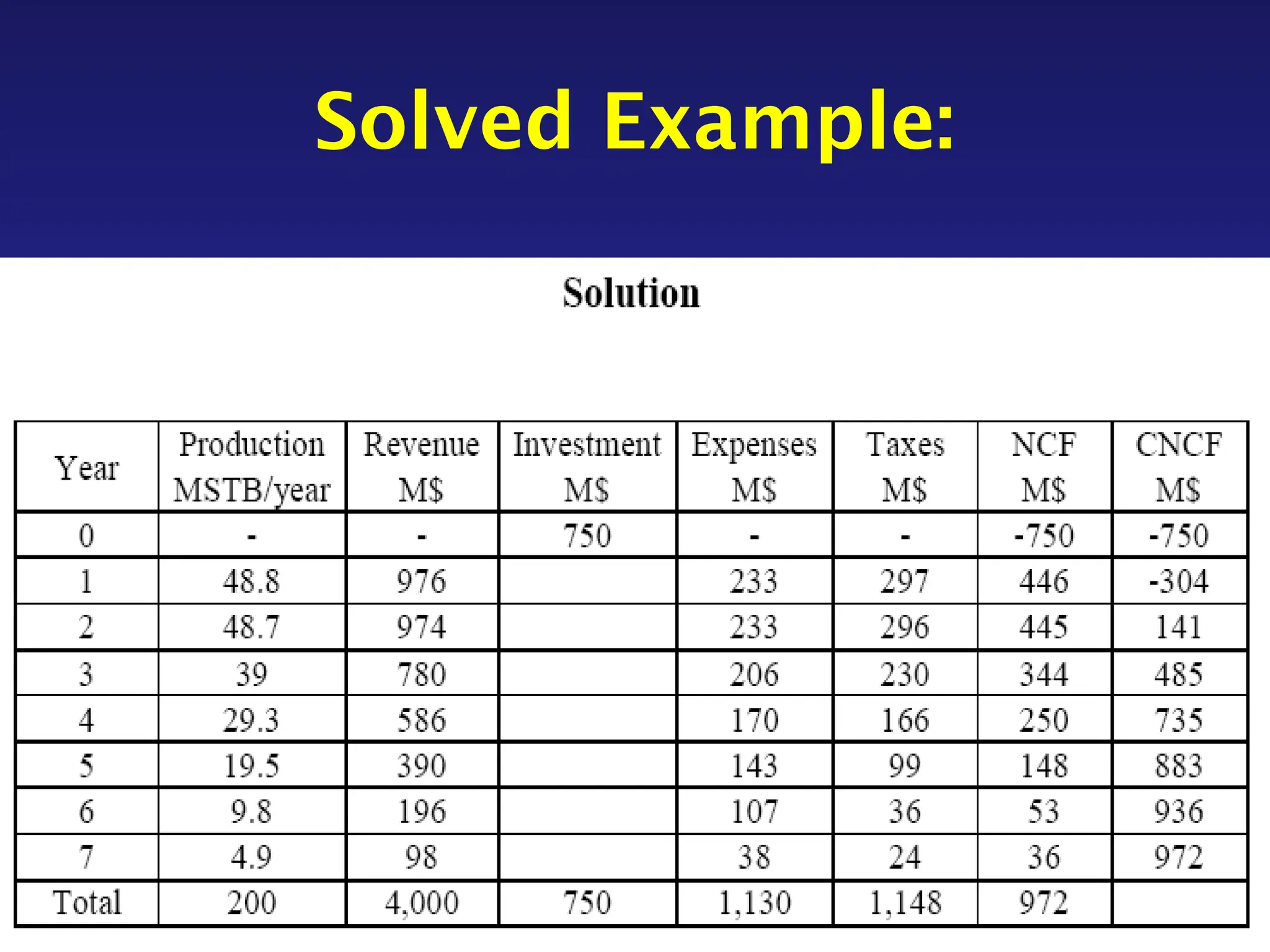

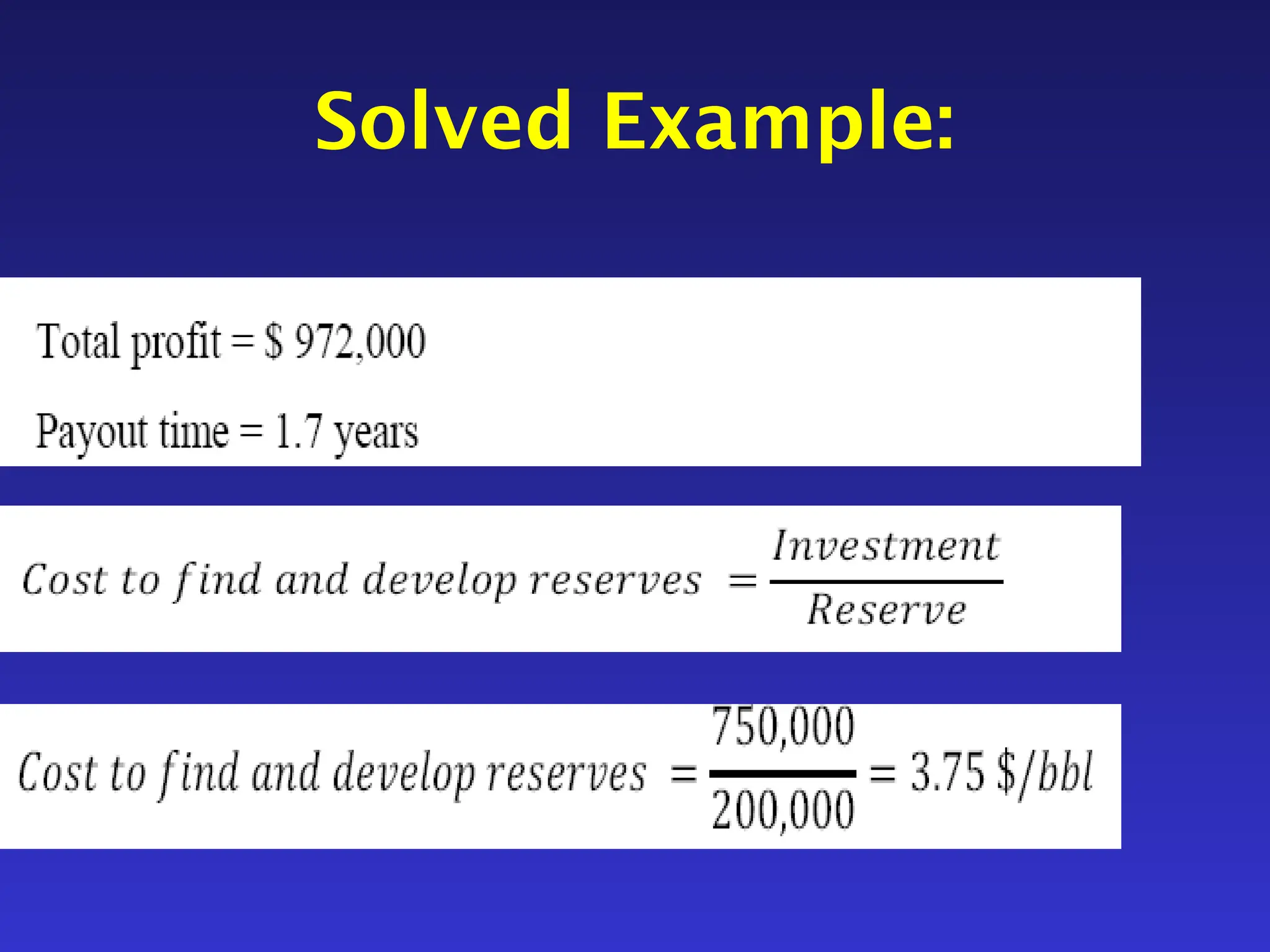

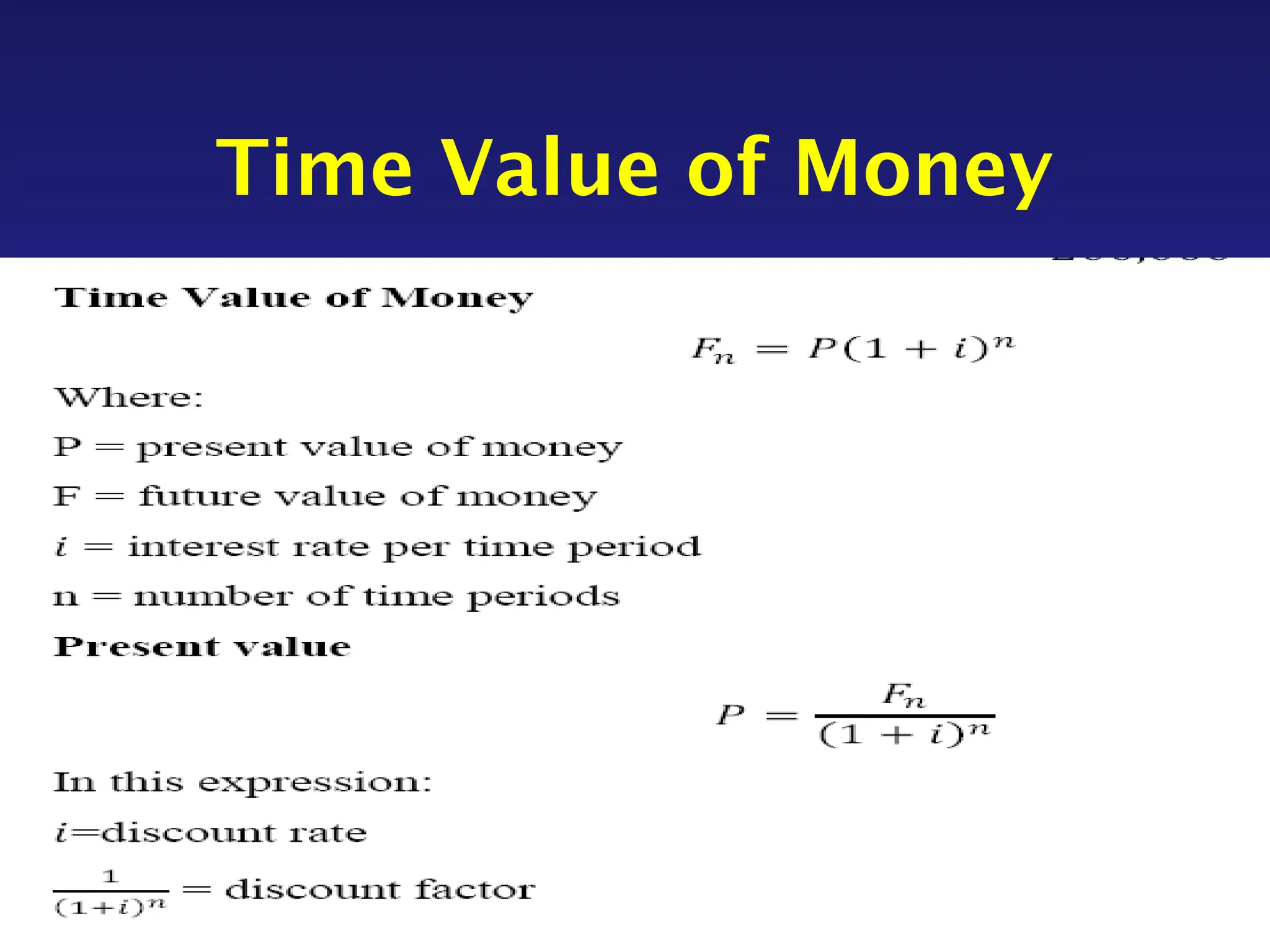

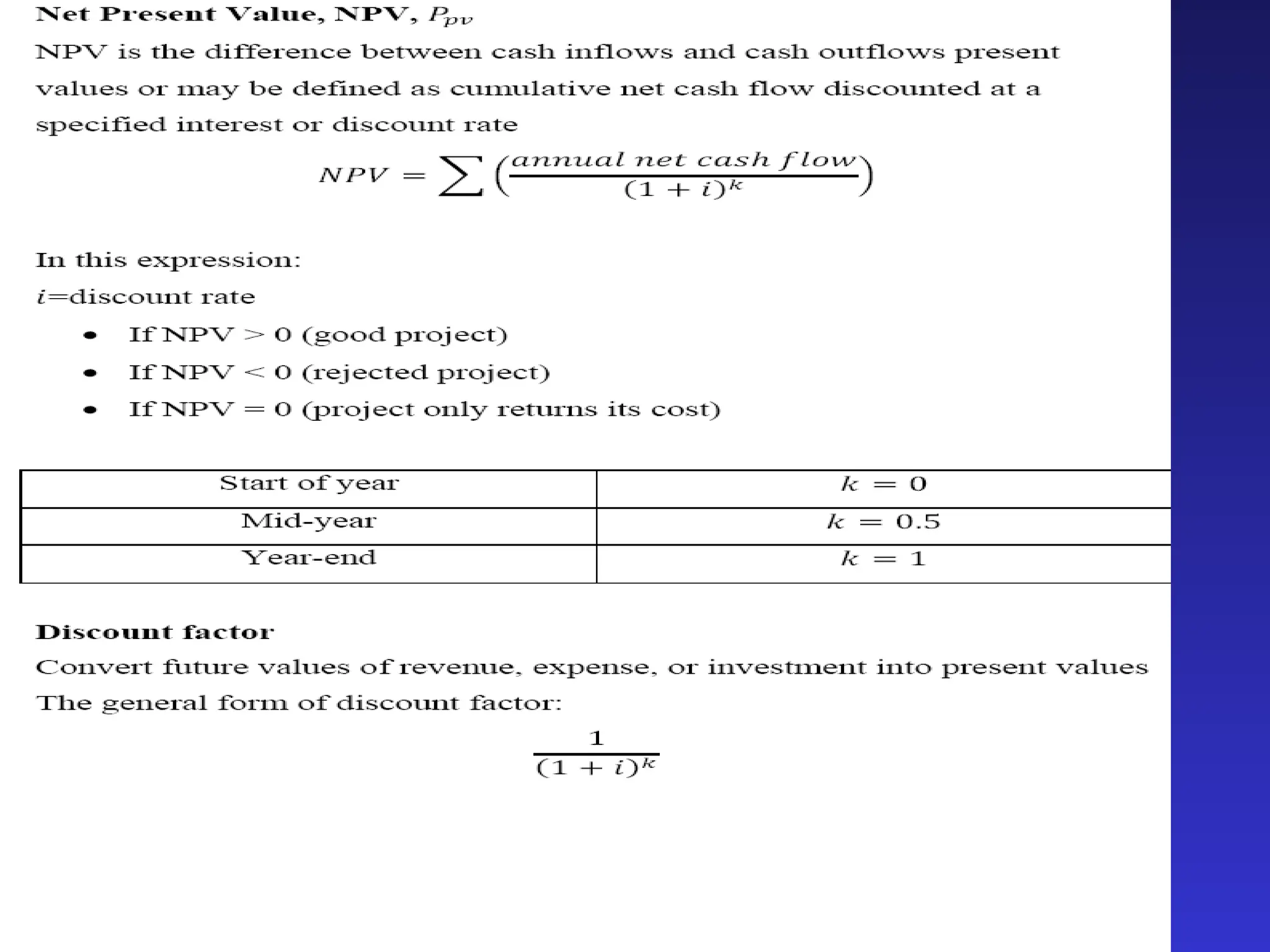

