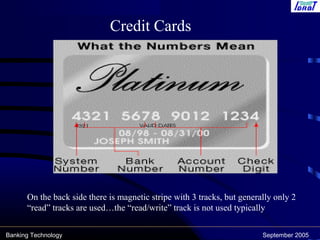

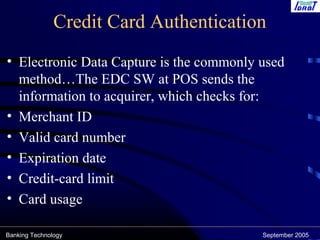

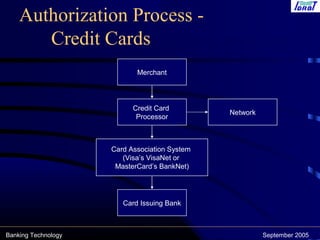

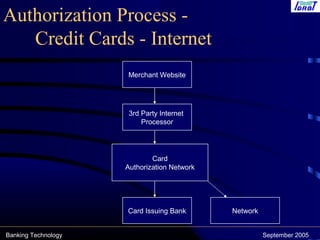

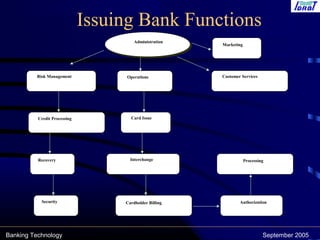

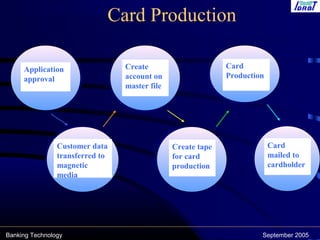

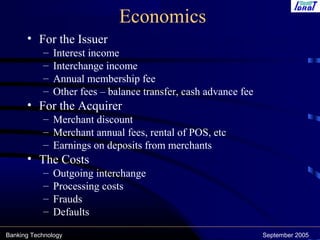

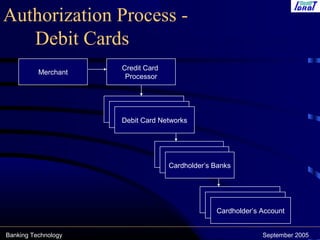

This document discusses credit cards and debit cards in banking technology. It provides a brief history of credit cards dating back to ancient times and highlights key developments like Diners Club launching the first plastic credit card in 1950. It describes the different types of credit cards like bank cards, travel cards, and affinity cards. The document also outlines the credit card authorization and settlement processes between merchants, card networks and issuing banks. Additionally, it summarizes the economics of credit cards for issuers, acquirers and associated costs. Debit cards are also introduced along with their authorization process through debit card networks.