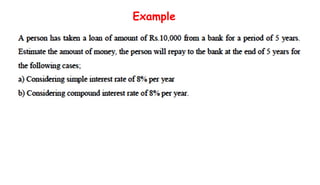

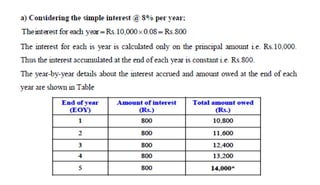

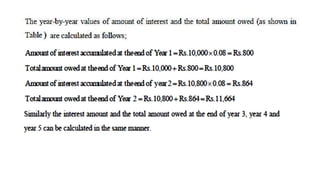

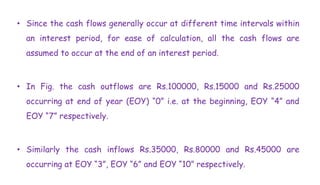

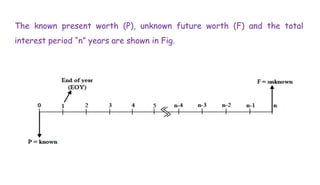

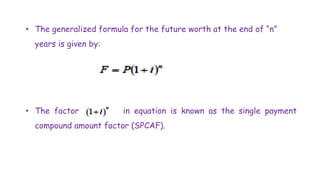

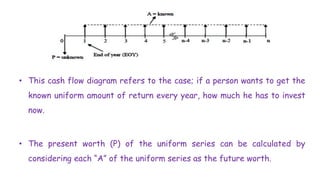

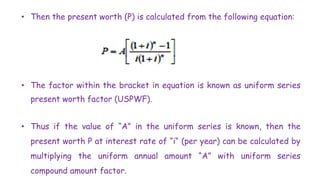

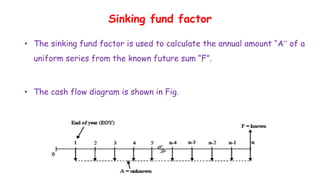

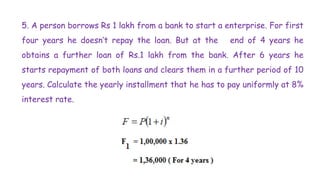

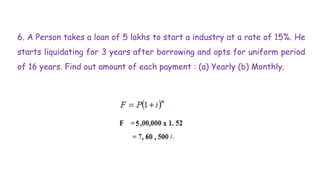

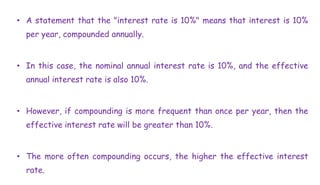

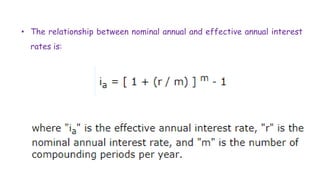

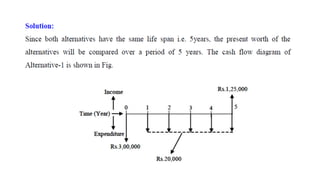

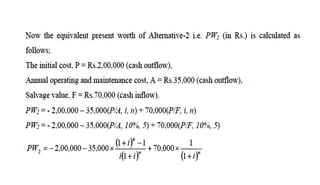

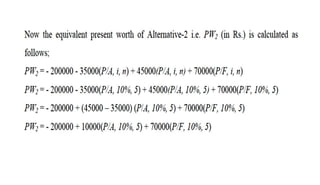

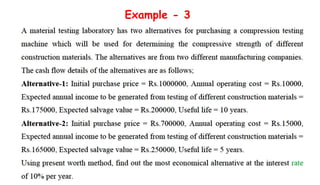

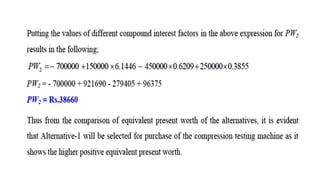

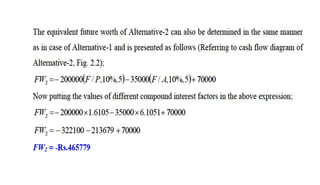

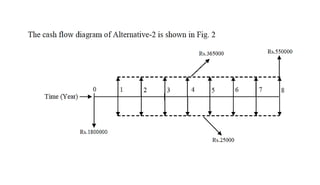

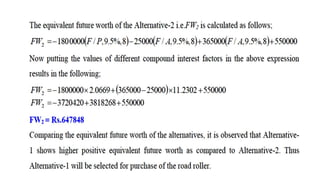

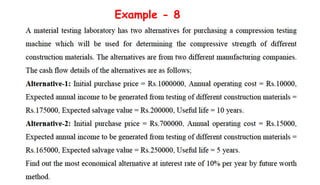

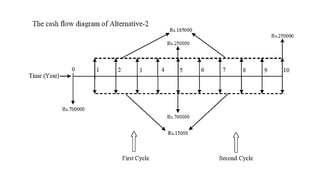

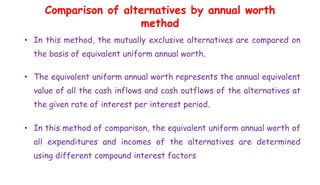

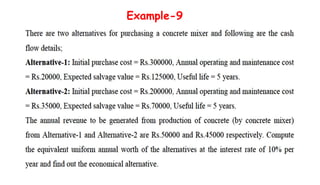

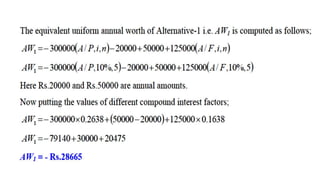

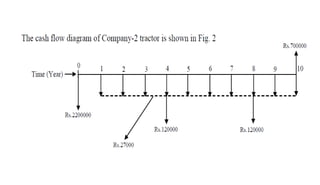

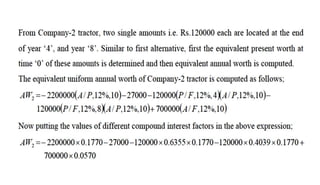

This document provides an overview of construction management, engineering economics, and related concepts. It defines construction management as overseeing project planning, design, and construction. Engineering economics involves evaluating design alternatives from an economic standpoint. Key terms are introduced, such as present worth, future worth, compound interest, cash flows, and factors used to analyze alternatives over time. Several examples of engineering economic calculations are provided.