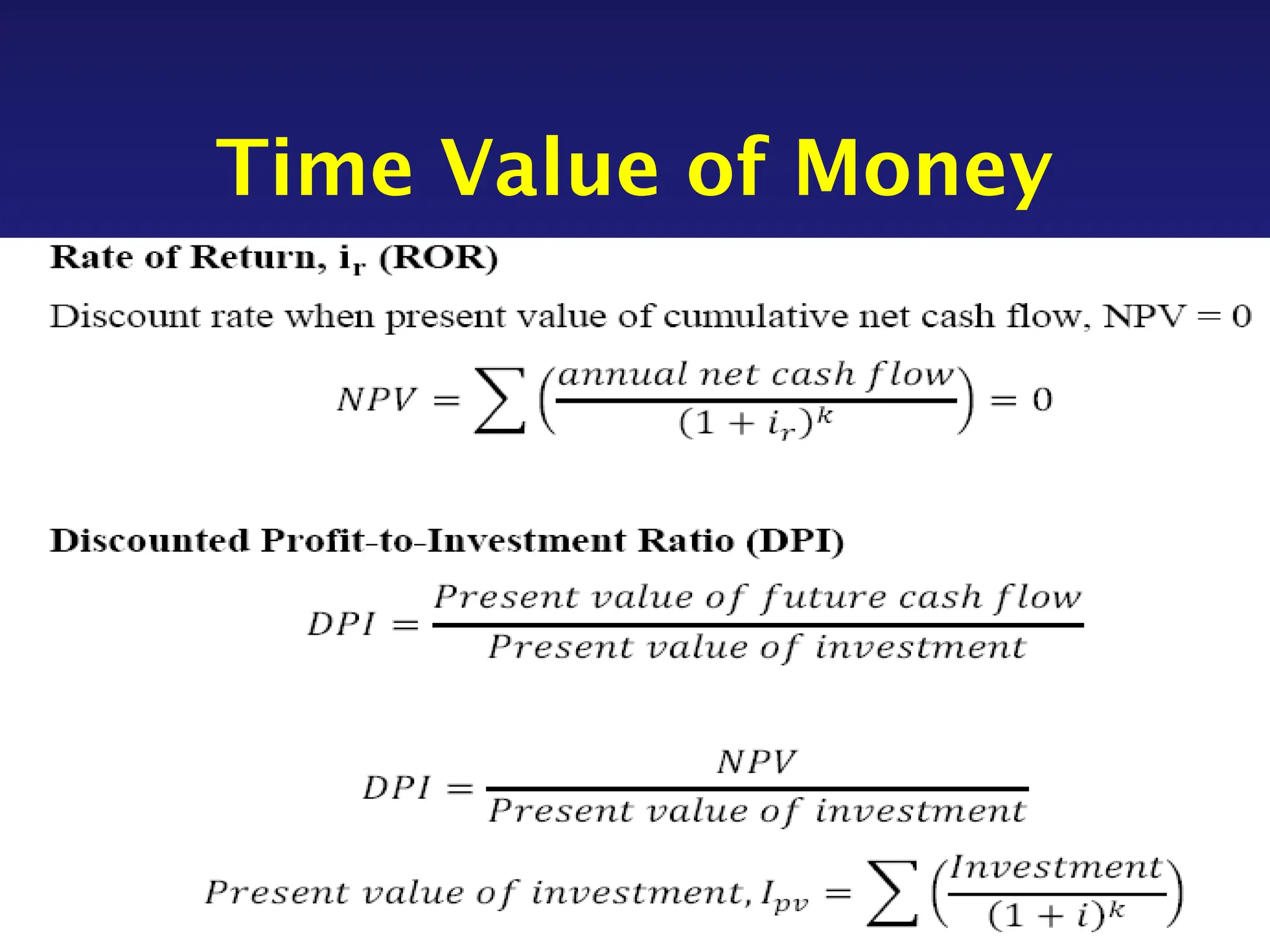

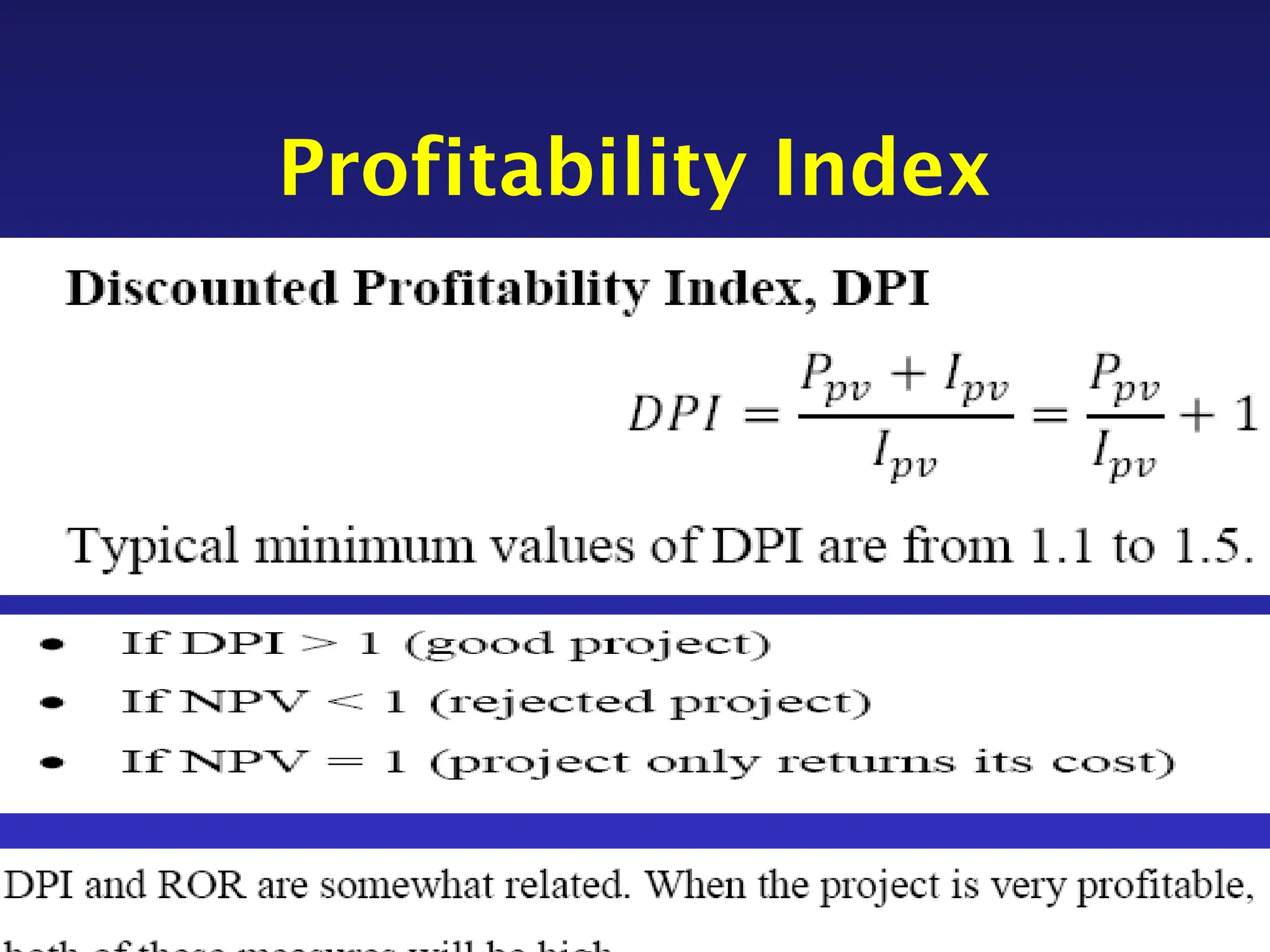

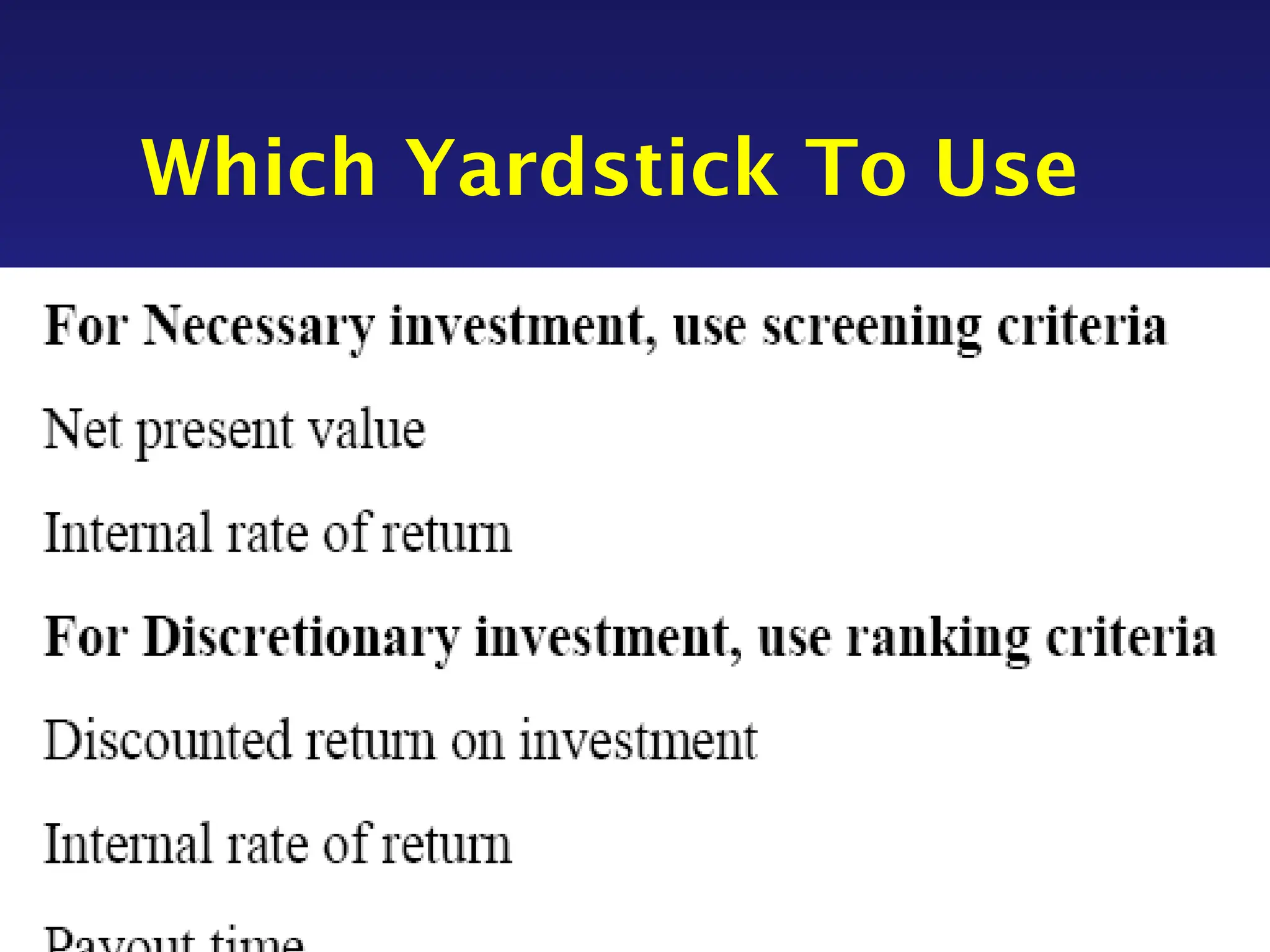

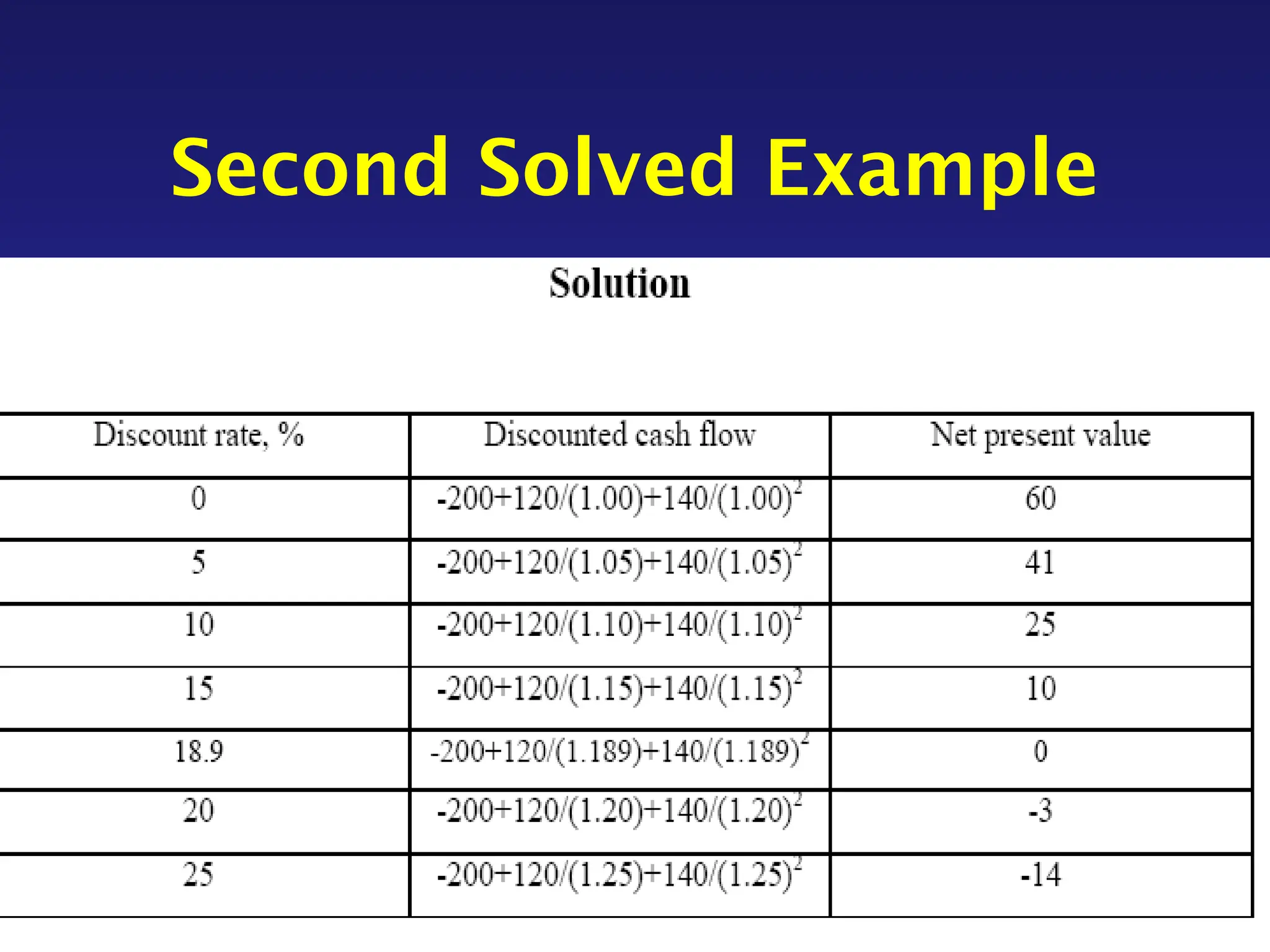

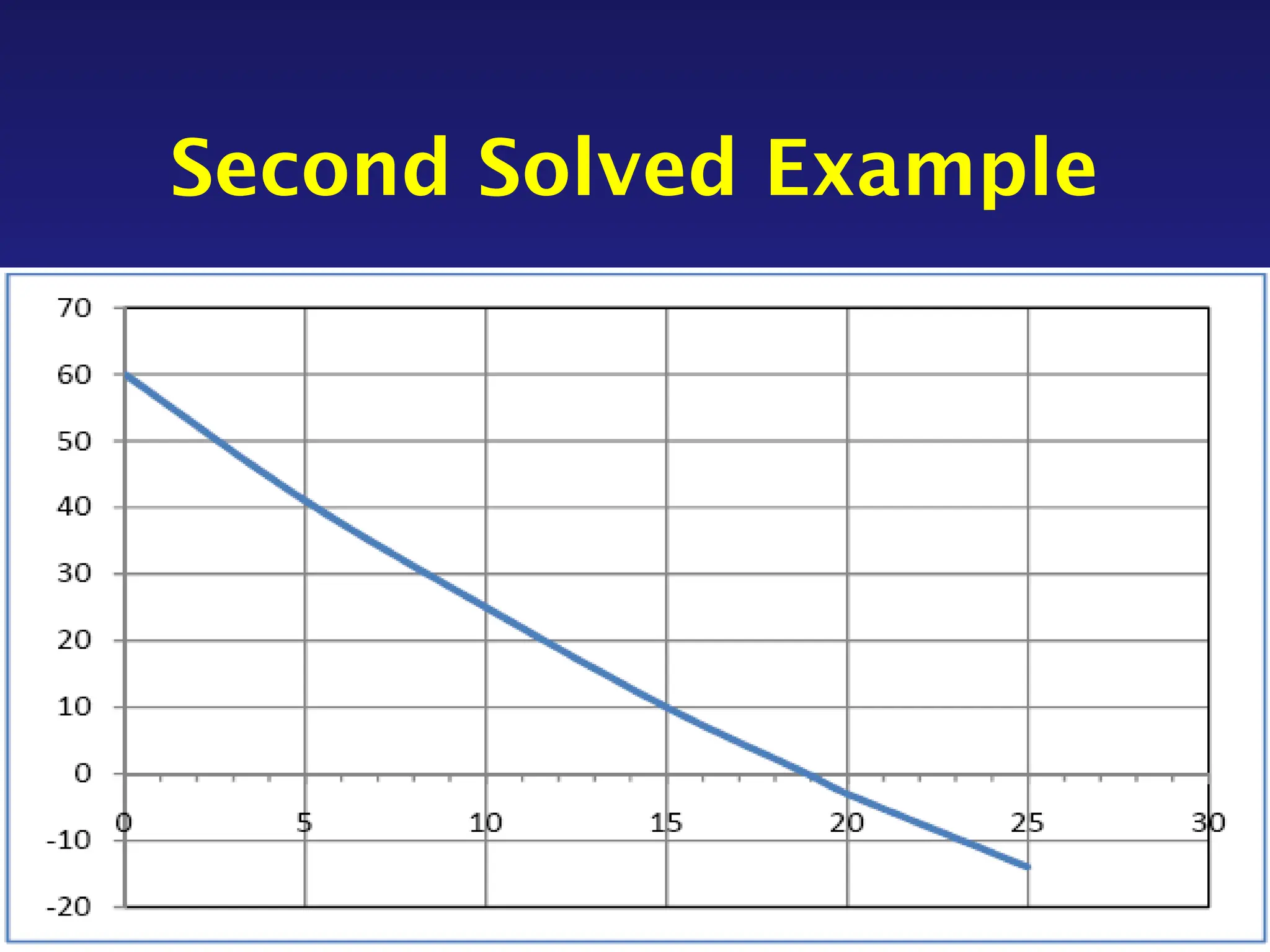

