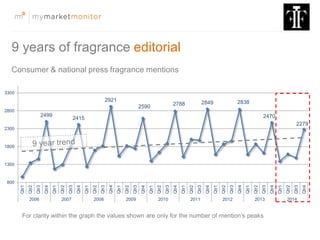

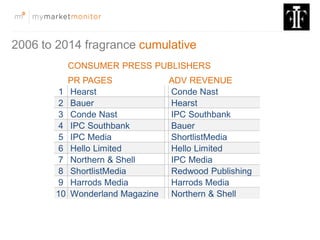

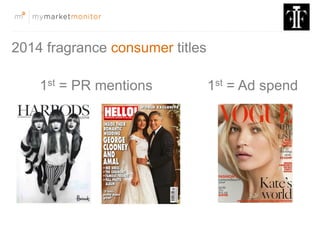

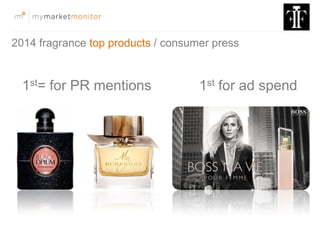

The document presents a market overview by Mike Ramseyer, CEO, highlighting the company's extensive data solutions that cover 90% of the beauty market and provide insights from real-time data and historical sources. It includes advertising expenditures, consumer engagement, and innovations within the fragrance industry, showcasing trends from 2006 to 2014. The report emphasizes the importance of understanding consumer behavior and the effectiveness of promotional strategies.