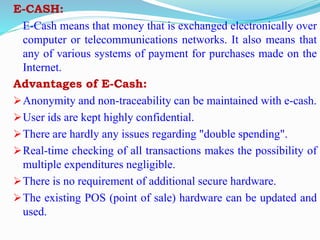

This document discusses different electronic payment systems used in e-commerce. It describes e-cash, credit cards, debit cards, smart cards, e-wallets, and electronic funds transfer. It provides details on credit cards and debit cards, including how they work, their advantages and disadvantages. Credit cards offer benefits like easy access to credit, rewards programs, and purchase protection, but can also lead to debt issues if not managed properly due to high interest rates and potential overspending. Debit cards provide convenience but have limitations like restricted funds access and potential fees for using other banks' ATMs.