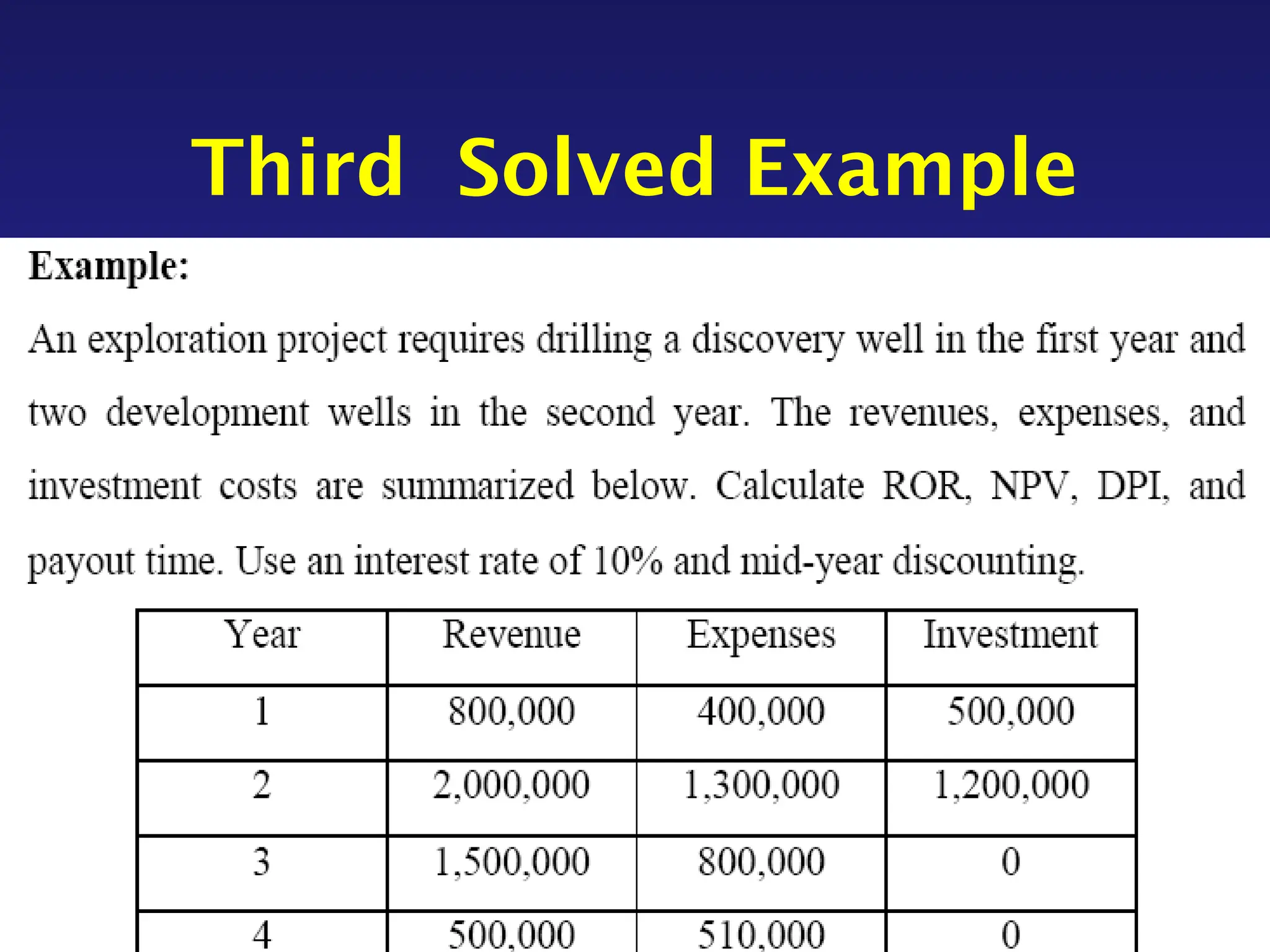

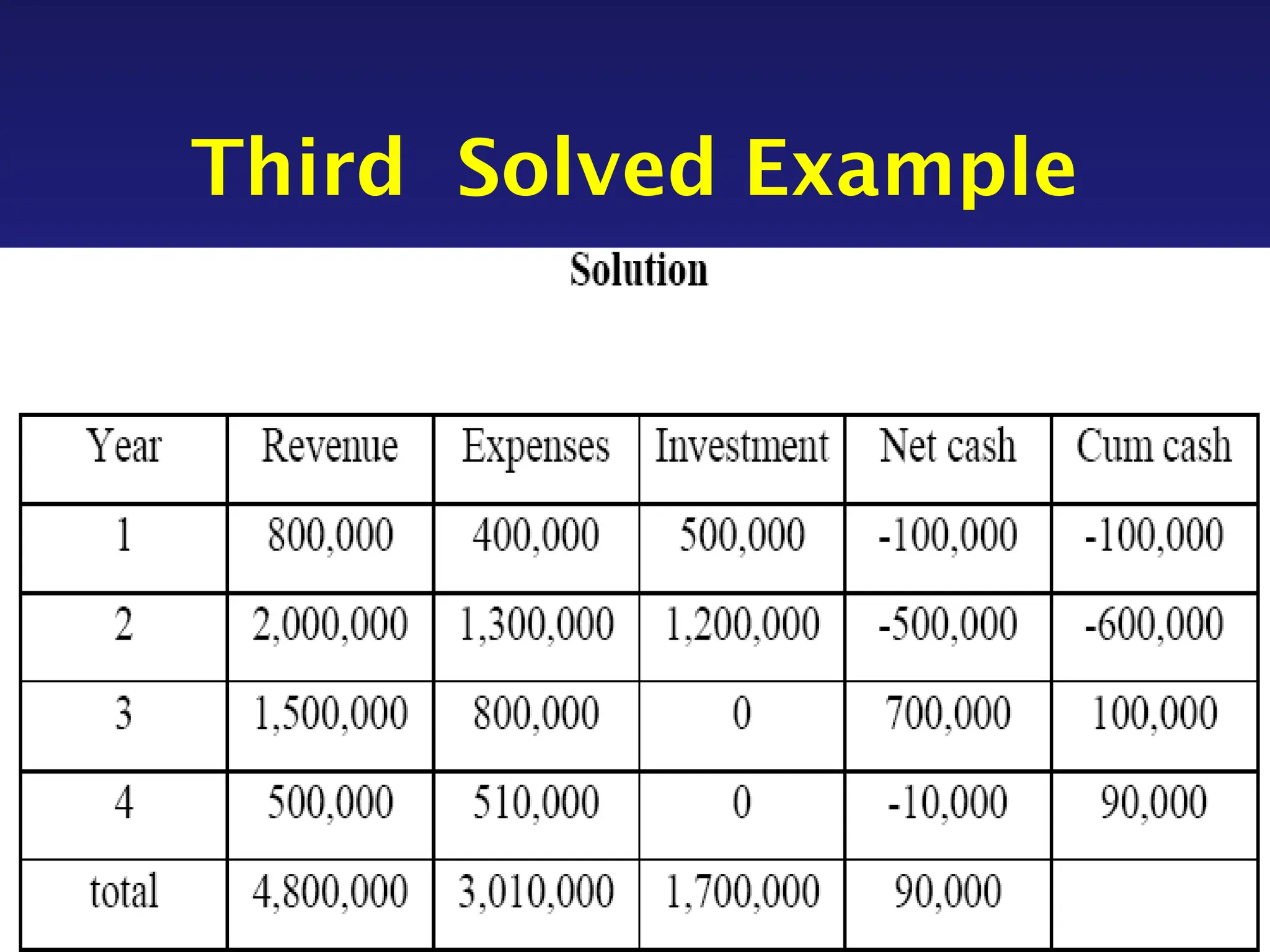

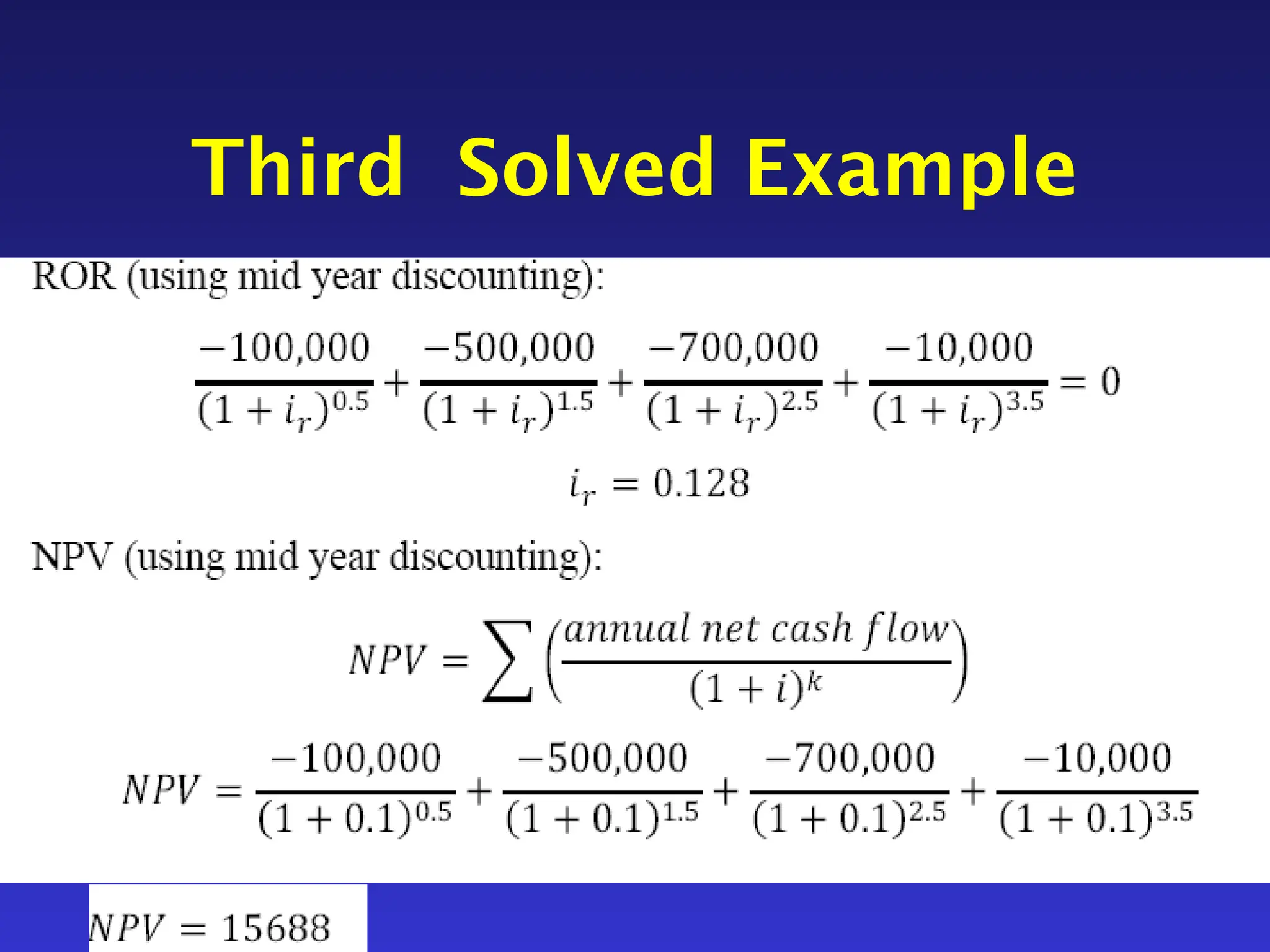

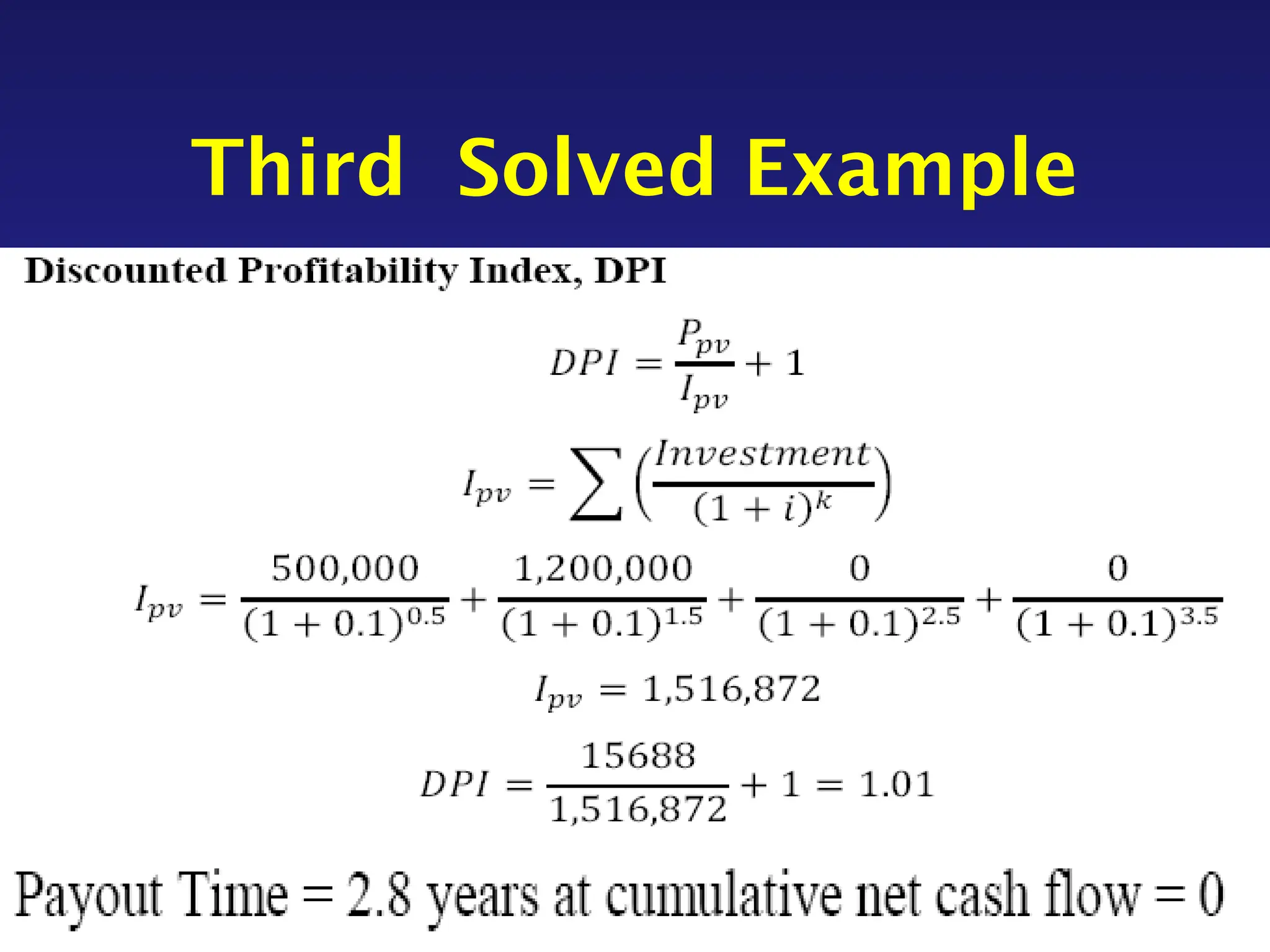

