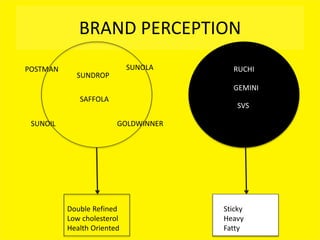

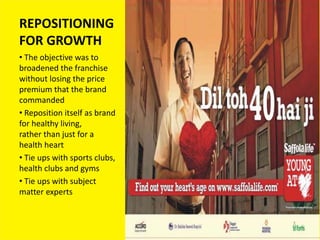

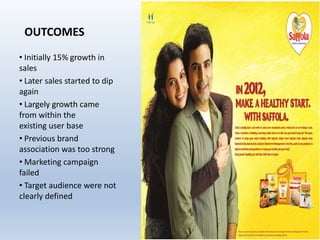

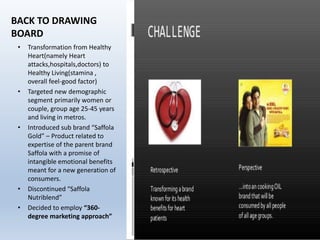

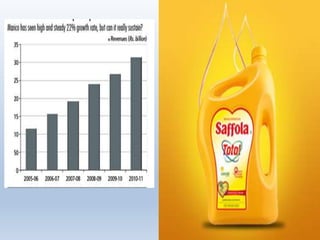

Saffola cooking oil was originally launched in 1960 as a flagship brand of Marico Ltd, targeting male consumers over 45 years old concerned with heart health. In the 1990s, Saffola established itself as the first "healthy oils" brand through doctor endorsements promoting its benefits. However, sales began stagnating as the brand was seen only as a prescription product. A repositioning effort in the 2000s aimed to broaden Saffola's appeal beyond heart health to "healthy living", but this also failed to significantly boost sales. The brand's strong medical association proved difficult to change. A new strategy refocused on younger urban consumers through the sub-brand "Saffola Gold" and a 360 degree marketing approach