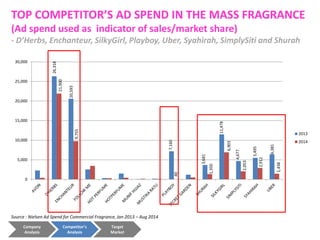

Maybelline is launching a new fragrance product line called "It Girls" targeted at young Malaysian females aged 15-24. There are three fragrances - Glamour Girly Girl, Provocative Rebel, and Trend Setting Fashionista. The product will be priced slightly below the market leader Enchanteur to gain market share in the elastic mass fragrance market. A promotional campaign including TV, print, and digital advertising will launch in October 2014 to drive initial sales. Financial projections estimate sales will grow slowly over the first three years as distribution expands and promotional activities are implemented.