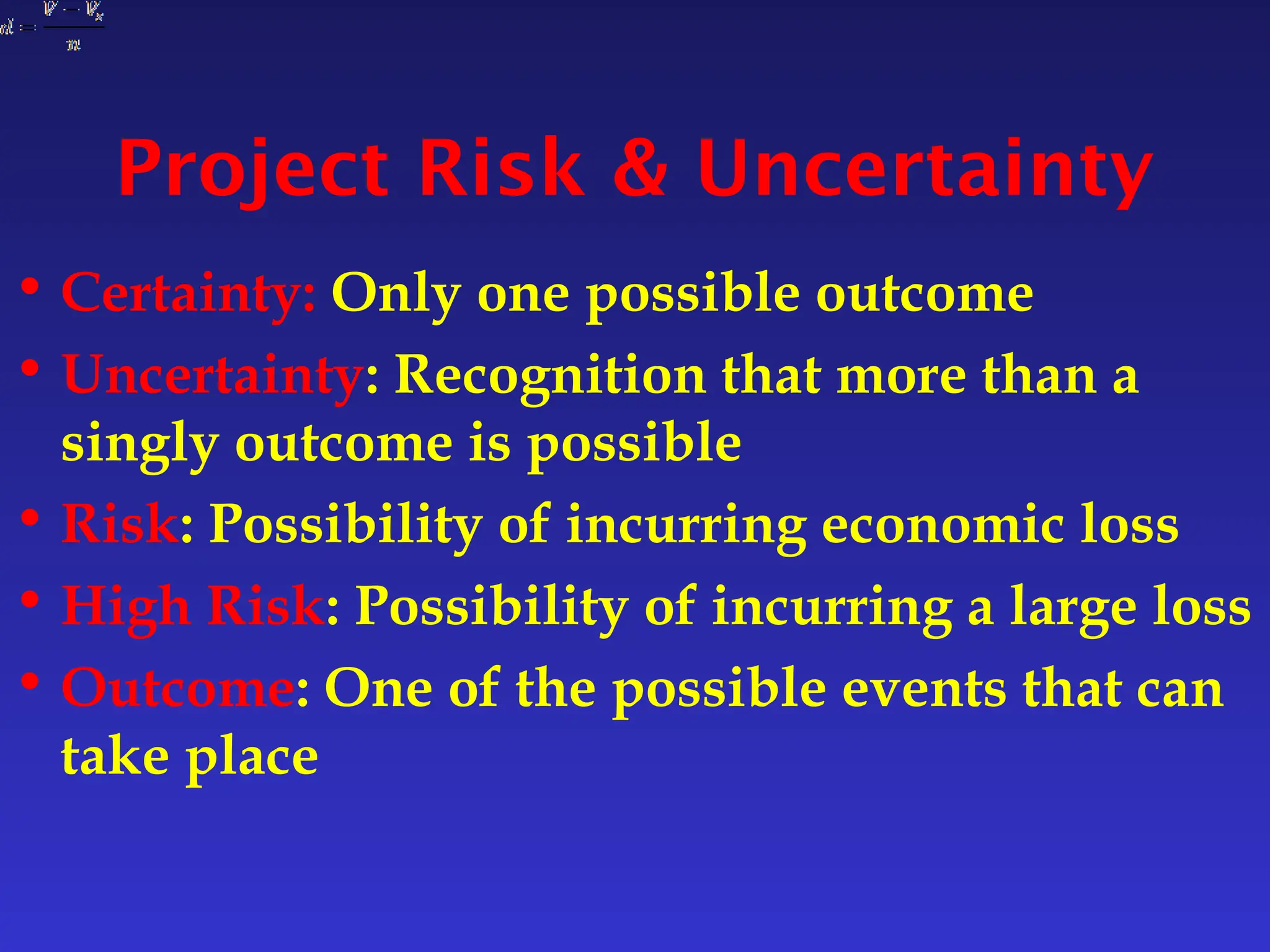

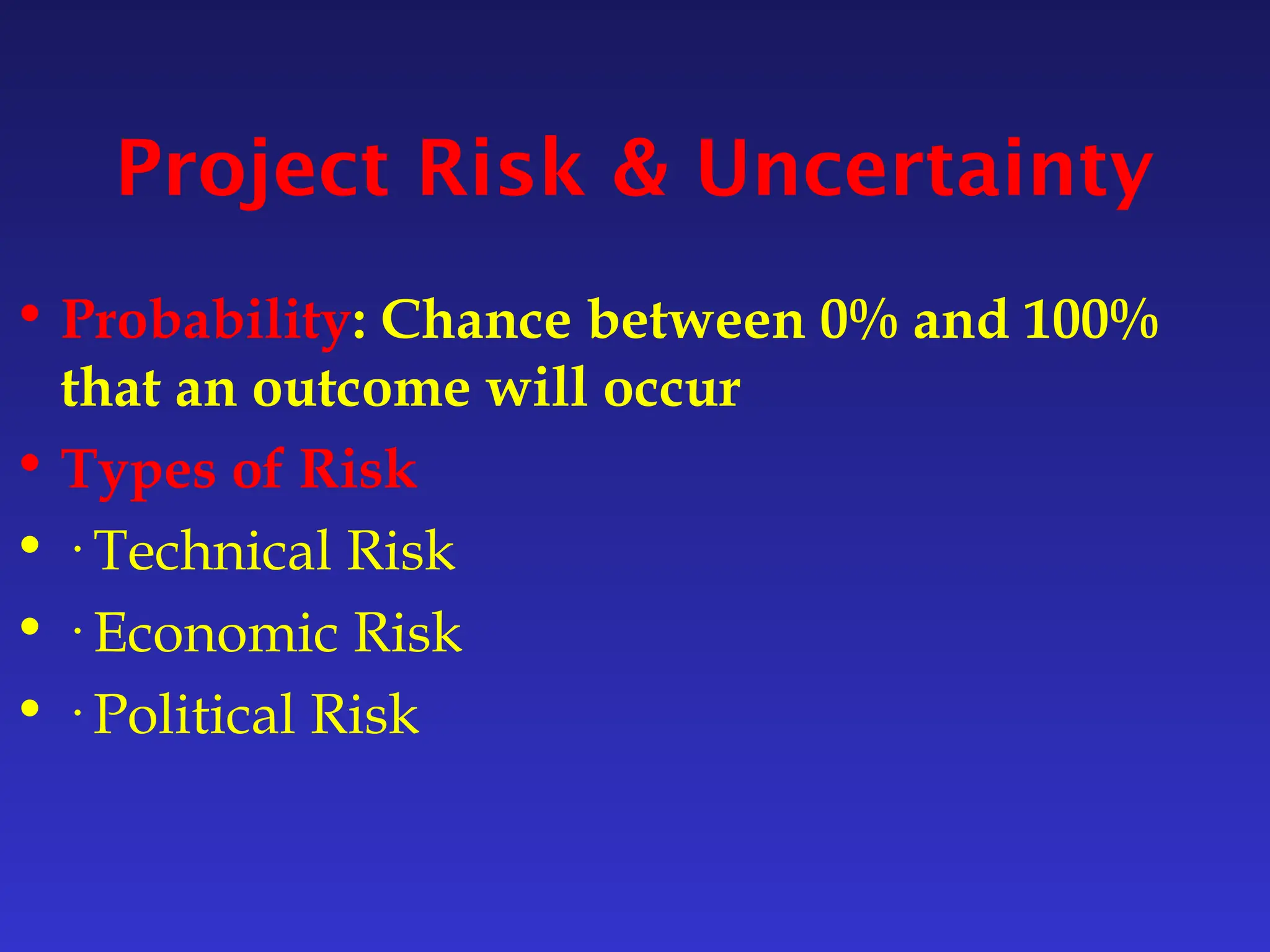

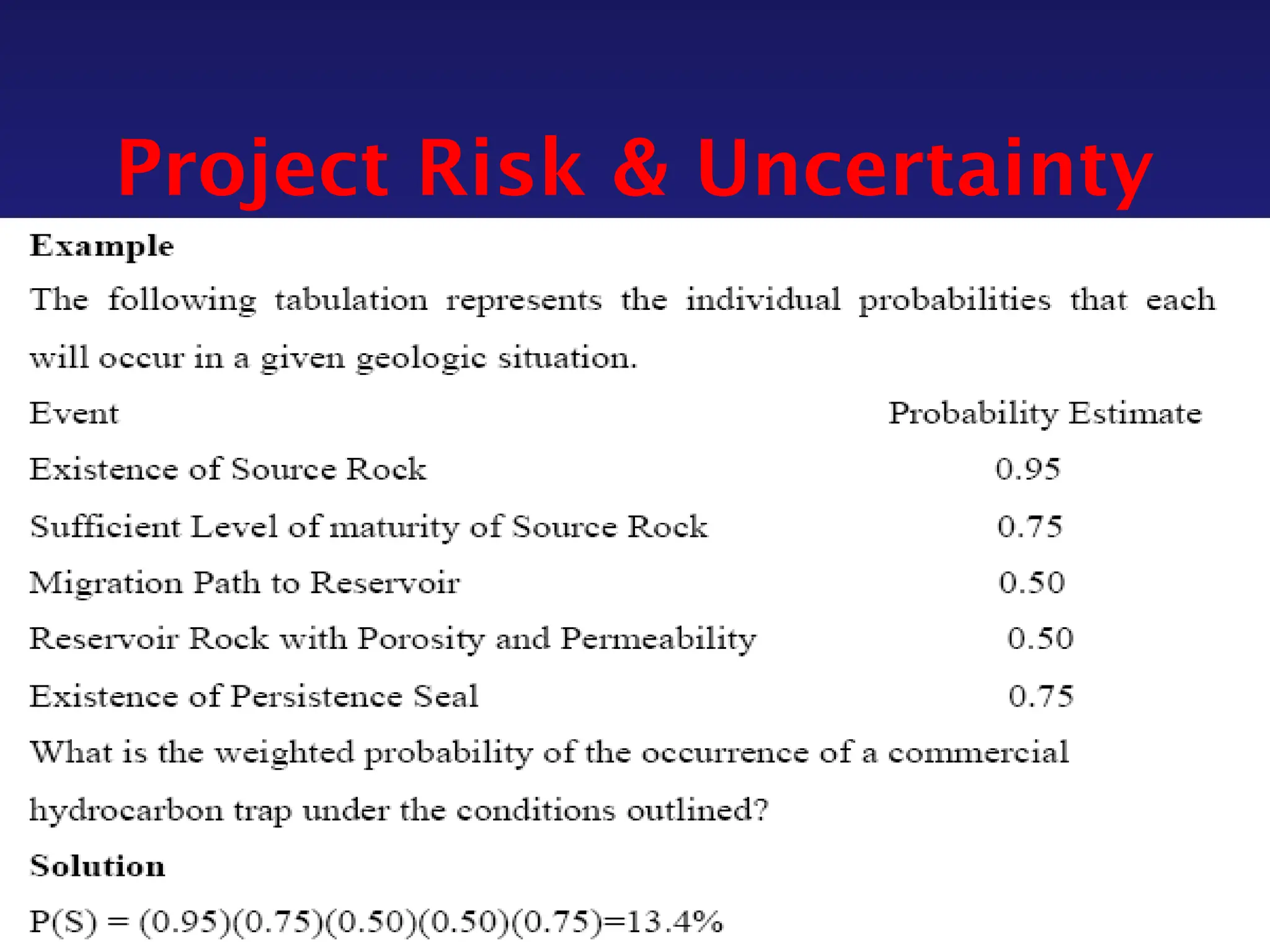

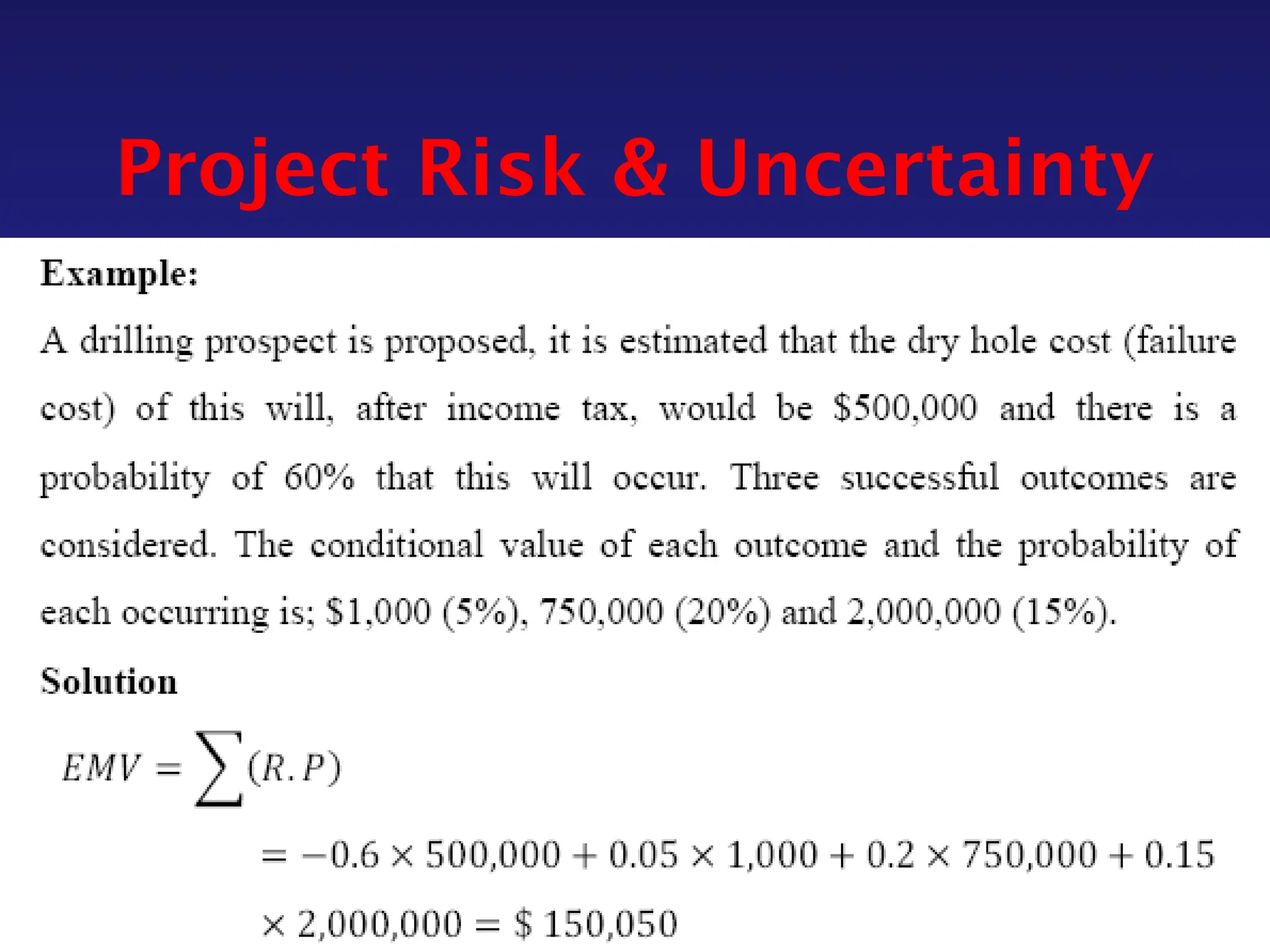

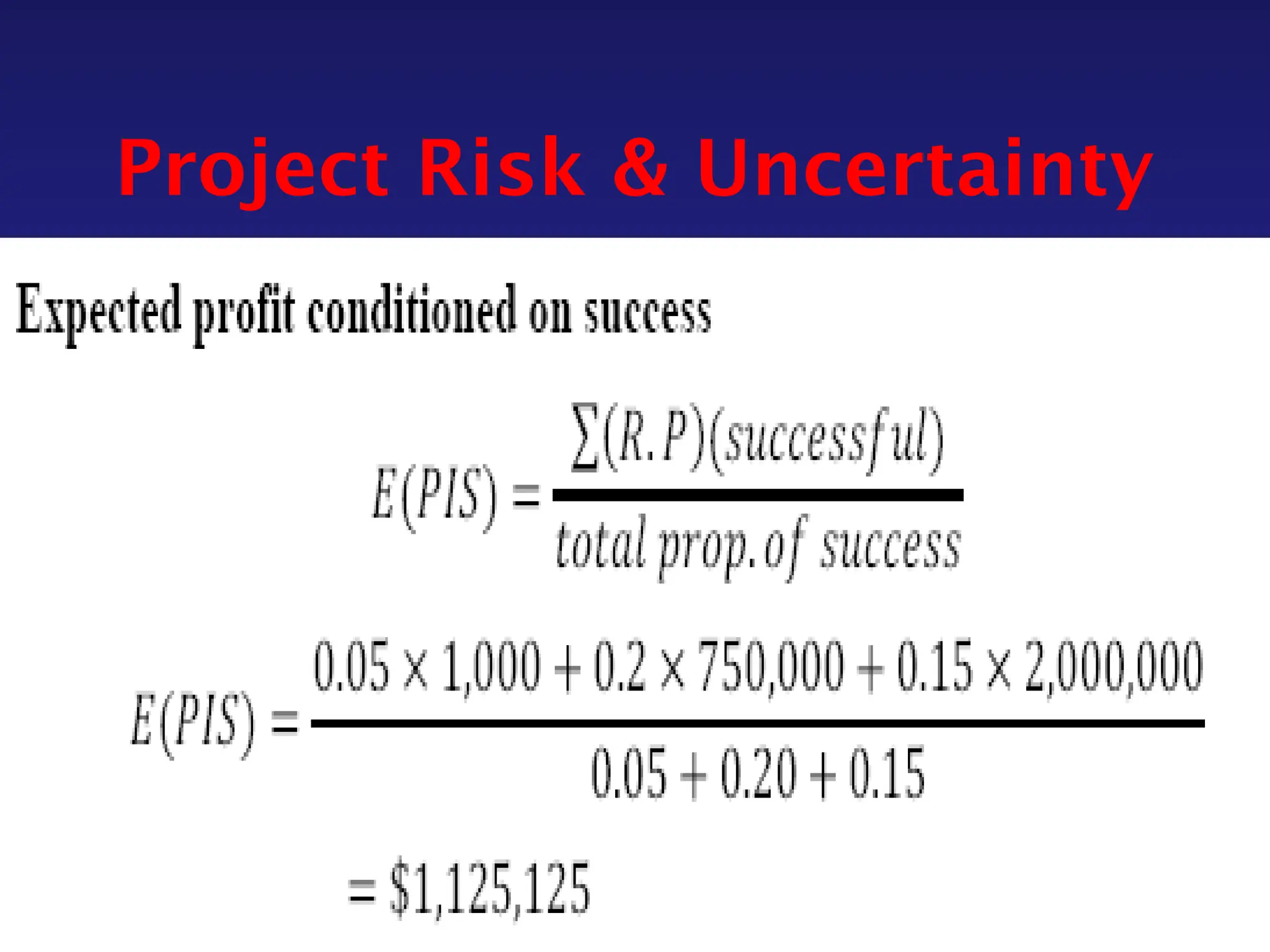

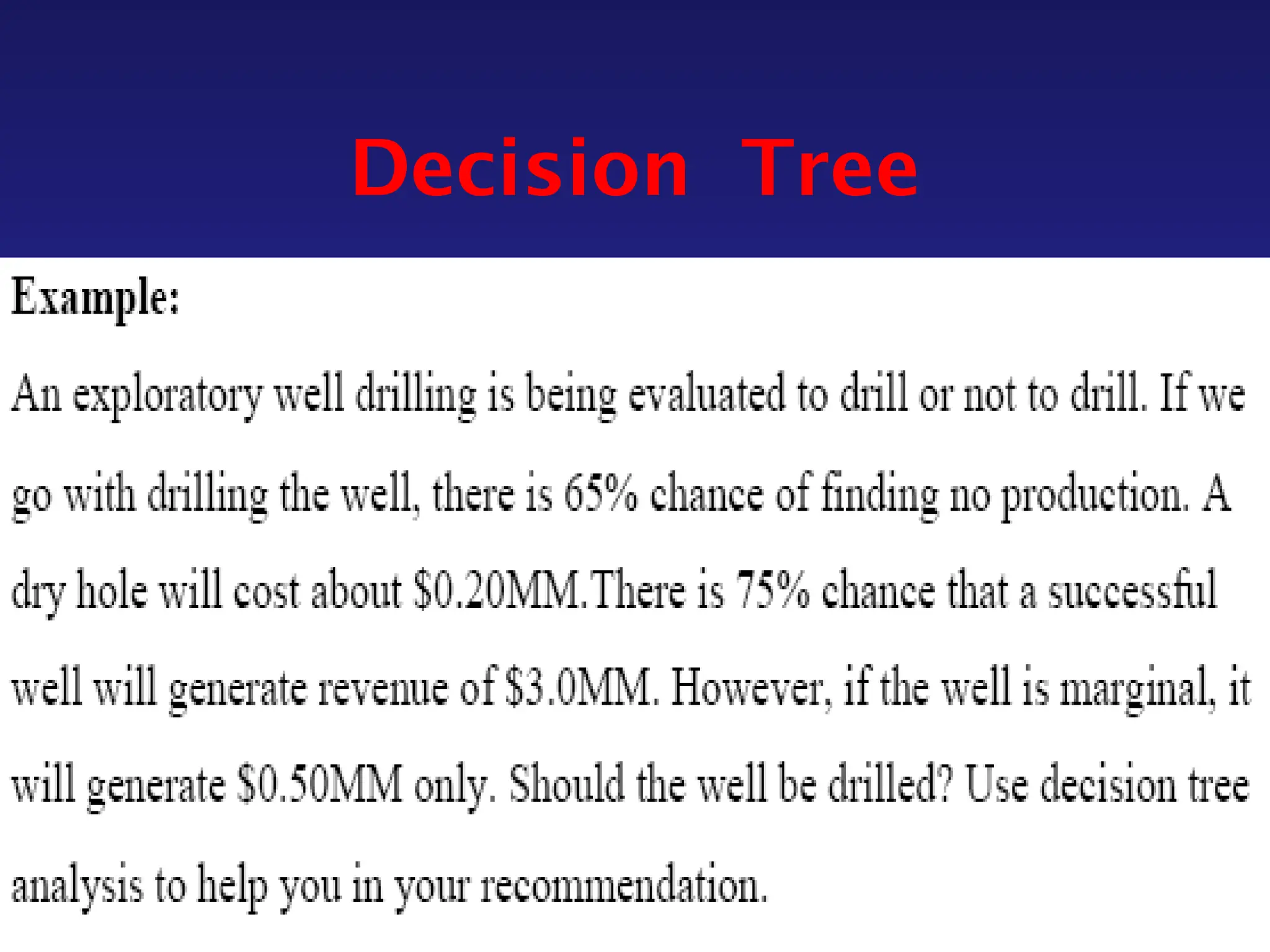

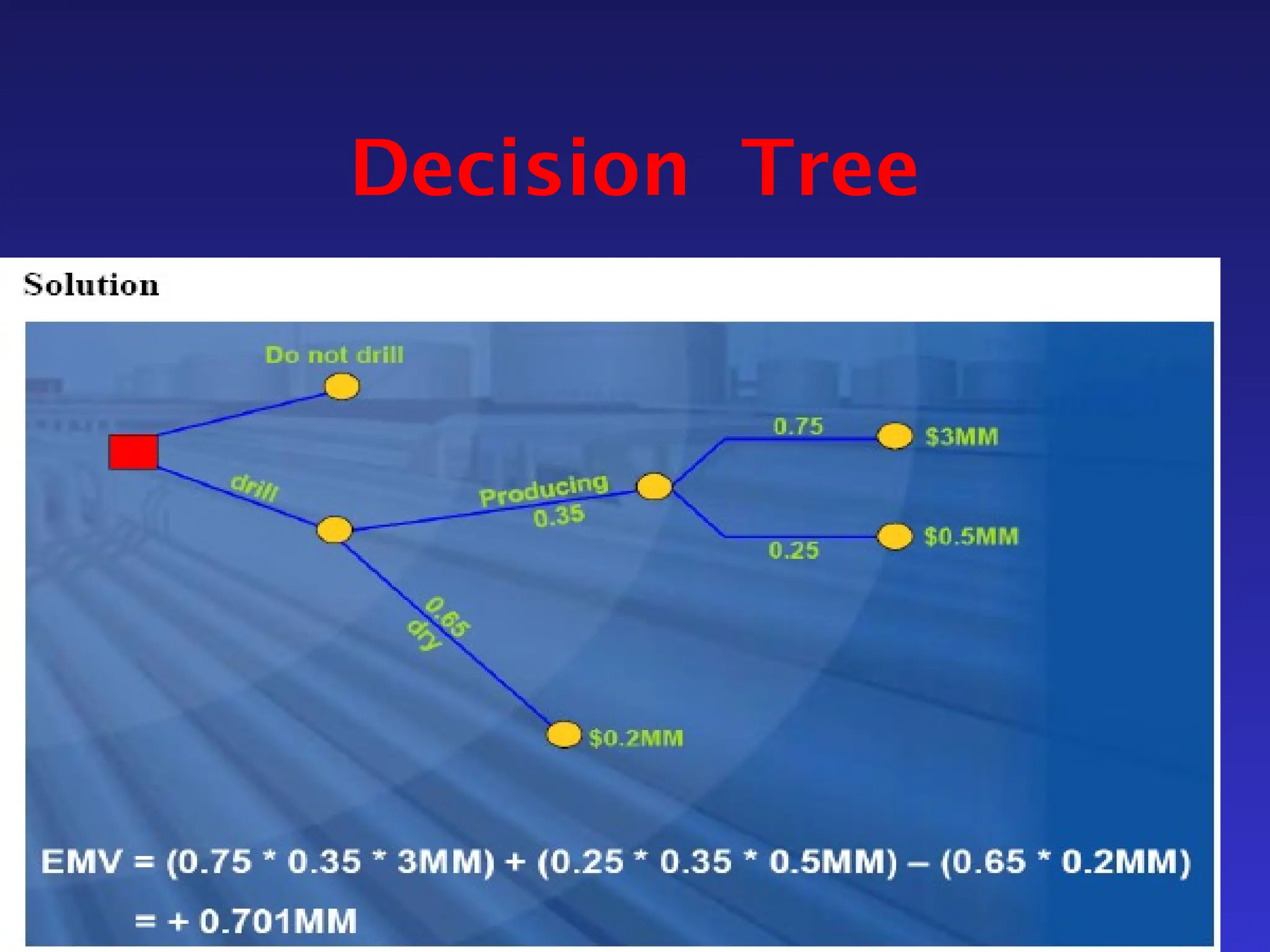

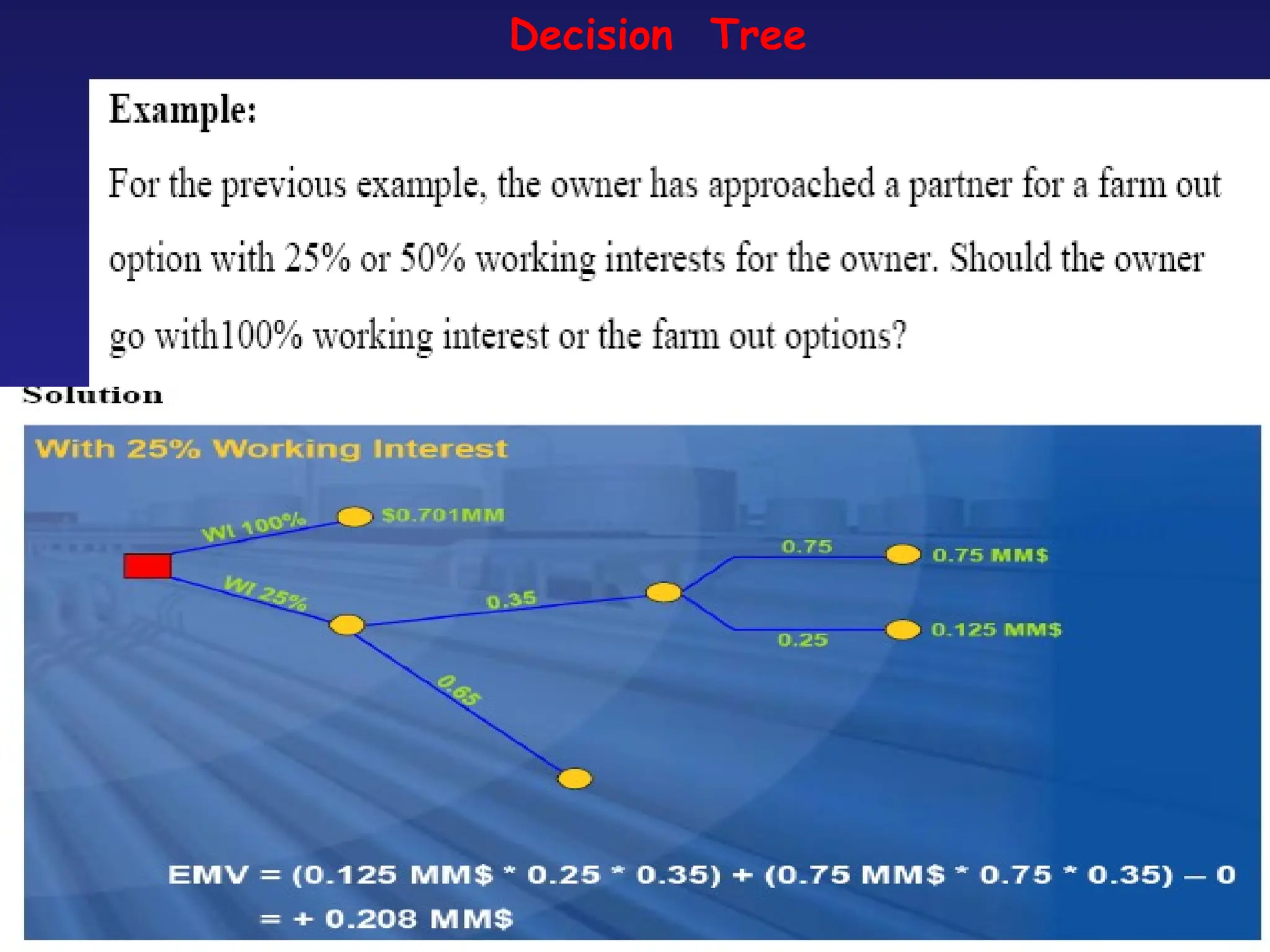

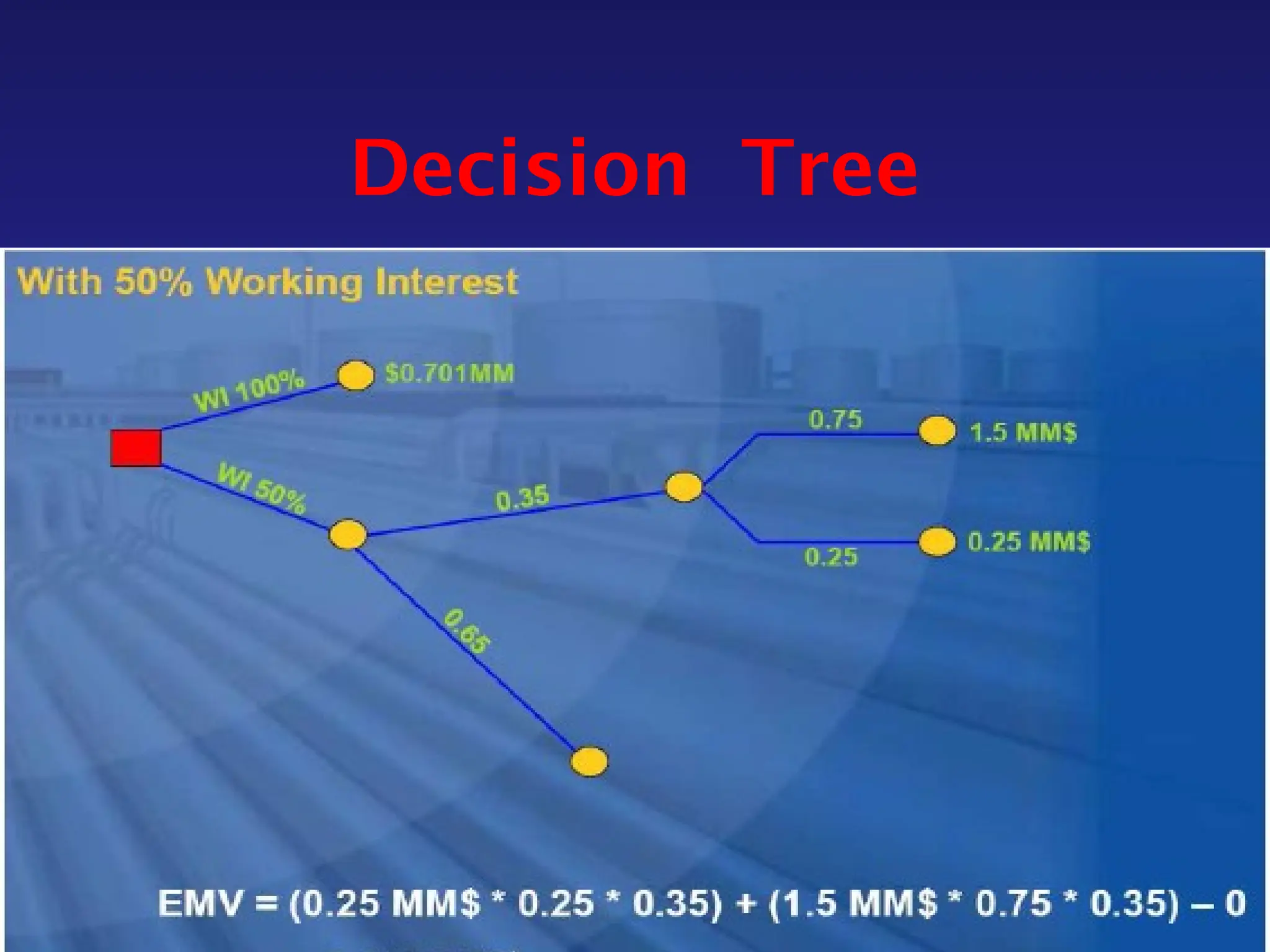

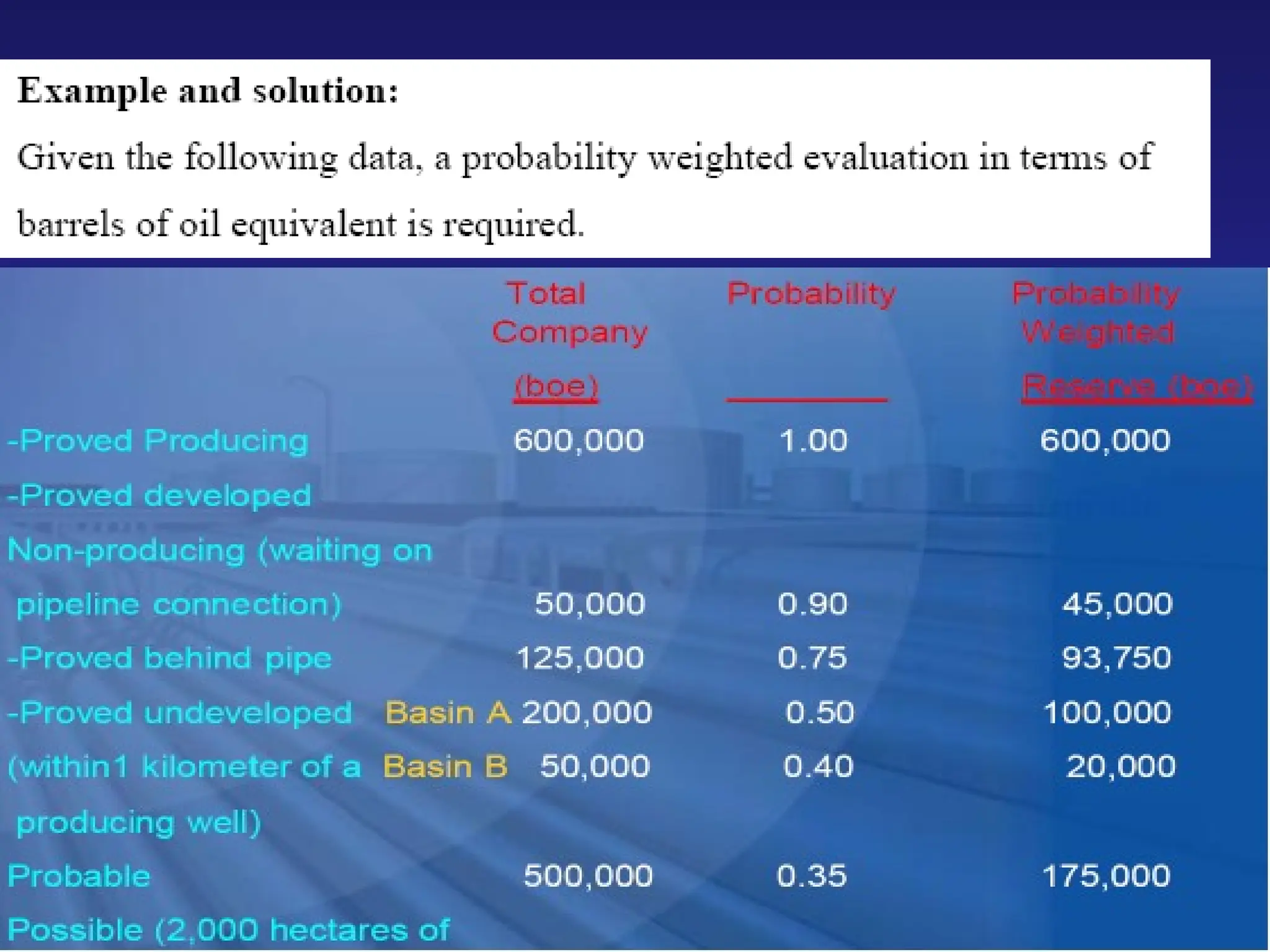

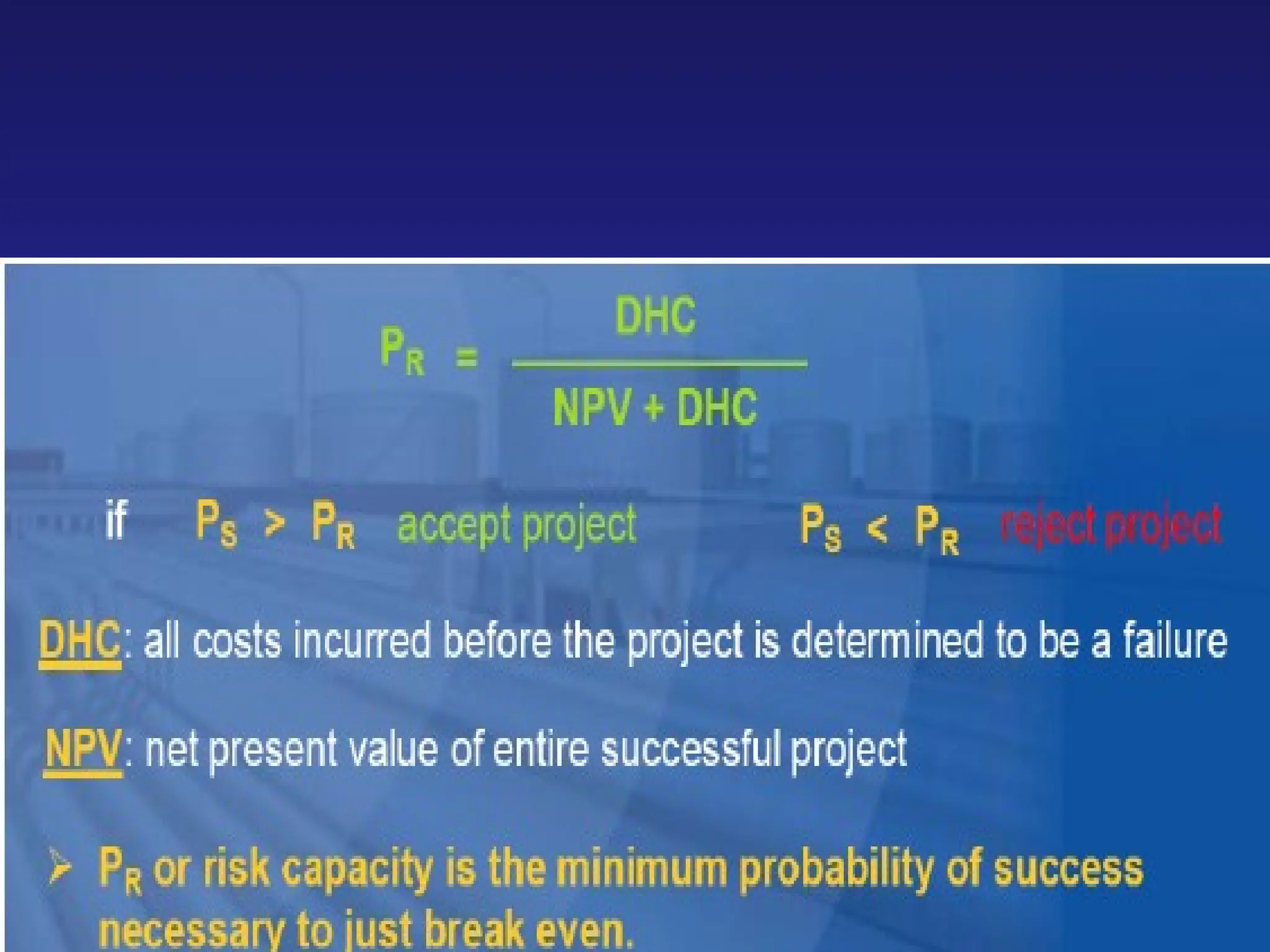

The document provides a comprehensive overview of petroleum economics, covering elements such as project evaluation, risk assessment, and economic analysis procedures. Key topics include capital and operational expenditures, cash flow analysis, oil price classifications, and inflation impact on profitability. It also discusses decision-making criteria and various evaluation measures to assess the economic viability of petroleum projects.